welfare schemes in cisf - Central Industrial Security Force

welfare schemes in cisf - Central Industrial Security Force

welfare schemes in cisf - Central Industrial Security Force

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WELFARE SCHEMES IN C.I.S.F<br />

CISF came <strong>in</strong>to existence <strong>in</strong> the year 1969 and was declared as an Armed <strong>Force</strong> of the Union<br />

<strong>in</strong> June 1983. Welfare of personnel is a highly motivat<strong>in</strong>g factor to achieve optimum level of<br />

professional efficiency and organizational goals <strong>in</strong> a uniformed <strong>Force</strong>.<br />

The CISF is deployed for many sensitive duties <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>ternal security, VIP security,<br />

guard<strong>in</strong>g build<strong>in</strong>gs and Airports/Metro Stations. The variety of <strong>in</strong>dustries covered is also wide and<br />

diverse. It is therefore, <strong>in</strong>cumbent upon us to look after the <strong>welfare</strong> and well be<strong>in</strong>g of our personnel<br />

deployed all over the country and perform<strong>in</strong>g arduous duties. In this regard, the Non-Govt. Funds<br />

manual has been revised/ published which came <strong>in</strong>to existence w.e.f 01.01.2003. The fund manual<br />

has already been made available to all the field units. The major <strong>welfare</strong> <strong>schemes</strong> exist<strong>in</strong>g <strong>in</strong> CISF<br />

are described below <strong>in</strong> brief: -<br />

CENTRAL WELFARE FUND<br />

OBJECTIVES<br />

To extend monetary assistance to the family members of personnel: -<br />

a. Who die while <strong>in</strong> service.<br />

b. To provide assistance <strong>in</strong> case of <strong>in</strong>validation or disablement as a result of <strong>in</strong>juries<br />

susta<strong>in</strong>ed while perform<strong>in</strong>g duties and prolonged illness.<br />

c. Distress caused by natural calamities.<br />

d. Sanction of loans and advances.<br />

e. Sanction of Out-right grants.<br />

The ma<strong>in</strong> objects of out-right grants are as under:-<br />

i. The NOK of deceased will be paid the actual expenditure on funeral rites, subject to the<br />

maximum of Rs 5000/- from the CWF when funeral rites of the deceased is held at the place<br />

of death.<br />

ii. The transportation grant will be limited maximum upto Rs. 9,000/-.(i.e Rs 5,000/- plus actual<br />

cost of transport). If arrangements regard<strong>in</strong>g transport are made by the Unit/Govt. vehicle,<br />

the grant will be restricted to Rs.5,000/-.<br />

iii. The member <strong>in</strong> case of serious <strong>in</strong>jury or sickness of self or family requir<strong>in</strong>g prolonged or<br />

expensive treatment <strong>in</strong> case of Kidney Transplant, Bye-Pass Surgery, Cancer, Bra<strong>in</strong><br />

Hemorrhage, AIDS, Paralysis or Amputation of any organ of the body, on the merit of each<br />

case, it will be 10% of un-passed medical expenses under Govt. Rules subject to maximum of<br />

Rs. 20,000/-.<br />

iv. The member, who susta<strong>in</strong>ed <strong>in</strong>juries dur<strong>in</strong>g active duty, may be granted maximum of Rs<br />

3000/- as grant.<br />

v. The member at the time of retirement / superannuation after completion of 20 years service <strong>in</strong><br />

case of direct recruits and 10 years <strong>in</strong> case of re-employment may be presented with a gift of<br />

his choice worth of Rs 2000/- from Unit/ Zonal/Sector/CWF. In addition memento-cost<strong>in</strong>g<br />

Rs.300/- (plague depict<strong>in</strong>g CISF) may also be given.<br />

vi. Special Out-Right Grant is be<strong>in</strong>g provided to newly established Unit/Bn./Office, to establish<br />

<strong>welfare</strong> fund for <strong>welfare</strong> activities to members @ Rs.100/- per person restricted to m<strong>in</strong>imum<br />

Rs.10,000/- from CWF.<br />

vii. The Unit/Bn./Office for organiz<strong>in</strong>g Barakhana on occasion of Republic Day, Independence<br />

Day, CISF Day, All India Police Games, Unit function, Inspection or any other special<br />

occasion. Maximum rates for organiz<strong>in</strong>g Barakhana will be @ Rs. 60/- per head. Source of<br />

this fund will be Unit Welfare Fund / Zonal Welfare Fund / Sector Welfare Fund / CWF as<br />

the case may be.<br />

viii. Any other purpose for betterment and enhancement of the image of the <strong>Force</strong>. This option can<br />

be exercised only by President of CWF i.e. DG/CISF and amount to be spent will be decided<br />

by him.<br />

1

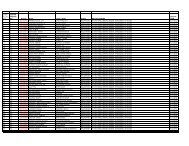

B. Sanction loans for the follow<strong>in</strong>g purposes<br />

Loans will be sanctioned for the follow<strong>in</strong>g purposes from UWF/ZWF/SWF/CWF. The<br />

application to CWF should come, if it is not met from the <strong>welfare</strong> fund of UWF, ZWF, SWF: -<br />

