February 2007 - National Fair Housing Advocate Online

February 2007 - National Fair Housing Advocate Online

February 2007 - National Fair Housing Advocate Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDITOR’S NOTE<br />

Will we ever move past race?<br />

The recent dustup over a white Congressman<br />

applying for membership in the Congressional<br />

Black Caucus and being rejected,<br />

as well as the myriad of conversations<br />

on whether or not Barack Obama is<br />

“black enough” has got me wondering,<br />

“Will we ever move past race?”<br />

As a civil rights advocate, I have this<br />

vague notion that my colleagues and I are<br />

working toward a society where the color<br />

of one’s skin will no longer matter. You<br />

know, that whole “content of one’s character”<br />

thing that Dr. King talked about.<br />

We don’t really say it. We don’t really<br />

talk about it, but when I’m with other<br />

civil rights professionals, I’m pretty sure<br />

that we all have this feeling somewhere in<br />

our hearts.<br />

As we work to enforce the law and<br />

inform people of their rights, I think we’re<br />

all trying to reach the same goal. But, I’m<br />

starting to have doubts that we’ll ever get<br />

there. Are we as a species that flawed?<br />

More and more, I’m starting to hear<br />

my friends and colleagues give ground on<br />

issues related to civil rights, especially on<br />

issues of racial segregation.<br />

I’ve heard several colleagues in recent<br />

years talk about how segregation, apart<br />

from being caused partially by discrimination,<br />

is also at least partly due to<br />

people choosing to live “with people<br />

who look like them.”<br />

This is the argument that I have been<br />

fighting against for more than a decade<br />

now. When landlords tell me that the reason<br />

Louisville’s West End is 92 percent<br />

black is because “black people want to<br />

live near other black people,” I politely<br />

disagree.<br />

I point to the white flight that the West<br />

End experienced in the 1940s, 1950s, and<br />

1960s. I point to the segregation laws that<br />

prohibited African Americans from building<br />

news houses on “white blocks” in the<br />

city. I point to the fact that Andrew and<br />

Charlotte Wade had crosses burned on their<br />

lawn and ultimately saw their home destroyed<br />

by a bomb in 1954 for daring to<br />

move into an all-white neighborhood.<br />

I don’t buy that notion. Not for a second.<br />

Not when thugs and segregation laws<br />

forced most of Louisville’s black citizens<br />

into one part of town.<br />

You can’t spend 300 years segregating<br />

a community, including years of slavery,<br />

and then, less than two generations<br />

after Jim Crow say, “Black people live in<br />

black neighborhoods, because that’s where<br />

they want to live.”<br />

If every citizen -- rich or poor, regardless<br />

of race -- really had a totally free<br />

choice of where to live, would they choose<br />

to live only near people who look like<br />

themselves? If your answer<br />

is yes, why?<br />

Is it because most white people don’t<br />

generally know a lot of black people and<br />

vice versa? Is it because there’s a history<br />

of racial bigotry and violence in this country?<br />

Is it because black pioneers like the<br />

Wades in Louisville have been chased out<br />

of all-white neighborhoods?<br />

If you could take all those things away and<br />

if we could erase all the history that led us to<br />

this point, would your answer be the same?<br />

Of course, we cannot erase our history,<br />

so we may never know. And that<br />

bothers me.<br />

Each new generation that comes along<br />

in America seems to be more tolerant than<br />

the last. Today’s young people seem to<br />

be more accepting of people who aren’t<br />

their mirror images. I just don’t know<br />

if that’s enough.<br />

Add all this to the notion that there’s<br />

always a new group to hate -- gay people,<br />

Muslims, Mormons, atheists, etc. -- and I<br />

don’t know if a colorblind society will<br />

actually be that different from the one<br />

we live in now.<br />

A colleague of mine, Dr. Ricky Jones<br />

from the University of Louisville, was on<br />

the radio recently talking about race relations,<br />

and he spoke about how he didn’t<br />

feel we could ever move past race. “You<br />

can look at me and see that I am a black<br />

man,” he said. “You cannot ignore that.”<br />

I guess that’s true, but it also hurts my<br />

heart to think that the human race is inca-<br />

pable of moving past color and race. Is<br />

there no way to elevate ourselves above<br />

this? Is there no way that, through extrapolation,<br />

we can take our experiences with<br />

people who don’t look like us and apply<br />

them to all humankind?<br />

If we are prisoners to our senses, to<br />

what our misguided relatives taught us as<br />

children, and to what the media teaches us<br />

about others, what chance do we have?<br />

What are we fighting for, anyway?<br />

I suppose this is a question that can<br />

only be answered by time. I’m hoping the<br />

immortality pills are invented soon.<br />

As to this nonsense about whether<br />

Barack Obama is “black enough,” I must<br />

admit that I just sit here and scratch my<br />

head. Is this what we’ve come to?<br />

As much as I hate to, I will fall back<br />

on Dr. Jones’s position. Do the people<br />

who are asking these questions about<br />

Obama honestly think that when he was<br />

a child, racists who taunted him suddenly<br />

stopped when they found out his<br />

mother was white? Do you think they<br />

bothered to find out?<br />

I went to high school with several biracial<br />

kids in rural Indiana. I can tell you<br />

that the names they were often called was<br />

because the racist namecallers thought they<br />

were black, even though at least one of<br />

their parents was white.<br />

Did anyone ever stop to ask if the first<br />

43 presidents of the United States were<br />

white enough or male enough?<br />

Has anyone ever asked if the luxury<br />

in which both Presidents Bush grew up put<br />

them out of touch with the bottom 98 percent<br />

of the American populace? Does being<br />

the son of incredibly wealthy parents<br />

make you less American somehow?<br />

I don’t know. Maybe. :)<br />

Tony Baize, Editor<br />

tony@kyfhc.org<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 2

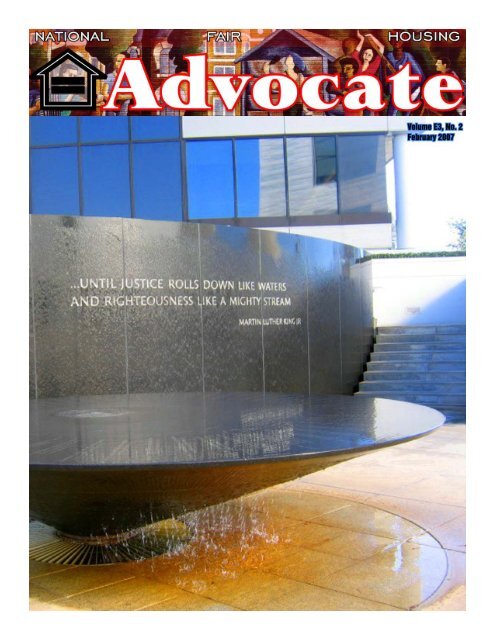

Cover: Birmingham Civil Rights Museum<br />

by “The Horror” at www.flickr.com<br />

NATIONAL FAIR HOUSING ADVOCATE<br />

Volume E3, Number 2<br />

Feb. <strong>2007</strong><br />

Editor/Publisher Tony Baize (tony@kyfhc.org)<br />

Contributing Editor Tracey McCartney<br />

(tracey@fairhousing.com)<br />

Legal Consultant Paul F. Curry<br />

KENTUCKY FAIR HOUSING COUNCIL<br />

The <strong>National</strong> <strong>Fair</strong> <strong>Housing</strong> <strong>Advocate</strong> is a publication<br />

of the Kentucky <strong>Fair</strong> <strong>Housing</strong> Council and is<br />

dedicated to educating the public about fair housing<br />

issues and providing pertinent information to<br />

civil rights advocates, attorneys and real estate professionals.<br />

The ultimate goal of this publication is<br />

to eliminate the need for itself through the eradication<br />

of discrimination in housing.<br />

Tony Baize, Executive Director<br />

Board of Directors<br />

Cecil Blye, Sr., Acting Chair<br />

Stephen Porter, Treasurer<br />

Oliver Barber<br />

William Haliday<br />

Ricky Jones<br />

John R. Williams<br />

Ann Wagner<br />

Richard Miller<br />

Ralph Calvin<br />

Rev. Louis Coleman<br />

CONTENTS<br />

Features<br />

8 Inaccessibility leads to broken hip<br />

A Hawaii man will receive $150,000 after alleging inaccessible<br />

design in a senior apartment complex led to his broken hip.<br />

9 Cross burner sent to prison<br />

A Florida man will spend 14 months in federal prison and three<br />

years on probation for burning a cross in an attempt to keep an<br />

African American family out of his neighborhood.<br />

10 “You’re missing something”<br />

A south Florida condo association and two of its board members<br />

agreed to pay $150,000 for attempting to keep out an African<br />

American widow.<br />

11 Allstate to drop credit score policy<br />

A federal judge has approved a $12 million settlement in a race<br />

and national origin discrimination that alleged the insurance giant<br />

illegally used credit scores to make Latinos and African<br />

Americans pay more.<br />

14 $320,000 in Memphis access case<br />

The Department of Justice has settled a federal lawsuit against the<br />

developers, builders and architects of two Memphis, Tenn.<br />

apartment complexes for a $320,000 accessibility fund and<br />

numerous retrofits.<br />

Departments<br />

Editor’s Note . . . . . . . . . . . . . . . . . . . . . . . . . . . 2<br />

In Brief . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4<br />

Case Law Update . . . . . . . . . . . . . . . . . . . . . . . . . 6<br />

Brief Articles of Note . . . . . . . . . . . . . . . . . . . . . . . . . 9 -15<br />

