You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Uncerta<strong>in</strong>ty <strong>in</strong> Income Taxes, an <strong>in</strong>terpretation of FASB Statement No. 109, Account<strong>in</strong>g for Income Taxes<br />

(“FIN 48”). FIN 48 was adopted on January 1, 2008 with no material impact to the Company’s consolidated<br />

f<strong>in</strong>ancial position or its results of operations. Deferred <strong>in</strong>come tax assets and liabilities have been provided <strong>in</strong><br />

recognition of the <strong>in</strong>come tax effect attributable to the book and tax basis differences of assets and liabilities<br />

reported <strong>in</strong> the accompany<strong>in</strong>g consolidated f<strong>in</strong>ancial statements. Deferred tax assets or liabilities are provided<br />

us<strong>in</strong>g the enacted tax rates expected to apply to taxable <strong>in</strong>come <strong>in</strong> the periods <strong>in</strong> which they are expected to be<br />

settled or realized. Interest and penalties relat<strong>in</strong>g to uncerta<strong>in</strong> tax positions are recognized <strong>in</strong> the Company’s<br />

<strong>in</strong>come tax provision. In accordance with SFAS No. 109, the Company records a valuation allowance to reduce<br />

its deferred tax assets if it is more likely than not that some portion or all of the deferred tax assets will not be<br />

realized.<br />

Deferred Ga<strong>in</strong>s. From time to time, the Company enters <strong>in</strong>to vessel sale and leaseback transactions and sells<br />

vessels to bus<strong>in</strong>ess ventures <strong>in</strong> which it holds an equity ownership <strong>in</strong>terest. Certa<strong>in</strong> of the ga<strong>in</strong>s realized from<br />

these transactions are not immediately recognized <strong>in</strong> <strong>in</strong>come and have been recorded <strong>in</strong> the accompany<strong>in</strong>g<br />

consolidated balance sheets <strong>in</strong> deferred ga<strong>in</strong>s and other liabilities. In sale and leaseback transactions, ga<strong>in</strong>s are<br />

deferred to the extent of the present value of future m<strong>in</strong>imum lease payments and are amortized as reductions to<br />

rental expense over the applicable lease terms. In bus<strong>in</strong>ess venture sale transactions, ga<strong>in</strong>s are deferred and<br />

amortized based on the Company’s ownership <strong>in</strong>terest, cash received from the bus<strong>in</strong>ess venture and the<br />

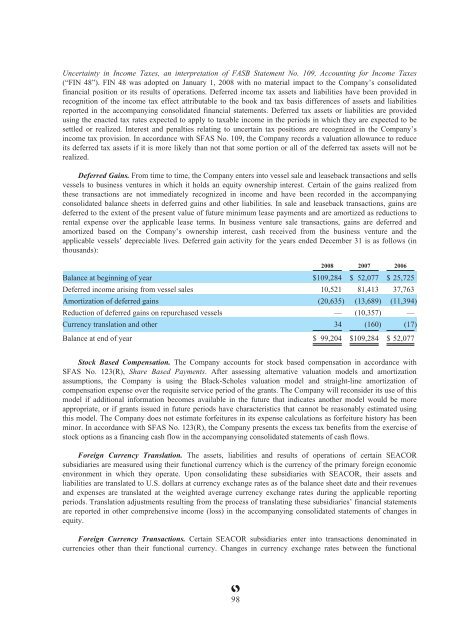

applicable vessels’ depreciable lives. Deferred ga<strong>in</strong> activity for the years ended December 31 is as follows (<strong>in</strong><br />

thousands):<br />

98<br />

2008 2007 2006<br />

Balance at beg<strong>in</strong>n<strong>in</strong>g of year $109,284 $ 52,077 $ 25,725<br />

Deferred <strong>in</strong>come aris<strong>in</strong>g from vessel sales 10,521 81,413 37,763<br />

Amortization of deferred ga<strong>in</strong>s (20,635) (13,689) (11,394)<br />

Reduction of deferred ga<strong>in</strong>s on repurchased vessels — (10,357) —<br />

Currency translation and other 34 (160) (17)<br />

Balance at end of year $ 99,204 $109,284 $ 52,077<br />

Stock Based Compensation. The Company accounts for stock based compensation <strong>in</strong> accordance with<br />

SFAS No. 123(R), Share Based Payments. After assess<strong>in</strong>g alternative valuation models and amortization<br />

assumptions, the Company is us<strong>in</strong>g the Black-Scholes valuation model and straight-l<strong>in</strong>e amortization of<br />

compensation expense over the requisite service period of the grants. The Company will reconsider its use of this<br />

model if additional <strong>in</strong>formation becomes available <strong>in</strong> the future that <strong>in</strong>dicates another model would be more<br />

appropriate, or if grants issued <strong>in</strong> future periods have characteristics that cannot be reasonably estimated us<strong>in</strong>g<br />

this model. The Company does not estimate forfeitures <strong>in</strong> its expense calculations as forfeiture history has been<br />

m<strong>in</strong>or. In accordance with SFAS No. 123(R), the Company presents the excess tax benefits from the exercise of<br />

stock options as a f<strong>in</strong>anc<strong>in</strong>g cash flow <strong>in</strong> the accompany<strong>in</strong>g consolidated statements of cash flows.<br />

Foreign Currency Translation. The assets, liabilities and results of operations of certa<strong>in</strong> SEACOR<br />

subsidiaries are measured us<strong>in</strong>g their functional currency which is the currency of the primary foreign economic<br />

environment <strong>in</strong> which they operate. Upon consolidat<strong>in</strong>g these subsidiaries with SEACOR, their assets and<br />

liabilities are translated to U.S. dollars at currency exchange rates as of the balance sheet date and their revenues<br />

and expenses are translated at the weighted average currency exchange rates dur<strong>in</strong>g the applicable report<strong>in</strong>g<br />

periods. Translation adjustments result<strong>in</strong>g from the process of translat<strong>in</strong>g these subsidiaries’ f<strong>in</strong>ancial statements<br />

are reported <strong>in</strong> other comprehensive <strong>in</strong>come (loss) <strong>in</strong> the accompany<strong>in</strong>g consolidated statements of changes <strong>in</strong><br />

equity.<br />

Foreign Currency Transactions. Certa<strong>in</strong> SEACOR subsidiaries enter <strong>in</strong>to transactions denom<strong>in</strong>ated <strong>in</strong><br />

currencies other than their functional currency. Changes <strong>in</strong> currency exchange rates between the functional<br />

98