Title of research - Nordea Markets Research

Title of research - Nordea Markets Research

Title of research - Nordea Markets Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Rickard Bredeby, +46 8 614 80 03<br />

Nya rekordnivåer för S&P 500 och Dow Jones<br />

Europa presenterar industriproduktionsiffror<br />

Marknadsnoteringar idag kl 07:00<br />

EUR/USD 1,3083 US 2Y 0,33 S&P 500 +1,36<br />

USD/JPY 99,0050 US 10Y 2,56 Nikkei +0,25<br />

EUR/SEK 8,7306 DE 2Y 0,11 OMX +1,30<br />

USD/SEK 6,6685 DE 10Y 1,62 VIX Index 14,01<br />

GBP/SEK 10,1260 SE 2Y 1,05 Nymex crude 104,96<br />

NOK/SEK 1,1010 SE 10Y 2,15 Guld 1279,40<br />

Se alla <strong>Nordea</strong>s analyser på nordeamarkets.com<br />

Nyheter<br />

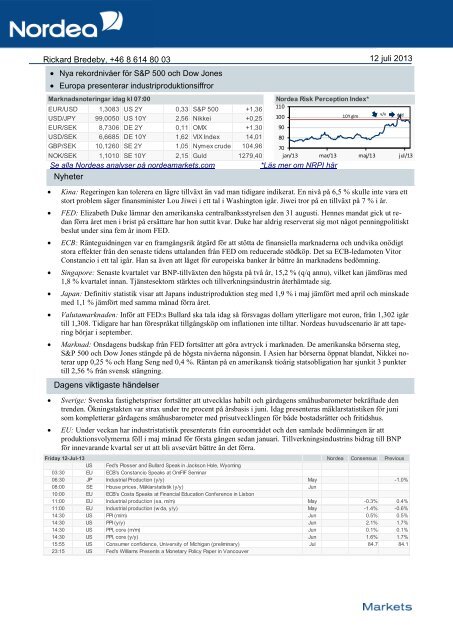

*Läs mer om NRPI här<br />

Kina: Regeringen kan tolerera en lägre tillväxt än vad man tidigare indikerat. En nivå på 6,5 % skulle inte vara ett<br />

stort problem säger finansminister Lou Jiwei i ett tal i Washington igår. Jiwei tror på en tillväxt på 7 % i år.<br />

FED: Elizabeth Duke lämnar den amerikanska centralbanksstyrelsen den 31 augusti. Hennes mandat gick ut redan<br />

förra året men i brist på ersättare har hon suttit kvar. Duke har aldrig reserverat sig mot något penningpolitiskt<br />

beslut under sina fem år inom FED.<br />

ECB: Ränteguidningen var en framgångsrik åtgärd för att stötta de finansiella marknaderna och undvika onödigt<br />

stora effekter från den senaste tidens uttalanden från FED om reducerade stödköp. Det sa ECB-ledamoten Vitor<br />

Constancio i ett tal igår. Han sa även att läget för europeiska banker är bättre än marknadens bedömning.<br />

Singapore: Senaste kvartalet var BNP-tillväxten den högsta på två år, 15,2 % (q/q annu), vilket kan jämföras med<br />

1,8 % kvartalet innan. Tjänstesektorn stärktes och tillverkningsindustrin återhämtade sig.<br />

Japan: Definitiv statistik visar att Japans industriproduktion steg med 1,9 % i maj jämfört med april och minskade<br />

med 1,1 % jämfört med samma månad förra året.<br />

Valutamarknaden: Inför att FED:s Bullard ska tala idag så försvagas dollarn ytterligare mot euron, från 1,302 igår<br />

till 1,308. Tidigare har han förespråkat tillgångsköp om inflationen inte tilltar. <strong>Nordea</strong>s huvudscenario är att tapering<br />

börjar i september.<br />

Marknad: Onsdagens budskap från FED fortsätter att göra avtryck i marknaden. De amerikanska börserna steg,<br />

S&P 500 och Dow Jones stängde på de högsta nivåerna någonsin. I Asien har börserna öppnat blandat, Nikkei noterar<br />

upp 0,25 % och Hang Seng ned 0,4 %. Räntan på en amerikansk tioårig statsobligation har sjunkit 3 punkter<br />

till 2,56 % från svensk stängning.<br />

Dagens viktigaste händelser<br />

<strong>Nordea</strong> Risk Perception Index*<br />

110<br />

70<br />

jan/13 mar/13 maj/13 jul/13<br />

Sverige: Svenska fastighetspriser fortsätter att utvecklas habilt och gårdagens småhusbarometer bekräftade den<br />

trenden. Ökningstakten var strax under tre procent på årsbasis i juni. Idag presenteras mäklarstatistiken för juni<br />

som kompletterar gårdagens småhusbarometer med prisutvecklingen för både bostadsrätter och fritidshus.<br />