The <strong>National</strong> <strong>Fair</strong> <strong>Housing</strong> <strong>Advocate</strong> (ISSN 1932-2216 print, ISSN 1932-2224 online)<br />

is published monthly by the Kentucky <strong>Fair</strong> <strong>Housing</strong> Council. Editorial, advertising and<br />

all other inquiries should be sent to P.O. Box 1293, Louisville, KY 40201 E-mail:<br />

advocate@kyfhc.org, voice: (502) 583-3247, fax (805) 357-5959<br />

Subscription rates are $150 per year for online access, $200 per year for online access<br />

and full-color copy via postal mail. Make checks or money orders payable to “Kentucky<br />

<strong>Fair</strong> <strong>Housing</strong> Council” and mail to P.O. Box 1293, Louisville, KY 40201. To subscribe<br />

using a credit card, visit www.fairhousing.com/advocate.<br />

Copyright © 2006. All rights reserved. No portion of this publication may be reprinted<br />

without permission from the publisher, except for fair use purposes.<br />

This publication is reader supported. No public money has been used. The opinions of<br />

commentators are not necessarily those of the Kentucky <strong>Fair</strong> <strong>Housing</strong> Council.<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 3

KY. GOVERNOR FILLS REAL ESTATE POSTS<br />

Governor Ernie Fletcher has appointed two members to the<br />

Kentucky Real Estate Commission.<br />

F. M. Sponcil, of Mount Sterling, is a retired farmer and<br />

former Montgomery County Commissioner. He and his wife Patsy<br />

are the owners and operators of Regan Ridge Farm. Sponcil has<br />

served as a member of the Montgomery County Board of Elections<br />

and the Montgomery County Board of Health.<br />

Ronald K. Smith, of Louisville, is the principal broker of<br />

Ron Smith Realty in Louisville. Smith is a member of the Louisville<br />

Board of Realtors and the Kentucky Association of Realtors<br />

and has served on the Kentucky Real Estate Commission<br />

since 1999. He is also a member of the <strong>National</strong> Association of<br />

Real Estate Brokers and served as president of the Louisville<br />

branch from 1995-98.<br />

The Kentucky Real Estate Commission is made up of five<br />

gubernatorial appointees. The commission is charged with the<br />

responsibility of protecting the public interest through regulation,<br />

examination and licensing of Kentucky real estate brokers<br />

and sales associates.<br />

Fletcher has also appointed Garlan E. VanHook, of Stanford,<br />

David E. Heyne, of Louisville, and Jill L. Smith, of Anchorage,<br />

to the Kentucky Board of Architects.<br />

VanHook is an architect and general manager of facilities<br />

for the Administrative Office of the Courts. He received a<br />

bachelor’s degree in architecture from the University of Kentucky.<br />

VanHook is a member of the American Institute of Architects,<br />

the Kentucky Music Hall of Fame Board of Directors and<br />

the Capitol Planning and Advisory Board.<br />

Heyne is senior architect and assistant vice president of Qk4<br />

in Louisville. He received a bachelor of architecture from Kansas<br />

State University. Heyne is a member of the American Institute<br />

of Architects, the Construction Specifications Institute and<br />

the American Solar Energy Society. He has been a member of<br />

the Kentucky Board of Architects since 2003.<br />

Smith is an architect and owner of Jill Lewis Smith Architect,<br />

Inc. She received a bachelor’s degree in architecture from<br />

Tulane University. Smith is a member of the American Institute<br />

of Architects and the <strong>National</strong> Council of Architecture Registration.<br />

She is serving consecutive terms on the board.<br />

The Kentucky Board of Architects is made up of eight members,<br />

seven of whom are appointed by the governor. The board is<br />

in charge of regulating licenses of architects and overseeing that<br />

all licensed architects in Kentucky practice within the state’s code<br />

of conduct. (Source: Commonwealth News Center)<br />

NFHA FILES SUIT IN DETROIT<br />

On Jan. 25th, the <strong>National</strong> <strong>Fair</strong> <strong>Housing</strong> Alliance held a news<br />

conference to announce a lawsuit in federal district court against<br />

Century 21 Town & Country, the largest and top-producing real<br />

estate company in metropolitan Detroit. The lawsuit alleges racial<br />

discrimination in violation of the federal <strong>Fair</strong> <strong>Housing</strong> Act.<br />

The Alliance is joined in the lawsuit by an African American<br />

family, the Hollowells, who were victims of housing dis-<br />

KENTUCKY GIVES $50,000 TO FAMILY PLACE<br />

The commonwealth of Kentucky has awarded $50,000 to<br />

Family Place to enhance its visitation center, where families dealing<br />

with divorce, domestic violence or custody issues can meet.<br />

The dedicated room for supervised visitation for Department<br />

for Community Based Services children in out-of-home care is<br />

an in-kind contribution from Family Place. The additional funding<br />

will be available to hire staff to supervise visitations.<br />

For 30 years, Family Place has assisted Louisville families<br />

in moving beyond issues of abuse through education and treatment<br />

programs. Its visitation center opened in 1999, and cabinet<br />

staff will use it as a safe, supervised meeting place for children in<br />

state foster care and their birth parents. (Source: Commonwealth<br />

News Center)<br />

GUIDEONE INSURANCE HIT WITH HUD FAIR HOUSING COMPLAINTS<br />

GuideOne Mutual Insurance Company, based in Des Moines,<br />

Iowa has been accused of religious discrimination in the marketing<br />

and selling of its “FaithGuard” homeowners insurance policies,<br />

which claims to offer “special discounts and services” to<br />

“churchgoers” and “persons of faith.”<br />

An Indiana atheist, a Kentucky agnostic, and three fair housing<br />

groups have filed complaints against the company, alleging<br />

that the “FaithGuard” policies violate the <strong>Fair</strong> <strong>Housing</strong> Act by<br />

discriminating on the basis of religion.<br />

Among other things, FaithGuard homeowners insurance offers<br />

to double coverage for homeowners who experience churchrelated<br />

losses at their homes, and to pay tithes to customers’<br />

churches if they become disabled and unable to work.<br />

The complaints have been referred to HUD’s Systemic Investigations<br />

Unit in Fort Worth, Texas. (Source: <strong>Fair</strong> <strong>Housing</strong><br />

<strong>Advocate</strong>s Association)<br />

BORDER FAIR HOUSING CENTER OPENS THIRD OFFICE<br />

The Border <strong>Fair</strong> <strong>Housing</strong> and Economic Justice Center has<br />

opened its third office in McAllen, Texas. The Center asserts<br />

that this third office will allow them to offer fair housing services<br />

to all of the cities and towns along the U.S.-Mexico border in<br />

Texas and New Mexico.<br />

The Center has just launched a new round of testing on sales<br />

agents, developers and other real estate professionals to ensure<br />

equal housing opportunity to the residents of border towns<br />

throughout the American southwest.<br />

This month, six AmeriCorps Vista members will join the Center<br />

for a year of service in the Center’s fair housing programs.<br />

(Source: NCRC’s Reinvestment Works)<br />

D.C. COUNCIL MOVES TO PROTECT DOMESTIC VIOLENCE VICTIMS<br />

Last December, in a unanimous vote, the District of Columbia<br />

Council passed the Protection from Discriminatory Eviction<br />

for Victims of Domestic Violence Amendments Act of 2006.<br />

The ordinance prohibits landlords from evicting victims of<br />

domestic violence from being evicted based on events surrounding<br />

the crimes of their attackers. According to a 2004 ACLU<br />

report, as many as 34 percent of homeless persons cite domestic<br />

violence as a contributing factor to their homelessness.<br />

Under the new ordinance, victims of domestic violence will be<br />

able to fight evictions based on the violent behavior of their attackers<br />

or to break leases if moving will protect them.<br />

For more information about the new law, contact Naomi Stern<br />

at the <strong>National</strong> Law Center on Homelessness and Poverty at (202)<br />

