Curricula vitae (pdf) - Andrew Young School of Policy Studies ...

Curricula vitae (pdf) - Andrew Young School of Policy Studies ...

Curricula vitae (pdf) - Andrew Young School of Policy Studies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

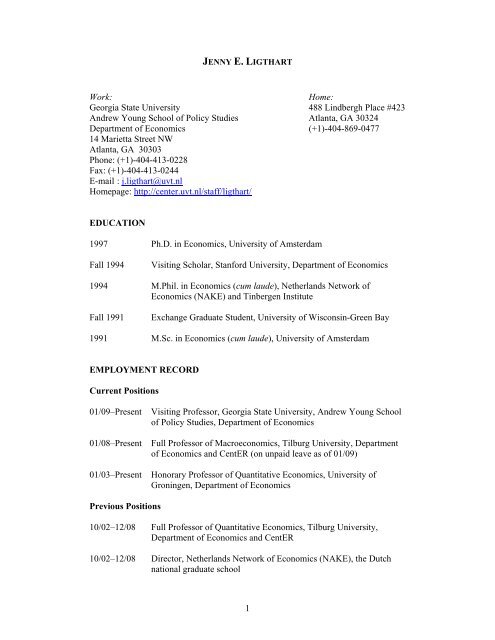

JENNY E. LIGTHART<br />

Work: Home:<br />

Georgia State University 488 Lindbergh Place #423<br />

<strong>Andrew</strong> <strong>Young</strong> <strong>School</strong> <strong>of</strong> <strong>Policy</strong> <strong>Studies</strong> Atlanta, GA 30324<br />

Department <strong>of</strong> Economics (+1)-404-869-0477<br />

14 Marietta Street NW<br />

Atlanta, GA 30303<br />

Phone: (+1)-404-413-0228<br />

Fax: (+1)-404-413-0244<br />

E-mail : j.ligthart@uvt.nl<br />

Homepage: http://center.uvt.nl/staff/ligthart/<br />

EDUCATION<br />

1997 Ph.D. in Economics, University <strong>of</strong> Amsterdam<br />

Fall 1994 Visiting Scholar, Stanford University, Department <strong>of</strong> Economics<br />

1994 M.Phil. in Economics (cum laude), Netherlands Network <strong>of</strong><br />

Economics (NAKE) and Tinbergen Institute<br />

Fall 1991 Exchange Graduate Student, University <strong>of</strong> Wisconsin-Green Bay<br />

1991 M.Sc. in Economics (cum laude), University <strong>of</strong> Amsterdam<br />

EMPLOYMENT RECORD<br />

Current Positions<br />

01/09–Present Visiting Pr<strong>of</strong>essor, Georgia State University, <strong>Andrew</strong> <strong>Young</strong> <strong>School</strong><br />

<strong>of</strong> <strong>Policy</strong> <strong>Studies</strong>, Department <strong>of</strong> Economics<br />

01/08–Present Full Pr<strong>of</strong>essor <strong>of</strong> Macroeconomics, Tilburg University, Department<br />

<strong>of</strong> Economics and CentER (on unpaid leave as <strong>of</strong> 01/09)<br />

01/03–Present Honorary Pr<strong>of</strong>essor <strong>of</strong> Quantitative Economics, University <strong>of</strong><br />

Groningen, Department <strong>of</strong> Economics<br />

Previous Positions<br />

10/02–12/08 Full Pr<strong>of</strong>essor <strong>of</strong> Quantitative Economics, Tilburg University,<br />

Department <strong>of</strong> Economics and CentER<br />

10/02–12/08 Director, Netherlands Network <strong>of</strong> Economics (NAKE), the Dutch<br />

national graduate school<br />

1

12/02–12/07 Ministry <strong>of</strong> Finance Pr<strong>of</strong>essor <strong>of</strong> Economics, Tilburg University,<br />

Department <strong>of</strong> Economics<br />

10/99–09/02 Economist (Regular Staff), International Monetary Fund,<br />

Washington, D.C., Fiscal Affairs Department, Tax <strong>Policy</strong> Division<br />

