Insurance Company Capital Structure Swaps and Shareholder Wealth

Insurance Company Capital Structure Swaps and Shareholder Wealth

Insurance Company Capital Structure Swaps and Shareholder Wealth

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

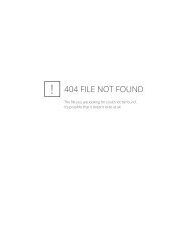

Table 3: Loss Volatility Understated<br />

Changes in Insider shareholder wealth following recapitalizations of insurance companies. Calculated using Merton-Margrabe model. The<br />

first model shows the capital structure of the firm <strong>and</strong> equity <strong>and</strong> loss value estimates of both the manager (Insider) <strong>and</strong> market participants<br />

(market). The second model shows the change in shareholder wealth resulting from issuing $500 in equity at the market per-share price <strong>and</strong><br />

using the proceeds to purchase reinsurance at the market price. The third model shows the change in shareholder wealth resulting from selling<br />

$200 in new policies at the market price <strong>and</strong> using the proceeds to retire equity at the per-share market price.<br />

High Primary Premiums Available Issue Equity Retire Equity<br />

Insider Market Insider Market Insider Market<br />

Asset Value 1500 1500 1500 1500 1500 1500<br />

Expected Loss 1000 1000 500 500 1200 1200<br />

Asset Volatility 0.19 0.19 0.19 0.19 0.19 0.19<br />

Loss Volatility 0.4 0.1 0.4 0.1 0.4 0.1<br />

Time 1 1 1 1 1 1<br />

Asset/Loss Correlation 0.25 0.25 0.25 0.25 0.25 0.25<br />

25<br />

Equity Value 538.58 501.43 1000.29 1000 394.80 315.37<br />

Loss Value 961.42 998.57 499.71 500 1105.20 1184.63<br />

50.14%<br />

62.89%<br />

Controlling Portion of Initial<br />

Equity<br />

Controlling Portion of Post-<br />

Swap Equity<br />

-37.00 56.06<br />

Change in Controlling Equity<br />

Insider Value