utility systems automation - Description

utility systems automation - Description

utility systems automation - Description

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

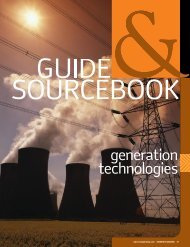

As FIGURE 4 illustrates, geospatial system purchases represented about half of<br />

all GFAS expenditures in 2004, but that dominance is expected to decline in comparison<br />

with surging FAS project activity between 2005 and 2007. The influx of more<br />

modest projects by municipal and rural electric utilities will shape the market mix<br />

going forward.<br />

Tales from the Dark Side<br />

Just as the Utility System Automation markets have evolved, utilities have been undergoing<br />

a transformation that has had a profound impact. Whether defined as restructuring<br />

or deregulation, utilities remain in a quandary. While the industry has been struggling<br />

to get its arms around the changes and implications by experimenting with new<br />

ventures, the basic culture of utilities still has not really changed much.<br />

Following the recent period of corporate crises, financial scandals and other debacles,<br />

utilities have been returning to their core business.<br />

The blackout of August 2003 left more than 50 million people in the northeastern<br />

United States and Canada in the dark for up to 38 hours. This event had both immediate<br />

and far-reaching implications for investments in <strong>utility</strong> <strong>automation</strong> and IT products,<br />

<strong>systems</strong> and services.<br />

The Past is Prologue<br />

Among other things, the August 2003 blackout – the largest in North American history<br />

– underlined the Achilles heel in the longstanding practice of minimizing investments in<br />

power transmission and distribution facilities, along with the associated <strong>automation</strong> <strong>systems</strong>,<br />

generally in favor of investments in generation. The blackout reminded the industry<br />

that a network of highly coordinated real-time operations and information management<br />

<strong>systems</strong> are vitally needed to oversee the already heavily interconnected grid.<br />

Moreover, population shifts over the past 30 to 40 years have fundamentally<br />

changed the balance and demographics of power supply and demand. Moving power<br />

across the grid efficiently, reliably and profitably are now substantive issues. These<br />

new challenges come at a time when the grid is not fully able to meet new demands.<br />

Many critical components of the T&D infrastructure are nearing the end of their estimated<br />

life expectancies. However, new infrastructure deployment is often opposed by<br />

environmentalists, special interest groups or ratepayers.<br />

As a result, a substantial percentage of long-anticipated T&D spending – and associated<br />

<strong>automation</strong> spending – failed to materialize. Until recently, most spending for<br />

infrastructure, though in many cases quite substantial, has concentrated on routine<br />

upgrades and occasional system replacements. Although much of the problem-solving<br />

emphasis has been placed on preventing future outages, the answers are inextricably<br />

linked to infrastructure improvements with long deliveries and huge price tags that<br />

will take decades to fund, plan, design, permit and implement even under the best of<br />

circumstances.<br />

A Road Paved with Good Intentions<br />

In recent years there has been a shift toward more investments in T&D in order to alleviate<br />

grid bottlenecks, which is a principal area of need for <strong>automation</strong> and IT investment.<br />

However, although most new infrastructure will take years to upgrade or replace,<br />

<strong>automation</strong> allows better management of the grid. Moreover, new <strong>automation</strong> technology<br />

might be better targeted toward faster service restoration, rather than focusing<br />

exclusively on outage prevention.<br />

Although billions — or by some accounts, trillions — in infrastructure investment are<br />

needed to bring the grid up to 21st century demands, <strong>automation</strong> currently accounts<br />

for only a tiny fraction of the investments that will be needed to modernize infrastructure.<br />

Hence, utilities should be looking toward <strong>automation</strong> as a means of preserving and<br />

enhancing the operational integrity of their asset base while the determination of how to<br />

best modernize the aging T&D infrastructure is studied and deployed.<br />

40 ENERGYBIZ MAGAZINE January/February 2005<br />

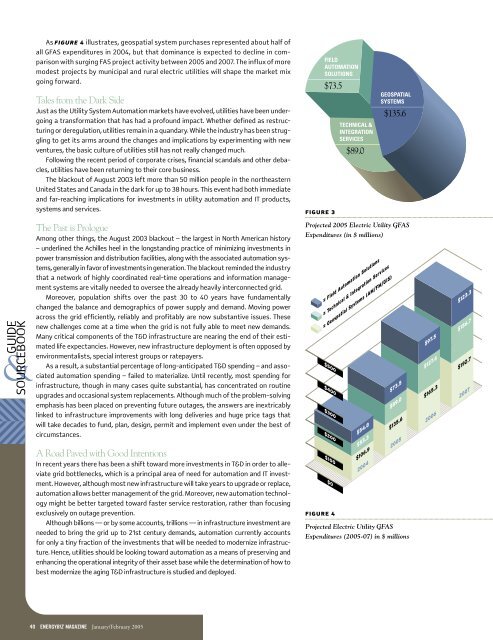

FI GURE 3<br />

Projected 2005 Electric Utility GFAS<br />

Expenditures (in $ millions)<br />

FI GURE 4<br />

Projected Electric Utility GFAS<br />

Expenditures (2005-07) in $ millions

![View From the Trenches [PDF]](https://img.yumpu.com/18854438/1/190x252/view-from-the-trenches-pdf.jpg?quality=85)