Sl.<br />

No<br />

Purpose Maximum limit of loans<br />

1. Meet<strong>in</strong>g expenses <strong>in</strong>curred <strong>in</strong> Four months basic pay or as decided by the<br />

connection with marriage of self or Manag<strong>in</strong>g committee accord<strong>in</strong>g to availability of<br />

his/her dependents and Daughter's<br />

engagement<br />

fund<br />

2. Meet<strong>in</strong>g expenses <strong>in</strong>curred <strong>in</strong> Six months basic pay or as decided by the<br />

connection with illness of self or Manag<strong>in</strong>g committee accord<strong>in</strong>g to availability of<br />

dependents<br />

fund<br />

3. Meet<strong>in</strong>g expenses of higher education Four months basic pay or as decided by the<br />

[PG (Technical)/Professional Courses Manag<strong>in</strong>g committee accord<strong>in</strong>g to availability of<br />

<strong>in</strong>clud<strong>in</strong>g MCA & M. Tech] for self or fund<br />

dependents UWF ZWF/SWF CWF<br />

4. Purchase / Book<strong>in</strong>g of plot/flat or<br />

construction of house for his/her own<br />

residential use<br />

Rs.5,000/- Rs.10,000/- Rs.50,000/-<br />

5. Cost of repairs of flat/house, owned by<br />

him or his/her spouse affected/caused<br />

by natural calamities<br />

Rs.5,000/- Rs. 15,000/- Rs.10,000/-<br />

6. Purchase of computer by the <strong>Force</strong> Nil Rs.15,000/- Rs. 15,000/personnel<br />

whose basic pay is up to<br />

4 cases for All the cases will<br />

Rs.10,500/- (pre-revised)<br />

Zonal/Plant DIG be sanctioned <strong>in</strong> the<br />

will be sanctioned monthly <strong>welfare</strong><br />

<strong>in</strong> the monthly committee meet<strong>in</strong>g<br />

<strong>welfare</strong> committee subject to the<br />

meet<strong>in</strong>g.<br />

availability<br />

funds.<br />

of<br />

7. Meet<strong>in</strong>g Funeral expenses <strong>in</strong> case of<br />

death of his/her immediate blood<br />

relations<br />

Rs.3,000/- Rs. 3,000/- Rs. 3,000/-<br />

8. Personnel go<strong>in</strong>g on UN Mission. Nil Nil Rs. 30,000/-<br />

(Recoverable <strong>in</strong> 12<br />

<strong>in</strong>stallments from<br />

9. For purchase of sew<strong>in</strong>g mach<strong>in</strong>e upto<br />

the rank of Inspector & below only<br />

Rs. 2500/- Rs. 2500/the<br />

salary of the<br />

officials.<br />

Rs. 2500/-<br />

10. Any other good and bonafide purpose.<br />

Reasons to be justified by the loan<br />

sanction<strong>in</strong>g authority <strong>in</strong> writ<strong>in</strong>g to<br />

next higher authority.<br />

Four months basic pay or as decided by the<br />

Manag<strong>in</strong>g committee accord<strong>in</strong>g to availability of<br />

fund<br />

C. Sanction Advances<br />

To advance loans for meet<strong>in</strong>g urgent travel<strong>in</strong>g expenses on tour/transfer where the time is<br />

too short for the member to draw advance under the provision of GFRs, provided that the member<br />

has applied for the advance under GFRs to the concerned authority and has also given an authority<br />

letter <strong>in</strong> favour of the sanction<strong>in</strong>g authority of the fund to receive an amount equal to the advance<br />

given to him.<br />

2

SUBSCRIPTION<br />

C. Annual subscription from all the members at the rate prescribed by the Govern<strong>in</strong>g Body as<br />

per follow<strong>in</strong>g rates to be recovered from the pay of December every year.<br />

GO’s Rs.180/- p.a<br />

SO’s Rs.120/- p.a<br />

OR’s Rs. 60/- p.a<br />

D. Share of Welfare subscriptions of Unit/Res.Bns/ Trg.Inst. /Gp.HQrs/ Zonal HQrs / Sector<br />

HQrs / FHQ are as under.<br />

To CISF HQrs : 15% share<br />

To Sector HQrs : 05% share<br />

To Zonal, DAE/DOS HQrs./GBS (from units under<br />

their command)<br />

: 20% share<br />

NISA Hyderabad : 85% share<br />

Units headed by DIsG plants : 80% share<br />

To Gp. HQrs. (from units under their command) : 10% share<br />

Units under Gp. HQrs. : 50% share<br />

Other Units : 60% share<br />

Note: - New units are exempted for mak<strong>in</strong>g any subscription share to higher formations for<br />

first 2 years.<br />

EDUCATION FUND<br />

The Education Fund was <strong>in</strong>troduced on 1st September 1990.<br />

OBJECTIVES<br />

1. To provide f<strong>in</strong>ancial assistance for educational purposes to the wards of CISF personnel<br />

<strong>in</strong>clud<strong>in</strong>g wards of those personnel who die <strong>in</strong> harness or <strong>in</strong> some action.<br />

2. To promote excellence and merit amongst the wards of member by giv<strong>in</strong>g them<br />

<strong>in</strong>centives <strong>in</strong> the form of scholarships and other subsidies.<br />

