2012 FORECLOSURE LIST ISSUED BY LINCOLN COUNTY The tax

2012 FORECLOSURE LIST ISSUED BY LINCOLN COUNTY The tax

2012 FORECLOSURE LIST ISSUED BY LINCOLN COUNTY The tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

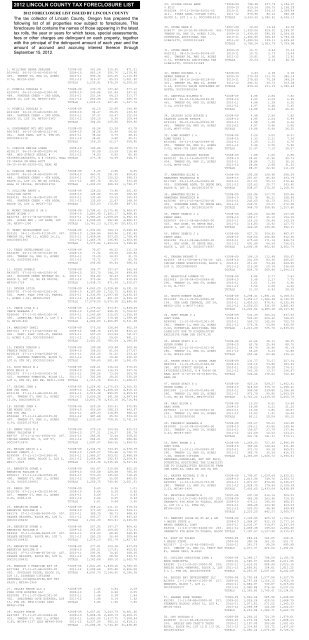

<strong>2012</strong> <strong>LINCOLN</strong> <strong>COUNTY</strong> TAX <strong>FORECLOSURE</strong> <strong>LIST</strong><br />

<strong>2012</strong> <strong>FORECLOSURE</strong> <strong>LIST</strong> <strong>ISSUED</strong> <strong>BY</strong> <strong>LINCOLN</strong> <strong>COUNTY</strong><br />

<strong>The</strong> <strong>tax</strong> collector of Lincoln County, Oregon has prepared the<br />

following list of all properties now subject to foreclosure. This<br />

foreclosure list contains the names of those appearing in the latest<br />

<strong>tax</strong> rolls, the year or years for which <strong>tax</strong>es, special assessments,<br />