638-2535, ext. 208 or nstern@nlchp.org. (Source: Poverty & Race)<br />

crimination. (Source: NFHA) continued on next page<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 4

ADC SUES WESTCHESTER, N.Y. FOR FAIR HOUSING FAILURES<br />

A New York City-based anti-discrimination group is charging,<br />

in a new lawsuit, that Westchester has failed to meet its federal<br />

obligations to promote fair housing opportunities.<br />

The group - the Anti-Discrimination Center of Metro New<br />

York - accused the county government of turning a blind eye to<br />

overly restrictive zoning laws in local municipalities that hinder<br />

the construction of affordable housing and prevent minorities<br />

from moving in.<br />

“There are a lot of Westchester communities that remain<br />

unbelievably segregated,” said Craig Gurian, executive director<br />

of the center.<br />

County officials reject the group's lawsuit as “absurd.”<br />

(Source: The Journal News)<br />

SARATOGA COUNTY, N.Y. LANDLORD ACCUSED OF DISCRIMINATION<br />

Jodi Hocking, a white woman with two biracial children, has<br />

filed a federal lawsuit against a landlord who allegedly would not<br />

let her rent an apartment because her two children are biracial.<br />

Hocking has asserted that landlord John Petta was very supportive<br />

of her renting a large apartment from him until he saw<br />

that her children were not white.<br />

Last August, Hocking was looking for an apartment in southern<br />

Saratoga County for her son, her daughter and herself. She<br />

looked at Petta’s three-bedroom apartment on her own at first<br />

and then brought her children to see the apartment, as well.<br />

According to a statement from the <strong>Fair</strong> <strong>Housing</strong> Justice Center,<br />

“Petta, a white man, met one of Ms. Hocking’s children (and)<br />

asked if the child was ‘black.’ (He then) told Ms. Hocking that<br />

she should have told him the race of her children ahead of time.”<br />

Petta told reporters that he was surprised when he saw her<br />

children but said it would not have affected his decision on renting<br />

the recently-renovated apartment.<br />

“This is disgusting,” Petta said about the lawsuit. “She<br />

looked at the apartment and never even filled out an application<br />

to live there. I would never let something like a person’s<br />

race influence how I rent out my property. It has been months<br />

since she even looked at the place. It seems to me that she is<br />

just trying to make some money out of the lawsuit.” (Source:<br />

The Troy Record)<br />

VERMONT’S PRISONS SUBJECT TO STATE CIVIL RIGHTS LAW<br />

Vermont’s prisons are subject to the state’s public accommodations<br />

law and must respond to a Vermont Human Rights<br />

Commission subpoena brought on behalf of a disabled prisoner,<br />

the state Supreme Court ruled late last year.<br />

The Corrections Department had argued that it was not a<br />

“place of public accommodation” under state law and did not<br />

come within the state Human Rights Commission’s jurisdiction.<br />

In a 3-2 decision, the court upheld a 2004 Superior Court<br />

ruling that the law -- and the commission's jurisdiction -- do apply<br />

to the state’s prisons.<br />

The court found that “irrespective of whether the physical<br />

structures of government buildings, including prisons, are open<br />

to the public, state prisons are essentially public places open to<br />

any member of the general public unfortunate enough to meet<br />

the criteria for obtaining their services.”<br />

The ruling opens up Vermont’s prison system to a broad<br />

range of civil rights complaints by inmates protected by antidiscrimination<br />

law, Barbara Prine told the Boston Globe. Prine<br />

is a Vermont Legal Aid lawyer who represented inmate John<br />

Boldosser before the commission. Boldosser has a developmental<br />

disability. (Source: Boston Globe)<br />

MENTALLY DISABLED PLAINTIFFS DON’T DO WELL IN ADA CASES<br />

Sixteen years after Congress enacted the Americans with<br />

Disabilities Act (ADA), people with psychiatric disabilities are<br />

faring worse in court cases against employers for discrimination<br />

than are people with physical disabilities, researchers have found<br />

in a national study.<br />

“People with psychiatric disabilities were less likely to receive<br />

a monetary award or job-related benefit, more likely to<br />

feel as though they were not treated fairly during the legal proceedings<br />

and more likely to believe they received less respect in<br />

court,” said Jeffrey Swanson, Ph.D., a study investigator and an<br />

associate professor of psychiatry at Duke University Medical<br />

Center.<br />

“When people with disabilities sue their employers for discriminating<br />

against them, they are hoping to achieve a tangible<br />

result, such as getting their job back or receiving some monetary<br />

compensation,” Swanson said. “But that's not the only thing that<br />

matters. They want to be heard and treated fairly. Sometimes<br />

that alone can signal victory for a plaintiff, but if that doesn't<br />

happen, it can add insult to injury.”<br />

The findings appear in the January issue (Volume 66, Issue<br />

1) of the Maryland Law Review. The research was funded by the<br />

<strong>National</strong> Institute of Mental Health. (Source: Medicine Today)<br />

LINCOLN, NEB. COMM. ON HUMAN RIGHTS DOUBLES COMPLAINTS<br />

The number of discrimination complaints made to the Lincoln<br />

Commission on Human Rights in 2006 were nearly double<br />

that of the previous year, according to the commission's annual<br />

report. A total of 112 complaints were filed last year, up from 65<br />

in 2005.<br />

“It’s hard to determine whether discrimination is occurring<br />

more often in our community, but I do believe more people are<br />

aware of fair housing laws and the role of (the commission),”<br />

said commission director Larry Williams.<br />

The report showed that complaints of housing and employment<br />

discrimination were about twice the number filed in 2005,<br />

contributing to the increase. There were 32 housing complaints<br />

in 2006, up from 13, and 72 employment complaints, up from 47<br />

last year.<br />

The commission obtained more than $20,000 in settlements,<br />

according to the report. (Source: Associated Press)<br />

ECHO HOUSING CONDUCTS FAMILIAL STATUS AUDIT<br />

Families with children face more discrimination when searching<br />

for housing than childless couples, according to a recent study<br />

of seven northern California cities.<br />

Overall, 21 percent of<br />

families with children reported<br />

facing discrimination<br />

from those showing<br />

them apartments.<br />

That's a big improvement<br />

over the group's study<br />

in 1990, when 55 percent<br />

of the properties tested showed evidence of discrimination against<br />

families with children. However, in 1999 only 17 percent of families<br />

with children faced discrimination.<br />

<strong>Housing</strong> discrimination has decreased in recent years as more<br />

landlords have become aware of fair housing laws, said Angie<br />

Watson-Hajjem, an ECHO fair housing counselor.<br />

Tim May, president of the Rental <strong>Housing</strong> Owners Association<br />

of Southern Alameda County, said this year's results<br />

showed property owners still need training. (Source: The Argus)<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 5<br />

photo by bohphoto

Human Rts. Ctr. v. Snow<br />

2006 U.S. Dist. LEXIS 94472, CA, January 3, <strong>2007</strong>. Decision<br />

includes Court’s list of conclusions regarding Plaintiff’s<br />

motion for default judgment for violations of the <strong>Fair</strong> <strong>Housing</strong><br />

Act based on familial status discrimination. The Court<br />

grants Plaintiff’s motion finding that Defendant did unlawfully refuse<br />

to rent to families with children and did unlawfully evict families<br />

with children. The Court further found that Defendant’s occupancy<br />

limitations of no more than two person per a one bedroom unit<br />

were overly restrictive and had the effect of excluding families with<br />

children. NFHAO Case ID 3103<br />

Stable v. Kelly Towers Assocs.<br />

<strong>2007</strong> U.S. Dist. LEXIS 1975, S.D. NY, January 9, <strong>2007</strong>. Pro se<br />

plaintiff commenced this action asserting violations of the <strong>Fair</strong><br />

