MARYLAND OTHER TOBACCO PRODUCTS - the Comptroller of ...

MARYLAND OTHER TOBACCO PRODUCTS - the Comptroller of ...

MARYLAND OTHER TOBACCO PRODUCTS - the Comptroller of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

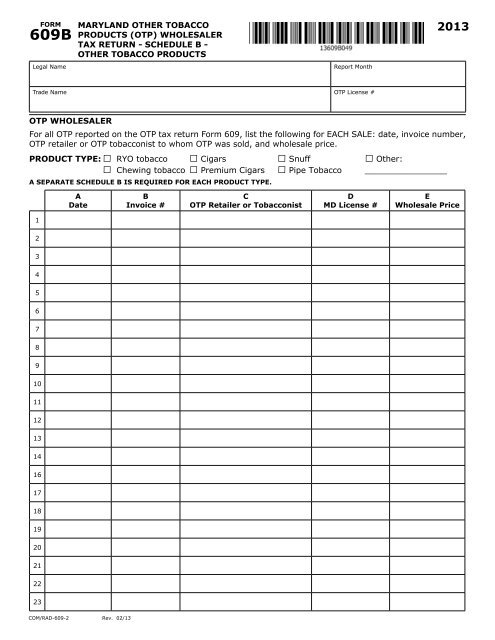

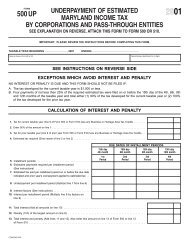

FORM<br />

609B<br />

OTP WHOLESALER<br />

<strong>MARYLAND</strong> <strong>OTHER</strong> <strong>TOBACCO</strong><br />

<strong>PRODUCTS</strong> (OTP) WHOLESALER<br />

TAX RETURN - SCHEDULE B -<br />

<strong>OTHER</strong> <strong>TOBACCO</strong> <strong>PRODUCTS</strong><br />

Legal Name Report Month<br />

Trade Name OTP License #<br />

For all OTP reported on <strong>the</strong> OTP tax return Form 609, list <strong>the</strong> following for EACH SALE: date, invoice number,<br />

OTP retailer or OTP tobacconist to whom OTP was sold, and wholesale price.<br />

PRODUCT TYPE: □ RYO tobacco □ Cigars □ Snuff □ O<strong>the</strong>r:<br />

□ Chewing tobacco □ Premium Cigars □ Pipe Tobacco ________________<br />

A SEPARATE SCHEDULE B IS REQUIRED FOR EACH PRODUCT TYPE.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

A<br />

Date<br />

COM/RAD-609-2 Rev. 02/13<br />

B<br />

Invoice #<br />

C<br />

OTP Retailer or Tobacconist<br />

D<br />

MD License #<br />

2013<br />

E<br />

Wholesale Price

FORM<br />

609B<br />

2013<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

47<br />

48<br />

49<br />

50<br />

<strong>MARYLAND</strong> <strong>OTHER</strong> <strong>TOBACCO</strong><br />

<strong>PRODUCTS</strong> (OTP) WHOLESALER<br />

TAX RETURN - SCHEDULE B -<br />

<strong>OTHER</strong> <strong>TOBACCO</strong> <strong>PRODUCTS</strong><br />

A<br />

Date<br />

COM/RAD-609-2 Rev. 02/13<br />

B<br />

Invoice #<br />

C<br />

OTP Retailer or Tobacconist<br />

D<br />

MD License #<br />

Page 2<br />

E<br />

Wholesale Price

FORM<br />

609B<br />

2013<br />

<strong>MARYLAND</strong> <strong>OTHER</strong> <strong>TOBACCO</strong><br />

<strong>PRODUCTS</strong> (OTP) WHOLESALER TAX<br />

RETURN – SCHEDULE B – <strong>OTHER</strong><br />

<strong>TOBACCO</strong> <strong>PRODUCTS</strong> INSTRUCTIONS<br />

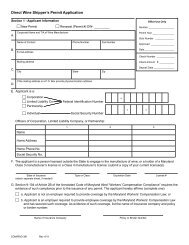

Who must file this Schedule B?<br />

OTP WHOLESALER - An OTP wholesaler who<br />

reports sales <strong>of</strong> OTP on its Maryland OTP tax<br />

return.<br />

A SEPARATE SCHEDULE B MUST BE SUBMITTED<br />

FOR EACH PRODUCT TYPE REPORTED ON<br />

YOUR <strong>MARYLAND</strong> WHOLESALER OTP TAX<br />

RETURN, FORM 609.<br />

Enter your legal name, report month, trade name,<br />

and license number on <strong>the</strong> lines provided. In lieu<br />

<strong>of</strong> using <strong>the</strong> form to report each sale, a hard-copy<br />

report with <strong>the</strong> same information on each Schedule<br />

B may be submitted.<br />

Instructions for completion:<br />

Line Column<br />

1-50 A List <strong>the</strong> date <strong>of</strong> each sale <strong>of</strong> OTP in<br />

Maryland.<br />

1-50 B Provide <strong>the</strong> invoice number for each<br />

sale.<br />

1-50 C Provide <strong>the</strong> name <strong>of</strong> <strong>the</strong> OTP retailer<br />

or OTP tobacconist to whom OTP<br />

was sold.<br />

1-50 D Provide license number <strong>of</strong> Maryland<br />

licensee for each sale. An OTP<br />

retailer license and OTP tobacconist<br />

license are issued by <strong>the</strong> Clerk <strong>of</strong> <strong>the</strong><br />

Circuit Court in <strong>the</strong> county (or city)<br />

where <strong>the</strong> business is located.<br />

1-50 E Provide <strong>the</strong> total wholesale price <strong>of</strong><br />

each sale.<br />

COM/RAD-609-2 Rev. 02/13<br />

For more information:<br />

<strong>Comptroller</strong> <strong>of</strong> Maryland<br />

Revenue Administration Division<br />

P.O. Box 2999<br />

Annapolis, MD 21404-2999<br />

Telephone: 410-260-7980, 800-638-2937<br />

Fax: 410-974-3608<br />

www.marylandtaxes.com<br />

Page 3