fees or other charges are delinquent on each property, together<br />

with the principal of the delinquent amount of each year and the<br />

amount of accrued and accruing interest thereon through<br />

September 15, <strong>2012</strong>.<br />

1. WILLIAMS DEBRA DARLENE *2008-09 561.06 310.45 871.51<br />

R314455 06-10-33-AC-04100-00 2009-10 863.14 356.76 1,219.90<br />

493. TWNSHP 06, RNG 10, ACRES 2010-11 890.34 225.55 1,115.89<br />

0.76, MF218-2262 2011-12 916.37 85.53 1,001.90<br />

TOTALS 3,230.91 978.29 4,209.20<br />

2. PUDWILL DOUGLAS D *2008-09 239.70 137.42 377.12<br />

R159073 06-10-33-AD-01900-00 2009-10 245.88 101.64 347.52<br />

489. PANTHER CREEK - 2ND ADDN, 2010-11 253.54 64.23 317.77<br />

BLOCK 10, LOT 18, MF306-2363 2011-12 260.99 24.36 285.35<br />

TOTALS 1,000.11 327.65 1,327.76<br />

3. PUDWILL DOUGLAS D *2008-09 92.10 52.80 144.90<br />

R161426 06-10-33-AD-02000-00 2009-10 94.47 39.05 133.52<br />

489. PANTHER CREEK - 2ND ADDN, 2010-11 97.37 24.67 122.04<br />

BLOCK 10, LOT 19, MF306-2363 2011-12 100.10 9.34 109.44<br />

TOTALS 384.04 125.86 509.90<br />

4. GOVERNMENT NTL MTG ASSN *2008-09 40.54 23.24 63.78<br />

R507683 06-10-33-BB-01101-00 2009-10 38.56 15.94 54.50<br />

461. JADE PARK, LOT 5, PTN OF, 2010-11 38.62 9.79 48.41<br />

DOC200812118 2011-12 38.61 3.60 42.21<br />

TOTALS 156.33 52.57 208.90<br />

5. CORDOVA DENISE LUANA 2009-10 106.66 44.08 150.74<br />

M126137 06-10-34-BD-02200-00 2010-11 93.09 23.59 116.68<br />

489. MFD STRUCT SERIAL # 2011-12 74.03 6.92 80.95<br />

6610K5014E2S4509, X # 109452, Home TOTALS 273.78 74.59 348.37<br />

ID 186366 ON REAL ACCT<br />

06-10-34-BD-02200-00, REAL MS<br />

6. CORDOVA DENISE L *2008-09 5.25 2.80 8.05<br />

R338570 06-10-34-BD-02200-00 2009-10 463.31 191.50 654.81<br />

489. PANTHER CREEK - 4TH ADDN, 2010-11 475.71 120.52 596.23<br />

BLOCK 21, LOT 13, MS X# 109452, 2011-12 487.76 45.52 533.28<br />

Home ID 186366, DOC200616741 TOTALS 1,432.03 360.34 1,792.37<br />

7. SULLIVAN BARRY & *2008-09 128.02 73.40 201.42<br />

SULLIVAN CATHY 2009-10 128.92 53.28 182.20<br />

R184191 06-10-34-CB-01200-00 2010-11 132.40 33.53 165.93<br />

492. PANTHER CREEK - 4TH ADDN, 2011-12 135.69 12.67 148.36<br />

BLOCK 18, LOT 1, MF207-722 TOTALS 525.03 172.88 697.91<br />

8. WYANT CHARLES E JR & *2008-09 3,794.41 2,175.46 5,969.87<br />

WYANT WILMA J 2009-10 3,883.48 1,605.17 5,488.65<br />

R420704 06-11-34-AD-04900-00 2010-11 3,983.25 1,009.09 4,992.34<br />

495. ROADS END - 1ST ADDN, LOT 2011-12 4,099.99 382.68 4,482.67<br />

36, MF387-1300 TOTALS 15,761.13 5,172.40 20,933.53<br />

9. TEENY DEVELOPMENT LLC *2008-09 1,332.80 764.13 2,096.93<br />

R33181 06-11-35-00-01100-00 407. 2009-10 1,366.86 564.96 1,931.82<br />

TWNSHP 06, RNG 11, ACRES 14.21, 2010-11 1,409.44 357.05 1,766.49<br />

DOC200801583 2011-12 1,466.76 136.90 1,603.66<br />

TOTALS 5,575.86 1,823.04 7,398.90<br />

10. TEENY DEVELOPMENT LLC *2008-09 70.67 40.52 111.19<br />

R524090 06-11-35-00-01100-00 2009-10 71.32 29.50 100.82<br />

402. TWNSHP 06, RNG 11, ACRES 2010-11 73.20 18.55 91.75<br />

0.59, DOC200801583 2011-12 75.71 7.07 82.78<br />

TOTALS 290.90 95.64 386.54<br />

11. RIEHL RONALD *2008-09 344.77 197.67 542.44<br />

R410875 07-10-01-AA-02500-00 2009-10 353.70 146.19 499.89<br />

463. BOULDER CREEK RETREAT NO. 2, 2010-11 364.82 92.43 457.25<br />

BLOCK 2, LOT 12, MS X# 900500, 2011-12 375.44 35.05 410.49<br />

MF369-1729 TOTALS 1,438.73 471.34 1,910.07<br />

12. SNYDER LYDIA *2008-09 4,062.20 2,328.98 6,391.18<br />

R505730 07-10-03-A0-02001-00 2009-10 4,167.89 1,722.72 5,890.61<br />