<strong>Housing</strong> Act. Defendants are moving to dismiss the complaint<br />

for failure to state a cognizable claim and for lack of jurisdiction.<br />

Plaintiff filed no opposition to these motions. The Court<br />

found that Plaintiff’s allegations, regarding incidences that occurred<br />

during the litigation of an action against him for nonpayment<br />

of rent, do not give rise to a FHA claim, and that lodging a<br />

complaint with HUD objecting to rent increases does not constitute<br />

a “protected activity” as it unrelated to a FHA discriminatory<br />

housing proceeding. Accordingly, Plaintiff’s complaint was<br />

dismissed. NFHAO Case ID 3104<br />

Bailey v. Lawler-Wood <strong>Housing</strong>, LLC<br />

<strong>2007</strong> U.S. Dist. LEXIS 1683,E.D. LA, January 9, <strong>2007</strong>. This<br />

case arises out of the allegedly unlawful closure of the<br />

Tivoli Place apartments in which Plaintiffs resided prior to<br />

Hurricane Katrina. In their first amended complaint, Plaintiffs<br />

allege wrongful eviction under Louisiana law and a violation<br />

of the <strong>Fair</strong> <strong>Housing</strong> Act. It is uncontested in this case<br />

that Tivoli Place was closed to one hundred percent of all<br />

tenants, regardless of disability, race, color, religion, sex, familial<br />

status, or national origin. Therefore, all tenants were<br />

equally affected by the practice which plaintiffs contend<br />

constitutes a discriminatory effect under Section 3604.<br />

Though plaintiffs allege that, in absolute numbers, more<br />

disabled and African-Americans were affected because<br />

they purportedly constitute the majority of lessees at Tivoli<br />

Place, that fact simply does not establish a “significantly<br />

greater discriminatory impact on members of a protected<br />

class.” This alleged statistical imbalance alone is insufficient.<br />

While the Court is certainly not unsympathetic to<br />

the difficulties faced by plaintiffs in the wake of Hurricane<br />

Katrina, as a matter of law and based on uncontested<br />

facts, plaintiffs cannot establish a prima facie case under<br />

the <strong>Fair</strong> <strong>Housing</strong> Act. NFHAO Case ID 3087<br />

Lynn v. Village of Pomona<br />

<strong>2007</strong> U.S. App. LEXIS 610, 2 nd Cir., January 9, <strong>2007</strong>. Plaintiffs<br />

appeal from an award of summary judgment in favor of Defendants<br />

on Plaintiff’s claims of racial discrimination and retaliation<br />

in violation of the <strong>Fair</strong> <strong>Housing</strong> Act. Finding that the Plaintiff<br />

failed to adduce evidence sufficient to establish even a prima<br />

facie case, the Court affirms the judgment of the district court.<br />

NFHAO Case ID 3096<br />

Kukui Gardens Assoc. v. Jackson<br />

<strong>2007</strong> U.S. Dist. LEXIS 2308, D.HI, January 11, <strong>2007</strong>. Two organizations<br />

filed this action to stop the sale of Kukui Gardens,<br />

an affordable housing project, to Carmel Partners, a for-profit<br />

company. The organizations sued Alphonso Jackson, in his capacity<br />

as Secretary of the United States Department of <strong>Housing</strong><br />

and Urban Development (“HUD”), claiming that HUD has committed<br />

various violations of the <strong>National</strong> <strong>Housing</strong> Act and the<br />

Administrative Procedures Act in connection with the proposed<br />

sale. The Complaint alleges that prepayment of the Kukui Gardens’<br />

mortgage threatens the loss of 857 affordable units and<br />

will have a disproportional effect on nonwhite renters. Plaintiffs<br />

say that HUD’s approval of the prepayment of the mortgage<br />

under the Notice will violate the antidiscrimination provisions<br />

of 42 U.S.C. § 3604. Finding that Plaintiff’s claim is<br />

not ripe, the Court dismisses it. NFHAO Case ID 3092<br />

Miles v. Century 21 Real Estate, LLC<br />

<strong>2007</strong> U.S. Dist. LEXIS 2334, E.D. AR, January 11, <strong>2007</strong>. Plaintiffs<br />

brought this action alleging violations of federal and state<br />

anti-discrimination laws based on race, naming the real estate<br />

agency as a Defendant. In its Motion for Summary Judgment,<br />

Defendant Century 21 argues that there is no actual or apparent<br />

agency relationship between Century 21 and any of the other<br />

Defendants to support Plaintiff’s vicarious liability theory. The<br />

Court found that a reasonable jury could conclude that Century<br />

21 represented or held out Century 21 Cabot and that the Miles’<br />

justifiably relied upon the representation, which led to their injury.<br />

More specifically, a reasonable jury could conclude that<br />

Century 21 acted in a manner that would lead a reasonable person<br />

to conclude that Century 21 Cabot and Ms. Ward were agents<br />

of Century 21; (2) that the plaintiffs actually believed that Century<br />

21 Cabot and Ms. Ward were agents or servants of Century<br />

21; and (3) that the plaintiffs thereby relied to their detriment<br />

upon the care and skill of Century 21 Cabot and Ms. Ward. Therefore,<br />

summary judgment is denied as to the issue of apparent<br />

agency. NFHAO Case ID 3100<br />

Lanier v. Ass’n of Apt. Owners<br />

<strong>2007</strong> U.S. Dist. LEXIS 2791, D. HI, January 12, <strong>2007</strong>. On June<br />

5 and 6, 2006, the Site Manager observed Plaintiff having work<br />

done at her condominium to install an A/C system, including a<br />

hole cut into the exterior wall. The Site Manager told Plaintiff<br />

that she was required to wait to receive installation drawings<br />

from the architect and have the Board’s approval. When asked<br />

to delay the installation until she had Board approval, Plaintiff<br />

responded that she has health issues, that she was within her rights<br />

to install the A/C system, and that she was going ahead with the<br />

installation. On June 6, 2006, the Board sent Plaintiff a letter<br />

requesting that she halt the A/C installation in her unit. The Board<br />

quoted the relevant section of the By-Laws and meeting minutes<br />

informing Plaintiff of what was required in order to proceed with<br />

installation of A/C. The Board stated that all owners are allowed<br />

to install A/C units provided that: “1) the unit is installed by a<br />

professional 2) the unit is installed in a like manner to those installed<br />

by the Developer and 3) the request is submitted in writing<br />

to the Board accompanied by drawings of the installation<br />

continued on next page<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 6

and assurances of items 1 and 2.” On June<br />

8, 2006, Plaintiff emailed the Board, requesting<br />

permission to install the A/C in an expedited<br />

manner since she has a breathing problem<br />

and the A/C unit will help her. Plaintiff<br />

suffers from asthma and her doctor has recommended<br />

that she install A/C. Plaintiff’s<br />

doctor believes that “delay in installation of<br />

an AC unit may result in an asthma exacerbation<br />

that could cause serious harm including<br />

need for emergency hospitalization.” Defendants<br />

responded by requesting that Plaintiff<br />

focus her energy on complying with the<br />

application procedures that are required of<br />

all homeowners who desire to install A/C.<br />

Plaintiff responded by providing the documents<br />

used to obtain the permit and again<br />

claimed that Defendants must accommodate<br />

her under the <strong>Fair</strong> <strong>Housing</strong> Act. Defendants<br />

again informed Plaintiff that her submission<br />

was insufficient and asked her to provide information<br />

regarding the relationship between<br />

the person who pulled the permit and the<br />

work done so far, to confirm whether the installation<br />

of the A/C will be in a like manner<br />

as the units installed by the developer, and<br />

informed her that the documents used to obtain<br />

the permit did not constitute the required<br />

architectural drawings. Plaintiff argues that<br />

pursuant to their own By-laws, which cite<br />

the <strong>Fair</strong> <strong>Housing</strong> Act, Defendants should accommodate<br />