10/98–09/99 Economist Program (Tenure-Track Staff), International<br />

Monetary Fund, Washington, D.C., European I Department, Central<br />

II Division<br />

09/97–09/98 Economist Program (Tenure-Track Staff), International Monetary<br />

Fund, Washington, D.C., Fiscal Affairs Department, Tax <strong>Policy</strong><br />

Division<br />

05/95–09/97 Assistant Pr<strong>of</strong>essor, University <strong>of</strong> Amsterdam, Department <strong>of</strong><br />

Economics, International Economics Division<br />

Spring 1996 Lecturer, University <strong>of</strong> Amsterdam, International Monetary Affairs,<br />

Amsterdam <strong>School</strong> <strong>of</strong> International Relations (ASIR)<br />

01/92–05/95 Lecturer, University <strong>of</strong> Amsterdam, Department <strong>of</strong> Economics,<br />

Macroeconomics Division<br />

Spring 1991 Internship, Dutch Central Bank, Balance <strong>of</strong> Payments Department<br />

Editorial Positions<br />

03/09– Co-Editor, FinanzArchiv (Public Finance Analysis)<br />

10/02–12/08 Editor, Nake News<br />

Pr<strong>of</strong>essional Affiliations<br />

01/06–Present Research Fellow, CESifo Research Network, Munich<br />

10/02–Present Senior Research Fellow, CentER, Tilburg University<br />

Other Pr<strong>of</strong>essional Activities<br />

03/08–Present Member <strong>of</strong> ad-hoc fiscal committee advising the Chair <strong>of</strong> the<br />

Social and Economic Council <strong>of</strong> the Netherlands<br />

02/08–07/08 Member selection committee <strong>of</strong> VIDI grants (Associate Pr<strong>of</strong>essor<br />

level), Dutch National Science Foundation<br />

11/06–Present Educational Coordinator Macro Track, CentER Graduate <strong>School</strong>,<br />

Tilburg University<br />

2

06/03–Present Consultant, Netherlands Organization for Applied Scientific<br />

Research (TNO), Institute for Traffic Transport, Logistics, and<br />

Spatial Development<br />

12/03–Present Board Member <strong>of</strong> the Royal Netherlands Economic Association<br />

10/03–Present Supervisory Board Member <strong>of</strong> the National Academy for Finance<br />

and Economy, The Hague<br />

06/03–07/07 Member <strong>of</strong> the Supervisory Board (“Central Planning Committee”)<br />

<strong>of</strong> the Netherlands Bureau for Economic <strong>Policy</strong> Analysis (CPB)<br />

10/02–Present Member <strong>of</strong> the Panel <strong>of</strong> Fiscal Experts, Fiscal Affairs Department,<br />

International Monetary Fund<br />

12/99–10/01 Member <strong>of</strong> the International Advisory Group on Taxation (IAGT) in<br />

Bosnia and Herzegovina<br />

Short-Term Visiting Positions<br />

European Central Bank (May 2007); CESifo, University <strong>of</strong> Munich (October–<br />

November 2005); World Bank (January 2005); International Monetary Fund (April<br />

2004 and March 2003); Tilburg University, CentER (June 2001 and September 1996);<br />

Groningen University (May 1999); and University College London (April 1996)<br />

Teaching Experience<br />

Tilburg University: BA course on Growth and Development (2006–08); MPhil<br />

course on Open Economy Macroeconomics (2005–08); MPhil course on Dynamic<br />

Macroeconomics (2003–04); BA course on International Economics (2002–03);<br />

University <strong>of</strong> Amsterdam: Graduate course on Trade and Monetary Theory (1995–<br />

1997); Graduate International Macroeconomics (1996); Graduate International<br />

Environmental Economics (1997); MA Course on International Monetary Affairs<br />

(1996); Intermediate and Graduate Macroeconomics (1992–1995)<br />

International Monetary Fund: Sections <strong>of</strong> the Public Finance Course for Country<br />

