Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

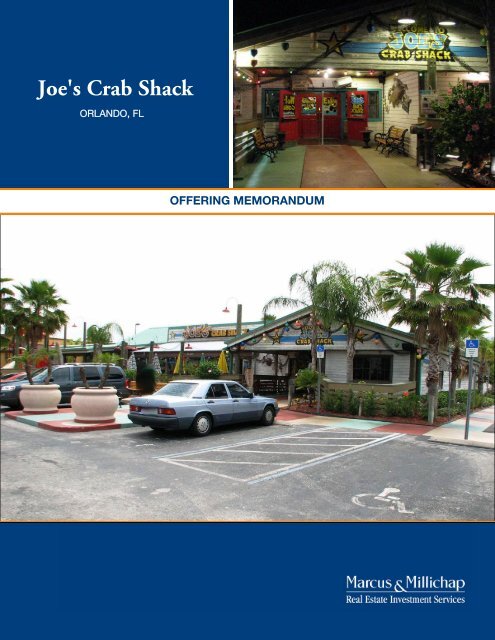

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

OFFERING MEMORANDUM

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

CONFIDENTIALITY AND DISCLAIMER<br />

The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is<br />

intended to be reviewed only by the party receiving it from Marcus & Millichap and should not be made<br />

available to any other person or entity without the written consent of Marcus & Millichap. This Marketing<br />

Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to<br />

establish only a preliminary level of interest in the subject property. The information contained herein is not a<br />

substitute for a thorough due diligence investigation. Marcus & Millichap has not made any investigation, and<br />

makes no warranty or representation, with respect to the income or expenses for the subject property, the future<br />

projected financial performance of the property, the size and square footage of the property and improvements,<br />

the presence or absence of contaminating substances, PCB's or asbestos, the compliance with State and Federal<br />

regulations, the physical condition of the improvements thereon, or the financial condition or business prospects<br />

of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The<br />

information contained in this Marketing Brochure has been obtained from sources we believe to be reliable;<br />

however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor<br />

has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or<br />

representation whatsoever regarding the accuracy or completeness of the information provided. All potential<br />

buyers must take appropriate measures to verify all of the information set forth herein.<br />

ALL PROPERTY SHOWINGS ARE BY APPOINTMENT ONLY. PLEASE CONSULT YOUR MARCUS<br />

& MILLICHAP AGENT FOR MORE DETAILS.

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

NET LEASED DISCLAIMER<br />

Marcus & Millichap hereby advises all prospective purchasers of Net Leased property as follows:<br />

The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable.<br />

However, Marcus & Millichap has not and will not verify any of this information, nor has Marcus & Millichap<br />

conducted any investigation regarding these matters. Marcus & Millichap makes no guarantee, warranty or<br />

representation whatsoever about the accuracy or completeness of any information provided.<br />

As the Buyer of a net leased property, it is the Buyer’s responsibility to independently confirm the accuracy and<br />

completeness of all material information before completing any purchase. This Marketing Brochure is not a substitute<br />

for your thorough due diligence investigation of this investment opportunity. Marcus & Millichap expressly denies<br />

any obligation to conduct a due diligence examination of this Property for Buyer.<br />

Any projections, opinions, assumptions or estimates used in this Marketing Brochure are for example only and do not<br />

represent the current or future performance of this property. The value of a net leased property to you depends on<br />

factors that should be evaluated by you and your tax, financial and legal advisors.<br />

Buyer and Buyer’s tax, financial, legal, and construction advisors should conduct a careful, independent investigation of<br />

any net leased property to determine to your satisfaction with the suitability of the property for your needs.<br />

Like all real estate investments, this investment carries significant risks. Buyer and Buyer’s legal and financial advisors<br />

must request and carefully review all legal and financial documents related to the property and tenant. While the<br />

tenant’s past performance at this or other locations is an important consideration, it is not a guarantee of future success.<br />

Similarly, the lease rate for some properties, including newly-constructed facilities or newly-acquired locations, may be<br />

set based on a tenant’s projected sales with little or no record of actual performance, or comparable rents for the area.<br />

Returns are not guaranteed; the tenant and any guarantors may fail to pay the lease rent or property taxes, or may fail<br />

to comply with other material terms of the lease; cash flow may be interrupted in part or in whole due to market,<br />

economic, environmental or other conditions. Regardless of tenant history and lease guarantees, Buyer is responsible<br />

for conducting his/her own investigation of all matters affecting the intrinsic value of the property and the value of any<br />

long-term lease, including the likelihood of locating a replacement tenant if the current tenant should default or<br />

abandon the property, and the lease terms that Buyer may be able to negotiate with a potential replacement tenant<br />

considering the location of the property, and Buyer’s legal ability to make alternate use of the property.<br />

By accepting this Marketing Brochure you agree to release Marcus & Millichap Real Estate Investment Services<br />

and hold it harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or<br />

purchase of this net leased property.

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

TABLE OF CONTENTS<br />

Section 1 PRICING AND FINANCIAL ANALYSIS<br />

Section 2 PROPERTY DESCRIPTION<br />

Section 3 RECENT SALES<br />

Section 4 MARKET OVERVIEW<br />

Section 5 DEMOGRAPHIC ANALYSIS

PRICING AND FINANCIAL ANALYSIS<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

FINANCIAL OVERVIEW<br />

Location<br />

12124 South Apopka Vineland<br />

Orlando, FL 32836<br />

Price $2,486,000<br />

Down Payment 40% / $994,400<br />

Rentable Square Feet 9,056<br />

Price/SF $274.51<br />

CAP Rate 7.30%<br />

Year Built 1995<br />

Lot Size 1.76 Acres<br />

Type of Ownership Fee Simple<br />

Tenant Summary<br />

Tenant Trade Name <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong> / <strong>Crab</strong> Addison<br />

