Insurance-Linked Securities Report 2008 - Aon

Insurance-Linked Securities Report 2008 - Aon

Insurance-Linked Securities Report 2008 - Aon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Insurance</strong>-<strong>Linked</strong> <strong>Securities</strong> <strong>2008</strong><br />

28<br />

There is presently a lack of liquidity across this array of contracts. To date,<br />

trading has been limited to the $10 billion and $20 billion contracts and,<br />

even for those contracts, volume has been light. Only 1,104 of the $10<br />

billion <strong>2008</strong> contracts changed hands from its inception in September<br />

through December 2007. From January through June 30, <strong>2008</strong>, only 354<br />

contracts changed hands. IFEX plans to offer other geographies including<br />

Europe and Japan, as well as U.S. catastrophe sub-zones. In fact, contracts<br />

dealing with Florida tropical wind and Gulf Coast tropical wind are currently<br />

under review by the Commodities Futures Trading Commission (CFTC).<br />

IFEX has also created an infrastructure for trading the contracts. All contracts<br />

trade and clear through the Chicago Climate Futures Exchange (CCFE) with<br />

variable margin requirements set by the exchange based on an estimated<br />

daily risk of loss as determined by an outside consultant. The CCFE is<br />

regulated by the CFTC and the National Futures Association.<br />

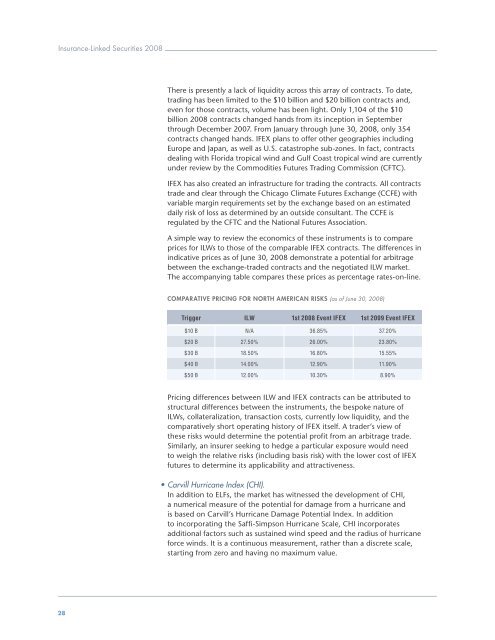

A simple way to review the economics of these instruments is to compare<br />

prices for ILWs to those of the comparable IFEX contracts. The differences in<br />

indicative prices as of June 30, <strong>2008</strong> demonstrate a potential for arbitrage<br />

between the exchange-traded contracts and the negotiated ILW market.<br />

The accompanying table compares these prices as percentage rates-on-line.<br />

COMPARATIVE PRICING FOR NORTH AMERICAN RISKS (as of June 30, <strong>2008</strong>)<br />

Trigger ILW 1st <strong>2008</strong> Event IFEX 1st 2009 Event IFEX<br />

$10 B N/A 36.85% 37.20%<br />

$20 B 27.50% 26.00% 23.80%<br />

$30 B 18.50% 16.80% 15.55%<br />

$40 B 14.00% 12.90% 11.90%<br />

$50 B 12.00% 10.30% 8.90%<br />

Pricing differences between ILW and IFEX contracts can be attributed to<br />

structural differences between the instruments, the bespoke nature of<br />

ILWs, collateralization, transaction costs, currently low liquidity, and the<br />

comparatively short operating history of IFEX itself. A trader’s view of<br />

these risks would determine the potential profit from an arbitrage trade.<br />

Similarly, an insurer seeking to hedge a particular exposure would need<br />

to weigh the relative risks (including basis risk) with the lower cost of IFEX<br />

futures to determine its applicability and attractiveness.<br />

• Carvill Hurricane Index (CHI).<br />

In addition to ELFs, the market has witnessed the development of CHI,<br />

a numerical measure of the potential for damage from a hurricane and<br />

is based on Carvill’s Hurricane Damage Potential Index. In addition<br />

to incorporating the Saffi-Simpson Hurricane Scale, CHI incorporates<br />

additional factors such as sustained wind speed and the radius of hurricane<br />

force winds. It is a continuous measurement, rather than a discrete scale,<br />

starting from zero and having no maximum value.