Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

© <strong>Cengage</strong> <strong>Learning</strong>. All rights reserved. No distribution allowed without express authorization.<br />

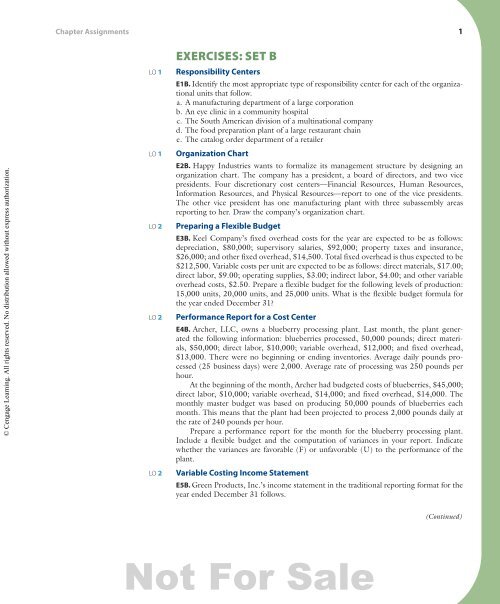

Chapter Assignments 1<br />

LO 1<br />

LO 1<br />

LO 2<br />

LO 2<br />

LO 2<br />

ExErcisEs: sEt B<br />

Responsibility Centers<br />

E1B. Identify the most appropriate type of responsibility center for each of the organizational<br />

units that follow.<br />

a. A manufacturing department of a large corporation<br />

b. An eye clinic in a community hospital<br />

c. The South American division of a multinational company<br />

d. The food preparation plant of a large restaurant chain<br />

e. The catalog order department of a retailer<br />

Organization Chart<br />

E2B. Happy Industries wants to formalize its management structure by designing an<br />

organization chart. The company has a president, a board of directors, and two vice<br />

presidents. Four discretionary cost centers—Financial Resources, Human Resources,<br />

Information Resources, and Physical Resources—report to one of the vice presidents.<br />

The other vice president has one manufacturing plant with three subassembly areas<br />

reporting to her. Draw the company’s organization chart.<br />

Preparing a Flexible Budget<br />

E3B. Keel Company’s fixed overhead costs for the year are expected to be as follows:<br />

depreciation, $80,000; supervisory salaries, $92,000; property taxes and insurance,<br />

$26,000; and other fixed overhead, $14,500. Total fixed overhead is thus expected to be<br />

$212,500. Variable costs per unit are expected to be as follows: direct materials, $17.00;<br />

direct labor, $9.00; operating supplies, $3.00; indirect labor, $4.00; and other variable<br />

overhead costs, $2.50. Prepare a flexible budget for the following levels of production:<br />

15,000 units, 20,000 units, and 25,000 units. What is the flexible budget formula for<br />

the year ended December 31?<br />

Performance Report for a Cost Center<br />

E4B. Archer, LLC, owns a blueberry processing plant. Last month, the plant generated<br />

the following information: blueberries processed, 50,000 pounds; direct materials,<br />

$50,000; direct labor, $10,000; variable overhead, $12,000; and fixed overhead,<br />

$13,000. There were no beginning or ending inventories. Average daily pounds processed<br />

(25 business days) were 2,000. Average rate of processing was 250 pounds per<br />

hour.<br />

At the beginning of the month, Archer had budgeted costs of blueberries, $45,000;<br />

direct labor, $10,000; variable overhead, $14,000; and fixed overhead, $14,000. The<br />

monthly master budget was based on producing 50,000 pounds of blueberries each<br />

month. This means that the plant had been projected to process 2,000 pounds daily at<br />

the rate of 240 pounds per hour.<br />

Prepare a performance report for the month for the blueberry processing plant.<br />

Include a flexible budget and the computation of variances in your report. Indicate<br />

whether the variances are favorable (F) or unfavorable (U) to the performance of the<br />

plant.<br />

Variable Costing Income Statement<br />

E5B. Green Products, Inc.’s income statement in the traditional reporting format for the<br />

year ended December 31 follows.<br />

<strong>Not</strong> <strong>For</strong> <strong>Sale</strong><br />

(Continued)<br />

CHE-NEEDLES_FINM-12-0107-021-WEB.indd 1 17/10/12 8:43 AM

<strong>Not</strong> <strong>For</strong> <strong>Sale</strong><br />

2 Chapter 21: Flexible Budgets and Performance Analysis<br />

LO 2<br />

LO 3<br />

LO 3<br />

Green Products, Inc.<br />

Income Statement<br />

<strong>For</strong> the Year Ended December 31<br />

<strong>Sale</strong>s $296,400<br />

Cost of goods sold 112,750<br />

Gross margin $183,650<br />

Selling expenses:<br />

Variable (69,820)<br />

Fixed (36,980)<br />

Administrative expenses (27,410)<br />

Operating income $ 49,440<br />

Total fixed manufacturing costs for the year were $16,750. All administrative expenses<br />