Ownership Private<br />

Tenant Corporate Store / <strong>Crab</strong> Addison<br />

Lease Guarantor Corporate Guarantee<br />

Lease Type Absolute Net<br />

Roof and Structure Tenant Responsible<br />

Lease Term 20 Years<br />

Lease 5/23/2000<br />

Rent Commencement 1/23/2001<br />

Lease Expiration Date 1/31/2021<br />

Term Remaining on 8-Plus Years<br />

Increases CPI<br />

Options Four Five-Year Options<br />

Financing<br />

FIRST TRUST DEED<br />

Loan Amount $1,491,600<br />

Loan Type Proposed New<br />

Interest Rate 4.95%<br />

Amortization 20 Years<br />

Loan information is time sensitive and subject to change.<br />

Contact your local Marcus & Millichap Capital Corporation<br />

representative.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

PRICING AND FINANCIAL ANALYSIS<br />

Annualized Operating Data<br />

Rent Increases Annual Rent Monthly Rent<br />

2/1/2000 to 1/31/2005 $150,000.00 $12,500.00<br />

2/1/2005 to 1/31/2011 $165,000.00 $13,750.00<br />

2/1/2011 to 1/31/2016 $181,500.00 $15,125.00<br />

2/1/2016 to 1/31/2021<br />

CPI<br />

Renewal Option 1<br />

CPI<br />

Renewal Option 2<br />

CPI<br />

Renewal Option 3<br />

Renewal Option 4<br />

CPI<br />

CPI<br />

Base Rent ($20.04/SF) $181,500<br />

Net Operating Income $181,500<br />

Debt Service $117,633<br />

Debt Coverage Ratio 1.54<br />

Net Cash Flow After Debt Service 6.42% / $63,867<br />

Principal Reduction $44,806<br />

Total Return 10.93% / $108,673<br />

1

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

TENANT OVERVIEW<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

PRICING AND FINANCIAL ANALYSIS<br />

Property Name <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

Property Address 12124 South Apopka Vineland Road<br />

Orlando, FL 32836<br />

Property Type Net Leased Restaurant - Other<br />

Rentable Square Feet 9,056<br />

Tenant Trade Name <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong> / <strong>Crab</strong> Addison Inc.<br />

Ownership Private<br />

Tenant Corporate Store / <strong>Crab</strong> Addison Inc.<br />

Lease Guarantor Corporate Guarantee<br />

Lease Commencement Date 5/23/2000<br />

Rent Commencement Date 1/23/2001<br />

Lease Expiration Date 1/31/2021<br />

Term Remaining on Lease 8-Plus Years<br />

Lease Type Absolute Net<br />

Roof and Structure Tenant Responsible<br />

Lease Term 20 Years<br />

Increases CPI<br />

Options to Renew Four Five-Year Options<br />

Options to Terminate No<br />

Options to Purchase No<br />

First Right of Refusal No<br />

No. of Locations 120<br />

Headquartered Houston, TX<br />

Web Site<br />

Franchisee Profile<br />

http://www.joescrabshack.com/<br />

Years in the Business 21 Years<br />

Ignite Restaurant <strong>Group</strong> operates <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong> (<strong>Crab</strong> Addison, Inc.), a casual dining chain with more than 115 locations in Texas, California,<br />

Florida and about 25 other states. The eateries feature a wide variety of grilled, fried and stuffed seafood, along with sandwiches and sides. The<br />

seafood chain is known for its quirky surf-inspired atmosphere where the servers are often part of the entertainment. In addition to its flagship<br />

restaurant brand, Ignite Restaurant <strong>Group</strong> operates a small number of Brick House Tavern + Tap locations. Private equity group J. H. Whitney<br />

Capital Partners owns the company. Ignite Restaurant <strong>Group</strong> filed an IPO in mid-2011.<br />

2

PROPERTY DESCRIPTION<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

INVESTMENT OVERVIEW<br />

Investment Highlights<br />

■ Corporate Guaranteed Lease by <strong>Crab</strong> Addison, Inc.<br />

■ Eight-Plus Years Remaining on 20-Year Lease<br />

■ Four Five-Year Options to Renew<br />

■ CPI Rental Increases Every Five Years<br />

■ Located Just off I-4 on Highway 535/South Apopka Vineland Road<br />

■ Located Seven Miles from Disney World and All Surrounding<br />

Disney Parks<br />

■ Disney - Over 30 Million Visitors per Year<br />

■ Average Resident Household Income Over $92,000<br />

PROPERTY DESCRIPTION<br />

The subject property, located just off Interstate 4 on Highway 535/South Apopka Vineland Road and on a 1.76-acre parcel of<br />

land, was built in 1995 and consists of 9,056 square feet. To the north of the property sits a Walgreens on a hard-corner lot,<br />

which also provides parking lot access to Joe’s <strong>Crab</strong> <strong>Shack</strong>; to the south is a Romano’s Macaroni Grill which is also connected<br />

by parking lot. Other national retailers in the direct vicinity include Chili’s, Hooters, CiCi’s Pizza, Olive Garden, IHOP,<br />

Denny’s, Buffalo Wild Wings and Burger King. Hotels chains surrounding the subject property include Courtyard Marriott,<br />

Sheraton, Holiday Inn, Hyatt Regency, Double Tree, Caribe Royale Suites and many more. The entrance to Disney World<br />

and Disney Animal Kingdom is located only eight miles away; Disney’s Blizzard Beach, Disney Hollywood Studios and<br />

Disney’s Epcot are all only seven miles away. Walt Disney World Resort is the world's most-visited entertainment resort<br />

bringing more than 30 million visitors per year. The average resident household income in the area is well above average at<br />