Plaintiff’s alleged handicap by<br />

waiving the requirement of Board approval<br />

for installation of A/C, since the A/C is necessary<br />

for her asthma. The Court found that<br />

the Plaintiff may be able to establish a claim<br />

that the Board should reasonably accommodate<br />

her by waiving the $ 300 fee for<br />

the architectural drawings. Further, Plaintiff<br />

has established the possibility of irreparable<br />

harm, serious questions going to the<br />

merits, and that the balance of the hardships<br />

tips decidedly in her favor. Accordingly,<br />

the Court orders Defendants to waive<br />

Plaintiffs pro-rated portion of the fee<br />

for architectural drawings, promptly<br />

obtain architectural drawings, and allow<br />

Plaintiff to move forward with installing<br />

her A/C as long as she has complied<br />

with the Board’s requirements.<br />

NFHAO Case ID 3093<br />

KB2’s Inc. v. City of San Diego<br />

<strong>2007</strong> U.S. Dist. LEXIS 3673 , S.D. CA,<br />

January 17, <strong>2007</strong>. The Court found that summary<br />

judgment for Defendant was warranted<br />

because Plaintiffs lacked Article III standing,<br />

which is necessary for federal court jurisdiction.<br />

NFHAO Case ID 3091<br />

Hopkins v. Villa Rose Apts.<br />

<strong>2007</strong> U.S. Dist. LEXIS 3566, C.D.IL, January<br />

18, <strong>2007</strong>. This action arises out circum-<br />

stances surrounding the Plaintiffs’ having to<br />

vacate their apartment at MacArthur Park<br />

allegedly in violation of the <strong>Fair</strong> <strong>Housing</strong><br />

Act and the Consumer Fraud and Unfair and<br />

Deceptive Business Practices Act. Defendant<br />

was found to be in default on June 22,<br />

2006. The Magistrate Judge held an evidentiary<br />

hearing to establish the amount of<br />

damages to which Plaintiffs are entitled.<br />

Plaintiffs’ disagreement is with respect to an<br />

award of statutory damages. The Court finds<br />

that the Plaintiffs have offered nothing more<br />

than bald summarizations of the statutory<br />

damages provisions of the various statutes<br />

without making any attempt to apply the requirements<br />

of the statutes to the facts of the<br />

case. Nor have they otherwise attempted to<br />

establish that there were actionable violations<br />

of the statutes, which is a necessary<br />

prerequisite to seeking an award of statutory<br />

damages. On the record before the<br />

Court, Plaintiffs have demonstrated no<br />

error of law or fact in the findings set forth<br />

in the Report & Recommendation. The<br />

losses proven by the Plaintiffs are fully<br />

and fairly compensated by the recommended<br />

damages award, and reconsideration<br />

of the claim for statutory damages is<br />

not warranted. NFHAO Case ID 3090<br />

Massie v. HUD<br />

<strong>2007</strong> U.S. Dist. LEXIS 3978, W.D. PA,<br />

January 19, <strong>2007</strong>. This matter is before the<br />

Court on Defendants’ motion to dismiss pursuant<br />

to Rule 12(b)(1) and 12(h)(3) asserting<br />

that this Court lacks jurisdiction, and<br />

Rule 12(b)(6) asserting that Plaintiffs’ claims<br />

lack merit. Finding injury in fact and the<br />

possibility of a remedy, Defendant 12(h)(3)<br />

motion is denied. Finding that Plaintiffs have<br />

failed to meet their burden of persuading the<br />

Court that it has jurisdiction over the case,<br />

excepting Plaintiffs’ claim for a violation of<br />

109 P.L. 115 § 311, Defendant’s 12(b)(1)<br />

claim is granted. Finally, the Court agrees<br />

with Defendants that § 311 does not apply<br />

because HUD did not own or hold the property<br />

at issue. Accordingly, Defendants’<br />

12(b)(6) motion is granted. NFHAO Case<br />

ID 3099<br />

Preferred Props. v. Indian River Estates Inc.<br />

<strong>2007</strong> U.S. App. LEXIS 1550, 6 th Cir., January<br />

22, <strong>2007</strong>. This court affirmed the district<br />

court’s denial of defendant’s motions<br />

for judgment as a matter of law and a new<br />

trial on the ground that the defendants did<br />

violate the <strong>Fair</strong> <strong>Housing</strong> Act. The case was<br />

then remanded to the district court to deal<br />

with issues regarding discovery. Defendants<br />

now seek review of the district court’s order<br />

granting Plaintiff attorney fees for expenses<br />

incurred in the first appeal before this court<br />

and in enforcing the judgment. The <strong>Fair</strong><br />

<strong>Housing</strong> Act provides that “the court, in its<br />

discretion, may allow the prevailing party . .<br />

. a reasonable attorney’s fee and costs.”<br />

Abuse of discretion is the standard for reviewing<br />

an award of attorney fees under the<br />

<strong>Fair</strong> <strong>Housing</strong> Act. In the present case, the<br />

