You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

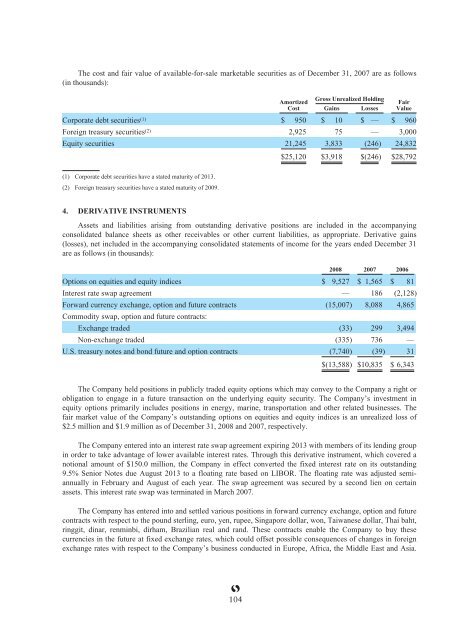

The cost and fair value of available-for-sale marketable securities as of December 31, 2007 are as follows<br />

(<strong>in</strong> thousands):<br />

104<br />

Amortized<br />

Cost<br />

Gross Unrealized Hold<strong>in</strong>g<br />

Ga<strong>in</strong>s Losses<br />

Fair<br />

Value<br />

Corporate debt securities (1) $ 950 $ 10 $ — $ 960<br />

Foreign treasury securities (2) 2,925 75 — 3,000<br />

Equity securities 21,245 3,833 (246) 24,832<br />

(1) Corporate debt securities have a stated maturity of 2013.<br />

(2) Foreign treasury securities have a stated maturity of 2009.<br />

$25,120 $3,918 $(246) $28,792<br />

4. DERIVATIVE INSTRUMENTS<br />

Assets and liabilities aris<strong>in</strong>g from outstand<strong>in</strong>g derivative positions are <strong>in</strong>cluded <strong>in</strong> the accompany<strong>in</strong>g<br />

consolidated balance sheets as other receivables or other current liabilities, as appropriate. Derivative ga<strong>in</strong>s<br />

(losses), net <strong>in</strong>cluded <strong>in</strong> the accompany<strong>in</strong>g consolidated statements of <strong>in</strong>come for the years ended December 31<br />

are as follows (<strong>in</strong> thousands):<br />

2008 2007 2006<br />

Options on equities and equity <strong>in</strong>dices $ 9,527 $ 1,565 $ 81<br />

Interest rate swap agreement — 186 (2,128)<br />

Forward currency exchange, option and future contracts (15,007) 8,088 4,865<br />

Commodity swap, option and future contracts:<br />

Exchange traded (33) 299 3,494<br />

Non-exchange traded (335) 736 —<br />

U.S. treasury notes and bond future and option contracts (7,740) (39) 31<br />

$(13,588) $10,835 $ 6,343<br />

The Company held positions <strong>in</strong> publicly traded equity options which may convey to the Company a right or<br />

obligation to engage <strong>in</strong> a future transaction on the underly<strong>in</strong>g equity security. The Company’s <strong>in</strong>vestment <strong>in</strong><br />

equity options primarily <strong>in</strong>cludes positions <strong>in</strong> energy, mar<strong>in</strong>e, transportation and other related bus<strong>in</strong>esses. The<br />

fair market value of the Company’s outstand<strong>in</strong>g options on equities and equity <strong>in</strong>dices is an unrealized loss of<br />

$2.5 million and $1.9 million as of December 31, 2008 and 2007, respectively.<br />

The Company entered <strong>in</strong>to an <strong>in</strong>terest rate swap agreement expir<strong>in</strong>g 2013 with members of its lend<strong>in</strong>g group<br />

<strong>in</strong> order to take advantage of lower available <strong>in</strong>terest rates. Through this derivative <strong>in</strong>strument, which covered a<br />

notional amount of $150.0 million, the Company <strong>in</strong> effect converted the fixed <strong>in</strong>terest rate on its outstand<strong>in</strong>g<br />

9.5% Senior Notes due August 2013 to a float<strong>in</strong>g rate based on LIBOR. The float<strong>in</strong>g rate was adjusted semiannually<br />

<strong>in</strong> February and August of each year. The swap agreement was secured by a second lien on certa<strong>in</strong><br />

assets. This <strong>in</strong>terest rate swap was term<strong>in</strong>ated <strong>in</strong> March 2007.<br />

The Company has entered <strong>in</strong>to and settled various positions <strong>in</strong> forward currency exchange, option and future<br />

contracts with respect to the pound sterl<strong>in</strong>g, euro, yen, rupee, S<strong>in</strong>gapore dollar, won, Taiwanese dollar, Thai baht,<br />

r<strong>in</strong>ggit, d<strong>in</strong>ar, renm<strong>in</strong>bi, dirham, Brazilian real and rand. These contracts enable the Company to buy these<br />

currencies <strong>in</strong> the future at fixed exchange rates, which could offset possible consequences of changes <strong>in</strong> foreign<br />

exchange rates with respect to the Company’s bus<strong>in</strong>ess conducted <strong>in</strong> Europe, Africa, the Middle East and Asia.<br />

104