500. PART. PLAT 1994-22, PARCEL 2010-11 4,332.95 1,097.68 5,430.63<br />

1, ACRES 1.02, MF389-0923 2011-12 4,512.96 421.20 4,934.16<br />

TOTALS 17,076.00 5,570.58 22,646.58<br />

13. VANCE LYLE K & *2008-09 1,175.52 673.97 1,849.49<br />

VANCE BARBARA J 2009-10 1,205.67 498.35 1,704.02<br />

R266450 07-11-01-BA-01300-00 2010-11 1,243.64 315.05 1,558.69<br />

490. LAKEVIEW, BLOCK 2, LOT 5 & 2011-12 1,280.00 119.48 1,399.48<br />

6, MF108-862 TOTALS 4,904.83 1,606.85 6,511.68<br />

14. MAKSIMOV DANIL *2008-09 573.55 328.84 902.39<br />

R507013 07-11-10-AD-05500-00 2009-10 588.76 243.36 832.12<br />

402. PART. PLAT 1995-35, PARCEL 2010-11 607.23 153.84 761.07<br />

2, ACRES 0.22, DOC200505862 2011-12 632.11 59.00 691.11<br />

TOTALS 2,401.65 785.04 3,186.69<br />

15. FRENCH GORDON & *2008-09 190.98 109.48 300.46<br />

FRENCH PATRICIA 2009-10 196.03 81.04 277.07<br />

R258129 07-11-10-DA-03800-00 2010-11 202.20 51.22 253.42<br />

407. RAYMOND TOWNSITE, BLOCK 5, 2011-12 210.44 19.66 230.10<br />

LOT 8, PTN OF, DOC201010624 TOTALS 799.65 261.40 1,061.05<br />

16. KOCH KELLY W & *2008-09 240.01 136.24 376.25<br />

KOCH KELLY A 2009-10 281.43 116.33 397.76<br />

R502270 07-11-10-DD-00301-00 2010-11 290.24 73.54 363.78<br />

412. RAYMOND TOWNSITE, BLOCK 12, 2011-12 302.08 28.20 330.28<br />

LOT 4, PTN OF, EXC RW, MF311-1399 TOTALS 1,113.76 354.31 1,468.07<br />

17. DEJONG JOHN & *2008-09 2,224.92 1,275.63 3,500.55<br />

KIM JIN SUNG 2009-10 3,406.92 1,408.20 4,815.12<br />

R331198 07-11-11-BD-00102-00 2010-11 3,513.38 890.05 4,403.43<br />

407. TWNSHP 07, RNG 11, ACRES 2011-12 3,656.56 341.28 3,997.84<br />

12.08, DOC200808116 TOTALS 12,801.78 3,915.16 16,716.94<br />

18. DEJONG JOHN & *2008-09 620.24 355.61 975.85<br />

LEE WOONG YOUL & 2009-10 455.64 188.33 643.97<br />

KIM YOU JEA 2010-11 469.33 118.89 588.22<br />

R524462 07-11-11-BD-00105-00 2011-12 487.68 45.52 533.20<br />

407. TWNSHP 07, RNG 11, ACRES TOTALS 2,032.89 708.35 2,741.24<br />

0.34, DOC201107618<br />

19. HENRY PAUL N & *2008-09 270.14 154.89 425.03<br />

HENRY TALIATHA K 2009-10 277.21 114.57 391.78<br />

R68707 07-11-11-CC-05800-00 407. 2010-11 285.91 72.44 358.35<br />

INDIAN SHORES NO. 3, LOT 57, 2011-12 264.21 24.65 288.86<br />

DOC200715975 TOTALS 1,097.47 366.55 1,464.02<br />

20. WRIGHT DAVID L & *2008-09 1,334.74 743.65 2,078.39<br />

WRIGHT CHERYL J 2009-10 1,925.07 795.68 2,720.75<br />

R199099 07-11-11-CD-01800-00 2010-11 1,985.57 503.02 2,488.59<br />

407. ALICE PARK, BLOCK 2, LOT 5, 2011-12 2,066.98 192.93 2,259.91<br />

MF217-1825 TOTALS 7,312.36 2,235.28 9,547.64<br />

21. BERGEVIN DUANE & *2008-09 541.87 310.68 852.55<br />

BERGEVIN PAULINE R 2009-10 555.68 229.68 785.36<br />

R356211 07-11-12-CB-02500-00 2010-11 573.23 145.22 718.45<br />

490. TWNSHP 07, RNG 11, ACRES 2011-12 589.97 55.08 645.05<br />

0.18, DOC201108431 TOTALS 2,260.75 740.66 3,001.41<br />

22. REEDS INC *2008-09 0.65 0.36 1.01<br />

R515726 07-11-14-CB-22199-00 2009-10 0.66 0.26 0.92<br />

407. TWNSHP 07, RNG 11, ACRES 2010-11 0.66 0.17 0.83<br />

0.05, DV85-135 2011-12 0.64 0.05 0.69<br />

TOTALS 2.61 0.84 3.45<br />

23. BERGEVIN DUANE & *2008-09 368.22 211.12 579.34<br />

BERGEVIN PAULINE R 2009-10 377.90 156.21 534.11<br />

R45176 07-11-23-BB-06400-00 407. 2010-11 389.70 98.73 488.43<br />

DELAKE HEIGHTS, BLOCK M4, LOT 5, 2011-12 405.57 37.85 443.42<br />

DOC201108432 TOTALS 1,541.39 503.91 2,045.30<br />

24. BERGEVIN DUANE & *2008-09 257.05 147.37 404.42<br />

BERGEVIN PAULINE R 2009-10 263.85 109.06 372.91<br />

R49900 07-11-23-BB-06600-00 407. 2010-11 272.03 68.92 340.95<br />