$92,929, with a population of 66,000-plus in a five-mile radius.<br />

The lease agreement commenced in January of 2001 with the initial term expiring January 31st of 2021, leaving eight-plus<br />

years on the initial term; the lease also includes four five-year options to renew and CPI increases every five years throughout<br />

the initial term and exercised option periods. Landry’s Seafood House - Florida, Inc. was the initial tenant under the lease<br />

agreement, operating all <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong>s nationally; Landry’s then assigned all of its interest in <strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong> to <strong>Crab</strong><br />

Addison, Inc., doing business as Joe’s <strong>Crab</strong> <strong>Shack</strong> in January of 2007. <strong>Joe's</strong> serves a variety of unique, high-quality seafood<br />

items, with an emphasis on crab. Joe’s <strong>Crab</strong> <strong>Shack</strong> operates 124 restaurants in 33 states as of May 10, 2012.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

4

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

AREA MAPS<br />

PROPERTY DESCRIPTION<br />

Local Map Regional Map<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

5

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

SITE PLAN<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

PROPERTY DESCRIPTION<br />

6

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

AERIAL PHOTO<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

PROPERTY DESCRIPTION<br />

7

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

TRADE AREA PHOTO<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

PROPERTY DESCRIPTION<br />

8

RECENT SALES<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

RECENT SALES MAP<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

1)<br />

2)<br />

3)<br />

4)<br />

5)<br />

6)<br />

7)<br />

8)<br />

9)<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

Logan's Roadhouse<br />

Romano's Macaroni Grill<br />

Buffalo Wild Wings<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

Sweet Tomatoes<br />

Buca di Beppo<br />

Applebee's<br />

Applebee's<br />

Denny's<br />

RECENT SALES<br />

10

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

CAP RATE AND PRICE PER SQUARE FOOT<br />

Average Cap Rate<br />

8.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

700.00<br />

600.00<br />

500.00<br />

400.00<br />

300.00<br />

200.00<br />

100.00<br />

0.00<br />

Subject Logan's<br />

Roadhouse<br />

Average Price per Square Foot<br />

Subject Logan's<br />

Roadhouse<br />

Romano's<br />

Macaroni<br />

Grill<br />

Romano's<br />

Macaroni<br />

Grill<br />

Buffalo<br />

Wild<br />

Wings<br />

Buffalo<br />

Wild<br />

Wings<br />

<strong>Joe's</strong><br />

<strong>Crab</strong><br />

<strong>Shack</strong><br />

<strong>Joe's</strong><br />

<strong>Crab</strong><br />

<strong>Shack</strong><br />

Sweet<br />

Tomatoes<br />

Sweet<br />

Tomatoes<br />

Buca<br />

di<br />

Beppo<br />

Buca<br />

di<br />

Beppo<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Applebee's Applebee's Denny's<br />

Applebee's Applebee's Denny's<br />

RECENT SALES<br />

11

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

RECENT SALES<br />

1<br />

2<br />

Subject Property<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

12124 South Apopka Vineland Road<br />

Orlando, FL 32836<br />

Logan's Roadhouse<br />

3060 West Sand Lake Road<br />

Orlando, FL 32819<br />

Comments<br />

Fourteen years remaining on lease agreement. Logan's Roadhouse Corporate lease agreement assigned at closing.<br />

Romano's Macaroni Grill<br />

315 North Alafaya Trail<br />

Orlando, FL 32828<br />

Comments<br />

MAC Acquisitions as tenant, with 17 years remaining on triple-net (NNN) lease.<br />

RECENT SALES<br />

Rentable Square Feet: 9,056 Sales Price: $2,486,000<br />

Year Built: 1995 Down Payment: $994,400<br />

CAP Rate: 7.30%<br />

Price/SF: $274.51<br />

Close of Escrow: On Market Sales Price: $3,133,000<br />

Rentable SF: 8,000 Down Payment: N/A<br />

Year Built: 1999 CAP Rate: 7.50%<br />

Price/SF: $391.62<br />

Close of Escrow: 4/20/2012 Sales Price: $3,445,000<br />

Rentable SF: 7,055 Down Payment: 100%<br />

Year Built: 2001 CAP Rate: 7.81%<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Price/SF: $488.31<br />

12

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

RECENT SALES<br />

3<br />

4<br />

5<br />

Buffalo Wild Wings<br />

10056 Two Notch Road<br />

Columbia, SC 29223<br />

Close of Escrow: 6/28/2012 Sales Price: $2,143,000<br />

Rentable SF: 6,472 Down Payment: 100%<br />

Year Built: 2001 CAP Rate: 7.25%<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

20100 US Highway 59<br />

Humble, TX 77338<br />

Comments<br />

Corporate guaranteed lease by Ignite Restaurant <strong>Group</strong>s, with 15 years remaining on 20-year lease.<br />

Sweet Tomatoes<br />

1115 Mary Susan Drive<br />

Jacksonville, FL 32246<br />

Price/SF: $331.12<br />

Close of Escrow: 1/4/2011 Sales Price: $1,765,000<br />

Rentable SF: 7,519 Down Payment: 100%<br />

Year Built: 2001 CAP Rate: 8.00%<br />

Price/SF: $232.11<br />

RECENT SALES<br />

Close of Escrow: 3/10/2011 Sales Price: $3,811,000<br />

Rentable SF: 7,463 Down Payment: N/A<br />

Year Built: 1999 CAP Rate: 8.00%<br />

Comments<br />

Sweet Tomatoes' lease expires in seven years. The lease calls for two 10-year renewal options, as well as CPI increases every five years.<br />

Sweet Tomatoes operates under Garden Fresh Restaurant Corporation. Garden Fresh Restaurant Corporation operates over 112 Sweet<br />

Tomatoes and Souplantation restaurants throughout 15 states.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Price/SF: $348.39<br />

13

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

RECENT SALES<br />

6<br />

7<br />

8<br />

Buca di Beppo<br />

1351 South Orlando Avenue<br />

Maitland (Orlando), FL 32751<br />

Close of Escrow: On Market Sales Price: $2,434,733<br />

Rentable SF: 8,071 Down Payment: N/A<br />

Year Built: 1959 CAP Rate: 7.50%<br />

Comments<br />

Thirteen years left on triple-net (NNN) lease agreement with 1.5 percent rental increases every five years.<br />