SUBSCRITION<br />

Subscriptions at flat rate toward Education Fund are be<strong>in</strong>g recovered w.e.f. 1-9-1990 from<br />

the salary of March every year from all the members of the <strong>Force</strong> <strong>in</strong>clud<strong>in</strong>g deputationist and<br />

Civilians staff as under: -<br />

RANK<br />

SUBSCRIPTION<br />

(Includ<strong>in</strong>g<br />

equivalent ranks <strong>in</strong><br />

civil staff)<br />

Per month Per Year<br />

GOs Rs.20/- Rs.240/-<br />

SOs Rs.06/- Rs. 72/-<br />

ORs Rs.04/- Rs. 48/-<br />

3

BENEFITS<br />

The follow<strong>in</strong>g types of scholarships / f<strong>in</strong>ancial assistance are be<strong>in</strong>g granted to the wards of<br />

CISF personnel: -<br />

Name of<br />

Scholarship<br />

General<br />

Scholarship<br />

Merit<br />

Scholarship<br />

Merit<br />

Scholarship<br />

Merit<br />

Scholarship<br />

Merit<br />

Scholarship<br />

F<strong>in</strong>ancial<br />

Assistance<br />

(Handicapped)<br />

40 cases for<br />

all ranks<br />

Name of class<br />

for which<br />

scholar-ship<br />

is applicable<br />

7 th to 10 th<br />

Entitlement Entitlement Entitlement Amount<br />

GO’s SO’s OR’s (<strong>in</strong> Rs.)<br />

NA<br />

11 th & 12 th 65% or above<br />

(15 wards of<br />

GO’s FHQrs<br />

Graduation<br />

level<br />

Post Graduation<br />

level<br />

Technical /<br />

Medical/<br />

Professional<br />

level)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/50 FHQrs<br />

Level)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/800 FHQrs<br />

Level)<br />

70% (1/100)<br />

at Zonal / plant<br />

level<br />

70%<br />

(1/75)<br />

60% (No limit) 60% (No<br />

limit)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/500 FHQrs<br />

Level)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/800 FHQrs<br />

Level)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/500<br />

FHQrs<br />

Level)<br />

55% - Arts<br />

60% - Com.<br />

65% - Sc. /<br />

Agriculture<br />

(1/800<br />

FHQrs<br />

Level)<br />

55%-MBBS/MS/Eng<strong>in</strong>eer<strong>in</strong>g/technical degree/ BE/<br />

B.Tech/ M.Tech/ LLB/ LLM/ B.Ed/BCA/ MCA/<br />

MBA/CA/ICWA/CS/CFA,. Courses recognized by<br />

Govt. of India.<br />

-Bachelor of General Nurs<strong>in</strong>g and Midwifery courses.<br />

-Dip. <strong>in</strong> Polytechnic Eng.<br />

-Dip.&Digree Hotel Management, Fashion Design<strong>in</strong>g.<br />

-Dip. <strong>in</strong> Pharmacy, Bachelor of Occupational and<br />

Physiotherapy. (1/500 for all ranks comb<strong>in</strong>ed)<br />

Wards of the member of the force who are deaf, dumb, bl<strong>in</strong>d, seriously<br />

handicapped, mentally retarded study<strong>in</strong>g <strong>in</strong> recognized schools/<br />

colleges/Universities.<br />

Rs.1500/-<br />

Rs.1800/-<br />

Rs. 2000/-<br />

Rs. 3000/-<br />

Degree courses<br />

for GO’s &<br />

SO’s Rs.8000/-<br />

& OR’s Rs.<br />

10000/-<br />

Diploma courses<br />

GO’s & SO’s<br />

Rs.6000/- &<br />

OR’s Rs.<br />

7500/-<br />

Rs.2400/-<br />

About 40<br />

cases <strong>in</strong> this<br />

category<br />

irrespective<br />

of the rank<br />

may be<br />

considered at<br />

FHqrs level.<br />

4

Hostel<br />

Subsidy<br />

100 cases<br />

for all ranks<br />

Reimburse<br />

ment cost of<br />

one set of<br />

text books<br />

for Group<br />

“D” employees<br />

only<br />

Coach<strong>in</strong>g<br />

Scheme for<br />

CISF wards<br />

entrance<br />

exam<strong>in</strong>ation<br />

for Engg &<br />

Medical<br />

(Limited for<br />

80 cases)<br />

11, 12 &<br />

Tech. Dip.<br />

Courses<br />

Graduation<br />

/Post<br />

Graduation<br />

Technical/<br />

Degree<br />

MBBS, MD,<br />

Eng<strong>in</strong>eer<strong>in</strong>g,<br />

MS)<br />

1 st to 12 th<br />

Classes<br />

Eng<strong>in</strong>eer<strong>in</strong>g &<br />

Medical<br />

Note: - Col.-7 (Hostel Subsidy)<br />

-- NA -- Rs.1200/- Rs.1800/- FHqrs<br />

LEVEL<br />

SOs=05<br />

Ors=15<br />

Rs.1200/- Rs.1800/- Rs.2400/- Gos=08<br />

SOs=10<br />

Ors=22<br />

Rs.2400/- Rs.3600/- Rs.4800/- Gos=08<br />

SOs=10<br />

ORs=22<br />

--NA-- --NA-- Cost of one<br />

set of text<br />

books of all<br />

classes.<br />

However, the<br />

amount may<br />

be limited<br />

maximum to<br />

Rs.1000/- or<br />

actual cost of<br />

the books<br />

whichever is<br />

less.<br />

70% Marks <strong>in</strong> 12th standard <strong>in</strong> case the result of 12th<br />

