Salary Sacrifice - Australian Customs Service

Salary Sacrifice - Australian Customs Service

Salary Sacrifice - Australian Customs Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

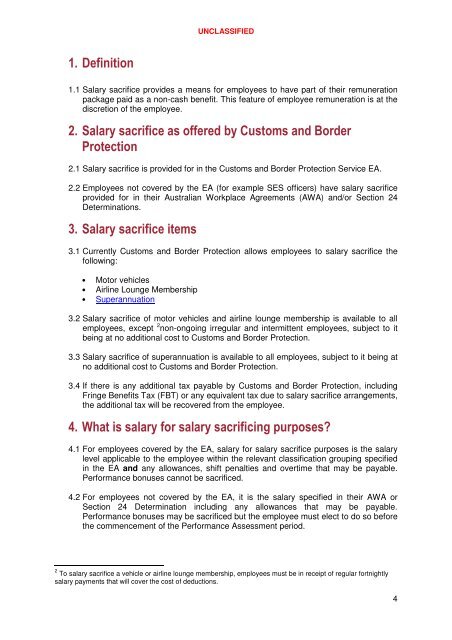

1. Definition<br />

UNCLASSIFIED<br />

1.1 <strong>Salary</strong> sacrifice provides a means for employees to have part of their remuneration<br />

package paid as a non-cash benefit. This feature of employee remuneration is at the<br />

discretion of the employee.<br />

2. <strong>Salary</strong> sacrifice as offered by <strong>Customs</strong> and Border<br />

Protection<br />

2.1 <strong>Salary</strong> sacrifice is provided for in the <strong>Customs</strong> and Border Protection <strong>Service</strong> EA.<br />

2.2 Employees not covered by the EA (for example SES officers) have salary sacrifice<br />

provided for in their <strong>Australian</strong> Workplace Agreements (AWA) and/or Section 24<br />

Determinations.<br />

3. <strong>Salary</strong> sacrifice items<br />

3.1 Currently <strong>Customs</strong> and Border Protection allows employees to salary sacrifice the<br />

following:<br />

• Motor vehicles<br />

• Airline Lounge Membership<br />

• Superannuation<br />

3.2 <strong>Salary</strong> sacrifice of motor vehicles and airline lounge membership is available to all<br />

employees, except 2 non-ongoing irregular and intermittent employees, subject to it<br />

being at no additional cost to <strong>Customs</strong> and Border Protection.<br />

3.3 <strong>Salary</strong> sacrifice of superannuation is available to all employees, subject to it being at<br />

no additional cost to <strong>Customs</strong> and Border Protection.<br />

3.4 If there is any additional tax payable by <strong>Customs</strong> and Border Protection, including<br />

Fringe Benefits Tax (FBT) or any equivalent tax due to salary sacrifice arrangements,<br />

the additional tax will be recovered from the employee.<br />

4. What is salary for salary sacrificing purposes?<br />

4.1 For employees covered by the EA, salary for salary sacrifice purposes is the salary<br />

level applicable to the employee within the relevant classification grouping specified<br />

in the EA and any allowances, shift penalties and overtime that may be payable.<br />

Performance bonuses cannot be sacrificed.<br />

4.2 For employees not covered by the EA, it is the salary specified in their AWA or<br />

Section 24 Determination including any allowances that may be payable.<br />

Performance bonuses may be sacrificed but the employee must elect to do so before<br />

the commencement of the Performance Assessment period.<br />

2 To salary sacrifice a vehicle or airline lounge membership, employees must be in receipt of regular fortnightly<br />

salary payments that will cover the cost of deductions.<br />

4