Officials (IMF Institute, 1997 and 1999–2002)<br />

Other institutions: Principles <strong>of</strong> Macroeconomics (Georgia State University, Spring<br />

2009); Sections <strong>of</strong> the course for Central American Central Bankers (Development<br />

Research Institute, IVO, June 2006); Graduate Course on Macroeconomics and Fiscal<br />

<strong>Policy</strong> (University <strong>of</strong> Munich, Fall 2005)<br />

Technical Assistance and IMF Country Work<br />

Bosnia and Herzegovina (October 1999–October 2001, June 2004, March 2005);<br />

Ethiopia (July 1998); The Gambia (February 2002); Georgia (November 1998);<br />

Kenya (May 2002–September 2002); Portugal (1999); Hungary (October 1998–<br />

October 1999); and Turkmenistan (October 1997–October 1998)<br />

3

RESEARCH RECORD<br />

Recent Academic Papers<br />

[1] “Do Immigrant Networks Promote Outward Foreign Direct Investment?<br />

Evidence from the Netherlands” (with Dorothe Singer), 2009, mimeo, Tilburg<br />

University<br />

[2] “The Determinants <strong>of</strong> Cross-Border Tax Information Sharing: A Panel Data<br />

Analysis” (with Johannes Voget), 2008, mimeo, Tilburg University. Paper<br />

presented at 2008 WZB conference<br />

[3] “How Productive is Public Capital? A Meta-Analysis” (with Pedro Bom), 2008,<br />

CentER Discussion Paper No. 2008-10. Paper presented at the 2008 IIPF<br />

conference.<br />

[4] “Currency Invoicing in International Trade: A Panel Data Approach” (with<br />

Jorge da Silva), 2007, CentER Discussion Paper No. 07-25, Tilburg University.<br />

Revise and resubmit, Journal <strong>of</strong> International Economics<br />

[5] “Commodity Tax Competition Among Governments: An Empirical Analysis”<br />

(with Jan Jacobs and Hendrik Vrijburg), 2007, Revise (minor) and resubmit,<br />

International Tax and Public Finance<br />

Publications in International Journals<br />

[6] “The Transitional Dynamics <strong>of</strong> Fiscal <strong>Policy</strong> in Small Open Economies” (with<br />

Ben Heijdra), 2009, Macroeconomic Dynamics, forthcoming<br />

[7] “Labor Tax Reform, Unemployment, and Search” (with Ben Heijdra), 2009,<br />

International Tax and Public Finance, Vol. 16, No. 1, pp. 82-104<br />

[8] “Information Exchange under Non-Discriminatory Taxation” (with Michael<br />

Keen), 2007, Scandinavian Journal <strong>of</strong> Economics, Vol. 109, No. 3, pp. 487-504<br />

[9] “Information Exchange for Consumption Tax Purposes: An Empirical<br />

Exploration,” 2007, Information Economics and <strong>Policy</strong>, Vol. 19, No. 1 pp. 24-<br />

42<br />

[10] “Fiscal <strong>Policy</strong>, Monopolistic Competition, and Finite Lives” (with Ben Heijdra),<br />

2007, Journal <strong>of</strong> Economic Dynamics and Control, Vol. 31, No. 1, pp. 325-359<br />

[11] “The Macroeconomic Dynamics <strong>of</strong> Demographic Shocks” (with Ben Heijdra),<br />

2006, Macroeconomic Dynamics, Vol. 10, No. 3, pp. 349-370<br />

[12] “Incentives and Information Exchange in International Taxation” (with Michael<br />

Keen), 2006, International Tax and Public Finance, Vol. 13, No. 2/3, pp. 163-<br />

180<br />

4

[13] “Environmental Quality, the Macroeconomy, and Intergenerational<br />

Distribution” (with Ben Heijdra and Jan Peter Kooiman), 2006, Resource and<br />

Energy Economics, Vol. 28, No. 1, pp. 74-104<br />

[14] “Information Sharing and International Taxation: A Primer” (with Michael<br />

Keen), 2006, International Tax and Public Finance, Vol. 13, No. 1, pp. 81-110<br />

