Overview on settlement processing - Eurex Clearing

Overview on settlement processing - Eurex Clearing

Overview on settlement processing - Eurex Clearing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

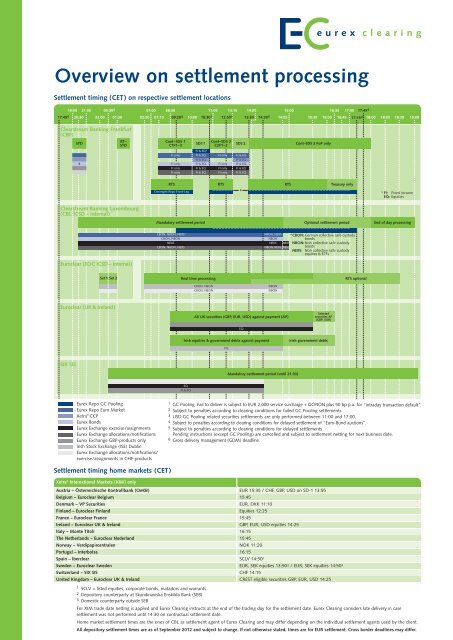

<str<strong>on</strong>g>Overview</str<strong>on</strong>g> <strong>on</strong> <strong>settlement</strong> <strong>processing</strong><br />

Settlement timing (CET) <strong>on</strong> respective <strong>settlement</strong> locati<strong>on</strong>s<br />

08:30<br />

16:30<br />

17:456 20:30 22:00 01:30 02:30 07:10 09:206 10:00 10:301 19:00 21:00 00:306 07:00 11:00 13:15 15:00 17:00 17:456 13:30 14:305 14:00<br />

12:50 14:55 15:30 16:00 16:45 17:152 18:00 18:05 18:30 19:00<br />

6<br />

Clearstream Banking Frankfurt<br />

(CBF)<br />

STD<br />

4<br />

RT–<br />

STD<br />

Clearstream Banking Luxembourg<br />

(CBL ICSD – internal)<br />

Euroclear (EOC ICSD – internal)<br />

Set 1 Set 2<br />

Euroclear (UK & Ireland)<br />

SIX SIS<br />

<strong>Eurex</strong> Repo GC Pooling<br />

<strong>Eurex</strong> Repo Euro Market<br />

Xetra ® CCP<br />

<strong>Eurex</strong> B<strong>on</strong>ds<br />

<strong>Eurex</strong> Exchange exercise/assignments<br />

<strong>Eurex</strong> Exchange allocati<strong>on</strong>s/notificati<strong>on</strong>s<br />

<strong>Eurex</strong> Exchange GBP-products <strong>on</strong>ly<br />

Irish Stock Exchange (ISE) Dublin<br />

<strong>Eurex</strong> Exchange allocati<strong>on</strong>s/notificati<strong>on</strong>s/<br />

exercise/assignments in CHF-products<br />

Settlement timing home markets (CET)<br />

Xetra ® Internati<strong>on</strong>al Markets (XIM) <strong>on</strong>ly<br />

Austria – Österreichische K<strong>on</strong>trollbank (OeKB)<br />

Belgium – Euroclear Belgium<br />

Denmark – VP Securities<br />

Finland – Euroclear Finland<br />

France – Euroclear France<br />

Ireland – Euroclear UK & Ireland<br />

Italy – M<strong>on</strong>te Titoli<br />

The Netherlands – Euroclear Nederland<br />

Norway – Verdipapircentralen<br />

Portugal – Interbolsa<br />

Spain – Iberclear<br />

Sweden – Euroclear Sweden<br />

Switzerland – SIX SIS<br />

United Kingdom – Euroclear UK & Ireland<br />

C<strong>on</strong>t–SDS 1<br />

C1F1–3<br />

C<strong>on</strong>t–SDS 2<br />

SDS 1<br />

C2F1–2<br />

SDS 2 C<strong>on</strong>t–SDS 3 FoP <strong>on</strong>ly<br />

FI <strong>on</strong>ly<br />

FI & EQ*<br />

FI & EQ<br />

FI & EQ<br />

FI <strong>on</strong>ly<br />

FI <strong>on</strong>ly FI & EQ FI <strong>on</strong>ly<br />

FI <strong>on</strong>ly FI & EQ FI <strong>on</strong>ly<br />

FI <strong>on</strong>ly FI <strong>on</strong>ly<br />

RTS RTS<br />

Overnight Repo Fr<strong>on</strong>t-Leg<br />

Mandatory <strong>settlement</strong> period Opti<strong>on</strong>al <strong>settlement</strong> period End of day <strong>processing</strong><br />