Applebee's<br />

225 State Road 312<br />

Saint Augustine, FL 32086<br />

Applebee's<br />

24467 Sandhill Boulevard<br />

Port Charlotte, FL 33983<br />

Price/SF: $301.66<br />

Close of Escrow: On Market Sales Price: $3,034,000<br />

Rentable SF: 5,766 Down Payment: N/A<br />

RECENT SALES<br />

Year Built: 1993 CAP Rate: 7.25%<br />

Price/SF: $526.00<br />

Close of Escrow: On Market Sales Price: $3,310,000<br />

Rentable SF: 4,979 Down Payment: N/A<br />

Year Built: 2010 CAP Rate: 7.25%<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Price/SF: $665.00<br />

14

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

RECENT SALES<br />

9<br />

Comments<br />

This is a one-unit Denny's franchisee.<br />

Denny's<br />

12375 South Apopka Vineland Road<br />

Orlando, FL 32836<br />

RECENT SALES<br />

Close of Escrow: On Market Sales Price: $2,880,000<br />

Rentable SF: 6,571 Down Payment: N/A<br />

Year Built: 1987 CAP Rate: 6.25%<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Price/SF: $438.29<br />

15

MARKET OVERVIEW<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Market Highlights<br />

Economic diversity<br />

■ While Orlando’s economy has a strong tourism<br />

component, distribution, high-tech and<br />

healthcare also are prevalent.<br />

Pro-business environment<br />

■ Florida has low state and local taxes and no<br />

personal state income tax.<br />

Population growth<br />

■ Orlando's population is expected to increase by<br />

1.9 percent annually over the next five years.<br />

Geography<br />

The Orlando MSA encompasses 4,012 square<br />

miles near the center of Florida. There are<br />

numerous lakes scattered across the region, and<br />

the topography is generally flat with few<br />

impediments to development. Citrus, melons and<br />

strawberries are some of the agricultural products<br />

grown in the MSA.<br />

Orlando-Kissimmee MSA<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

17

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Metro<br />

The Orlando MSA is comprised of Osceola, Orange,<br />

Seminole and Lake counties. Orange County has the<br />

largest population, with 1.1 million residents, but the<br />

Osceola County population has grown the fastest, more<br />

than doubling in size since 1990. Orlando is the MSA’s<br />

largest city, containing 222,600 inhabitants.<br />

Infrastructure<br />

Air transportation service in the region is provided by<br />

Orlando International Airport, Orlando Sanford<br />

International Airport, Orlando Executive Airport and<br />

four smaller airports.<br />

A rail system helps move freight across the state and the<br />

nation. By water, Port Canaveral and the Atlantic<br />

Ocean are within a 45-minute drive to the east, and the<br />

Port of Tampa on the Gulf of Mexico is one hour to<br />

the west. Each port provides access to global markets.<br />

The region sits at the crossroads of Florida’s highway<br />

network. Florida’s Turnpike and Interstate 4 intersect<br />

in the metro. Toll roads include state Route 528, which<br />

links Orlando to Cape Canaveral; state routes 417 and<br />

429, which form a beltway around Orlando; and state<br />

Route 408, which crosses the city from east to west.<br />

Public transportation is orchestrated by the Central<br />

Florida Regional Transportation Authority, also known<br />

as LYNX, which offers bus routes throughout Orange,<br />

Seminole and Osceola counties.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

Largest Cities: Orlando MSA<br />

Orlando 222,600<br />

Kissimmee 55,400<br />

Sanford 47,000<br />

Altamonte Springs 39,700<br />

Pine Hills 39,100<br />

Apopka<br />

2011 Estimate<br />

Sources: Marcus & Millichap Research Services, AGS<br />

38,900<br />

Airports<br />

■ Orlando International, Orlando Sanford<br />

International, Orlando Executive<br />

■ Four smaller airports<br />

Major Roadways<br />

■ I-4, Florida's Turnpike<br />

■ State Routes 408, 417, 429 and 528<br />

Rail<br />

■ Freight - CSX, Florida Central<br />

■ Passenger - Amtrak<br />

The Orlando MSA is:<br />

■ 85 miles from Tampa<br />

■ 230 miles from Miami<br />

■ 430 miles from Atlanta<br />

■ 1,100 miles from New York City<br />

18

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Economy<br />

Orlando is a top vacation destination and home to<br />

Walt Disney World. It has also become a popular site<br />

for business meetings, with one of the nation’s largest<br />

convention centers. Over 51 million visitors traveled to<br />

Orlando last year, driving the hospitality employment<br />

sector to account for 21 percent of all area jobs.<br />

Key industries in the region include aerospace and<br />

defense systems, modeling, simulation and training,<br />

digital media, and biotechnology. Orlando is quickly<br />

transforming into a center for digital media, fueled by<br />

an expanding number of software, simulation and<br />

entertainment companies. Today, hundreds of digital<br />

media companies are located in the metro.<br />

The local life sciences, biotech and medical technology<br />

industries also are strengthening. Orlando has invested<br />

$2 billion in its life sciences industry, with community<br />

leaders actively pursuing initiatives to further grow this<br />

sector.<br />

University of Central Florida (UCF) offers top-ranked<br />

programs for engineering and computer sciences, and<br />

its Technology Incubator helps emerging technology<br />

companies, further enhancing the climate for high-tech<br />

growth. Adjacent to UCF are the Central Florida<br />

Research Park and the Quadrangle Office Park, the<br />

latter of which is recognized as one of the top research<br />

parks in the world.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

19

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Labor<br />

MARKET OVERVIEW<br />

The Orlando MSA has a skilled labor force of 1 million people. Although the troubled housing market and weak<br />

economy stymied job growth through the recession, recent economic improvements will help strengthen<br />

employment gains going forward. Through 2016, the local employment base is projected to expand at an average<br />

rate of 3.1 percent annually, well above the forecast growth rate for the nation.<br />