standard are awaited, 70 % marks and above of 10th<br />

standard are required.<br />

No limit.<br />

The fee for<br />

one year<br />

correspondence<br />

courses for<br />

medical and<br />

Engg will be<br />

Rs. 3850/- &<br />

Rs.4500/-<br />

respectively.<br />

i. The amounts of Hostel subsidy are subject to the rates laid down or actual expenditure,<br />

which ever is less.<br />

ii. The eligibility to apply for the Hostel Subsidy, the wards of the members of the Fund<br />

should obta<strong>in</strong> a m<strong>in</strong>imum percentage of marks <strong>in</strong> the previous year f<strong>in</strong>al exam<strong>in</strong>ation as<br />

fixed for Merit Scholarships. The eligible wards will either be considered for award of<br />

Merit Scholarship or Hostel Subsidy which ever is more beneficial to them.<br />

5

CENTRAL WELFARE RISK PREMIA-CUM-SAVING FUND<br />

SCHEME-2008<br />

This scheme <strong>in</strong>troduced <strong>in</strong> June 1986, revised <strong>in</strong> 1989, 1997, 2002 & 2008 now it is be<strong>in</strong>g<br />

called as Risk Premia-Cum Sav<strong>in</strong>g Fund Scheme-2008.<br />

OBJECTIVES<br />

To provide f<strong>in</strong>ancial assistance to the next of k<strong>in</strong> (NOK) of the deceased member / miss<strong>in</strong>g<br />

member or to those who are <strong>in</strong>validated on medical ground. The sav<strong>in</strong>g element of the scheme <strong>in</strong><br />

respect of the members are paid with prevail<strong>in</strong>g rate of <strong>in</strong>terest <strong>in</strong> lump-sum on superannuation<br />

/VRS/Compulsory Retirement/ resigned / dismissed / removal from service and on repatriation to<br />

their parent departments.<br />

SUBSCRIPTION<br />

Every member will contribute a sum of Rs. 100/- per month on quarterly basis as subscription<br />

dur<strong>in</strong>g his period of Govt. service till such time that he/she retires or leaves the service. The amount<br />

of Rs. 100/- per month will be sub-divided under two heads i.e. Sav<strong>in</strong>g Element @ Rs. 70/- and Risk<br />

Element @ Rs. 30/-. The contribution / subscription is be<strong>in</strong>g recovered on quarterly basis <strong>in</strong> the<br />

month of Feb, May, Aug and Nov.<br />

In case of death / miss<strong>in</strong>g<br />

BENEFITS<br />

Rs. 5 Lacs<br />

(Enhanced w.e.f. 01-01-2009)<br />

{Earlier the lump sum grant of RS Fund<br />

was Rs. 2 Lacs w.e.f. 01-11-2008}<br />

In case of <strong>in</strong>validation (lump sum grant)<br />

81% - 100% disability Rs.2,00,000/-<br />

51% - 80% disability Rs.1,00,000/-<br />

Upto 50% disability Rs. 50,000/-<br />

In all the Struck of Strength<br />

cases<br />

Payment of entire Sav<strong>in</strong>g Element<br />

with bonus/ prevail<strong>in</strong>g rate of<br />

<strong>in</strong>terest.<br />

Note: For enhancement of <strong>in</strong>validation (lump sum grant) is under consideration.<br />

6

EX-GRATIA LUMP-SUM COMPENSATION<br />

MHA sanctions, Ex-Gratia lump-sum grant <strong>in</strong> terms of Department of Pension & OM No.<br />

38/37/08-P&PW (A) dated 02-09-2008 ex-gratia lump sum compensation available to the families<br />

of <strong>Central</strong> Govt. Civilian employees, who died <strong>in</strong> harness <strong>in</strong> the performance of their bona fide<br />

official duties as per DOP&PW OM No. 45/55/97-P&PW(C) dated 11-09-1998 has been revised<br />

w.e.f 01-01-2006 as under: -<br />

Description Revised Ex-Gratia amount<br />

w.e.f. 01-01-2006<br />

(a) Death occurr<strong>in</strong>g due to accidents <strong>in</strong> the course<br />

of performance of duties.<br />

Rs.10.00 lakhs<br />

(b) Death occurr<strong>in</strong>g <strong>in</strong> the course of performance<br />

of duties attributable to acts of violence by<br />

terrorists anti social elements etc.<br />

(c) Death occurr<strong>in</strong>g dur<strong>in</strong>g (a) enemy action <strong>in</strong><br />