Real time <strong>processing</strong> RTS opti<strong>on</strong>al<br />

CBON, NBON NBON<br />

CBON, NBON NBON<br />

3<br />

All UK securities (GBP, EUR, USD) against payment (AP)<br />

RTS Treasury <strong>on</strong>ly<br />

Irish equities & government debts against payment Irish government debts<br />

EQ<br />

FI & EQ<br />

FI & EQ<br />

FI & EQ<br />

FI & EQ<br />

FI & EQ FI & EQ<br />

CBON, NBON, NEXS*<br />

CBON, NBON<br />

NBON, NEXS<br />

NBON<br />

*CBON: German collective safe custody<br />

b<strong>on</strong>ds<br />

NEXS<br />

CBON, NBON, NEXS<br />

NEXS NEXS NBON:N<strong>on</strong> collective safe custody<br />

NBON,NEXS NEXS b<strong>on</strong>ds<br />

NEXS: N<strong>on</strong> collective safe custody<br />

equities & ETFs<br />

EQ<br />

FI & EQ<br />

EQ<br />

Mandatory <strong>settlement</strong> period (until 21:30)<br />

Selected<br />

securities AP<br />

(GBP, EUR)<br />

1 GC Pooling: Fail to deliver is subject to EUR 2,000 service surcharge + GCPION plus 50 bp p.a. for “intraday transacti<strong>on</strong> default”.<br />

2 Subject to penalties according to clearing c<strong>on</strong>diti<strong>on</strong>s for failed GC Pooling <strong>settlement</strong>s.<br />

3 USD GC Pooling related securities <strong>settlement</strong>s are <strong>on</strong>ly performed between 11:00 and 17:00.<br />

4 Subject to penalties according to clearing c<strong>on</strong>diti<strong>on</strong>s for delayed <strong>settlement</strong> of “Euro-Bund aucti<strong>on</strong>s”.<br />

5 Subject to penalties according to clearing c<strong>on</strong>diti<strong>on</strong>s for delayed <strong>settlement</strong>s.<br />

Pending instructi<strong>on</strong>s (except GC Pooling) are cancelled and subject to <strong>settlement</strong> netting for next business date.<br />

6 Gross delivery management (GDM) deadline.<br />

EUR 15:35 / CHF, GBP, USD <strong>on</strong> SD-1 13:55<br />

15:45<br />

EUR, DKK 11:10<br />

Equities 12:25<br />

15:45<br />

GBP, EUR, USD equities 14:25<br />

16:15<br />

15:45<br />

NOK 11:20<br />

16:15<br />

SCLV 14:501 EUR, SEK equities 13:502 / EUR, SEK equities 14:503 CHF 14:15<br />

CREST eligible securities GBP, EUR, USD 14:25<br />

* FI: Fixed income<br />

EQ: Equities<br />

1 SCLV = listed equities, corporate b<strong>on</strong>ds, matadors and warrants<br />

2 Depository counterparty at Skandinaviska Enskilda Bank (SEB)<br />

3 Domestic counterparty outside SEB<br />

For XIM trade date netting is applied and <strong>Eurex</strong> <strong>Clearing</strong> instructs at the end of the trading day for the <strong>settlement</strong> date. <strong>Eurex</strong> <strong>Clearing</strong> c<strong>on</strong>siders late delivery in case<br />

<strong>settlement</strong> was not performed until 14:30 <strong>on</strong> c<strong>on</strong>tractual <strong>settlement</strong> date.<br />

Home market <strong>settlement</strong> times are the <strong>on</strong>es of CBL as <strong>settlement</strong> agent of <strong>Eurex</strong> <strong>Clearing</strong> and may differ depending <strong>on</strong> the individual <strong>settlement</strong> agents used by the client.<br />

All depository <strong>settlement</strong> times are as of September 2012 and subject to change. If not otherwise stated, times are for EUR <strong>settlement</strong>. Cross border deadlines may differ.