While tourism provides the largest portion of jobs in the metro at 21 percent, or around 212,000 positions, the<br />

local economy is diverse. The trade, transportation and utilities sector accounts for 18 percent of total<br />

employment, or 185,000 jobs. Professional and business services maintains 16 percent of the work force, or<br />

164,000 positions, and education and health services employers hire 12 percent of workers, or 126,000 jobs.<br />

Over the next five years, all local employment sectors will register gains. The hard-hit construction industry will<br />

post the largest growth rate, averaging a 5 percent increase per year. Leisure and hospitality and education and<br />

health services will expand 4.8 percent and 4.4 percent, respectively, adding an aggregate of more than 85,000<br />

jobs.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

20

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Employers<br />

For over 30 years, Orlando has been identified with<br />

Disney World. In addition to six Disney theme parks,<br />

the area contains other attractions such as SeaWorld<br />

and Universal Studios. Many of the area’s major<br />

employers are tourism-related.<br />

Orlando is also one of the fastest-growing high-tech<br />

centers in the country, led by efforts at the University<br />

of Central Florida. The region has a large concentration<br />

of laser and optics manufacturers, with companies<br />

producing everything from tattoo-removal lasers to<br />

laser-guided systems that maneuver fighter planes.<br />

The local manufacturing industry includes Lockheed<br />

Martin Missiles and Fire Control, Siemens AG, and<br />

Harris. The area is also home to the National Center of<br />

Simulation, internationally renowned for its research in<br />

laser and optics, as well as for its unique<br />

microelectronics technology training programs.<br />

The region is an ideal place to film television shows and<br />

motion pictures, ranking first in the state and third<br />

nationwide. State-of-the-art soundstages, inimitable<br />

venues, year-round filming capabilities, a highly skilled<br />

local crew base and supportive communities have<br />

helped the industry grow into a $845 million annual<br />

market.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

Major Employers<br />

Walt Disney World Co.<br />

Florida Hospital<br />

Publix Super Markets Inc.<br />

Universal Orlando<br />

Orlando Health<br />

Busch Entertainment Corp.<br />

Lockheed Martin Corp.<br />

Marriott International<br />

Darden Restaurants Inc.<br />

Starwood Hotels & Resorts Worldwide Inc.<br />

MARKET OVERVIEW<br />

21

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Demographics<br />

Expanding employment opportunities will draw a<br />

steady stream of workers into the MSA, pushing<br />

population growth to an average of 1.9 percent<br />

annually through 2016, or 200,000 new individuals.<br />

Over the past decade, the local population grew by<br />

almost 30 percent to more than 2.1 million residents.<br />

Much of the region’s population growth in recent years<br />

occurred in the areas south of Orlando and Walt<br />

Disney World and west of Kissimmee, spurred by the<br />

completion<br />

Interstate 4.<br />

of SR-417 and improved access to<br />

The median household income, currently at $52,000<br />

annually, will increase an average of 2.2 percent per<br />

year through 2016. The prevalence of lower-paying<br />

tourism jobs, however, will keep the median household<br />

income below the national rate and prevented many<br />

residents from purchasing a home. Homeownership in<br />

the MSA stands at 56 percent, with the median home<br />

price resting around $124,000.<br />

The median age of Orlando’s residents is 36.1 years<br />

old, closely matching the U.S. median age but<br />

significantly less than the state median age of 40.1 years<br />

old. More than half of the MSA’s inhabitants are in<br />

their working years.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

22

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Quality Of Life<br />

Orlando provides its residents with a remarkable quality<br />

of life, highlighted by a warm, sunny climate;<br />

professional sporting opportunities; outdoor recreational<br />

activities; cultural venues; world-famous attractions; and<br />

beaches.<br />

The region offers outstanding healthcare facilities and<br />

exceptional community services such as Orlando Health<br />

and Florida Hospital. In addition, Florida residents are<br />

not required to pay a personal state income tax.<br />

Orlando features dozens of cultural opportunities,<br />

including the Civic Theatre of Central Florida, the<br />

Orlando Opera Company, the Orlando Ballet Company<br />

and the Bach Festival Society. Also, the Shakespeare<br />

Festival is held downtown every year.<br />

For art lovers, there are a number of galleries, as well as<br />

the Morse Museum and the Orlando Museum of Art.<br />

Amway Center is the new arena for the Orlando Magic.<br />

The facility was built in an area in downtown Orlando<br />

currently undergoing redevelopment; a new performing<br />

arts center is also nearby.<br />

The Orlando region provides numerous highereducation<br />

opportunities. The largest institutions are the<br />

University of Central Florida, with 56,000 students, and<br />

Valencia Community College with a full-time<br />

enrollment of around 30,000.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

23

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Retailers Angling for New Locations in Orlando<br />

MARKET OVERVIEW<br />

As the national economy gains momentum, Orlando’s bellwether tourism industry is recovering, prompting<br />

retailers to start re-staffing and take on additional space. In 2011, approximately 86 million visitors came to<br />