district court, “[having reviewed the hourly<br />

rates charged by attorneys, paralegals and<br />

others and the expenses,” awarded Preferred<br />

Properties $ 82,489.98. The district court<br />

calculated that that amount would reimburse<br />

Preferred Properties for $ 25,000 in legal<br />

fees plus expenses of $ 1,983.35 related to<br />

defending the judgment on appeal, in addition<br />

to $ 50,000 in legal fees and $ 5,506.63<br />

in expenses related to enforcing the judgment.<br />

The district court did not abuse its discretion<br />

in doing so. Accordingly, this Court<br />

affirms the district court’s order regarding<br />

fees. NFHAO Case ID 3102<br />

Vaughn v. Consumer Home Mortg. Co.<br />

<strong>2007</strong> U.S. Dist. LEXIS 4381, E.D. NY, January<br />

22, <strong>2007</strong>. The plaintiffs move, pursuant<br />

to Fed. R. Civ. P. 59, for reconsideration of<br />

this court’s prior order granting the motion<br />

of defendant HUD to dismiss for lack of subject<br />

matter jurisdiction, granting the motion<br />

of defendant Silver for summary judgment<br />

as to all of the claims remaining against him,<br />

and denying the plaintiff’s motion to file a<br />

Second Amended Complaint. Plaintiffs initiated<br />

suit against FNNY and other defendants<br />

affiliated with that company, the attorneys<br />

who represented the plaintiffs during<br />

closing proceedings, alleging that they made<br />

false representations with the intent to deceive<br />

them into purchasing properties at inflated<br />

prices. As a component of the alleged<br />

scheme, FNNY steered the plaintiffs toward<br />

defendant Consumer Home Mortgage, a<br />

lender that the plaintiffs allege it consistently<br />

used to further the predatory lending scheme,<br />

in part by submitting fraudulent appraisal reports<br />

to HUD in order to obtain mortgage<br />

insurance available to qualifying low-income<br />

applicants under the <strong>Fair</strong> <strong>Housing</strong> Act.<br />

NFHAO Case ID 3107<br />

Wadley v. Park at Landmark, LP<br />

<strong>2007</strong> U.S. Dist. LEXIS 5029, E.D. VA, January<br />

24, <strong>2007</strong>. This action arises under the<br />

<strong>Fair</strong> <strong>Housing</strong> Act and Section 1982 of the<br />

Civil Rights Act of 1866 for alleged discrimination<br />

regarding the non-renewal of<br />

Plaintiff’s lease at Defendants’ property.<br />

Plaintiff has presented no credible evidence<br />

demonstrating discriminatory intent in Defendants’<br />

enactment of the Section 8 nonrenewal<br />

policy or termination of Plaintiff’s<br />

Section 8 lease. Further, Plaintiff has made<br />

continued on page 15<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 7

Hawaiian man wins $150,000 for<br />

injury due to inaccessible design<br />

The Justice Department has reported<br />

that they have reached a partial settlement<br />

with the city and county of Honolulu,<br />

Hawaii and the developers and managers<br />

of West Loch Village apartments. Additionally,<br />

the Justice Department reported<br />

that an intervening plaintiff,<br />

Chester Kobylanski, will receive<br />

$150,000 to settle<br />

claims that he broke his hip<br />

due to the inaccessible design<br />

and construction of the apartments.<br />

The Justice Department<br />

settlement includes several<br />

hundred thousand dollars<br />

worth of retrofits at West<br />

Loch Village and a $75,000<br />

fund to compensate victims<br />

who are identified at a later<br />

date. The list of retrofits<br />

agreed to by the defendants is<br />

more than 12 pages long.<br />

The specifics of this case are apparently<br />

still developing. The Justice<br />

Department’s web site has indicated<br />

Kobylanski’s claims have been settled,<br />

although the consent decree filed with<br />

the U.S. District Court in Hawaii indicates<br />

that Kobylanski’s claims are<br />

headed to trial.<br />

Calls and e-mails to Kobylanksi’s<br />

attorneys, the U.S. Attorney’s Office in<br />

Hawaii, and the Department of Justice<br />

Office of Public Affairs were not returned.<br />

West Loch Village was built in 1992<br />

as senior housing and is owned by the<br />

city and county of Honolulu. Hawaii<br />

Affordable Properties manages the<br />

apartment building for the city. The<br />

builders and designers of West Loch included<br />

Mecon Hawaii Ltd.; Yamasoto,<br />

Fujiwara, Aoki & Associates; and the<br />

R.M. Towill Corporation.<br />

According to the DOJ web site, the<br />

case was referred to the Justice Department<br />

by HUD, after it investigated<br />

Kobylanki’s complaint and issued a<br />

charge of discrimination. However, in<br />

Kobylanski’s intervening complaint, no<br />

HUD complaint is ever mentioned, and<br />

Kobylanski’s injuries occurred in 1998,<br />

more than seven years before his intervening<br />

complaint was filed.<br />

In <strong>February</strong> 2006, the city/county<br />

government and Hawaii Affordable Properties<br />

filed a third-party complaint against<br />

Edward Kubo, Jr. is the<br />

U.S. Attorney for the<br />

District of Hawaii.<br />

Chaney Brooks Management, alleging<br />

that their agreement with Chaney Brooks<br />

agreed to indemnify the government from<br />

any claims arising from injuries at the<br />

West Loch property. According to the<br />

third-party complaint, the city and county<br />

asserted this in the answer to the Justice<br />

Department lawsuit, but that<br />

Chaney Brooks had refused to<br />

defend the city and county.<br />

The third-party complaint<br />

does not mention<br />

whether Honolulu’s agreement<br />

with Chaney Brooks<br />

was in place at the time of<br />

West Loch’s construction or<br />

why Hawaii Affordable Properties<br />

might have standing to<br />

be a third-party plaintiff.<br />

Although details are<br />

still quite sketchy, it appears<br />

that the complaints about the<br />

design and construction at<br />

West Loch began in May 1998, when<br />

Kobylanski tripped and fell over a curb<br />

on his way to a trash dumpster at the<br />

property. Kobylanski is disabled and<br />

used a walker for mobility.<br />

INJURY BLAMED ON LACK OF CURB CUT<br />

According to Kobylanski’s complaint,<br />

had the curb been properly constructed<br />

with curb cuts as required by<br />

the <strong>Fair</strong> <strong>Housing</strong> Act and the Rehabilitation<br />

Act of 1973, he would not have<br />

tripped and broken his hip.<br />

Kobylanski’s injury was so severe, according<br />

to the complaint, that he had to<br />

undergo a complete left hip replacement<br />

after his fall.<br />

In additions to the retrofits and<br />

settlement funds obtained by the Justice<br />

Department, the defendants have agreed<br />

to undergo fair housing training, conduct<br />

an education program to inform<br />

tenants about their rights under the <strong>Fair</strong><br />

<strong>Housing</strong> Act and develop a nondiscrimination<br />

policy. The partial consent order<br />

settling the DOJ claims shall remain<br />

in effect for three years.<br />

Additional details about the status<br />

of this case will be published in future<br />

issues of the <strong>Advocate</strong> as they become<br />

available. To see the extremely lengthy<br />

Department of Justice consent decree,<br />

visit http://xrl.us/westloch.<br />

--- Tony Baize<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 8

Hastings, Fla. cross burner sentenced to 14 months in<br />

federal prison and three years supervised release<br />

Neal Chapman Coombs, a 50-year-old<br />

resident of Hastings, Fla., was sentenced<br />

last month to 14 months in<br />

prison, to be followed by three years of supervised<br />

release, the Justice Department<br />

announced. Coombs pleaded guilty on August<br />

16, 2006 to a racially motivated civil<br />

rights crime involving a cross burning.<br />

In August 2006, Coombs was<br />

charged with knowingly and willfully<br />

intimidating an African American family<br />

that was negotiating for the purchase<br />

of a house in Hastings, Fla., by threat<br />

of force and the use of fire.<br />

Specifically, it was alleged that<br />

Coombs’ actions were motivated by the<br />

family’s race and that he burned a cross<br />

on property adjacent to the house.<br />

“Cross burning remains a vicious<br />

symbol of hatred and intolerance,” said<br />

Wan J. Kim, assistant attorney general<br />

for the Civil Rights Division. “Our welcoming<br />

society encourages people to live<br />

where they choose, undisturbed by such<br />

racist threats. This prosecution sends a<br />

clear message that we will not tolerate<br />

such deplorable criminal conduct.”<br />

“This display of racial hatred is<br />

alarming. Victims of this crime can be<br />

assured that our office will vigorously<br />

investigate and prosecute those who<br />

would choose this form of ugly criminal<br />

conduct,” said Paul I. Perez, U.S.<br />

Attorney for the Middle District of<br />

Florida.<br />

According to the plea agreement,<br />

on the afternoon of Jan. 15, 2006, an<br />

African-American family<br />

of four was looking at a<br />

house for sale in St. Johns<br />

County. The family was<br />

accompanied by their real<br />

estate agent and his wife.<br />

The parents were in the<br />

process of negotiating to<br />

purchase the house.<br />

The plea agreement<br />

notes that while the parents<br />

were inside the house<br />

with the real estate agent,<br />

their son and daughter,<br />

who were 15 and 12 years<br />

old at the time, were outside<br />

the house, where they<br />

overheard the defendant,<br />

who was in front yard,<br />

speaking loudly, apparently to a man on<br />

the street. Coombs, who is Caucasian,<br />

made a remark about having a “housewarming,”<br />

and also made derogatory remarks<br />

about the visiting family.<br />

In Coombs’ front yard was a set of<br />

wooden beams in the shape of a cross.<br />

The cross, which was approximately six<br />

feet tall, faced the house the family was<br />

considering purchasing. Coombs<br />

Paul I. Perez, U.S. Attorney for<br />

the Middle District of Florida<br />

squirted a flammable liquid from a<br />

bottle onto the cross, and lit the cross<br />

on fire.<br />

Coombs then looked at the boy and<br />

stated, “I don’t want to see<br />

you around here again, boy.”<br />

The family was<br />

alarmed and frightened by<br />

the defendant’s actions<br />

and words, causing feelings<br />

of intimidation and<br />

disinterest in living in the<br />

house.<br />

Prosecuting the perpetrators<br />

of bias-motivated<br />

crimes is a top priority of<br />

the Justice Department.<br />

Since 2001, the Civil<br />

Rights Division has<br />

charged 163 defendants in<br />

bias-motivated crimes.<br />

The case was investigated<br />

by the Federal Bureau<br />

of Investigation. The case was<br />

prosecuted by Assistant U.S. Attorney<br />

Scot Morris and Andrew J. Kline of the<br />

Department of Justice’s Civil Rights<br />

Division.<br />

The Middle District of Florida includes<br />

35 of the 67 counties in the State<br />

of Florida and extends from the Florida-<br />

Georgia border near Jacksonville to the<br />

southern most boundary of Naples.<br />

Five Latino Los Angeles gang members accused of<br />

murdering hate crime witness and dumping body<br />

In Los Angeles, five Latino gang members<br />

have been charged with murdering<br />

an acquaintance they believed witnessed<br />

the racially motivated shooting death of a<br />

14-year-old black girl, prosecutors said earlier<br />

this month.<br />

The five men – one of whom is charged<br />

in Cheryl Green’s killing – were charged on<br />

Feb. 21 with murdering Christopher Ash, 25,<br />

on Dec. 28. His body was found on a street<br />

in Carson, Calif. with multiple stab wounds<br />

and his throat was cut, authorities said.<br />

Charged in Ash’s slaying were Jose<br />

Covarrubias, 20; Robert Gonzalez, 29; Raul<br />

Silva, 31; Daniel Aguilar, 19; and Jonathan<br />

Fajardo, 18, who also is suspected of killing<br />

Green. Prosecutors identified the five as active<br />

participants in a street gang.<br />

The defendants also face charges of<br />

“intentional murder of a witness to a<br />

crime” and “committing murder to further<br />

gang activities.”<br />

The criminal complaint alleged that<br />

Covarrubias and Gonzales used a knife to<br />

commit the murder.<br />

Prosecutors have not yet decided<br />

whether to seek the death penalty, according<br />

to various media reports.<br />

Fajardo and another gang member, 20year-old<br />

Ernesto Alcarez, face murder and<br />

hate crime charges for opening fire on Green<br />

and a group of her friends on Dec. 15, 2006<br />

in Los Angeles.<br />

Police spokespersons said the men were<br />

bent on killing African Americans as part of<br />

an ongoing campaign against black residents<br />

by Latino gangs in Los Angeles. Fajardo and<br />

Alcarez are scheduled to be arraigned March<br />

8 in Long Beach Superior Court.<br />

The September 2006 issue of the<br />

<strong>National</strong> <strong>Fair</strong> <strong>Housing</strong> <strong>Advocate</strong> featured<br />