EU: Under veckan har industristatistik presenterats från euroområdet och den samlade bedömningen är att<br />

produktionsvolymerna föll i maj månad för första gången sedan januari. Tillverkningsindustrins bidrag till BNP<br />

för innevarande kvartal ser ut att bli avsevärt bättre än det förra.<br />

100<br />

90<br />

80<br />

10Y glm<br />

12 juli 2013<br />

v/v d/d<br />

Friday 12-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

US Fed's Plosser and Bullard Speak in Jackson Hole, Wyoming<br />

03:30 EU ECB's Constancio Speaks at OmFIF Seminar<br />

06:30 JP Industrial Production (y/y) May -1.0%<br />

08:00 SE House prices, Mäklarstatistik (y/y) Jun<br />

10:00 EU ECB's Costa Speaks at Financial Education Conference in Lisbon<br />

11:00 EU Industrial production (sa, m/m) May -0.3% 0.4%<br />

11:00 EU Industrial production (w da, y/y) May -1.4% -0.6%<br />

14:30 US PPI (m/m) Jun 0.5% 0.5%<br />

14:30 US PPI (y/y) Jun 2.1% 1.7%<br />

14:30 US PPI, core (m/m) Jun 0.1% 0.1%<br />

14:30 US PPI, core (y/y) Jun 1.6% 1.7%<br />

15:55 US Consumer confidence, University <strong>of</strong> Michigan (preliminary) Jul 84.7 84.1<br />

23:15 US Fed's Williams Presents a Monetary Policy Paper in Vancouver

Monday 15-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

JP Marine Day<br />

CN Fixed asset inv. excl. rural YTD (y/y) Jun 20.2% 20.4%<br />

CN Money supply, M2 (y/y) (Exp 10-15 Jul) Jun 15.2% 15.8%<br />

04:00 CN GDP (y/y) Q2 7.5% 7.7%<br />

04:00 CN Industrial production (y/y) Jun 9.1% 9.2%<br />

04:00 CN Retail sales (y/y) Jun 12.9% 12.9%<br />

09:30 SE Business sector production (m/m) May<br />

09:30 SE Business sector production (y/y) May<br />

10:00 NO Exports, traditional, volume (q/q) Q2<br />

10:00 NO Foreign trade w ith goods (bn) Jun 30.1bn<br />

14:00 US Fed's Tarullo Speaks on Banking Regulation in Washington<br />

14:30 US Empire manufacturing Jul 5.00 7.84<br />

14:30 US Retail sales (m/m) Jun 0.8% 0.6%<br />

14:30 US Retail sales control group Jun 0.3% 0.3%<br />

14:30 US Retail sales, ex auto and gas (m/m) Jun 0.3%<br />

14:30 US Retail sales, less autos (m/m) Jun 0.4% 0.3%<br />

16:00 US Business inventories (m/m) May 0.3% 0.3%<br />

Tuesday 16-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

09:30 SE Minutes <strong>of</strong> the Jul 2 Riksbank meeting is published (published)<br />

