Charlotte Christiansen - European Capital Markets Institute

Charlotte Christiansen - European Capital Markets Institute

Charlotte Christiansen - European Capital Markets Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

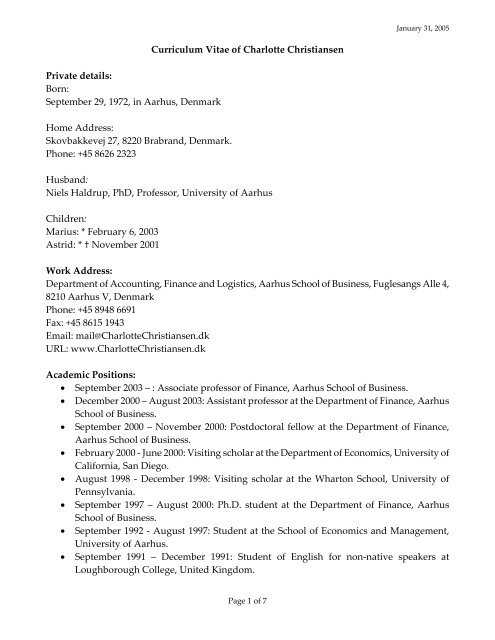

Private details:<br />

Born:<br />

September 29, 1972, in Aarhus, Denmark<br />

Home Address:<br />

Skovbakkevej 27, 8220 Brabrand, Denmark.<br />

Phone: +45 8626 2323<br />

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

Husband:<br />

Niels Haldrup, PhD, Professor, University of Aarhus<br />

Children:<br />

Marius: * February 6, 2003<br />

Astrid: * † November 2001<br />

January 31, 2005<br />

Work Address:<br />

Department of Accounting, Finance and Logistics, Aarhus School of Business, Fuglesangs Alle 4,<br />

8210 Aarhus V, Denmark<br />

Phone: +45 8948 6691<br />

Fax: +45 8615 1943<br />

Email: mail@<strong>Charlotte</strong><strong>Christiansen</strong>.dk<br />

URL: www.<strong>Charlotte</strong><strong>Christiansen</strong>.dk<br />

Academic Positions:<br />

• September 2003 – : Associate professor of Finance, Aarhus School of Business.<br />

• December 2000 – August 2003: Assistant professor at the Department of Finance, Aarhus<br />

School of Business.<br />

• September 2000 – November 2000: Postdoctoral fellow at the Department of Finance,<br />

Aarhus School of Business.<br />

• February 2000 ‐ June 2000: Visiting scholar at the Department of Economics, University of<br />

California, San Diego.<br />

• August 1998 ‐ December 1998: Visiting scholar at the Wharton School, University of<br />

Pennsylvania.<br />

• September 1997 – August 2000: Ph.D. student at the Department of Finance, Aarhus<br />

School of Business.<br />

• September 1992 ‐ August 1997: Student at the School of Economics and Management,<br />

University of Aarhus.<br />

• September 1991 – December 1991: Student of English for non‐native speakers at<br />

Loughborough College, United Kingdom.<br />

Page 1 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

January 31, 2005<br />

Degrees:<br />

• February 2001: PhD (Finance), Aarhus School of Business.<br />

• August 1997: MA (Economics and Business Administration), University of Aarhus.<br />

Publications:<br />

Finally Published ‐ International Refereed Journals:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2004): Regime Switching in the Yield Curve. Journal of Futures<br />

<strong>Markets</strong> 24(4), 315‐336.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2003): Testing the Expectations Hypothesis Using Long Maturity<br />

Forward Rates. Economics Letters 78(2), 175‐180.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2002): Credit Spreads and the Term Structure of Interest Rates.<br />

Special issue on Credit Derivatives in International Review of Financial Analysis 11(3), 279‐<br />

295.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and <strong>Charlotte</strong> Strunk Hansen (2002): Implied Volatility of Interest<br />

Rate Options: An Empirical Application of the Market Model. Review of Derivatives<br />

Research 5(1), 51‐79.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2000): Macroeconomic Announcement Effects on the Covariance<br />

Structure of Government Bond Returns. Journal of Empirical Finance 7(5), 479‐507.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (1999): Value at Risk Using the Factor‐ARCH Model, Journal of Risk<br />

1(2), 65‐86.<br />

Accepted for Publication – International Refereed Journals:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2004): Multivariate Term Structure Models with Level and<br />