Orlando, an annual rise of 4 percent. This increase in business prompted companies in the leisure and hospitality<br />

sector to expand staffs, including the addition of 1,600 workers in the first quarter. Higher employment and an<br />

uptick in tourism bodes well for retail sales. Year-over-year retail sales have jumped 6.9 percent. Although some<br />

cash-strapped retailers such as Albertsons and Perkins are still closing sites, the improving local economy is<br />

attracting well-financed retailers such as Dollar General, O’Reilly Auto Parts, Marco’s Pizza and Pita Pit to open<br />

stores in the metro. The latter two franchisees plan to open a combined 20 sites in the area by 2015, taking<br />

advantage of the availability of good locations and rent incentives. Indeed, with vacancy down 60 basis points over<br />

the past four quarters, operators will likely begin to raise rents this year as leases roll over. As good sites disappear,<br />

construction of single-tenant properties will pick up, especially at well-located corners. Completions will increase<br />

this year, but remain well below typical levels.<br />

Orlando retail investors will comb the market for opportunities this year, though options to purchase assets that<br />

meet investment objectives could be limited. While improving operations are attracting buyers to the area, they are<br />

finding few of the premium properties they are seeking. Rising prices, however, may motivate additional owners<br />

who are able to sell to list. Cap rates for quality single-tenant assets begin in the low-6 percent range for drugstores,<br />

while other national franchises start in the low-7 percent area. In the multi-tenant arena, private buyers are looking<br />

for value-add opportunities with at least 25 percent vacancy. These assets must be listed with initial yields above 9<br />

percent on current revenue to generate bids. REITs, meanwhile are beginning to divert from low cap rate deals and<br />

will target stabilized properties with cap rates in the 7.5 percent range to balance their portfolios.<br />

2012 Annual Retail Forecast<br />

Employment: Employers will generate 26,000 jobs in 2012, increasing staff levels by<br />

2.6 percent, the largest annual gain since 2007. The majority of these positions will be<br />

in the leisure and hospitality sector. In the preceding year, total employment expanded<br />

by 1.3 percent.<br />

Construction: Approximately 350,000 square feet of retail space will come online in<br />

Orlando during 2012, expanding inventory by 0.3 percent. Although activity is up<br />

from last year’s total of 200,000 square feet, it is well below the five-year annual<br />

average of 1 million square feet.<br />

Vacancy: In 2012, vacancy will contract 60 basis points to 9.7 percent on positive net<br />

absorption of 950,000 square feet. Last year, metrowide vacancy also fell 60 basis<br />

points.<br />

Rents: This year, asking rents will rise 0.5 percent to $17.08 per square foot, which is<br />

the first annual increase since 2008. Effective rents will rise 0.7 percent to $14.51 per<br />

square foot during 2012. Last year, asking rents ticked down 0.4 percent while<br />

effective rents declined 0.3 percent.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

24

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Economy<br />

MARKET OVERVIEW<br />

■ Hiring stalled in the first quarter as local employers cut 5,400 jobs, reducing the year-over-year increase to<br />

5,200 workers. Nearly 3,700 of these positions were in the professional and business services sector.<br />

Employment grew by 0.5 percent during this time, compared with a 1.4 percent rise in the preceding 12<br />

months.<br />

■ Recovery in the tourism industry boosted employment in the leisure and hospitality sector by nearly 10,000<br />

jobs in the past 12 months. Other sectors that added to payrolls included education and health services; trade,<br />

transportation and utilities; and other services.<br />

■ Solid job growth supported healthy retail spending in the last four quarters as retail sales jumped 6.9 percent,<br />

pushing up consumption to pre-recession levels.<br />

■ Outlook: Employers will generate 26,000 jobs in 2012, a 2.6 percent increase that is the largest annual gain<br />

since 2007. Last year, total employment in the metro expanded by 1.3 percent.<br />

* Forecast. Sources: Marcus & Millichap Research Services, CoStar <strong>Group</strong>, Inc., Real Capital Analytics<br />

Construction<br />

■ Developers completed 134,000 square feet of retail space in the first quarter of 2012, bringing the year-overyear<br />

total to approximately 305,000 square feet and expanding inventory 0.1 percent. In the preceding 12month<br />

period, nearly 175,000 square feet came online.<br />

■ One of the largest projects completed in the first quarter was the 34,000-square foot building for Pet<br />

Supermarket. The store is located along Orange Blossom Trail in Orlando.<br />

■ The planning pipeline includes 5.4 million square feet, though none of the projects has announced a<br />

construction start date. Some of these projects were put on hold during the recession. Over 1.6 million square<br />

feet of retail space is proposed for the city of Orlando.<br />

■ Outlook: Approximately 350,000 square feet of retail space will come online in the metro during 2012,<br />

expanding inventory by 0.3 percent. Last year, 200,000 square feet was delivered.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

25

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Vacancy<br />

MARKET OVERVIEW<br />

■ Healthy job growth and a rise in retail spending have stimulated leasing activity in the metro. As a result,<br />

vacancy dipped 10 basis points to 10.2 percent in the first quarter, a year-over-year retreat of 60 basis points.<br />

Vacancy decreased 30 basis points in the prior four quarters.<br />

■ Although vacancy has fallen 90 basis points from the recent high of 11.1 percent reached in the first quarter of<br />

2010, the rate is still 340 basis points above the five-year low recorded in the first quarter of 2008.<br />

■ Store closings during the recession have resulted in higher neighborhood/community center vacancy. Year over<br />

year in the first quarter, vacancy rose 20 basis points to 13.7 percent. A supply increase could push vacancy in<br />

these centers up another 30 basis points by year end.<br />

■ Outlook: In 2012, vacancy will contract 60 basis points to 9.7 percent on positive net absorption of 950,000<br />

square feet. Metrowide vacancy also tightened 60 basis points last year.<br />

* Forecast. Sources: Marcus & Millichap Research Services, CoStar <strong>Group</strong>, Inc., Real Capital Analytics<br />

Rents<br />

■ Operators in Orlando have been reducing rents to gain higher occupancy. Year over year in the first quarter of<br />

2012, asking rents dipped 0.6 percent to $16.95 per square foot. A 0.5 percent slide occurred in the previous<br />

12 months.<br />

■ Effective rents have followed a similar trend during the past year, decreasing 0.6 percent to $14.37 per square<br />

foot. In the preceding 12-month period, effective rents contracted 0.8 percent.<br />

