Not For Sale - Cengage Learning

Not For Sale - Cengage Learning

Not For Sale - Cengage Learning

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Not</strong> <strong>For</strong> <strong>Sale</strong><br />

Appendix 4 Financial Statement Information: Abercrombie & Fitch 745<br />

ABERCROMBIE & FITCH CO.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —(Continued)<br />

The Rights are initially attached to the shares of Common Stock. The Rights will separate from the Common Stock after a<br />

Distribution Date occurs. The “Distribution Date” generally means the earlier of (i) the close of business on the 10th day after the<br />

date (the “Share Acquisition Date”) of the first public announcement that a person or group (other than A&F or any of A&F’s subsidiaries<br />

or any employee benefit plan of A&F or of any of A&F’s subsidiaries) has acquired beneficial ownership of 20% or more of<br />

A&F’s outstanding shares of Common Stock (an “Acquiring Person”), or (ii) the close of business on the 10th business day (or such<br />

later date as A&F’s Board of Directors may designate before any person has become an Acquiring Person) after the date of the commencement<br />

of a tender or exchange offer by any person which would, if consummated, result in such person becoming an Acquiring<br />

Person. The Rights are not exercisable until the Distribution Date. After the Distribution Date, each whole Right may be exercised<br />

to purchase, at an initial exercise price of $250, one one-thousandth of a share of Series A Participating Cumulative Preferred Stock.<br />

At any time after any person becomes an Acquiring Person, but before the occurrence of any of the events described in the<br />

immediately following paragraph, each holder of a Right, other than the Acquiring Person and certain affiliated persons, will be entitled<br />

to purchase, upon exercise of the Right, shares of Common Stock having a market value of twice the exercise price of the Right.<br />

At any time after any person becomes an Acquiring Person, but before any person becomes the beneficial owner of 50% or more of<br />

the outstanding shares of Common Stock or the occurrence of any of the events described in the immediately following paragraph,<br />

A&F’s Board of Directors may exchange all or part of the Rights, other than Rights beneficially owned by an Acquiring Person and<br />

certain affiliated persons, for shares of Common Stock at an exchange ratio of one share of Common Stock per 0.50 Right.<br />

If, after any person has become an Acquiring Person, (i) A&F is involved in a merger or other business combination transaction<br />

in which A&F is not the surviving corporation or A&F’s Common Stock is exchanged for other securities or assets, or (ii) A&F<br />

and/or one or more of A&F’s subsidiaries sell or otherwise transfer 50% or more of the assets or earning power of A&F and its<br />

subsidiaries, taken as a whole, each holder of a Right, other than the Acquiring Person and certain affiliated persons, will be entitled<br />

to buy, for the exercise price of the Rights, the number of shares of common stock of the other party to the business combination<br />

or sale, or in certain circumstances, an affiliate, which at the time of such transaction will have a market value of twice the exercise<br />

price of the Right.<br />

The Rights will expire on July 16, 2018, unless earlier exchanged or redeemed. A&F may redeem all of the Rights at a price<br />

of $.01 per whole Right at any time before any person becomes an Acquiring Person.<br />

Rights holders have no rights as a stockholder of A&F, including the right to vote and to receive dividends.<br />

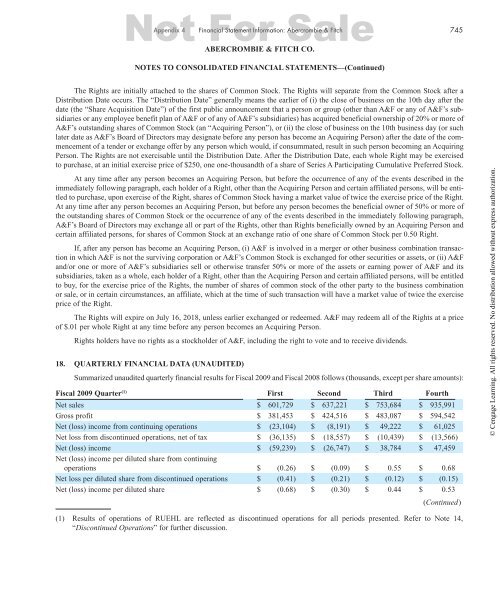

18. QUARTERLY FINANCIAL DATA (UNAUDITED)<br />

Summarized unaudited quarterly financial results for Fiscal 2009 and Fiscal 2008 follows (thousands, except per share amounts):<br />

Fiscal 2009 Quarter (1) First Second Third Fourth<br />

Net sales $ 601,729 $ 637,221 $ 753,684 $ 935,991<br />

Gross profit $ 381,453 $ 424,516 $ 483,087 $ 594,542<br />

Net (loss) income from continuing operations $ (23,104) $ (8,191) $ 49,222 $ 61,025<br />

Net loss from discontinued operations, net of tax $ (36,135) $ (18,557) $ (10,439) $ (13,566)<br />

Net (loss) income<br />

Net (loss) income per diluted share from continuing<br />

$ (59,239) $ (26,747) $ 38,784 $ 47,459<br />

operations $ (0.26) $ (0.09) $ 0.55 $ 0.68<br />

Net loss per diluted share from discontinued operations $ (0.41) $ (0.21) $ (0.12) $ (0.15)<br />

Net (loss) income per diluted share $ (0.68) $ (0.30) $ 0.44 $ 0.53<br />

(Continued)<br />

(1) Results of operations of RUEHL are reflected as discontinued operations for all periods presented. Refer to <strong>Not</strong>e 14,<br />

“Discontinued Operations” for further discussion.<br />

© <strong>Cengage</strong> <strong>Learning</strong>. All rights reserved. No distribution allowed without express authorization.