Most relevant <strong>settlement</strong> times*<br />

Equities<br />

Gross delivery management deadlines: 09:20 and 12:50 for<br />

<strong>settlement</strong> date (SD) and 17:45 for SD+1. Cancellati<strong>on</strong> of<br />

failed <strong>settlement</strong>s: ca. 14:30 <strong>on</strong> SD.<br />

<strong>Eurex</strong> Repo – GC Pooling<br />

Settlement for trades agreed before SD has to take place until<br />

SDS1 and is late after 10:30. Settlement for trades agreed<br />

before SD is failed after 17:15. Settlement for ON fr<strong>on</strong>t legs<br />

of trades agreed <strong>on</strong> SD are late after 0.5 hour and failed<br />

after 17:15.<br />

<strong>Eurex</strong> Repo – Euro Market<br />

Settlement for trades agreed before SD is failed after 14:30.<br />

Cancellati<strong>on</strong> of failed <strong>settlement</strong>s: ca. 14:30. On SD Settlement<br />

for ON fr<strong>on</strong>t legs of trades agreed <strong>on</strong> SD are late after:<br />

(I)CSD vs. (I)CSD<br />

From CBF<br />

From CBL<br />

From EOC<br />

To CBF<br />

13:30<br />

13:00<br />

13:00<br />

To CBL<br />

13:00<br />

14:45<br />

13:00<br />

To EOC<br />

13:00<br />

13:00<br />

15:30<br />

<strong>Eurex</strong> B<strong>on</strong>ds<br />

Settlement for trades agreed before SD are late if not settled<br />

in CBF’s standard <strong>settlement</strong> cycle (STD). Cancellati<strong>on</strong> of<br />

failed <strong>settlement</strong>s: ca. 14:30 <strong>on</strong> SD.<br />

Securities <strong>settlement</strong>s failure – overview<br />

General c<strong>on</strong>tractual penalties are defined in chapter I part 1<br />

of <strong>Eurex</strong> <strong>Clearing</strong>’s clearing c<strong>on</strong>diti<strong>on</strong>s and comprise:<br />

• 0.025 percent of failed value, but not less than EUR 2,500<br />

per day, if failed value exceeds EUR 100 milli<strong>on</strong>, c<strong>on</strong>tractual<br />

penalty are calculated based <strong>on</strong> the effective overnight<br />

interest rate applicable to the relevant clearing currency,<br />

but not less than EUR 25,000 per day.<br />

Equity specifics<br />

• For equities a buy-in and cash <strong>settlement</strong> model is applied.<br />

Shares falling under ESMA rules foresee an accelerated<br />

buy-in process after 4 days and cash <strong>settlement</strong> after<br />

* Please note: All times are CET.<br />

C<strong>on</strong>tacts<br />

Helpdesk<br />

Securities <strong>Clearing</strong>*<br />

Derivatives <strong>Clearing</strong>**<br />

Risk Hotline<br />

Teleph<strong>on</strong>e<br />

+49-69-211-11940<br />

+49-69-211-11250<br />

+49-69-211-12452<br />

Fax<br />

+49-69-211-14334<br />

+49-69-211-14334<br />

+49-69-211-18440<br />

*Delivery management and cash management<br />

** Post-trade management for derivatives and collateral management<br />

E-mail<br />

clearing@eurexclearing.com<br />

clearing@eurexclearing.com<br />

risk@eurexclearing.com<br />

8 days. Fines are charged for late deliveries over dividend<br />

days (35.8 percent <strong>on</strong> net dividend) and over corporate<br />

acti<strong>on</strong>s. In case of failed <strong>settlement</strong> in rights (e.g.subscripti<strong>on</strong><br />

rights) <strong>Eurex</strong> <strong>Clearing</strong> will disclose the counterparties.<br />

<strong>Eurex</strong> Repo specifics<br />

• For any <strong>Eurex</strong> Repo fr<strong>on</strong>t leg transacti<strong>on</strong>s fail <strong>Eurex</strong><br />