<strong>in</strong>ternational war or border skirmishes and (b)<br />

action aga<strong>in</strong>st militaries, terrorists extremists etc.<br />

(d) Death occurr<strong>in</strong>g while on duty <strong>in</strong> the specified<br />

high altitude, <strong>in</strong>accessible border posts, etc on<br />

account of natural disasters, extreme weather<br />

Rs.10.00 lakhs<br />

Rs.15.00 lakhs<br />

Rs.15.00 lakhs<br />

PRIME MINISTER’S SCHOLARSHIP SCHEME<br />

The Hon’ble Prime M<strong>in</strong>ister on the occasion of Independence Day 2005 announced the<br />

scheme to encourage technical and post graduate education for the widows and the unmarried wards<br />

of Ex-CPFs personnel and serv<strong>in</strong>g personnal (Below Officer rank upto Inspector).<br />

Courses eligible:- Medical / Engg. / MCA / MBA and other professional programme<br />

recognised by Govt.<br />

Duration / Amount:- Two to five years / Amount Rs. 1250/- for boys and Rs. 1500/- for<br />

girls per month.<br />

Scholarship is required to be submitted to MHA through WARB HQrs.<br />

CENTRAL POOL QUOTA FOR MBBS /BDS SEATS<br />

MHA has reserved seats for Medical and Dental colleges for the wards of serv<strong>in</strong>g CPMFs<br />

personnel and personnel those killed <strong>in</strong> action / permanently disabled <strong>in</strong> action and boarded out from<br />

service.<br />

Eligible applications are required to be forwarded through respective Sector HQrs to FHQrs<br />

(Welfare Branch) for onward submission to MHA.<br />

7

(i). Pension<br />

GOVERNMENT PENSIONARY BENEFITS<br />

(SUPERANNUATION, VOLUNTARY RETIREMENT,<br />

PREMATURE RETIREMENT, COMPULSORY RETIREMENT)<br />

Under CCS (Pension Rules-1972) a recurr<strong>in</strong>g monthly payment is admissible to permanent<br />

employees who retire or are retired with a qualify<strong>in</strong>g service of not less than 20 years for direct<br />

employee and 10 years service for re-employed ex-serviceman. The quantum of pension depends<br />

upon the qualify<strong>in</strong>g service and the average emoluments drawn dur<strong>in</strong>g the last 10 months of service.<br />

Full pension is admissible to an employee who retires after complet<strong>in</strong>g qualify<strong>in</strong>g service of not less<br />

than 33 years and the amount of pension is determ<strong>in</strong>ed @ 50% of the average emoluments (Basic<br />

Pay + SP+DP+NPA) drawn dur<strong>in</strong>g last 10 months of service. The m<strong>in</strong>imum pension admissible is<br />

Rs. 1913/- per month and maximum upto 50% of highest basic pay payable <strong>in</strong> the <strong>Central</strong> Govt.,<br />

which is Rs.30,000/- per month s<strong>in</strong>ce January 1996.<br />

(ii). Commutation of Pension<br />

Every pensioner is eligible to commute a portion of his monthly pension for lump-sum<br />

payment, which is the commuted value of that portion of the pension. 40% of the pension can be<br />

commuted and it is also restored on expiry of 15 years.<br />

(iii). Retirement Gratuity<br />

It is admissible to an employee who retires after completion of 5 years of qualify<strong>in</strong>g service<br />

and has become eligible for service gratuity or pension under Rule 49 of CCS Pension Rule. The<br />

amount payable <strong>in</strong> equal to ‘one fourth’ of his emoluments for each completed six monthly period of<br />

qualify<strong>in</strong>g service subject to a maximum of 16.5 times the ‘emoluments’.<br />

(iv). Death Gratuity<br />

Death Gratuity is admissible <strong>in</strong> the event of death, <strong>in</strong> service, as under: -<br />

a. Less than one year : 02 times of emoluments.<br />

b. One year or more but less than 5 years : 06 times of emoluments.<br />

c. 5 years or more but less than 20 years : 12 times of emoluments.<br />

d. 20 year or more : Half of emoluments for every completed<br />

6 monthly period of qualify<strong>in</strong>g service<br />

subject to a maximum of 33 times<br />

emoluments or Rs.3.50 lakh whichever<br />

is less. Emoluments <strong>in</strong>clude DA also on<br />

the date of cessation of service.<br />

Note: Every employee on his appo<strong>in</strong>tment should make nom<strong>in</strong>ation <strong>in</strong> the prescribed form<br />

conferr<strong>in</strong>g on one or more persons right to receive Death-cum-Retirement Gratuity<br />

amount <strong>in</strong> the event of his/her death.<br />

8

(v). GPF F<strong>in</strong>al Payment<br />

(a). The General Provident Fund (<strong>Central</strong> Service) Rules-1960 came <strong>in</strong>to existence w.e.f.<br />