Heteroskedasticity Effects, forthcoming Journal of Banking and Finance.<br />

Finally Published: Book Chapters:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, Tom Engsted, Svend Jakobsen, and Carsten Tanggaard (2004):<br />

Denmark in Jonathan A. Batten, Thomas A. Fetherston, and Peter G. Szilagyi , ed.,<br />

“<strong>European</strong> Fixed Income <strong>Markets</strong>: Money, Bond, and Interest Rate Derivatives”, John<br />

Wiley & Sons.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, Tom Engsted, Svend Jakobsen, and Carsten Tanggaard (2004): An<br />

Empirical Study of the Term Structure of Interest Rates in Denmark (1993‐2002) in<br />

Jonathan A. Batten, Thomas A. Fetherston, and Peter G. Szilagyi , ed., “<strong>European</strong> Fixed<br />

Income <strong>Markets</strong>: Money, Bond, and Interest Rate Derivatives”, John Wiley & Sons.<br />

Danish Publications:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, and Niels Haldrup (2004): Nobelprisen i Økonomi 2003,<br />

Tidsserieøkonometri: Cointegration og ARCH, Clive W. J. Granger og Robert F. Engle.<br />

Finans/Invest 2/04, 23‐27.<br />

Page 2 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

January 31, 2005<br />

Working Papers:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, Juanna Schrøter Joensen, and Jesper Rangvid (2004): Do More<br />

Economists Hold Stocks?<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2004): Decomposing <strong>European</strong> Bond and Equity Volatility,<br />

submitted to Journal of Business and Economic Statistics.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2003): Volatility Spillover Effects in <strong>European</strong> Bond <strong>Markets</strong>,<br />

submitted to Journal of International Money and Finance.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, Juanna Schrøter Joensen, and Helena Skyt Nielsen (2004): The<br />

Educational Asset Market: A Finance Perspective on Human <strong>Capital</strong> Investment, invited<br />

for resubmission to Labour Economics.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and Jesper Lund (2002): Revisiting the Shape of the Yield Curve:<br />

The Effect of Interest Rate Volatility, invited for resubmission to Review of Finance,<br />

December 2003.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> (2002): Variance‐in‐Mean Effects of the Long Forward‐Rate Slope,<br />

submitted to Applied Financial Economics.<br />

Work in Progress:<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong>, Juanna Schrøter Joensen, and Jesper Rangvid: Portfolio Choice and<br />

Human <strong>Capital</strong>.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and Niels Haldrup: Convergence of International Bond <strong>Markets</strong>.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and Ramaprasad Bhar: Impact of Forward FX Premium on Equity.<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and Svend Jakobsen: Property Investments in a Dynamic Asset<br />

Allocation Framework<br />

• <strong>Charlotte</strong> <strong>Christiansen</strong> and Lieven Baele: Regime‐Switching and Volatility‐Spillover in<br />

<strong>European</strong> Bond <strong>Markets</strong><br />

Paper Presentations:<br />

Conferences:<br />

• International Bond and Debt Market Integration Conference, Trinity College, Dublin,<br />

Ireland, June 2004.<br />

• Econometrics/Finance Workshop, University of Aarhus, Denmark, May 2004.<br />

• Aarhus Econometrics meeting, Svinkløv Badehotel, Denmark, May 2004.<br />

• Danish Network in Mathematical Finance members’ meeting, Molskroen, Denmark, April<br />

2004.<br />

• Centre for Analytical Finance members’ meeting, Sandbjerg manor, Denmark, January<br />

2004.<br />

• <strong>European</strong> Finance Association’s 29 th Annual Conference, Berlin, Germany, August 2002<br />

(EFA 2002).<br />

Page 3 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

January 31, 2005<br />

• Scottish <strong>Institute</strong> for Research in Investment and Finance (SIRIF) conference on “Advances<br />

in Modelling and Forecasting in Financial <strong>Markets</strong>”, Glasgow, UK, August 2002.<br />

• <strong>European</strong> Financial Management Association Meeting, Lugano, Switzerland, June 2001.<br />

• Arne Ryde Workshop in Empirical Finance, Lund University, Sweden, April 2001.<br />

• Centre for Analytical Finance members’ meeting, Sandbjerg manor, Denmark, January<br />

2001.<br />

• Symposium on Credit Risk Modelling, University of Southern Denmark, January 2001.<br />

• Quantitative Methods in Finance & Bernoulli Society 2000 Conference, Sydney,<br />