[15] “Coordinating Tariff Reduction and Domestic Tax Reform Under Imperfect<br />

Competition” (with Michael Keen), 2005, Review <strong>of</strong> International Economics,<br />

Vol. 13, No. 2, pp. 385-390<br />

[16] “Consumption Taxation in a Digital World: A Primer,” 2004, Canadian Tax<br />

Journal, Vol. 52, No. 3, pp. 1076-1101<br />

[17] “Savings Taxation in the European Union: An Economic Perspective” (with<br />

Michael Keen), 2004, Tax Notes International, Vol. 3, No. 6, pp. 539-546<br />

[18] “The Point <strong>of</strong> Collection <strong>of</strong> Single-Stage Sales Tax in a Federal System,” 2003,<br />

Tax Notes International, Vol. 32, pp. 569-577<br />

[19] “Coordinating Tariff Reductions and Domestic Tax Reform” (with Michael<br />

Keen), 2002, Journal <strong>of</strong> International Economics, Vol. 56, No. 2, pp. 407-425<br />

[20] “The Hiring Subsidy Cum Firing Tax in a Search Model <strong>of</strong> Unemployment”<br />

(with Ben Heijdra), 2002, Economics Letters, Vol. 75, No. 1, pp. 97-108<br />

[21] “Public Capital and Output Growth in Portugal: An Empirical Analysis” 2002,<br />

European Review <strong>of</strong> Economics and Finance, Vol.1, No. 2, pp. 3-30<br />

[22] “Tax <strong>Policy</strong>, Output, and Intergenerational Distribution” (with Ben Heijdra),<br />

2002, IMF Staff Papers, Vol. 49, No. 1, pp. 106-127<br />

[23] “Deposit-Refund on Labor: A Solution to Equilibrium Unemployment?” (with<br />

Ben Heijdra), 2001, IMF Staff Papers, Vol. 48, No. 2, pp. 593-609<br />

[24] “The Dynamic Macroeconomic Effects <strong>of</strong> Tax <strong>Policy</strong> in an Overlapping<br />

Generations Model” (with Ben Heijdra), 2000, Oxford Economic Papers, Vol.<br />

52, No. 4, pp. 677-701<br />

[25] “Environmental <strong>Policy</strong>, Tax Incidence, and the Cost <strong>of</strong> Public Funds” (with<br />

Frederick van der Ploeg), 1999, Environmental and Resource Economics, Vol.<br />

13, No. 2, pp. 187-207<br />

[26] “Fiscal <strong>Policy</strong>, Distortionary Taxation, and Direct Crowding Out under<br />

Monopolistic Competition” (with Ben Heijdra and Frederick van der Ploeg),<br />

1998, Oxford Economic Papers, Vol. 50, No. 1, pp. 79-88<br />

[27] “Keynesian Multipliers, Direct Crowding Out, and the Optimal Provision <strong>of</strong><br />

Public Goods” (with Ben Heijdra), 1997, Journal <strong>of</strong> Macroeconomics, Vol. 19,<br />

No. 4, pp. 803-826<br />

5

[28] “Pollution, the Cost <strong>of</strong> Public Funds, and Endogenous Growth” (with Frederick<br />

van der Ploeg), 1994, Economics Letters, Vol. 46, No. 4, pp. 351-361<br />

[29] “Valuing Recreational King Mackerel Fishing: An Application <strong>of</strong> the<br />

Contingent Valuation Method,” 1993, Tinbergen Institute Research Bulletin,<br />

Vol. 5, pp. 15-28<br />

Books and Contributions to Edited Volumes<br />

[30] “Taxing Cross-Border Savings Income: An Economic Analysis <strong>of</strong> the EU<br />

Savings Tax,” 2007, in Read, C. and G.N. Gregoriou (eds), International<br />

Taxation (Amsterdam: Elsevier Science Publishers)<br />

[31] Environment, Imperfect Markets, and Public Finance, 1997, Tinbergen Institute<br />

Research Series No. 170 (Amsterdam: Thesis Publishers)<br />

[32] “Optimal Government <strong>Policy</strong>, Tax Incidence, and the Environment” (with<br />