are considered to be fixed.<br />

Prepare an income statement for Green Products, Inc., for the year ended<br />

December 31, using the variable costing format.<br />

Traditional and Variable Costing Income Statements<br />

E6B. Interior designers often use the deluxe carpet products of Lux Mills, Inc. The Maricopa<br />

blend is the company’s top product line. In March, Lux produced and sold 174,900<br />

square yards of the Maricopa blend. Factory operating data for the month included variable<br />

cost of goods sold of $2,623,500 and fixed overhead of $346,875. Other expenses<br />

were variable selling expenses, $166,155; fixed selling expenses, $148,665; and fixed<br />

general and administrative expenses, $231,500. Total sales revenue equaled $3,935,250.<br />

All production took place in March, and there was no work in process at month end.<br />

Goods are usually shipped when completed. Prepare the March income statement for<br />

Lux Mills using:<br />

1. the traditional reporting format<br />

2. the variable costing format<br />

Investment Center Performance<br />

E7B. Accounting connEction ▶ Momence Associates is evaluating the performance<br />

of three divisions: Maple, Oaks, and Juniper. Using the data that follow, compute the<br />

return on investment and residual income for each division, compare the divisions’ performance,<br />

and comment on the factors that influenced performance.<br />

Maple Oaks Juniper<br />

<strong>Sale</strong>s $100,000 $100,000 $100,000<br />

Operating income $10,000 $10,000 $20,000<br />

Assets invested $25,000 $12,500 $25,000<br />

Desired ROI 40% 40% 40%<br />

Economic Value Added<br />

E8B. Accounting connEction ▶ Leesburg, LLP, is evaluating the performance of<br />

three divisions: Lake, Sumter, and Poe. Using the data that follow, compute the economic<br />

value added by each division, and comment on each division’s performance.<br />

Lake Sumter Poe<br />

<strong>Sale</strong>s $100,000 $100,000 $100,000<br />

After-tax operating income $10,000 $10,000 $20,000<br />

Total assets $25,000 $12,500 $25,000<br />

Current liabilities $5,000 $5,000 $5,000<br />

Cost of capital 15% 15% 15%<br />

CHE-NEEDLES_FINM-12-0107-021-WEB.indd 2 17/10/12 8:43 AM<br />

© <strong>Cengage</strong> <strong>Learning</strong>. All rights reserved. No distribution allowed without express authorization.

© <strong>Cengage</strong> <strong>Learning</strong>. All rights reserved. No distribution allowed without express authorization.<br />

Chapter Assignments 3<br />

LO 3<br />

LO 4<br />

LO 4<br />

LO 4<br />

Return on Investment and Economic Value Added<br />

E9B. Micanopy Company makes replicas of Indian artifacts. The balance sheet for the<br />

Arrowhead Division showed that the company had invested assets of $300,000 at the<br />

beginning of the year and $500,000 at the end of the year. During the year, the division’s<br />

operating income was $80,000 on sales of $1,200,000.<br />

1. Compute the division’s residual income if the desired ROI is 20 percent.<br />

2. Compute the following performance measures for the division: (a) profit margin,<br />

(b) asset turnover, and (c) return on investment. (Round profit margin percentage<br />

to two decimal places.)<br />

3. Recompute the division’s ROI under each of the following independent assumptions:<br />

a. <strong>Sale</strong>s decrease from $1,200,000 to $1,000,000, causing operating income to fall<br />

from $80,000 to $50,000.<br />

b. Invested assets at the beginning of the year are reduced from $300,000 to<br />

$100,000. (Round to two decimal places.)<br />

c. Operating expenses are reduced, causing operating income to rise from $80,000<br />

to $90,000.<br />

4. Compute the company’s EVA if total corporate assets are $6,000,000, current<br />

liabilities are $800,000, after-tax operating income is $750,000, and the cost of<br />

capital is 12 percent.<br />

Balanced Scorecard<br />

E10B. BusinEss ApplicAtion ▶ Biggs Industries is considering adopting the balanced<br />

scorecard and has compiled the following list of possible performance measures. Select<br />

the balanced scorecard perspective that best matches each performance measure.<br />