■ The Northwest was the only submarket to record rent growth in the past 12 months. Average asking rents<br />

nudged up 0.8 percent to $15.27 per square foot, while effective rents advanced 0.2 percent to $13.02 per<br />

square foot. The highest asking rents are recorded in the Southwest submarket.<br />

■ Outlook: In 2012, asking rents will inch up a modest 0.5 percent to $17.08 per square foot, which is the first<br />

annual increase since 2008. Effective rents this year will rise 0.7 percent to $14.51 per square foot. Last year,<br />

asking rents ticked down 0.4 percent while effective rents declined 0.3 percent.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

26

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Single-Tenant Sales Trends**<br />

MARKET OVERVIEW<br />

■ Deal flow in the single-tenant arena slowed 11 percent in the past 12 months as compressed cap rates moved<br />

buyers to higher yielding assets. Out-of-state and international investors are very active, seeking stability in netleased<br />

properties.<br />

■ Over the last 12 months, the median price of single-tenant assets increased 18 percent to $234 per square foot<br />

as higher-quality properties traded. The median price for drugstores net-leased to a national tenant was $221<br />

per square foot.<br />

■ Cap rates have compressed over the past year, averaging in the low-6 percent range for drugstores and in the<br />

low- to mid-7 percent area for national-tenant assets. Initial returns for fast-food properties averaged in the<br />

mid-7 percent span.<br />

■ Outlook: Although quality assets are in short supply, more owners will take advantage of the cap rate<br />

compression and dispose of single-tenant properties to traditional buyers looking for long-term stability.<br />

International investors will remain active in the market, seeking to diversify holdings.<br />

* Forecast. Sources: Marcus & Millichap Research Services, CoStar <strong>Group</strong>, Inc., Real Capital Analytics<br />

Multi-Tenant Sales Trends**<br />

■ Multi-tenant transaction velocity in the metro spiked 79 percent during the past 12 months, as predominantly<br />

local buyers were active throughout the year, targeting smaller strip centers.<br />

■ During the most recent 12-month period, the median price contracted 13 percent to $91 per square foot,<br />

following a 3 percent drop in the prior year. The median price is 42 percent below the five-year high of $156<br />

per square foot, which was achieved in 2009.<br />

■ Cap rates for multi-tenant properties have stabilized intothemid-7tomid-8percentrangeforqualitygroceryanchored<br />

centers, while initial yields for older neighborhood/community centers exceeds 10 percent.<br />

■ Outlook: REITs and institutional investors looking for higher initial yields will consider quality groceryanchored<br />

centers in high traffic areas, while local investors will target older, smaller centers for value-add plays.<br />

** Trailing 12-month period<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

27

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

ORLANDO<br />

Capital Markets<br />

Submarket Overview<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

MARKET OVERVIEW<br />

■ The yield on the 10-year Treasury hovers below 2 percent as political uncertainty in the eurozone has investors<br />

flocking to the safety of U.S. bonds. In response, lenders have pushed out loan spreads by approximately 250<br />

basis points to 300 basis points, with CMBS lenders pushing wider.<br />

■ Mortgage originations were up 46 percent in the second half of 2011 when compared with the same period the<br />

previous year, driven by higher activity among commercial banks and life insurance companies.<br />

■ Funding for single-tenant assets with credit tenants will remain plentiful this year. All-in lending rates for<br />

drugstore assets currently fall in the high-4 to mid-5 percent range, while loans for fast-food and restaurant<br />

properties price 50 to 100 basis points higher. In the multi-tenant sector, lenders are loosening criteria on<br />

anchored Class B centers and Class A strip centers.<br />

■ Deals under $10 million will be dominated by local and regional banks, which offer three- to seven-year, fixedrate<br />

recourse loans. In the $10 million to $20 million range, CMBS lenders and finance companies step into<br />

the picture, while deals over $20 million typically have access to a full spectrum of sources. On average, debt<br />

yields will hover in the 9.5 to 10.5 percent range, translating into LTVs of 65 percent to as high as 75 percent.<br />

■ The Partin Village Shopping Center on East Irlo Bronson Memorial Highway is under way in the Southeast<br />

submarket. This 66,000-square foot center will be anchored by Publix and is scheduled to be delivered in the<br />

second quarter of 2012 with 70 percent of the space occupied.<br />

■ Although the Southeast submarket has the highest vacancy in the metro at 11.8 percent in the first quarter, the<br />

area posted one of the largest vacancy declines year over year. Operators opted to roll back rents to boost<br />

occupancy.<br />

■ Albertsons recently announced plans to lay off 510 Central Florida workers in the second quarter as they close<br />

stores. Sites to be vacated are located in Winter Springs, Longwood, Lake Mary, Orlando and two sites in<br />

Apopka. These closings will impact vacancy rates in the Northeast and Northwest submarkets.<br />