Frederick van der Ploeg), 1996, in Carraro, Carlo and Dominico Siniscalco<br />

(eds.), Environmental Taxation, Revenue Recycling and Unemployment<br />

(Dordrecht: Kluwer Academic Press)<br />

[33] “Environmental Quality, Public Finance and Sustainable Growth” (with<br />

Frederick van der Ploeg), 1995, in Carraro, Carlo and Jerzey Filar (eds.), Game<br />

Theoretic and Control Models <strong>of</strong> the Environment (Boston: Birkhauser)<br />

[34] “Sustainable Growth and Renewable Resources in the Global Economy” (with<br />

Frederick van der Ploeg), 1994, in Carraro, Carlo (ed.), Trade, Innovation, and<br />

Environment (Dordrecht: Kluwer Academic Press)<br />

Publications in Refereed Dutch Academic Journals and Books<br />

[35] “Belasten van kapitaalinkomen en globalisering” (with Ruud de Mooij), 2007,<br />

in C.L.J. Caminada, A.M. Haberham, J.H. Hoogteijling en H. Vording (red.),<br />

Belasting met beleid, Den Haag: Sdu, pp. 335-350<br />

[36] “The Productivity <strong>of</strong> Public Capital: A Meta-Analysis” (with Rosa M. Martin<br />

Suarez), 2005, Conference Proceedings, Netherlands Regional Science<br />

Association, forthcoming<br />

[37] “Het belasten van grensoverschrijdende spaartegoeden: inlichtingenuitwisseling<br />

<strong>of</strong> bronbelasting?” 2003, Maandschrift Economie, Vol. 67, pp. 315-333<br />

[38] “SIMPC: Een kritische aanbeveling” (with Hans Amman and Pieter Prins),<br />

1990, Kwantitatieve Methoden, Vol. 35, pp. 107-112<br />

Work in Progress<br />

[39] “A Meta-Analysis on the Output Elasticity <strong>of</strong> Public Capital: A Nonlinear<br />

Publication Bias Approach” (with Pedro Bom), 2008, mimeo, Tilburg<br />

6

University. Paper presented at the 2 nd Annual conference <strong>of</strong> the Portuguese<br />

Economic Journal and Meta-Analysis workshop in Nancy<br />

[40] “Dynamic Panel Data Models Featuring Spatially Correlated Errors and<br />

Endogenous Interaction: A Monte-Carlo Approach” (with Jan Jacobs and<br />

Hendrik Vrijburg)<br />

[41] “Panel Data Models Featuring a Spatial Lag and Spatially Correlated Errors”<br />

(with Jan Jacobs and Hendrik Vrijburg)<br />

[42] “Dealing with Dependency in Meta-Analysis: A GLS Approach Applied to the<br />

Output Elasticity <strong>of</strong> Public Capital” (with Pedro Bom)<br />

[43] “Coordinated Consumption Tax and Tariff Reform: A Dynamic Approach”<br />

(with Ben Heijdra). Draft available soon<br />

[44] “The Distributional Consequences <strong>of</strong> Coordinated Consumption Tax and Tariff<br />

Reform” (with Ben Heijdra and Gerard van der Meijden). Draft available soon<br />

[45] “Intergenerational Distribution, Public Capital, and Output” (with Pedro Bom<br />

and Ben Heijdra)<br />

[46] “Fiscal <strong>Policy</strong> in a Labor Market Search Model <strong>of</strong> a Small Open Economy”<br />

(with Ben Heijdra)<br />

[47] “The Political Economy <strong>of</strong> Export Taxes” (with Manuel Oechslin)<br />

[48] “The Determinants <strong>of</strong> Currency Invoicing in Norwegian International Trade”<br />

(with Sebastian Werner)<br />

[49] “The EU Savings Tax” (with Sijbren Cnossen)<br />

[50] “The Determinants <strong>of</strong> Tax Treaties: An Empirical Analysis” (with Johannes<br />

