Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

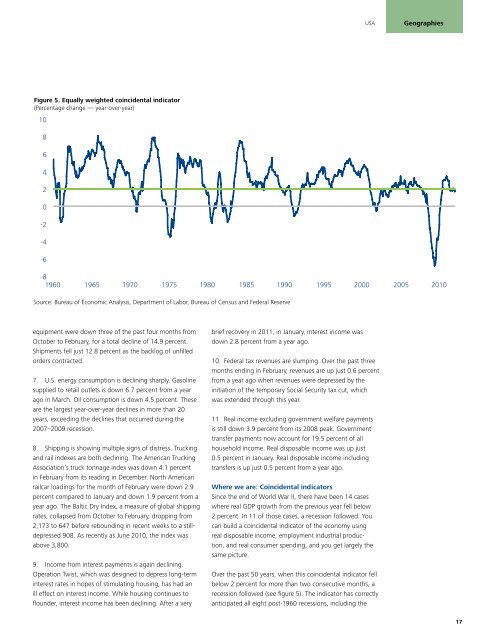

Figure 5. Equally weighted coincidental indicator<br />

(Percentage change — year-over-year)<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

USA<br />

Geographies<br />

-8<br />

1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010<br />

Source: Bureau <strong>of</strong> Economic Analysis, Department <strong>of</strong> Labor, Bureau <strong>of</strong> Census and Federal Reserve<br />

equipment were down three <strong>of</strong> the past four months from<br />

October to February, for a total decline <strong>of</strong> 14.9 percent.<br />

Shipments fell just 12.8 percent as the backlog <strong>of</strong> unfilled<br />

orders contracted.<br />

7. U.S. energy consumption is declining sharply. Gasoline<br />

supplied to retail outlets is down 6.7 percent from a year<br />

ago in March. Oil consumption is down 4.5 percent. These<br />

are the largest year-over-year declines in more than 20<br />

years, exceeding the declines that occurred during the<br />

2007–2009 recession.<br />

8. Shipping is showing multiple signs <strong>of</strong> distress. Trucking<br />

and rail indexes are both declining. The American Trucking<br />

Association’s truck tonnage index was down 4.1 percent<br />

in February from its reading in December. North American<br />

railcar loadings for the month <strong>of</strong> February were down 2.9<br />

percent compared to January and down 1.9 percent from a<br />

year ago. The Baltic Dry Index, a measure <strong>of</strong> global shipping<br />

rates, collapsed from October to February, dropping from<br />

2,173 to 647 before rebounding in recent weeks to a stilldepressed<br />

908. As recently as June 2010, the index was<br />

above 3,800.<br />

9. Income from interest payments is again declining.<br />

Operation Twist, which was designed to depress long-term<br />

interest rates in hopes <strong>of</strong> stimulating housing, has had an<br />

ill effect on interest income. While housing continues to<br />

flounder, interest income has been declining. After a very<br />

brief recovery in 2011, in January, interest income was<br />

down 2.8 percent from a year ago.<br />

10. Federal tax revenues are slumping. Over the past three<br />

months ending in February, revenues are up just 0.6 percent<br />

from a year ago when revenues were depressed by the<br />

initiation <strong>of</strong> the temporary Social Security tax cut, which<br />

was extended through this year.<br />

11. Real income excluding government welfare payments<br />

is still down 3.9 percent from its 2008 peak. Government<br />

transfer payments now account for 19.5 percent <strong>of</strong> all<br />

household income. Real disposable income was up just<br />

0.5 percent in January. Real disposable income including<br />

transfers is up just 0.5 percent from a year ago.<br />

Where we are: Coincidental indicators<br />

Since the end <strong>of</strong> World War II, there have been 14 cases<br />

where real GDP growth from the previous year fell below<br />

2 percent. In 11 <strong>of</strong> those cases, a recession followed. You<br />

can build a coincidental indicator <strong>of</strong> the economy using<br />

real disposable income, employment industrial production,<br />

and real consumer spending, and you get largely the<br />

same picture.<br />

Over the past 50 years, when this coincidental indicator fell<br />

below 2 percent for more than two consecutive months, a<br />

recession followed (see figure 5). The indicator has correctly<br />

anticipated all eight post-1960 recessions, including the<br />

17