01-04-1960. The subscription of GPF is mandatory from the pay of the <strong>Central</strong> Service<br />

employee not less than 6% of -his emoluments and not more than his /her total<br />

emoluments. When a subscriber quits the service, the amount stand<strong>in</strong>g to his credit <strong>in</strong> the<br />

fund shall become payable to him alongwith the <strong>in</strong>terest published by Government time<br />

to time.<br />

(b). Deposit L<strong>in</strong>ked Insurance Revised Scheme.<br />

It has been decided by <strong>Central</strong> Government that the death of a subscriber to provident<br />

fund after the normal work<strong>in</strong>g hours of the last work<strong>in</strong>g day before 12 midnight of the<br />

calendar day <strong>in</strong> a case of death, while <strong>in</strong> service entitl<strong>in</strong>g the nom<strong>in</strong>ee of the subscriber to<br />

the benefit of Deposit L<strong>in</strong>ked Insurance Scheme subject to the fulfillment of the<br />

prescribed conditions of the scheme.<br />

The maximum limit of Rs. 60,000/- is to be applied after arriv<strong>in</strong>g at the average of<br />

Thirty-six months and not at every stage.<br />

(vi) <strong>Central</strong> Government Employee’s Group Insurance Scheme.<br />

In replacement of the ‘<strong>Central</strong> Govt. Employee’s Insurance Scheme, 1977 a new scheme<br />

called CGEGIS 1980 was <strong>in</strong>troduced which was notified on 01-11-1980 and came <strong>in</strong>to force w.e.f.<br />

01-01-1982. It provides for the <strong>Central</strong> Govt. Employees, at a low cost and on a wholly contributory<br />

and self f<strong>in</strong>anc<strong>in</strong>g basis, the tw<strong>in</strong> benefits of an <strong>in</strong>surance cover to help their families <strong>in</strong> the event of<br />

unfortunate death while <strong>in</strong> service and a lump sum payment to augment their resources on retirement<br />

and resignation etc. The follow<strong>in</strong>g revised rates of subscriptions came <strong>in</strong>to force w.e.f. 01-01-1990.<br />

Group of<br />

employees<br />

belongs<br />

Subscription per month Amount of <strong>in</strong>surance<br />

cover<br />

Group A Rs.120/- Rs. 1,20,000/-<br />

Group B Rs.60/ Rs. 60,000/<br />

Group C Rs.30/ Rs. 30,000/<br />

Group D Rs.15/ Rs. 15,000/<br />

At the time of retirement/ resignation of Govt. servant the accumulated value of<br />

contributions is calculated as per the table circulated by the M<strong>in</strong>istry. In case of death while <strong>in</strong><br />

service the additional benefits of an <strong>in</strong>surance covered under scheme is paid to next of k<strong>in</strong>.<br />

(vii) ENCASHMENT OF LEAVE<br />

(Swamy’s – FR & SR part-III)<br />

Encashment of earned leave: - The authority competent to sanction leave should<br />

automatically grant lump sum cash equivalent of leave salary admissible for the number of days of<br />

earned leave at the credit of the employee on the last day of his service, subject to a maximum of 300<br />

days <strong>in</strong>clud<strong>in</strong>g the number of days, for which encashment was availed along with LTC.<br />

1. On retirement after atta<strong>in</strong><strong>in</strong>g the age of superannuation.<br />

2. When the service is extended <strong>in</strong> public <strong>in</strong>terest beyond superannuation, after<br />

extension.<br />

3. When an employee retires on superannuation while under suspension or while<br />

discipl<strong>in</strong>ary or crim<strong>in</strong>al proceed<strong>in</strong>gs are pend<strong>in</strong>g aga<strong>in</strong>st him, the whole or part of<br />

cash equivalent of leave salary may be withheld to meet recoveries from him possibly<br />

9

aris<strong>in</strong>g on conclusion of the proceed<strong>in</strong>gs. On conclusion of the proceed<strong>in</strong>gs, payment<br />

may be released after adjustment of Government dues, if any.<br />

4. On term<strong>in</strong>ation of service by notice/payment of pay and allowances <strong>in</strong> lieu of notice<br />

or otherwise <strong>in</strong> accordance with the terms and conditions of his appo<strong>in</strong>tment.<br />

5. On term<strong>in</strong>ation of service of officials re-employed after retirement. In this case, the<br />

maximum will <strong>in</strong>clude the period for which encashment of leave was allowed at the<br />

time of previous retirement and also encashment availed with LTC.<br />

6. When an employee is <strong>in</strong>valided from service on medical grounds.<br />

7. When an employee resigns or quits service on his own accord, the lump-sum cash<br />

payment will be only to the extent of half of the earned leave at his credit subject to a<br />

maximum of 150 days <strong>in</strong>clud<strong>in</strong>g the number of days for which encashment was<br />

availed along with LTC, on the date of cessation from service.<br />

8. On premature retirement under FR 56(j) or (i) of Rule 48 of CCS (pension) Rules.<br />

9. On voluntary retirement under FR 56 (k) or (m) or Rule 48 or 48-A of CCS (pension)<br />

Rules.<br />

10. On compulsory retirement as a measure of penalty when no reduction <strong>in</strong> pension is<br />

ordered.<br />

(viii). Family Pension<br />

Family pension is payable to the family of a Govt. servant on his death <strong>in</strong> service or<br />

after his retirement. For this purpose "family" <strong>in</strong> relation to a Govt. Servant, means: -<br />

i. Wife or wives <strong>in</strong>clud<strong>in</strong>g judicially separated wife or wives <strong>in</strong> the case of a male<br />