Voget)<br />

[51] “The Determinants <strong>of</strong> Transfer Prices in Soccer: A Panel Data Analysis” (with<br />

Martin van Tuijl)<br />

[52] “The Political Economy <strong>of</strong> the Flat Tax” (with Rick van der Ploeg).<br />

[53] “The Impact <strong>of</strong> Foreign Ownership on Capital Taxation: Evidence from US<br />

States” (with Wolf Wagner)<br />

Unpublished Working Papers<br />

[54] “Optimal Fiscal <strong>Policy</strong> and the Environment,” IMF Working Paper No. 98/146<br />

(Washington: International Monetary Fund)<br />

7

[55] “The Macroeconomic Effects <strong>of</strong> Environmental Taxes: A Closer Look at the<br />

Feasibility <strong>of</strong> ‘Win-Win’ Outcomes,” IMF Working Paper No. 98/75, May 1998<br />

(Washington: International Monetary Fund)<br />

[56] “Environmental Tax Substitution: A Dynamic General Equilibrium Analysis for<br />

the U.S. Economy” (with Kerry Krutilla and Roy Boyd), presented at the 1998<br />

World Congress <strong>of</strong> Environmental and Resource Economists, Venice, June 25-<br />

27<br />

Selected IMF <strong>Policy</strong> and Technical Assistance Reports<br />

[57] “Bosnia and Herzegovina: Assessing the Distributional Impact <strong>of</strong> VAT,” (with<br />

Samsuddin Tareq and others), Technical Assistance Report, Fiscal Affairs<br />

Department, IMF, March 2005 (60 pages)<br />

[58] “Bosnia and Herzegovina: A State Level VAT—<strong>Policy</strong> and Implementation<br />

Issues” (with Emil Sunley and others), Technical Assistance Report, Fiscal<br />

Affairs Department, IMF, August 2004 (80 pages)<br />

[59] “The Gambia: A Program for Tax Reform” (with Emil Sunley and Lee Burns),<br />

Technical Assistance Report, Fiscal Affairs Department, IMF, February 2002<br />

(87 pages)<br />

[60] “Bosnia and Herzegovina: Toward a Value-Added Tax,” (with Russell Krelove,<br />

John Bristow, and Richard Fulford), Technical Assistance Report, Fiscal Affairs<br />

Department, IMF, February 2001 (108 pages)<br />

[61] “Bosnia and Herzegovina: Taxation <strong>of</strong> Consumption and Inter-Entity Trade”<br />

(with Koen van der Heeden and Jim Walsh), Technical Assistance Report,<br />

Fiscal Affairs Department, IMF, February 2000 (53 pages)<br />

[62] “Ethiopia: Liberalizing Trade and Improving the Tax System” (with Michael<br />

Keen and John Bristow), Technical Assistance Report, Fiscal Affairs<br />

Department, IMF, August 1998 (67 pages)<br />

[63] Various chapters in Juan Jose Fernandez-Ansola et al., 2000, Bosnia and<br />

Herzegovina: Selected Issues, SM/00/37, February 2000 (all co-authored with<br />

Jun Ma): “The Size and Structure <strong>of</strong> Public Finance” (Chapter 4); “Fiscal<br />

Sustainability: Current Policies” (Chapter 5); “Fiscal Sustainability: Medium-<br />

Term Adjustment” (Chapter 6); and “Social Insurance and Social Assistance<br />

Programs” (Chapter 7)<br />

[64] “Tax Reform in Hungary” in Craig Beaumont et al., 1999, “Hungary: Selected<br />

Issues,” IMF Staff Country Report No. 99/27<br />

[65] “Hungary: Operational Aspects <strong>of</strong> Medium-Term Expenditure Budgeting” (with<br />

Max Watson and Cristina Daseking), mimeo, IMF, May 1999<br />

[66] “Turkmenistan: Public Finance,” in Emine Gürgen et al., 1998, Turkmenistan:<br />