28

DEMOGRAPHIC ANALYSIS<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

DEMOGRAPHIC REPORT<br />

1 Mile 3 Miles 5 Miles<br />

1990 Population 142 6,298 22,697<br />

2000 Population 359 11,769 39,838<br />

2010 Population 565 23,099 64,027<br />

2011 Population 439 22,646 66,677<br />

2016 Population 523 27,280 79,024<br />

1990 Households 268 2,611 9,382<br />

2000 Households 544 4,507 16,227<br />

2010 Households 774 6,903 22,788<br />

2011 Households 723 6,731 23,768<br />

2016 Households 857 8,195 28,591<br />

2011 Average Household Size 0.49 2.62 2.52<br />

2011 Daytime Population 4,256 32,487 85,778<br />

1990 Median Housing Value $172,109 $101,969 $97,136<br />

2000 Median Housing Value $251,609 $237,067 $157,746<br />

2000 Owner Occupied Housing Units 52.95% 39.36% 53.54%<br />

2000 Renter Occupied Housing Units 31.37% 44.82% 31.94%<br />

2000 Vacant 15.68% 15.80% 14.51%<br />

2011 Owner Occupied Housing Units 31.17% 25.00% 34.82%<br />

2011 Renter Occupied Housing Units 19.94% 32.20% 24.06%<br />

2011 Vacant 48.88% 42.80% 41.12%<br />

2016 Owner Occupied Housing Units 30.35% 24.37% 34.33%<br />

2016 Renter Occupied Housing Units 20.94% 32.65% 24.15%<br />

2016 Vacant 48.71% 42.98% 41.52%<br />

$ 0 - $14,999 8.8% 9.6% 8.3%<br />

$ 15,000 - $24,999 8.6% 10.0% 8.9%<br />

$ 25,000 - $34,999 8.3% 9.5% 10.5%<br />

$ 35,000 - $49,999 12.8% 16.8% 16.7%<br />

$ 50,000 - $74,999 16.7% 21.5% 20.6%<br />

$ 75,000 - $99,999 9.4% 9.7% 10.8%<br />

$100,000 - $124,999 10.3% 7.8% 8.5%<br />

$125,000 - $149,999 6.0% 4.5% 4.2%<br />

$150,000 - $199,999 9.6% 5.4% 4.9%<br />

$200,000 - $249,999 3.9% 2.0% 2.1%<br />

$250,000 + 5.6% 3.1% 4.6%<br />

2011 Median Household Income $66,897 $55,453 $56,925<br />

2011 Per Capita Income $36,856 $33,290 $33,966<br />

2011 Average Household Income $92,929 $73,105 $81,484<br />

Demographic data © 2010 by Experian/Applied Geographic Solutions.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

30

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

SUMMARY REPORT<br />

Geography: 5 Miles<br />

Population<br />

In 2011, the population in your selected geography was 66,677 . The population has changed by 67.37% since 2000. It is estimated<br />

that the population in your area will be 79,024 five years from now, which represents a change of 18.52% from the current year. The<br />

current population is 49.5% male and 50.5% female. The median age of the population in your area is 32.3 , compare this to the U.S.<br />

average which is 36.9. The population density in your area is 849.83 people per square mile.<br />

Households<br />

There are currently 23,768 households in your selected geography. The number of households has changed by 46.47% since 2000.<br />

It is estimated that the number of households in your area will be 28,591 five years from now, which represents a change of 20.29%<br />

from the current year. The average household size in your area is 2.52 persons.<br />

Income<br />

In 2011, the median household income for your selected geography is $56,925 , compare this to the U.S. average which is currently<br />

$53,620. The median household income for your area has changed by 12.26% since 2000. It is estimated that the median household<br />

income in your area will be $61,450 five years from now, which represents a change of 7.95% from the current year.<br />

The current year per capita income in your area is $33,966 , compare this to the U.S. average, which is $28,713. The current year<br />

average household income in your area is $81,484 , compare this to the U.S. average which is $73,458.<br />

Race & Ethnicity<br />

The current year racial makeup of your selected area is as follows: 71.80% White, 6.43% African American, 0.35% Native American<br />

and 7.55% Asian/Pacific Islander. Compare these to U.S. averages which are: 72.40% White, 12.60% African American, 0.95%<br />

Native American and 4.93% Asian/Pacific Islander.<br />

People of Hispanic origin are counted independently of race. People of Hispanic origin make up 24.26% of the current year<br />

population in your selected area. Compare this to the U.S. average of 16.90%.<br />

Housing<br />

The median housing value in your area was $157,746 in 2000, compare this to the U.S. average of $110,796 for the same year. In<br />

2000, there were 10,162 owner occupied housing units in your area and there were 6,063 renter occupied housing units in your area.<br />

The median rent at the time was $729 .<br />

Employment<br />

In 2011, there are 85,778 employees in your selected area, this is also known as the daytime population. The 2000 Census revealed<br />

that 70.4% of employees are employed in white-collar occupations in this geography, and 29.6% are employed in blue-collar<br />

occupations. In 2011, unemployment in this area is 7.13% . In 2000, the median time traveled to work was 20.3 minutes.<br />

Demographic data © 2010 by Experian/Applied Geographic Solutions.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

31

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

POPULATION DENSITY<br />

Demographic data © 2010 by Experian/Applied Geographic Solutions.<br />

Number of people living in a given area per square mile.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

32

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

EMPLOYMENT DENSITY<br />

Demographic data © 2010 by Experian/Applied Geographic Solutions.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

The number of people employed in a given area per square mile.<br />

33

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

AVERAGE HOUSEHOLD INCOME<br />

Demographic data © 2010 by Experian/Applied Geographic Solutions.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

Average income of all the people 15 years and older occupying a<br />

single housing unit.<br />

34

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

TRAFFIC COUNTS<br />

Traffic Count data © 2010 by TrafficMetrix. All rights reserved.<br />

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to<br />

the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any<br />

inaccuracies. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services of<br />

Florida © 2012 Marcus & Millichap T0110147<br />

DEMOGRAPHIC ANALYSIS<br />

Two-way, average daily traffic volumes.<br />

35

Offices Nationwide<br />

www.MarcusMillichap.com<br />

<strong>Joe's</strong> <strong>Crab</strong> <strong>Shack</strong><br />

ORLANDO, FL<br />

OFFERING MEMORANDUM<br />

Exclusively Listed By:<br />

Peter <strong>Nisbet</strong><br />

Vice President Investments<br />

Senior Director, National Retail <strong>Group</strong><br />

Seattle Office<br />

License: WA 47064<br />

Tel: (206)826-5700<br />

Fax: (206)826-5710<br />

Peter.<strong>Nisbet</strong>@marcusmillichap.com<br />

www.marcusmillichap.com/Peter<strong>Nisbet</strong><br />

Kirk Felici<br />

Broker<br />

Marcus & Millichap<br />

License: FL BK 672851<br />

Tel: (786)522-7000