an article about the racially motivated<br />

murders of Anthony Prudhomme<br />

and Christopher Bowser by the Latino<br />

Avenues gang in Los Angeles. Those<br />

gang members were sentenced to life in<br />

prison last November.<br />

Last month, the authorities reported that<br />

crimes in the city motivated by racial, religious<br />

or sexual orientation discrimination<br />

had increased 34 percent in 2005 over the<br />

previous year. Statistics for 2006 have not<br />

yet been compiled, according to the New<br />

York Times.<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 9

South Florida condo association and officers agree<br />

to pay $150,000 in racial discrimination case<br />

Elois Thomas was simply looking to<br />

downsize to a condo, after her husband<br />

passed away in 2005. What she<br />

found, however, was that racial discrimination<br />

is still a fact of life in the United States,<br />

and that even a cash offer on a home does<br />

not guarantee one’s choice of housing.<br />

Recently, a federal court in Florida denied<br />

a motion to throw out Thomas’s case<br />

against the High Point Section I Condominium<br />

Association, association president<br />

Charles Jordan and association president<br />

Herbert Keller. Faced with the possibility<br />

of a costly trial, the defendants agreed to<br />

settle and pay Thomas $150,000.<br />

In 2005, Thomas began a search for a<br />

smaller home following the death of her husband<br />

and her recovery from a long illness.<br />

She engaged the services of a real estate<br />

agent, Rhonda Boles, to sell her existing<br />

home and find a new, smaller home in a senior<br />

community.<br />

Boles managed to sell Thomas’s home<br />

relatively quickly and took her to see a condominium<br />

for sale at High Point Condominiums<br />

in Delray Beach, Fla. According to Thomas,<br />

she fell in love with the home, which<br />

had been put on the market by John<br />

Mendozza. Using the proceeds of her home<br />

sale, Thomas made a $127,000 full cash offer<br />

to Mendozza, which he had accepted.<br />

Mendozza’s real estate<br />

agent, Dunia Keldani, assisted<br />

Thomas in filling at the residency<br />

application packet for<br />

High Point, which included a<br />

copy of her driver’s license<br />

and the sales contract for<br />

Mendozza’s unit. Keldani<br />

then delivered the packet to association<br />

president Charles<br />

Jordan. Jordan promised to deliver the<br />

packet to the member of the association who<br />

processes residency applications.<br />

According to Pat Wojcik, the person<br />

responsible for reviewing the applications,<br />

Jordan never delivered Thomas’s application<br />

packet to her.<br />

Two weeks after the submission of the<br />

application packet, Jordan telephoned<br />

Keldana and asked her to come to his office<br />

to discuss Thomas’s application. Keldana<br />

met with Jordan the next day.<br />

According to Keldana, Jordan handed<br />

her Thomas’s application packet and asked<br />

her to check it for errors. Keldana looked<br />

over the packet and told Jordan that she did<br />

not see any errors.<br />

High Point Condos in Delray<br />

Beach, Fla.<br />

According to Keldana, Jordan looked at<br />

her and said, “You’re missing something.”<br />

Jordan then pointed to Thomas’s picture<br />

on her driver’s license and allegedly said,<br />

“She’s black, and I will not accept this application<br />

because we will not have any black<br />

people moving here.”<br />

Jordan then allegedly went on to express<br />

his blanket opinion of prospective African<br />

American residents to Keldana, stating that<br />

black people usually run day-care centers<br />

from their homes and that<br />

he did not want that to<br />

happen at High Point. Jordan<br />

also allegedly questioned<br />

where Plaintiff<br />

Thomas would get<br />

$127,000.<br />

Finally, according to<br />

Keldana, Jordan informed<br />

her that he was quite proud<br />

that there were only a few<br />

Vince Larkins<br />

Jewish families living at High Point, and that<br />

they had moved in before he had become association<br />

president. Jordan allegedly<br />

claimed that if he had been in charge when<br />

the Jewish residents applied to live at High<br />

Point, he would have rejected them as well.<br />

Jordan then allegedly went on to instruct<br />

Keldana to lie about why Thomas’s application<br />

had not been approved. Jordan told<br />

Keldana that the association<br />

would need to see proof that<br />

Thomas had income of between<br />

$1,200 and $1,500,<br />

despite the fact that monthly<br />

maintenance fees at High<br />

Point were only $176.<br />

Jordan then allegedly told<br />

Keldana that even if Thomas<br />

could meet the income requirements,<br />

he would continue to stall<br />

Thomas’s application process until she became<br />

“discouraged enough to move on.”<br />

Meanwhile, association vice president<br />

Keller allegedly told Mendozza, the unit<br />

owner, that Thomas’s application was going<br />

to be denied because she had “lied” on it.<br />

Keldana informed Boles, Thomas’s<br />

agent, about the conversation with Jordan.<br />

Boles, who did not want to reveal the discrimination<br />

to Thomas for fear of upsetting<br />

her, made numerous written and verbal appeals<br />

to Jordan and association attorney<br />

Larry Shendell.<br />

Keldana called the Florida Office of the<br />

Condominium Ombudsman about the discrimination<br />

being perpetuated at High Point.<br />

The state office referred the case to the <strong>Fair</strong><br />

<strong>Housing</strong> Center of the Greater Palm<br />

Beaches. The Center contacted Keldana and<br />

launched an investigation.<br />

On September 10, 2005, Thomas resubmitted<br />

her occupancy application. Several<br />

days later, Thomas received a letter from<br />

Shendell explaining that her application had<br />

been rejected, because she had not provided<br />

verification of her income.<br />

The <strong>Fair</strong> <strong>Housing</strong> Center joined with<br />

Thomas in filing a federal lawsuit against<br />

the Association, Jordan and Keller. They<br />

were represented by attorney Jene P. Williams,<br />

a partner in the law firm of Liggio,<br />

Benrubi and Williams.<br />

In a motion for summary judgment, the<br />

defendants argues that even if Jordan had<br />

made racially discriminatory comments, he<br />

was not the ultimate decision maker at High<br />

Point. Therefore, argued the defendants, the<br />

plaintiffs could not prove that discrimination<br />

had occurred. The defendants also attempted<br />

to argue that Thomas was not financially<br />

qualified to purchase the home.<br />

U.S. District Judge Daniel T. K. Hurley<br />

rejected both arguments and denied the motion<br />

to throw out the case. Judge Hurley<br />

noted that while the defendants had claimed<br />

to have erected a “firewall” between Jordan<br />

and the rest of the association board, he was<br />

not convinced that such a firewall existed,<br />

since Jordan had regular communications<br />

with other board members and their attorney<br />

about Thomas’s allegations.<br />

Judge Hurley also noted that Jordan was<br />

ultimately one of the board members who<br />

got to vote on Thomas’s application.<br />

Soon after their motion for summary<br />

judgment was denied, the defendants agreed<br />

to settle.<br />

“This case serves as a wake-up call to<br />

all residents in Condo and Homeowners<br />

Associations throughout the state of Florida<br />

that failure to police your condo officers and<br />

discriminating with the consent of legal<br />

counsel can result in paying big fees for not<br />

complying with the <strong>Fair</strong> <strong>Housing</strong> Act. We<br />

commend the seller’s Realtor and the Condo<br />

Ombudsman’s office for stepping forward<br />

to make sure that fairness would prevail,”<br />

said Vince Larkins, president and CEO of<br />

the <strong>Fair</strong> <strong>Housing</strong> Center.<br />

Larkins told the <strong>Advocate</strong> that Thomas<br />

moved into a different section at High Point<br />

and that the publicity surrounding this case<br />

has his phone “ringing off the hook” with<br />

tales describing similar discrimination.<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 10