Balanced Scorecard Perspective Performance Measure<br />

a. Financial (investor) 1. Residual income<br />

b. <strong>Learning</strong> and growth (employee) 2. Customer satisfaction rating<br />

c. Internal business processes 3. Employee absentee rate<br />

d. Customer 4. Growth in profits<br />

5. On-time deliveries<br />

6. Manufacturing processing time<br />

Performance Measures<br />

E11B. BusinEss ApplicAtion ▶ Sam Yu wants to measure customer satisfaction within<br />

his region. Link an appropriate performance measure with each balanced scorecard<br />

perspective.<br />

Customer Satisfaction Possible Performance Measures<br />

a. Financial (investor) 1. Number of staff promotions<br />

b. <strong>Learning</strong> and growth (employee) 2. Number of repeat customers<br />

c. Internal business processes 3. Number of process improvements<br />

d. Customer 4. Percentage sales increase over last period<br />

The Balanced Scorecard<br />

E12B. BusinEss ApplicAtion ▶ Tim’s Bargain Basement sells used goods at very low<br />

prices. Tim has developed the following business objectives:<br />

1. To buy only the inventory that sells<br />

2. To have repeat customers<br />

3. To be profitable and grow<br />

4. To keep employee turnover low<br />

<strong>Not</strong> <strong>For</strong> <strong>Sale</strong><br />

(Continued)<br />

CHE-NEEDLES_FINM-12-0107-021-WEB.indd 3 17/10/12 8:43 AM

<strong>Not</strong> <strong>For</strong> <strong>Sale</strong><br />

4 Chapter 21: Flexible Budgets and Performance Analysis<br />

LO 4<br />

LO 5<br />

LO 5<br />

Tim also developed the following performance measures:<br />

5. Growth in revenues and net income per quarter<br />

6. Average unsold goods at the end of the business day as a percentage of the total<br />

goods purchased that day<br />

7. Number of unemployment claims<br />

8. Percentage of repeat customers<br />

Match each of these objectives and performance measures with the four perspectives<br />

of the balanced scorecard: financial perspective, learning and growth perspective,<br />

internal business processes perspective, and customer perspective.<br />

The Balanced Scorecard<br />

E13B. BusinEss ApplicAtion ▶ Your college’s overall goal is to add value to the communities<br />

it serves. In light of that goal, match each of the stakeholders’ perspectives that<br />

follow with the appropriate objective.<br />

Perspective Objective<br />

a. Financial (investor) 1. Adding value means that the faculty engages in<br />

meaningful teaching and research.<br />

b. <strong>Learning</strong> and growth (employee) 2. Adding value means that students receive their<br />

degrees in four years.<br />

c. Internal business processes 3. Adding value means that the college has<br />

winning sports teams.<br />

d. Customer 4. Adding value means that fund-raising<br />

campaigns are successful.<br />

Performance Incentives<br />

E14B. BusinEss ApplicAtion ▶ Dynamic Consulting is advising Solid Industries on<br />

the short-term and long-term effectiveness of cash bonuses, awards, profit sharing, and<br />

stock as performance incentives. Prepare a chart identifying the effectiveness of each<br />

incentive as either long-term or short-term or both.<br />

Goal Congruence<br />

E15B. BusinEss ApplicAtion ▶ Serious Toys, Inc., has adopted the balanced scorecard<br />

to motivate its managers to work toward the companywide goal of leading its industry<br />

in innovation. Identify the four stakeholder perspectives that would link to the following<br />

objectives, measures, and targets:<br />

Perspective Objective Measure Target<br />

Profitable new<br />

products<br />

Successful product<br />

introductions<br />

Agile production<br />

processes<br />

Workforce with<br />

cutting-edge skills<br />

New-product RI New-product RI of at least<br />

$100,000<br />

New-product market share Capture 75 percent of<br />

new-product market<br />

within 6 months<br />

Time to market (the time<br />

between a product idea<br />

and its first sales)<br />

Percentage of employees<br />

cross-trained on<br />

work-group tasks<br />

Time to market less than<br />

6 months for 80 percent of<br />

product introductions<br />

90 percent of work group<br />

cross-trained on new tasks<br />

within 10 days<br />

CHE-NEEDLES_FINM-12-0107-021-WEB.indd 4 17/10/12 8:43 AM<br />

© <strong>Cengage</strong> <strong>Learning</strong>. All rights reserved. No distribution allowed without express authorization.