10:00 NO House prices SSB (y/y) Q2 6.0%<br />

10:30 GB CPI (m/m) Jun -0.1% 0.2%<br />

10:30 GB CPI (y/y) Jun 2.9% 2.7%<br />

11:00 EU CPI (m/m) Jun 0.1% 0.1%<br />

11:00 EU CPI (y/y) Jun 1.6% 1.6%<br />

11:00 EU CPI - Core (y/y) Jun 1.2%<br />

11:00 EU Trade balance, sa May 16.1bn<br />

11:00 DE ZEW, current situation Jun 8.6<br />

11:00 DE ZEW, economic sentiment Jun 38.5<br />

15:00 US TIC flow s, net long-term May -$37.3bn<br />

15:00 US TIC flow s, net total May $12.7bn<br />

15:15 US Capacity utilization Jun 77.7% 77.6%<br />

15:15 US Industrial production (m/m) Jun 0.3% 0.0%<br />

16:00 US Housing market index, NAHB Jul 52 52<br />

20:15 US Fed's George Speaks on Economic Conditions and Agriculture<br />

Wednesday 17-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

10:00 GB Earnings, ex bonus, average (3mma, y/y) May 0.9%<br />

10:30 GB Minutes <strong>of</strong> the BoE meeting Jul<br />

10:30 GB Unemployment rate, claimant count Jun 4.5% 4.5%<br />

13:00 US Mortgage applications, MBA Jul -4.0%<br />

14:30 US Building permits Jun 1000k 985k<br />

14:30 US Housing starts Jun 950k 914k<br />

14:30 US Housing starts (m/m) Jun 3.9% 6.8%<br />

15:00 CA BoC announces interest rate 1.00%<br />

16:00 US Fed's Bernanke Delivers Semi-Annual Policy Report to House<br />

20:00 US U.S. Federal Reserve Releases Beige Book<br />

Thursday 18-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

CN FDI (y/y) (Exp 14-18 Jul) Jun 1.0% 0.3%<br />

10:00 EU Current account balance, sa May 19.5bn<br />

10:00 NO Norges Bank's survey <strong>of</strong> bank lending Q2<br />

10:30 GB Retail sales ex auto fuel (m/m) Jun 0.5% 2.1%<br />

10:30 GB Retail sales ex auto fuel (y/y) Jun 2.1%<br />

14:30 US Jobless claims, continuing Jul<br />

14:30 US Jobless claims, initial Jul<br />

16:00 US Fed's Bernanke Delivers Semi-Annual Policy Report to Senate<br />

16:00 US Leading indicators Jun 0.3% 0.1%<br />

16:00 US Philadelphia Fed Jul 5.5 12.5<br />

Friday 19-Jul-13<br />

<strong>Nordea</strong> Consensus Previous<br />

13:00 CA Bank <strong>of</strong> Canada core CPI (m/m) Jun 0.2%<br />

13:00 CA Bank <strong>of</strong> Canada core CPI (y/y) Jun 1.1%<br />

13:00 CA CPI (m/m) Jun 0.2%<br />

13:00 CA CPI (y/y) Jun 0.7%<br />

<strong>Nordea</strong> <strong>Markets</strong> is the name <strong>of</strong> the <strong>Markets</strong> departments <strong>of</strong> <strong>Nordea</strong> Bank Norge ASA, <strong>Nordea</strong> Bank Sverige AB (publ), <strong>Nordea</strong> Bank Finland Plc and <strong>Nordea</strong> Bank Danmark A/S.<br />

Copyright <strong>Nordea</strong> <strong>Markets</strong>, 2001. Not approved for publication in the United States<br />

.<br />

<strong>Nordea</strong> <strong>Markets</strong> is part <strong>of</strong> the <strong>Nordea</strong> Group (<strong>Nordea</strong> AB). This document has been issued for the information <strong>of</strong> <strong>Nordea</strong> <strong>Markets</strong> Non-Private Customers and Market Counterparties only, it is not intended for and<br />

must not be distributed to Private Customers. This document may not be reproduced, distributed or published for any purpose without the prior written permission <strong>of</strong> <strong>Nordea</strong> <strong>Markets</strong>. <strong>Nordea</strong> Group (<strong>Nordea</strong> AB) and<br />

any person connected with them may provide investment banking services to an issuer <strong>of</strong> any <strong>of</strong> the securities or any other company mentioned in this document either directly or indirectly and may have done so<br />

during the twelve months prior to publication <strong>of</strong> this document. <strong>Nordea</strong> Group (<strong>Nordea</strong> AB) and persons connected with it may from time to time have long or short positions in the securities mentioned in this<br />

document and as agent or market maker, may buy, sell or hold such securities. All the information and opinions contained in this document have been prepared or arrived at from publicly available sources which are<br />

believed to be reliable and given in good faith. We do not represent that such information is accurate or complete and it should not be relied upon as such, nor is it a substitute for the judgment <strong>of</strong> the recipient. All<br />

opinions and estimates contained herein constitute <strong>Nordea</strong> <strong>Markets</strong>’ judgment as <strong>of</strong> the date <strong>of</strong> this document and are subject to change without notice. The information in this document is not, and should not be<br />

construed as an <strong>of</strong>fer to sell or solicitation <strong>of</strong> an <strong>of</strong>fer to buy any securities, options or futures contracts. <strong>Nordea</strong> <strong>Markets</strong> does not accept any liability whatsoever for any direct, indirect or consequential loss arising<br />

from any use <strong>of</strong> information in this document. <strong>Nordea</strong> Bank Finland Plc, London Branch, is regulated for the conduct <strong>of</strong> investment business in the U.K. by the Securities and Futures Authority and is a member <strong>of</strong> the<br />

London Stock Exchange and as regards the activities <strong>of</strong> <strong>Nordea</strong> Bank Finland Plc, London Branch, in the United Kingdom. <strong>Nordea</strong> Bank Finland Plc, London Branch, does not seek to restrict or exclude any duty or<br />

liability to its customers which it may have under the Financial Services Act 1986 or regulations implemented pursuant thereto.<br />

<strong>Nordea</strong>, <strong>Markets</strong> Division<br />

<strong>Nordea</strong> Bank Norge ASA<br />

17 Middelthuns gt.<br />

PO Box 1166 Sentrum, N-0107 Oslo<br />

+47 2248 5000<br />

<strong>Nordea</strong> Bank Sverige AB (publ)<br />

10 Hamngatan<br />

SE-105 71 Stockholm<br />

+46 8 614 7000<br />

<strong>Nordea</strong> Bank Finland Plc<br />

27A Fleminginkatu, Helsinki<br />

FIN-00020 <strong>Nordea</strong>-Merita<br />

+358 9 1651<br />

<strong>Nordea</strong> Bank Danmark A/S<br />

3 Strandgade<br />

PO Box 850, DK-0900 Copenhagen C<br />

+45 3333 3333