Allstate agrees to pay nearly $12 million to settle race<br />

and national origin case based on credit score policy<br />

Earlier this month, a federal judge<br />

in Texas gave final approval to a<br />

class-action settlement in a lawsuit<br />

accusing Allstate Insurance of discriminating<br />

against black and Latino<br />

policyholders by using credit reports to<br />

set rates.<br />

U.S. District Judge<br />

Fred Biery approved<br />

the settlement, writing<br />

in his order that the<br />

agreement calling for<br />

Allstate to change its<br />

rate-setting formula is<br />

“fair, reasonable and<br />

adequate.”<br />

Jose DeHoyos, the<br />

San Antonio man who<br />

served as the lead<br />

plaintiff in the lawsuit filed in 2001, had<br />

his premium jump 31 percent in one<br />

year even though he and his wife had<br />

made only one claim during 20 years as<br />

Allstate customers.<br />

A<br />

consent decree was filed last month<br />

settling a case alleging retaliation<br />

against an individual for filing a<br />

complaint with a local fair housing center,<br />

according to Stephen J. Murphy, United<br />

States Attorney. The decree calls for the<br />

owners and managers of <strong>Fair</strong>way Trails<br />

Apartments to pay $50,000 to Harry Tyus, a<br />

disabled man who had asked to move his rent<br />

payment date to later in the month to coincide<br />

with the receipt of his Social Security<br />

Disability Income payments.<br />

The case was brought under the federal<br />

<strong>Fair</strong> <strong>Housing</strong> Act against <strong>Fair</strong>way Trails Limited,<br />

L.P., Benchmark Management Corporation,<br />

Benchmark Michigan Properties,<br />

Inc., and Nicole Morbach, who owned, operated<br />

and managed <strong>Fair</strong>way Trails Apartments<br />

in Ypsilanti, Mich. The consent decree<br />

has been submitted to Judge John<br />

Corbett O’Meara of the United States District<br />

Court for the Eastern District of Michigan<br />

for approval.<br />

LETTER DREW EVICTION THREAT<br />

The government’s complaint alleged<br />

that the defendants retaliated against Tyus<br />

after the executive director of the <strong>Fair</strong> Hous-<br />

“We’re very proud” of the settlement,<br />

DeHoyos said in a statement released<br />

to the press by his attorney.<br />

“We’re very happy to be part of something<br />

that will really make a difference,<br />

not only for ourselves, but for so many<br />

others in the same situation.”<br />

The plaintiffs’ attorneys<br />

were awarded<br />

$11.7 million in legal<br />

fees and expenses, and<br />

the six named plaintiffs<br />

were given<br />

$5,000 each.<br />

Minority customers<br />

who paid higher<br />

premiums under the<br />

old Allstate formula<br />

can seek $50 to $150<br />

in refunds under the settlement.<br />

The class action lawsuit challenged<br />

Allstate’s use of credit scoring to determine<br />

rates set for policyholders, arguing the formula<br />

had a discriminatory impact on minori-<br />

ing Center of Southeastern Michigan sent a<br />

letter to <strong>Fair</strong>way Trails Apartments stating that<br />

Tyus was an individual with a disability and<br />

asking that he be granted a reasonable accommodation<br />

under the <strong>Fair</strong><br />

<strong>Housing</strong> Act. Shortly thereafter,<br />

defendants attempted<br />

to evict Tyus, and when they<br />

were unsuccessful, they announced<br />

that he would not be<br />

permitted to renew his lease.<br />

The case was initiated<br />

when Tyus filed a fair housing<br />

complaint with the U.S.<br />

Department of <strong>Housing</strong> and<br />

Urban Development<br />

(HUD). After investigating<br />

the matter, HUD issued a<br />

charge of discrimination,<br />

and the matter was referred to the United<br />

States Attorney’s Office, which filed the federal<br />

lawsuit on May 8, 2006. The case was<br />

handled jointly with attorneys from the<br />

<strong>Housing</strong> and Civil Enforcement Section of<br />

the Civil Rights Division at the U.S. Department<br />

of Justice in Washington, D.C.<br />

“Our country’s civil rights laws require<br />

not only freedom from discrimination but<br />

ties and forced Latino and African American<br />

customers to pay more.<br />

The settlement, which had been tentatively<br />

reached last June, calls for<br />

Allstate to change its formula to include<br />

strictly financial factors like the number<br />

of late bill payments or how often<br />

items were purchased on installment<br />

plans.<br />

Allstate continues to deny that it<br />

discriminated against customers or that<br />

the credit data was invalid. In addition<br />

to the policy changes and monetary<br />

settlements, the company will increase<br />

its marketing to minority customers, offer<br />

a credit education program for minorities<br />

and provide a process for appealing<br />

high rates.<br />

“Allstate is pleased that the settlement<br />

has met with the court’s approval<br />

and the settlement which benefits many<br />

people is moving forward,” Allstate<br />

spokesman Raleigh Floyd said in a written<br />

statement released to the press.<br />

Mich. owners & managers agree to pay $50,000 in DOJ<br />

reasonable accommodation and retaliation case<br />

U.S. Attorney Stephen J.<br />

Murphy, Eastern District of<br />

Michigan<br />

also freedom from retaliation for those who<br />

seek to exercise their civil rights. Today’s<br />

settlement helps to ensure that those who<br />

wish to assert their rights under the <strong>Fair</strong><br />

<strong>Housing</strong> act can do so without<br />

fear of reprisal.” U.S. Attorney<br />

Murphy said. “We appreciate the<br />

cooperation of the defendants in<br />

resolving this case without protracted<br />

litigation.”<br />

The settlement resolves the<br />

government’s case as well as the<br />

related claim filed by Tyus who<br />

intervened in the government’s<br />

lawsuit. Under the settlement, the<br />

Defendants have agreed to pay<br />

$50,000 in damages and attorney<br />

fees to Harry Tyus, to post a nondiscriminatory<br />

rental policy, to<br />

undergo training on the requirements of the<br />

<strong>Fair</strong> <strong>Housing</strong> Act; and to submit periodic reports<br />

to the U.S. Attorney’s Office.<br />

The federal <strong>Fair</strong> <strong>Housing</strong> Act makes it illegal<br />

to deny reasonable accommodation requests<br />

from disabled tenants and also bars<br />

retaliation and intimidation against persons<br />

who file fair housing complaints or who assist<br />

others in doing so.<br />

<strong>February</strong> <strong>2007</strong> NATIONAL FAIR HOUSING ADVOCATE 11<br />

012

Florida management company and housing authority<br />

pay $50,000 for denying reasonable accommodations<br />

On January 10, <strong>2007</strong>, the U.S. District<br />

Court for the Northern District of<br />

Florida entered a consent decree resolving<br />

United States v. Gainesville <strong>Housing</strong><br />

Authority, et al.<br />

The complaint, filed on November 28,<br />

2005, alleged that the defendants violated<br />

the <strong>Fair</strong> <strong>Housing</strong> Act on the basis of disability<br />

by refusing to grant the reasonable accommodation<br />

requests of a husband and<br />

wife, both of whom are disabled.<br />

The complaint alleged that, for nearly<br />

two years, the defendants refused the complainants’<br />

requests to move from a secondfloor<br />

unit to a first-floor unit at Madison<br />

Cove Apartments to accommodate their disabilities.<br />

The complaint further alleged that<br />

defendants retaliated against the complainants<br />

by threatening to evict them and to terminate<br />

their section 8 eligibility.<br />

The Consent Decree will remain in effect<br />

for three years, requires the defendants<br />

to pay the complainants $50,000 in compensatory<br />

damages, and provides for other injunctive<br />

relief, including training and the<br />

drafting of a new reasonable accommodation<br />

policy.<br />

The case was referred to the Justice<br />

Department after the U.S. Department<br />

of <strong>Housing</strong> and Urban Development<br />

(HUD) received a complaint, conducted<br />

an investigation,<br />

and issued a<br />

charge of discrimination.<br />

The United States<br />

Department of Justice<br />

filed the complaint on<br />

behalf of Sheila and<br />

Charles O’Steen. Both<br />

have disabilities that Madison Cove Apts.<br />

substantially limit their<br />

mobility, coordination, muscular power<br />

(strength) and ability to walk up stairs. Specifically,<br />

the United States asserted that<br />

Charles O’Steen has arthritis, cardiovascular<br />

disease, and a pacemaker, and that Sheila<br />

O’Steen has cardiomyopathy, congestive<br />

heart failure and coronary artery disease, and<br />

is required to carry and use an oxygen tank.<br />

On or about May 21, 2001, the O’Steens<br />

completed an application for an apartment<br />

at Madison Cove and submitted it to Madison<br />

Cove’s manager. At this time, the<br />

O’Steens had recently had their Section 8<br />

file transferred from the Alachua County<br />