LETTER OF OFFER - Securities and Exchange Board of India

LETTER OF OFFER - Securities and Exchange Board of India

LETTER OF OFFER - Securities and Exchange Board of India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

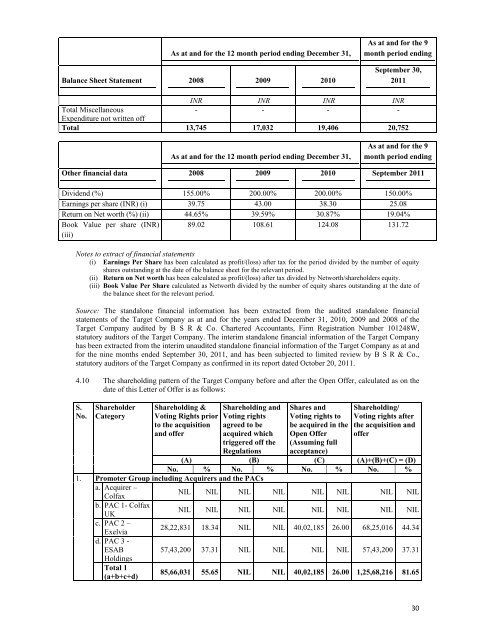

As at <strong>and</strong> for the 12 month period ending December 31,<br />

Balance Sheet Statement 2008 2009 2010<br />

As at <strong>and</strong> for the 9<br />

month period ending<br />

September 30,<br />

2011<br />

INR INR INR INR<br />

Total Miscellaneous<br />

Expenditure not written <strong>of</strong>f<br />

- - - -<br />

Total 13,745 17,032 19,406 20,752<br />

As at <strong>and</strong> for the 12 month period ending December 31,<br />

As at <strong>and</strong> for the 9<br />

month period ending<br />

Other financial data 2008 2009 2010 September 2011<br />

Dividend (%) 155.00% 200.00% 200.00% 150.00%<br />

Earnings per share (INR) (i) 39.75 43.00 38.30 25.08<br />

Return on Net worth (%) (ii) 44.65% 39.59% 30.87% 19.04%<br />

Book Value per share (INR)<br />

(iii)<br />

89.02 108.61 124.08 131.72<br />

Notes to extract <strong>of</strong> financial statements<br />

(i) Earnings Per Share has been calculated as pr<strong>of</strong>it/(loss) after tax for the period divided by the number <strong>of</strong> equity<br />

shares outst<strong>and</strong>ing at the date <strong>of</strong> the balance sheet for the relevant period.<br />

(ii) Return on Net worth has been calculated as pr<strong>of</strong>it/(loss) after tax divided by Networth/shareholders equity.<br />

(iii) Book Value Per Share calculated as Networth divided by the number <strong>of</strong> equity shares outst<strong>and</strong>ing at the date <strong>of</strong><br />

the balance sheet for the relevant period.<br />

Source: The st<strong>and</strong>alone financial information has been extracted from the audited st<strong>and</strong>alone financial<br />

statements <strong>of</strong> the Target Company as at <strong>and</strong> for the years ended December 31, 2010, 2009 <strong>and</strong> 2008 <strong>of</strong> the<br />

Target Company audited by B S R & Co. Chartered Accountants, Firm Registration Number 101248W,<br />

statutory auditors <strong>of</strong> the Target Company. The interim st<strong>and</strong>alone financial information <strong>of</strong> the Target Company<br />

has been extracted from the interim unaudited st<strong>and</strong>alone financial information <strong>of</strong> the Target Company as at <strong>and</strong><br />

for the nine months ended September 30, 2011, <strong>and</strong> has been subjected to limited review by B S R & Co.,<br />

statutory auditors <strong>of</strong> the Target Company as confirmed in its report dated October 20, 2011.<br />

4.10 The shareholding pattern <strong>of</strong> the Target Company before <strong>and</strong> after the Open Offer, calculated as on the<br />

date <strong>of</strong> this Letter <strong>of</strong> Offer is as follows:<br />

S.<br />

No.<br />

1.<br />

Shareholder Shareholding & Shareholding <strong>and</strong> Shares <strong>and</strong> Shareholding/<br />

Category Voting Rights prior Voting rights Voting rights to Voting rights after<br />

to the acquisition agreed to be be acquired in the the acquisition <strong>and</strong><br />

<strong>and</strong> <strong>of</strong>fer<br />

acquired which Open Offer <strong>of</strong>fer<br />

triggered <strong>of</strong>f the (Assuming full<br />

Regulations acceptance)<br />

(A) (B) (C) (A)+(B)+(C) = (D)<br />

No. % No. % No. % No. %<br />

Promoter Group including Acquirers <strong>and</strong> the PACs<br />

a. Acquirer –<br />

Colfax<br />

NIL NIL NIL NIL NIL NIL NIL NIL<br />

b. PAC 1- Colfax<br />

UK<br />

NIL NIL NIL NIL NIL NIL NIL NIL<br />

c. PAC 2 –<br />

Exelvia<br />

d. PAC 3 -<br />

28,22,831 18.34 NIL NIL 40,02,185 26.00 68,25,016 44.34<br />

ESAB<br />

Holdings<br />

57,43,200 37.31 NIL NIL NIL NIL 57,43,200 37.31<br />

Total 1<br />

(a+b+c+d)<br />

85,66,031 55.65 NIL NIL 40,02,185 26.00 1,25,68,216 81.65<br />

30