Government servant,<br />

ii. husband, <strong>in</strong>clud<strong>in</strong>g judicially separated husband <strong>in</strong> the case of a female<br />

Government servant,<br />

iii. sons <strong>in</strong>clud<strong>in</strong>g stepsons and adopted sons,<br />

iv. unmarried daughters <strong>in</strong>clud<strong>in</strong>g step-daughters and adopted daughters,<br />

v. widowed daughters <strong>in</strong>clud<strong>in</strong>g step-daughters and adopted daughters,<br />

vi. father<br />

vii. mother<br />

<strong>in</strong>clud<strong>in</strong>g adoptive parents <strong>in</strong> the case of <strong>in</strong>dividuals whose personal<br />

law permits adoption.<br />

viii. brothers below the age of eighteen years <strong>in</strong>clud<strong>in</strong>g step brothers,<br />

ix. unmarried sisters and widow sisters <strong>in</strong>clud<strong>in</strong>g stepsisters,<br />

x. married daughters, and<br />

xi. children of a pre-deceased son.<br />

The monthly family pension is based upon ‘pay’ (Basic Pay + Stagnation Increment + DP<br />

+ NPA) drawn by a Govt. servant on the date of death or on the date of retirement. Normal rate of<br />

Family Pension is 30% of last pay drawn.<br />

(ix). Extra-Ord<strong>in</strong>ary Pension<br />

If an employee susta<strong>in</strong>s <strong>in</strong>juries, disease or dies, and the <strong>in</strong>jury, disease or death is<br />

attributable to Govt. service, he/his family become eligible to the grant of an award under <strong>Central</strong><br />

Civil Service (E.O.P) Rules. This would be <strong>in</strong> addition to service Gratuity / Pension admissible under<br />

the CCS (Pension) Rules (Appendix '3').<br />

10

If death is attributable to government service, wife of the deceased is eligible to the grant<br />

of Extra-ord<strong>in</strong>ary family pension. In the absence of wife/husband, family pension would be granted<br />

to the children.<br />

(x). Disability Pension<br />

When an employee is boarded out from service due to <strong>in</strong>jury / disease attributable to<br />

Govt. Service, he becomes entitled to disability pension, <strong>in</strong> addition to pension/gratuity admissible<br />

under CCS (Pension) Rules, 1972.<br />

(xi). Liberalized Pensionary Awards<br />

The liberalized pensionary award <strong>in</strong> the case of death / disability as a result of (i) attack<br />

by or dur<strong>in</strong>g action aga<strong>in</strong>st extremists, anti-social elements etc. and (ii) enemy action <strong>in</strong> <strong>in</strong>ternational<br />

war or border skirmishes are be<strong>in</strong>g awarded to the next of k<strong>in</strong> (NOK) of deceased or disabled<br />

member as per CCS Pension Rule-1972 (Appendix '4').<br />

In the event of death of the Govt. Servant <strong>in</strong> action, the widows will be entitled to family<br />

pension equal to the pay last drawn by the deceased Govt. Servant for his life or until re-marriage.<br />

(xii). Medical Facilities For Pensioners<br />

Circular No.38/99/99-P&PW (C) dated 17-04-2000<br />

Implementation of Government’s decision on the recommendations of 5 th <strong>Central</strong> Pay<br />

Commission - Grant of fixed medical allowance @ Rs.100/- P.M to <strong>Central</strong> Government Pensioners<br />

resid<strong>in</strong>g <strong>in</strong> areas not covered under CGHS.<br />

(xiii). MONETARY BENEFITS FOR THE RECIPIENTS OF PRESIDENT’S POLICE<br />

MEDAL FOR GALLANTRY AND POLICE MEDAL FOR GALLANTRY<br />

(a). The Govt. of India, MHA, vide their letter No. 11026/10/98-PMA dated 6-12-1999 have<br />

sanctioned the follow<strong>in</strong>g monetary allowances for the recipients of President’s Police Medal for<br />

Gallantry and Police Medal for Gallantry.<br />

Sl<br />

No.<br />

Name of the Medal Gallantry Allowance<br />

01 President’s Police Medal for Gallantry Rs. 750/-p.m<br />

02 Each of Bar to President’s Police medal<br />

for Gallantry<br />

Rs. 750/-p.m.<br />

03 Police medal for Gallantry Rs. 450/-p.m<br />

04 Each of Bar to Police Medal for Gallantry Rs. 450/-p.m.<br />

(b). The Govt. of India, MHA vide their letter No. 11026/12/05-PMA dated 09-03-2006 have<br />

sanctioned the follow<strong>in</strong>g concessions for the recipients of President’s Police Medal for Dist<strong>in</strong>guished<br />

Service and President’s Police Medal for Gallantry and Police Medal for Gallantry.<br />

i. 75% concession on journey to be undertaken by the recipients of President’s Police<br />

Medal for Gallantry and Police Medal for Gallantry (serv<strong>in</strong>g or retirees) <strong>in</strong> Economy<br />

Class on Domestic Sectors and for that purposes the concessional tickets are issued by the<br />

Indian Airl<strong>in</strong>es on verification of the Identity card issued by MHA.<br />

ii. 30% concession <strong>in</strong> basic Mail/Express fares of all classes and <strong>in</strong> the fares of Rajdhani /<br />