Recent Economic Developments, IMF Staff Country Report No. 98/81<br />

8

Unpublished Academic and <strong>Policy</strong> Reports (in Dutch)<br />

[67] “Imago-onderzoek ministerie van Financiën: In het kader van de door het<br />

ministerie van Financiën gesponsorde leerstoel aan de Faculteit Economie en<br />

Bedrijfswetenschappen van de Universiteit van Tilburg” (with Gerard van der<br />

Meijden), 2007, Tilburg University<br />

[68] “Imago-onderzoek ministerie van Financiën: In het kader van de door het<br />

ministerie van Financiën gesponsorde leerstoel aan de Faculteit Economie en<br />

Bedrijfswetenschappen van de Universiteit van Tilburg” (with Jan Bolle), 2004,<br />

Tilburg University<br />

[69] “De maatschappelijke betekenis van doorvoer (with Kuipers and others), 2003,<br />

TNO INRO rapport 2003-36, Delft (“The Societal Impact <strong>of</strong> Re-Export Trade”)<br />

[70] “De determinanten van de keuze van de factureringsvaluta in de internationale<br />

goederenhandel,” 1991, M.A. thesis, University <strong>of</strong> Amsterdam (“The Choice <strong>of</strong><br />

Invoicing Currency in International Goods Trade”)<br />

[71] “De determinanten van de keuze van de factureringsvaluta in de Nederlandse<br />

goederenhandel,” 1991, bbal/SA/FO/1101, Balance <strong>of</strong> Payments Department,<br />

Dutch Central Bank, May 1991 (“The Determinants <strong>of</strong> the Choice <strong>of</strong> Invoicing<br />

Currency in International Goods Trade”)<br />

Contributions to Magazines in Economics<br />

[72] “Prijsvorming op de voetbaltransfermarkt,” Aelementair, Vol. 6, March 2007,<br />

pp. 20-23<br />

[73] “Trade Liberalization Under Fire?”Aelementair, Vol. 4, January 2005, p. 13<br />

[74] “Taxing Cross-Border Savings Income in a Globalizing World,” 2004, Defacto,<br />

Vol. 18, pp. 36-39<br />

[75] “Ministry <strong>of</strong> Finance Sponsors Chair at Tilburg University,” VITE Bulletin, Vol.<br />

26, p. 22-23<br />

[76] “Pr<strong>of</strong>essor Jenny Ligthart,” CentERpoint, Vol. 12, pp. 6-8<br />

OTHER ACADEMIC ACTIVITIES<br />

Referee for: Canadian Journal <strong>of</strong> Economics, Economica, Economic Journal,<br />

Economics Letters, Environment and Development Economics, Environmental and<br />

Resource Economics, European Journal <strong>of</strong> Political Economy, FinanzArchiv,<br />

International Tax and Public Finance, German Economic Review, Journal <strong>of</strong><br />

Economics and Business, Journal <strong>of</strong> Environmental Economics and Management,<br />

Journal <strong>of</strong> Economic Dynamics and Control, Journal <strong>of</strong> International Economics,<br />

Journal <strong>of</strong> Macroeconomics, Journal <strong>of</strong> Public Economics, Journal <strong>of</strong> Public<br />

Economic Theory, National Tax Journal, Oxford Economic Papers, Review <strong>of</strong><br />

9

Economics and Statistics, Review <strong>of</strong> International Economics, Resource and Energy<br />

Economics, World Development, and CESifo books<br />

Member <strong>of</strong> the program committee <strong>of</strong>: (i) 65 th IIPF conference (in 2009); and (ii) 62 nd<br />

IIPF conference (in 2006)<br />

Chair <strong>of</strong> the scientific committee and organizer <strong>of</strong> the Annual NAKE Research<br />

Conference (2002-2008)<br />

Organizer <strong>of</strong> one-week workshops for Ph.D. students (2002-2008)<br />

Organizer <strong>of</strong> Annual Studium Generale Economics Workshop (2002-04)<br />

Organizer <strong>Young</strong>-KVS debating competition (2003-Present)<br />

Member <strong>of</strong> the search committee for: (i) Arie Kapteyn Chair (Tilburg University,<br />