Australia, December 2000.<br />

• <strong>European</strong> Finance Association’s 27 th Annual Conference, London, UK, August 2000 (EFA<br />

2000).<br />

• Symposium on Asset Allocation and Value‐at‐Risk, University of Southern Denmark,<br />

January 2000.<br />

• <strong>European</strong> Finance Association’s 26 th Annual Conference, Helsinki, Finland, August 1999<br />

(EFA 1999).<br />

• French Finance Association’s 16 th International Conference in Finance, Aix‐en‐Provence,<br />

France, June 1999.<br />

• <strong>Capital</strong> <strong>Markets</strong>: Pricing, Regulation and Market Structure Conference, Centre for<br />

Economic Policy Research, Louvain‐la‐Neuve, Belgium, June 1999.<br />

Departmental Seminars:<br />

• Dept. of Finance, Copenhagen Business School, April 2004.<br />

• Dept. of Finance, Stockholm School of Economics, March 2004.<br />

• School of Accounting and Finance, University of Manchester, February 2004.<br />

• Dept. of Finance, Aarhus School of Business, September 2003, May 2002, May 2001,<br />

November 1999, September 2000.<br />

• Centre de Mathematiques Appliquees, Ecole Polytechnique, Paris, April 2002.<br />

• Centre for Analytical Finance workshop, University of Aarhus, December 1999.<br />

Other:<br />

• Ait‐Sahalia Ph.D.‐course, University of Aarhus, December 1999.<br />

• <strong>European</strong> Finance Association’s 26 th Annual Conference Doctoral Tutorial, Helsinki,<br />

Finland, August 1999.<br />

• Singleton Ph.D.‐course, Norwegian School of Economics and Business Administration<br />

(NHH), June 1998.<br />

• VanHoose Ph.D.‐course, Aarhus School of Business, May 1998.<br />

Paper Discussions:<br />

• <strong>European</strong> Finance Association’s 29 th Annual Conference, Berlin, Germany, August 2002.<br />

Page 4 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

January 31, 2005<br />

• <strong>European</strong> Financial Management Association Meeting, Lugano, Switzerland, June 2001.<br />

• <strong>European</strong> Finance Association’s 27 th Annual Conference, London, UK, August 2000.<br />

• <strong>European</strong> Finance Association’s 27 th Annual Conference, Doctoral Tutorial, London, UK,<br />

August 2000.<br />

• <strong>European</strong> Finance Association’s 26th Annual Conference, Helsinki, Finland, August 1999.<br />

Refereeing:<br />

• Journal of Futures <strong>Markets</strong><br />

• Journal of International Money and Finance<br />

• International Review of Economics and Finance<br />

• Emerging <strong>Markets</strong> Finance and Trade<br />

• Journal of Applied Econometrics<br />

• International Review of Financial Analysis<br />

• <strong>European</strong> Financial Management<br />

• <strong>European</strong> Finance Review<br />

Awards:<br />

• November 2004: Winner of the Statoil Research Prize, DKK 100,000. In Danish: Modtager<br />

af Statoils Økonomiske Forskningspris.<br />

• May 2002: Winner of the Tietgen Gold Medal Prize, a prize for young researchers in<br />

business studies, DKK 100,000. In Danish: Modtager af Tietgenprisen uddelt af Foreningen<br />

til Unge Handelsmænds Uddannelse (FUHU).<br />

Research Grants:<br />

• Danish Social Science Research Council, 2003‐2005: “Education as a Risky Asset”, DKK 3.1<br />

million, a research collaboration directed by Helena Skyt Nielsen, Department of<br />

Economics, University of Aarhus.<br />

Committee work:<br />

Conferences:<br />

• Member of the program committee of the <strong>European</strong> Finance Association’s Annual<br />

Conference in Maastricht, August 2004.<br />

• Member of the program committee of the <strong>European</strong> Finance Association’s Annual<br />

Conference in Glasgow, August 2003.<br />

• Member of the program committee of the <strong>European</strong> Finance Association’s Annual<br />

Conference in Berlin, August 2002.<br />

PhD:<br />

• Member of the PhD evaluation committee for Randi Næs at NHH (Bergen, Norway),<br />