Shatabadi tra<strong>in</strong>s to the recipients of President’s Police Medal for Dist<strong>in</strong>guished Service<br />

who atta<strong>in</strong> the age of 60 years of age and above is available on the production of Identity<br />

card issued by the MHA.<br />

11

(xiv). NEW PENSION SCHEME<br />

The scheme is applicable to all <strong>Central</strong> Government servants who are appo<strong>in</strong>ted on or<br />

after 01-01-2004, except Armed <strong>Force</strong>s (Army, Navy & Air <strong>Force</strong>).<br />

Government servants have to contribute 10% of their (Basic Pay + Dearness Pay + DA)<br />

through salary bills. Recovery will commence from the follow<strong>in</strong>g month of jo<strong>in</strong><strong>in</strong>g the Government<br />

service. Government will make equal match<strong>in</strong>g contribution.<br />

GPF.<br />

PAOs.<br />

Employees covered under New Pension Scheme are not eligible to subscribe towards<br />

A unique 16 digit permanent pension Account Number (PPAN) will be allotted by the<br />

No withdrawal is admissible.<br />

Exit from the scheme will be on atta<strong>in</strong><strong>in</strong>g 60 years of age. It is mandatory to <strong>in</strong>vest forty<br />

percentage of pension wealth <strong>in</strong> an annuity (from an IRDA regulated Life Insurance Company) to<br />

provide pension for lifetime of the employee and his dependent parents/spouse. In the case of<br />

employees who leave the scheme before 60 years of age, the mandatory annualisation would be 80%<br />

of the Pension wealth.<br />

Individual will get an Annual statement conta<strong>in</strong><strong>in</strong>g the details of open<strong>in</strong>g balance,<br />

monthly contribution, Government's match<strong>in</strong>g contribution and <strong>in</strong>terest earned.<br />

to time.<br />

Interest for the accumulations will be at the rate prescribed by the Government from time<br />

12

FAMILY WELFARE CENTRE<br />

Family <strong>welfare</strong> Centre is <strong>in</strong> operation <strong>in</strong> most of the units where the family members of the<br />

<strong>Force</strong> personnel can augment their <strong>in</strong>come by way of fabricat<strong>in</strong>g uniforms etc. as per the rates fixed<br />

by G.O.I from time to time. The families of Ex-CISF personnel are also allowed to become member<br />

of Family Welfare Centre so that they can also augment their <strong>in</strong>come by stitch<strong>in</strong>g the uniforms etc.<br />

The Unit Commander is empowered to take them as a member of Unit Welfare Centre at their level.<br />

OPTION FOR FIXATION OF PAY ON PROMOTION<br />

On the basis of FR-22(I) (a) (I) straightway without any further review on the accrual of<br />

<strong>in</strong>crement <strong>in</strong> the pay scale of lower post.<br />

or<br />

Pay may be fixed <strong>in</strong>itially <strong>in</strong> the manner as provided under FR-22(I)(a)(I) and refix aga<strong>in</strong><br />

from the date of accrual of next <strong>in</strong>crement <strong>in</strong> the scale of pay of the lower post.<br />

INCENTIVES FOR PROMOTING SMALL<br />

FAMILY NORMS<br />

1. Employees who undergo sterilization operation are entitled to get a special <strong>in</strong>crement <strong>in</strong> the<br />

form of special pay.<br />

2. A rebate of 1/2% <strong>in</strong> the <strong>in</strong>terest on House Build<strong>in</strong>g Advance is admissible.<br />

3. Special casual leave is admissible as under: -<br />

(a) Male employee<br />

(1) Maximum of 6 work<strong>in</strong>g days for vasectomy operation. If undergoes the said operation<br />

for second time due to failure of the first, another six days will be admissible on the<br />

production of medical certificate.<br />

(2) Maximum of 21 days if his wife undergoes tuberculosis, laproscopy or salp<strong>in</strong>gectomy<br />

operation. The leave should follow the date of operation.<br />

(b) Female employees<br />

(1) Maximum of 14 days admissible for tubectomy/laproscopy. If she undergoes the<br />

operation for a second time due to failure of the first, maximum of 14 days will be<br />

admissible for the second time.<br />

(2) Maximum of 14 days admissible for salp<strong>in</strong>gectomy operation after Medical<br />

Term<strong>in</strong>ation of Pregnancy (MTP).<br />

(3) Admissible on the day of IUCD <strong>in</strong>sertion/re-<strong>in</strong>sertion.<br />

(4) Maximum of 21 days admissible for undergo<strong>in</strong>g re-canalisation operation.<br />

(5) One day admissible on the day of operation when her husband undergoes vasectomy<br />

operation.<br />

Extension/additional special casual leave is admissible for the period of hospitalization if<br />

the concerned employee is hospitalized on account of post-operational complication. Additional<br />

special casual leave for 7 days <strong>in</strong> case of vasectomy operation and 14 days <strong>in</strong> case of tubectomy<br />

operation is admissible if the employee does not rema<strong>in</strong> hospitalized after sterilization operation but<br />

is not fit to resume duty.<br />

13