Millicom - Jaarverslag.com

Millicom - Jaarverslag.com

Millicom - Jaarverslag.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26 Borrowings continued<br />

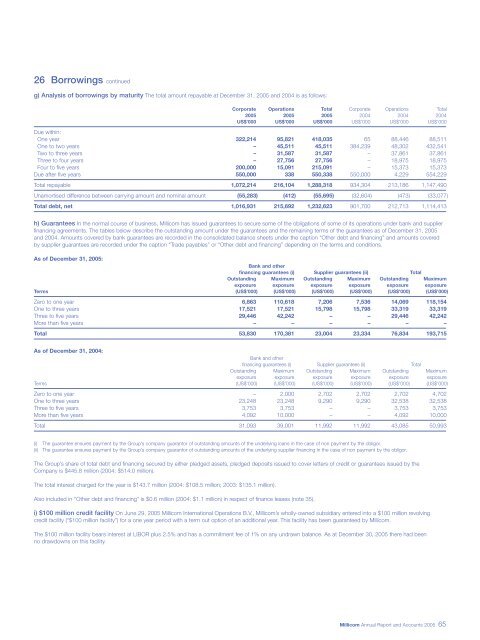

g) Analysis of borrowings by maturity The total amount repayable at December 31, 2005 and 2004 is as follows:<br />

Corporate Operations Total Corporate Operations Total<br />

2005 2005 2005 2004 2004 2004<br />

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000<br />

Due within:<br />

One year 322,214 95,821 418,035 65 88,446 88,511<br />

One to two years – 45,511 45,511 384,239 48,302 432,541<br />

Two to three years – 31,587 31,587 – 37,861 37,861<br />

Three to four years – 27,756 27,756 – 18,975 18,975<br />

Four to five years 200,000 15,091 215,091 – 15,373 15,373<br />

Due after five years 550,000 338 550,338 550,000 4,229 554,229<br />

Total repayable 1,072,214 216,104 1,288,318 934,304 213,186 1,147,490<br />

Unamortised difference between carrying amount and nominal amount (55,283) (412) (55,695) (32,604) (473) (33,077)<br />

Total debt, net 1,016,931 215,692 1,232,623 901,700 212,713 1,114,413<br />

h) Guarantees In the normal course of business, <strong>Milli<strong>com</strong></strong> has issued guarantees to secure some of the obligations of some of its operations under bank and supplier<br />

financing agreements. The tables below describe the outstanding amount under the guarantees and the remaining terms of the guarantees as of December 31, 2005<br />

and 2004. Amounts covered by bank guarantees are recorded in the consolidated balance sheets under the caption “Other debt and financing” and amounts covered<br />

by supplier guarantees are recorded under the caption “Trade payables” or “Other debt and financing” depending on the terms and conditions.<br />

As of December 31, 2005:<br />

Bank and other<br />

financing guarantees (i) Supplier guarantees (ii) Total<br />

Outstanding Maximum Outstanding Maximum Outstanding Maximum<br />

exposure exposure exposure exposure exposure exposure<br />

Terms (US$’000) (US$’000) (US$’000) (US$’000) (US$’000) (US$’000)<br />

Zero to one year 6,863 110,618 7,206 7,536 14,069 118,154<br />

One to three years 17,521 17,521 15,798 15,798 33,319 33,319<br />

Three to five years 29,446 42,242 – – 29,446 42,242<br />

More than five years – – – – – –<br />

Total 53,830 170,381 23,004 23,334 76,834 193,715<br />

As of December 31, 2004:<br />

Bank and other<br />

financing guarantees (i) Supplier guarantees (ii) Total<br />

Outstanding Maximum Outstanding Maximum Outstanding Maximum<br />

exposure exposure exposure exposure exposure exposure<br />

Terms (US$’000) (US$’000) (US$’000) (US$’000) (US$’000) (US$’000)<br />

Zero to one year – 2,000 2,702 2,702 2,702 4,702<br />

One to three years 23,248 23,248 9,290 9,290 32,538 32,538<br />

Three to five years 3,753 3,753 – – 3,753 3,753<br />

More than five years 4,092 10,000 – – 4,092 10,000<br />

Total 31,093 39,001 11,992 11,992 43,085 50,993<br />

(i) The guarantee ensures payment by the Group’s <strong>com</strong>pany guarantor of outstanding amounts of the underlying loans in the case of non payment by the obligor.<br />

(ii) The guarantee ensures payment by the Group’s <strong>com</strong>pany guarantor of outstanding amounts of the underlying supplier financing in the case of non payment by the obligor.<br />

The Group’s share of total debt and financing secured by either pledged assets, pledged deposits issued to cover letters of credit or guarantees issued by the<br />

Company is $445.8 million (2004: $514.0 million).<br />

The total interest charged for the year is $143.7 million (2004: $108.5 million; 2003: $135.1 million).<br />

Also included in “Other debt and financing” is $0.6 million (2004: $1.1 million) in respect of finance leases (note 35).<br />

i) $100 million credit facility On June 29, 2005 <strong>Milli<strong>com</strong></strong> International Operations B.V., <strong>Milli<strong>com</strong></strong>’s wholly-owned subsidiary entered into a $100 million revolving<br />

credit facility (“$100 million facility”) for a one year period with a term out option of an additional year. This facility has been guaranteed by <strong>Milli<strong>com</strong></strong>.<br />

The $100 million facility bears interest at LIBOR plus 2.5% and has a <strong>com</strong>mitment fee of 1% on any undrawn balance. As at December 30, 2005 there had been<br />

no drawdowns on this facility.<br />

<strong>Milli<strong>com</strong></strong> Annual Report and Accounts 2005 65