Page 5 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

September 2004.<br />

• Member of pre‐defence committee Lund University, October 2003.<br />

January 31, 2005<br />

Administration:<br />

• October 7‐8, 2004: Organizer of the annual PhD workshop of the Danish Doctoral School<br />

of Finance, Hotel Ebeltoft Strand.<br />

• August 30 ‐ September 3, 2004: Organizer of intensive PhD course taught by Prof. Kenneth<br />

J. Singleton, Stanford University.<br />

• September 2003‐: Member of the Steering Group of the Danish Doctoral School of Finance.<br />

• September 2003‐: Finance PhD coordinator, Aarhus School of Business.<br />

• May 2001 –: Member of the Board of Research Education (“Forskeruddannelsesudvalget”)<br />

at the Faculty of Business Administration, Aarhus School of Business.<br />

• Various semesters (including fall 2004): Organizer of the finance seminars, Aarhus School<br />

of Business.<br />

Network Memberships:<br />

• 2003‐2005: Participating in “Education as a Risky Asset”, a research collaboration headed<br />

by Helena Skyt Nielsen, University of Aarhus, www.econ.au.dk/vip_htm/hnielsen/educationrisk.<br />

• 2003‐: Member of Mathematical Network in Finance, Danish business schools and<br />

universities.<br />

• 1997‐: Member of Centre for Analytical Finance, University of Aarhus and Aarhus School<br />

of Business, www.caf.dk.<br />

Teaching:<br />

Teaching Experience:<br />

• September 1997 to present: Supervision of various graduate and undergraduate<br />

dissertations, Aarhus School of Business.<br />

• Fall term of 2004: Lecturer in “Quantitative Methods in Finance”, applied financial<br />

econometrics, graduate level, Aarhus School of Business.<br />

• Fall term of 2003: Lecturer in “Quantitative Methods in Finance”, applied financial<br />

econometrics, graduate level, Aarhus School of Business.<br />

• Fall term of 2002: Lecturer in “Quantitative Methods in Finance”, applied financial<br />

econometrics, graduate level, Aarhus School of Business,<br />

• Fall term of 2001: Lecturer in “Quantitative Methods in Finance”, investment science,<br />

graduate level, Aarhus School of Business.<br />

• Spring term of 2001: Lecturer in “Introductory Finance” (“DRØK 2”), undergraduate level,<br />

<strong>Institute</strong> of Mathematical Sciences, University of Aarhus.<br />

• Fall term of 1999: Lecturer in “Financial Engineering”, graduate level, Aarhus School of<br />

Business (substitute for Svend Jakobsen).<br />

Page 6 of 7

Curriculum Vitae of <strong>Charlotte</strong> <strong>Christiansen</strong><br />

January 31, 2005<br />

• Spring term of 1998: Teaching assistant in undergraduate finance at the Department of<br />

Finance, Aarhus School of Business.<br />

• Spring terms of 1995 and 1996: Teaching assistant in undergraduate statistics at the<br />

Department of Economics, School of Economics and Management, University of Aarhus.<br />

• Spring term of 1995: Teaching assistant in statistics at the House of Greenland in Aarhus.<br />

Teaching Material:<br />

• Fall 2003: Lecture notes from “Quantitative Methods in Finance”, revision of material from<br />

2003.<br />

• Fall 2003: Lecture notes from “Quantitative Methods in Finance”, revision of material from<br />

2002.<br />

• Fall 2002: Lecture notes from “Quantitative Methods in Finance”, 202 pages.<br />

• Fall 2001: Lecture notes from “Quantitative Methods in Finance”, 158 pages.<br />

• Spring 2001: Lecture notes from “Introductory Finance”, 266 pages.<br />

Pedagogical Teaching Courses Attended:<br />

• December 2002: “Project Supervision” a 1‐day course module under the pedagogical<br />

programme for the young academic staff at Aarhus School of Business, by Jens Tofteskov,<br />

Copenhagen Business School.<br />

• January 2002: “Pedagogical Planning” a 2‐day course module under the pedagogical<br />

programme for the young academic staff at Aarhus School of Business, by Tom Maarup,<br />

Aarhus Amt, and Professor Tage Rasmussen, Aarhus School of Business.<br />

• September 2000: “General Dissemination Technique” a 3‐day course module under the<br />

pedagogical programme for the young academic staff at Aarhus School of Business, by<br />

Professor Tage Rasmussen, Aarhus School of Business.<br />

• March 1995: ʺTeaching Pedagogic for Teaching Assistantsʺ a 3‐day course for teaching<br />

assistants at the University of Aarhus.<br />

Page 7 of 7