<strong>Clearing</strong> is entitled, whether or not requested by<br />

the <strong>Clearing</strong> Member, to set present business day as<br />

advanced repurchase date of the term leg to offset<br />

obligati<strong>on</strong>s and settle the repo rate amount <strong>on</strong>ly.<br />

• For any <strong>Eurex</strong> Repo term leg transacti<strong>on</strong>s fail <strong>Eurex</strong><br />

<strong>Clearing</strong> is entitled, whether or not requested by<br />

the <strong>Clearing</strong> Member, to launch a buy-in as from the<br />

fifth day following the delivery date of the term leg.<br />

• For a GC Pooling intraday default resulting from failure<br />

to comply with obligati<strong>on</strong>s at SDS1, <strong>Eurex</strong> <strong>Clearing</strong><br />

may charge EUR 2,000 for each defaulting transacti<strong>on</strong>.<br />

• <strong>Eurex</strong> <strong>Clearing</strong> may also invoice any interim financing costs<br />

incurred, up to the value of the GC Pooling Overnight<br />

Index (GCPION) plus 50 basis points p.a., in relati<strong>on</strong><br />

to the value of the underlying GC Pooling transacti<strong>on</strong> or<br />

the due cash amount respectively.<br />

<strong>Eurex</strong> Exchange specifics<br />

Fines for fails arising from delivery fails out of notificati<strong>on</strong>s/<br />

allocati<strong>on</strong>s are b<strong>on</strong>d type specific:<br />

• German government b<strong>on</strong>ds: 0.04 percent fines <strong>on</strong> volume<br />

not settled in SDS1 or 0.40 percent fines <strong>on</strong> volume<br />

not settled in SDS2 <strong>on</strong> the c<strong>on</strong>tractual <strong>settlement</strong> day<br />

else 0.40 percent fines <strong>on</strong> volume per calendar day.<br />

Additi<strong>on</strong>al charge of interest of delay (1 percent + ECB<br />

main refinancing rate <strong>on</strong> outstanding amount).<br />

• Other b<strong>on</strong>ds (except CHF-denominated b<strong>on</strong>ds):<br />

0.40 percent fines <strong>on</strong> volume not settled <strong>on</strong> the c<strong>on</strong>tractual<br />

<strong>settlement</strong> day per calendar day and interest of delay<br />

(1 percent + ECB main refinancing rate <strong>on</strong> outstanding<br />

amount).<br />

• CHF-denominated b<strong>on</strong>ds: 0.85 percent fines <strong>on</strong><br />

nominal value and interest of delay (1 percent + SNB<br />

main refinancing rate <strong>on</strong> outstanding amount).<br />

Helpdesk<br />

<strong>Clearing</strong> Business Relati<strong>on</strong>s<br />

<strong>Clearing</strong> Data C<strong>on</strong>trol<br />

Technical Support<br />

Teleph<strong>on</strong>e<br />

+44-20-78 62-7218<br />

+49-69-211-12453<br />

+49-69-211-11200<br />

Order Number: C1E-014-0213<br />

Neither <strong>Eurex</strong> <strong>Clearing</strong>, nor its servants nor agents, is resp<strong>on</strong>sible for any errors or omissi<strong>on</strong>s c<strong>on</strong>tained in this publicati<strong>on</strong> which is published<br />

for informati<strong>on</strong> <strong>on</strong>ly and shall not c<strong>on</strong>stitute an investment advice. Any informati<strong>on</strong> herein is not intended for solicitati<strong>on</strong> purposes but <strong>on</strong>ly<br />

for the use of general informati<strong>on</strong>. <strong>Eurex</strong> <strong>Clearing</strong> offers services directly to its members and its markets cleared. Those wishing to use such<br />

services should c<strong>on</strong>sider both their legal and regulatory positi<strong>on</strong> in the relevant jurisdicti<strong>on</strong> and the risks associated.<br />

Fax<br />

+44-20-78 62-9218<br />

+49-69-211-14220<br />

+49-69-211-11201<br />

E-mail<br />

clearingrelati<strong>on</strong>s@eurexclearing.com<br />

clearingdata@eurexclearing.com<br />

eurex-help@eurexclearing.com