January 2004); (ii) tenure-track faculty (Tilburg University, October-February 2004;<br />

October-February 2003,); and (ii) Ph.D. students (University <strong>of</strong> Amsterdam, June<br />

1993, May 1996)<br />

Supervisor <strong>of</strong> the following Ph.D. students:<br />

• Gerard van der Meijden (2008-Present)<br />

• Peter van Oudheusden (2008-Present)<br />

• Dorothe Singer (2008-Present); joint with Thorsten Beck<br />

• Christian Bogmans (2007-Present); joint with Cees Withagen<br />

• Pedro Bom (2006-Present)<br />

• Derek Eaton (2003-Present); joint with Erwin Bulte<br />

• Johannes Voget (2003-2008): joint with Harry Huizinga<br />

Member <strong>of</strong> the Ph.D. committee <strong>of</strong>: Anna-Katharina Wick (December 2008); Brenda<br />

Gonzalez-Hermosillo (May 2008); Attila Korpos (November 2006); Jardenna Kroeze-<br />

Gil (December 2003)<br />

Supervisor <strong>of</strong> the following M.Phil. students: Gerard van der Meijden (2008); Peter<br />

van Oudheusden (2008); Dorothe Singer (2008); Hendrik Vrijburg (2006, 2007);<br />

Pedro Bom (2006, 2007); Rosa Martin Suarez (2005); Valerio Ercolani (2005);<br />

Jorge da Silva (2004); and Punnoose Jacob (2003)<br />

Has supervised about 50 MA theses througout the years<br />

Organizer <strong>of</strong> research seminars at: EU1 Department (1998 and 1999); and University<br />

<strong>of</strong> Amsterdam (1995-1997)<br />

Supervisor <strong>of</strong> various summer interns while at the IMF’s Fiscal Affairs Department<br />

S<strong>of</strong>tware manager <strong>of</strong> the Department <strong>of</strong> Economics, University <strong>of</strong> Amsterdam (1992-<br />

1994)<br />

10

HONORS AND GRANTS<br />

Dutch National Science Foundation, Ph.D. grant on “Tax Competition and Tax<br />

Evasion in a Multi-Jurisdictional World (with Lans Bovenberg), February 2004<br />

Herman Karel Nieuwenhuis Prize awarded for the best M.Sc. thesis <strong>of</strong> 1991<br />

Pr<strong>of</strong>iled in: 21 st Edition <strong>of</strong> Marquis Who’s Who in the World; 56 th and 57 th Edition <strong>of</strong><br />

Marquis Who's Who in America; 23 rd Edition <strong>of</strong> Marquis Who's Who <strong>of</strong> American<br />

Women; 7 th Edition <strong>of</strong> Marquis Who’s Who in Science and Engineering<br />

PROFESSIONAL MEMBERSHIPS<br />

American Economic Association<br />

International Institute <strong>of</strong> Public Finance<br />

National Tax Association<br />

REFERENCES<br />

Michael Keen Ben Heijdra (Ph.D. advisor)<br />

Fiscal Affairs Department Department <strong>of</strong> Economics<br />

International Monetary Fund University <strong>of</strong> Groningen<br />

700 19 th Street, N.W. P.O. Box 800<br />

Washington, D.C. 20431 9700 AV Groningen<br />

United States The Netherlands<br />

Phone: (+1)-202-623-4199 Phone: (+31)-50-363-7303<br />

E-mail: mkeen@imf.org E-mail: b.j.heijdra@rug.nl<br />

Frederick van der Ploeg (main Ph.D. advisor) Jeffrey James<br />

Department <strong>of</strong> Economics Department <strong>of</strong> Economics<br />

Oxford University Tilburg University<br />

Manor Road Building P.O. Box 90153<br />

Manor Road, Oxford, OX1 3UQ 5000 LE Tilburg<br />

United Kingdom The Netherlands<br />

Phone: (+44)-186-528-1285 Phone: (+31)-13-466-2320<br />

E-mail: rick.vanderploeg@economics.ox.ac.uk E-mail: m.j.james@uvt.nl<br />

11