LETTER OF OFFER - Securities and Exchange Board of India

LETTER OF OFFER - Securities and Exchange Board of India

LETTER OF OFFER - Securities and Exchange Board of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

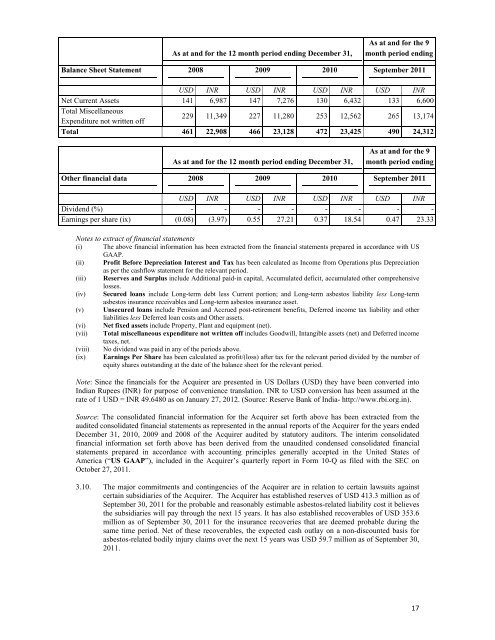

As at <strong>and</strong> for the 12 month period ending December 31,<br />

As at <strong>and</strong> for the 9<br />

month period ending<br />

Balance Sheet Statement 2008 2009 2010 September 2011<br />

USD INR USD INR USD INR USD INR<br />

Net Current Assets 141 6,987 147 7,276 130 6,432 133 6,600<br />

Total Miscellaneous<br />

Expenditure not written <strong>of</strong>f<br />

229 11,349 227 11,280 253 12,562 265 13,174<br />

Total 461 22,908 466 23,128 472 23,425 490 24,312<br />

As at <strong>and</strong> for the 12 month period ending December 31,<br />

As at <strong>and</strong> for the 9<br />

month period ending<br />

Other financial data 2008 2009 2010 September 2011<br />

USD INR USD INR USD INR USD INR<br />

Dividend (%) - - - - - - - -<br />

Earnings per share (ix) (0.08) (3.97) 0.55 27.21 0.37 18.54 0.47 23.33<br />

Notes to extract <strong>of</strong> financial statements<br />

(i) The above financial information has been extracted from the financial statements prepared in accordance with US<br />

GAAP.<br />

(ii) Pr<strong>of</strong>it Before Depreciation Interest <strong>and</strong> Tax has been calculated as Income from Operations plus Depreciation<br />

as per the cashflow statement for the relevant period.<br />

(iii) Reserves <strong>and</strong> Surplus include Additional paid-in capital, Accumulated deficit, accumulated other comprehensive<br />

losses.<br />

(iv) Secured loans include Long-term debt less Current portion; <strong>and</strong> Long-term asbestos liability less Long-term<br />

asbestos insurance receivables <strong>and</strong> Long-term asbestos insurance asset.<br />

(v) Unsecured loans include Pension <strong>and</strong> Accrued post-retirement benefits, Deferred income tax liability <strong>and</strong> other<br />

liabilities less Deferred loan costs <strong>and</strong> Other assets.<br />

(vi) Net fixed assets include Property, Plant <strong>and</strong> equipment (net).<br />

(vii) Total miscellaneous expenditure not written <strong>of</strong>f includes Goodwill, Intangible assets (net) <strong>and</strong> Deferred income<br />

taxes, net.<br />

(viii) No dividend was paid in any <strong>of</strong> the periods above.<br />

(ix) Earnings Per Share has been calculated as pr<strong>of</strong>it/(loss) after tax for the relevant period divided by the number <strong>of</strong><br />

equity shares outst<strong>and</strong>ing at the date <strong>of</strong> the balance sheet for the relevant period.<br />

Note: Since the financials for the Acquirer are presented in US Dollars (USD) they have been converted into<br />

<strong>India</strong>n Rupees (INR) for purpose <strong>of</strong> convenience translation. INR to USD conversion has been assumed at the<br />

rate <strong>of</strong> 1 USD = INR 49.6480 as on January 27, 2012. (Source: Reserve Bank <strong>of</strong> <strong>India</strong>- http://www.rbi.org.in).<br />

Source: The consolidated financial information for the Acquirer set forth above has been extracted from the<br />

audited consolidated financial statements as represented in the annual reports <strong>of</strong> the Acquirer for the years ended<br />

December 31, 2010, 2009 <strong>and</strong> 2008 <strong>of</strong> the Acquirer audited by statutory auditors. The interim consolidated<br />

financial information set forth above has been derived from the unaudited condensed consolidated financial<br />

statements prepared in accordance with accounting principles generally accepted in the United States <strong>of</strong><br />

America (“US GAAP”), included in the Acquirer’s quarterly report in Form 10-Q as filed with the SEC on<br />

October 27, 2011.<br />

3.10. The major commitments <strong>and</strong> contingencies <strong>of</strong> the Acquirer are in relation to certain lawsuits against<br />

certain subsidiaries <strong>of</strong> the Acquirer. The Acquirer has established reserves <strong>of</strong> USD 413.3 million as <strong>of</strong><br />

September 30, 2011 for the probable <strong>and</strong> reasonably estimable asbestos-related liability cost it believes<br />

the subsidiaries will pay through the next 15 years. It has also established recoverables <strong>of</strong> USD 353.6<br />

million as <strong>of</strong> September 30, 2011 for the insurance recoveries that are deemed probable during the<br />

same time period. Net <strong>of</strong> these recoverables, the expected cash outlay on a non-discounted basis for<br />

asbestos-related bodily injury claims over the next 15 years was USD 59.7 million as <strong>of</strong> September 30,<br />

2011.<br />

17