DELAKE HEIGHTS, BLOCK M4, LOT 7, 2011-12 283.20 26.44 309.64<br />

DOC201108432 TOTALS 1,076.13 351.79 1,427.92<br />

25. BERGEVIN DUANE & *2008-09 277.81 159.28 437.09<br />

BERGEVIN PAULINE R 2009-10 285.01 117.81 402.82<br />

R52262 07-11-23-BB-06700-00 407. 2010-11 293.91 74.45 368.36<br />

DELAKE HEIGHTS, BLOCK M4, LOT 8, 2011-12 305.95 28.56 334.51<br />

DOC201108432 TOTALS 1,162.68 380.10 1,542.78<br />

26. EMERSON S FRANCINE EST OF *2005-06 1,841.05 1,939.25 3,780.30<br />

R157948 07-11-27-AB-02000-00 2011-12 2,200.68 205.40 2,406.08<br />

402. SPYGLASS RIDGE, BLOCK 10, TOTALS 4,041.73 2,144.65 6,186.38<br />

LOT 13, DISABLED CITIZENS<br />

DEFERRAL-(DISQUALIFIED,NOT YET<br />

PAID), MF296-1959<br />

27. VALLEY BROOK LLC & *2008-09 1.45 0.84 2.29<br />

PINE COVE ESTATES LLC 2009-10 1.45 0.60 2.05<br />

R520095 07-11-27-DB-01301-00 2010-11 1.46 0.38 1.84<br />

402. SHELTERED COVE ESTATES, LOT 2011-12 1.48 0.14 1.62<br />

15, PTN OF, MF413-0040 LESS TOTALS 5.84 1.96 7.80<br />

MF462-2386<br />

28. ROLOFF RO<strong>BY</strong>N *2008-09 5,657.81 3,243.79 8,901.60<br />

R247903 07-11-27-DC-02604-00 2009-10 5,808.36 2,400.79 8,209.15<br />

412. TWNSHP 07, RNG 11, ACRES 2010-11 5,991.09 1,517.75 7,508.84<br />

0.65, MF394-1137 LESS MF444-3040 2011-12 6,237.09 582.12 6,819.21<br />

TOTALS 23,694.35 7,744.45 31,438.80<br />

29. SILVER FALLS BANK *2008-09 798.48 457.79 1,256.27<br />

% FDIC 2009-10 819.54 338.75 1,158.29<br />

R502264 07-11-34-DA-02501-00 2010-11 845.34 214.15 1,059.49<br />

412. PINES ADDN.-CUTLER CITY, 2011-12 879.96 82.12 962.08<br />

BLOCK 2, LOT 1 & 2, DOC200814519 TOTALS 3,343.32 1,092.81 4,436.13<br />

30. STONE MARK K *2007-08 19.09 13.24 32.33<br />

R34677 08-10-16-00-00504-00 493. *2008-09 1,430.06 819.91 2,249.97<br />

TWNSHP 08, RNG 10, ACRES 5.00, 2009-10 1,439.60 595.05 2,034.65<br />

POTENTIAL ADDITIONAL TAX 2010-11 1,406.95 356.43 1,763.38<br />

LIABILITY, DOC201011649 2011-12 1,490.54 139.11 1,629.65<br />

TOTALS 5,786.24 1,923.74 7,709.98<br />

31. STONE MARK K 2009-10 10.71 4.42 15.13<br />

R522312 08-10-16-00-00504-00 2010-11 10.72 2.72 13.44<br />

461. TWNSHP 08, RNG 10, ACRES 2011-12 10.81 1.00 11.81<br />

0.31, POTENTIAL ADDITIONAL TAX TOTALS 32.24 8.14 40.38<br />

LIABILITY, DOC201011649<br />

32. BERNS MICHAEL V & *2008-09 3.93 2.09 6.02<br />

BERNS PAMELA K 2009-10 270.39 111.75 382.14<br />

R323199 08-10-19-DA-00129-00 2010-11 278.65 70.59 349.24<br />

461. TWNSHP 08, RNG 10, ACRES 2011-12 286.32 26.72 313.04<br />

0.14, 2003/04 VALUE SUSTAINED <strong>BY</strong> TOTALS 839.29 211.15 1,050.44<br />

BOPTA, DOC200605254<br />

33. GERTTULA WILFRED R *2008-09 4.98 2.84 7.82<br />

R524241 08-10-19-DA-00199-00 2009-10 4.95 2.04 6.99<br />

461. TWNSHP 08, RNG 10, ACRES 2010-11 4.98 1.28 6.26<br />

3.14, DV234-0062 2011-12 4.97 0.48 5.45<br />

TOTALS 19.88 6.64 26.52<br />

34. CALKINS LOYD ESTATE & *2008-09 4.98 2.84 7.82<br />

CALKINS LOUISE ESTATE 2009-10 4.95 2.04 6.99<br />

R193323 08-10-20-CA-00218-00 2010-11 4.98 1.28 6.26<br />

461. TWNSHP 08, RNG 10, ACRES 2011-12 4.97 0.48 5.45<br />

0.06, MF67-0706 TOTALS 19.88 6.64 26.52<br />

35. LOWE ROBERT J & *2008-09 5.29 3.02 8.31<br />

LOWE TERRY L 2009-10 5.33 2.21 7.54<br />

R510860 08-11-16-DA-00699-00 2010-11 5.39 1.37 6.76<br />

455. TWNSHP 08, RNG 11, ACRES 2011-12 5.46 0.50 5.96<br />

0.02, MF85-755 LESS MF91-988 TOTALS 21.47 7.10 28.57<br />

36. JOHNSTON BROOKS ESTATE *2008-09 1.88 1.00 2.88<br />

R2<strong>2012</strong>2 08-11-16-DA-00707-00 2009-10 28.81 11.92 40.73<br />

454. TWNSHP 08, RNG 11, ACRES 2010-11 28.84 7.32 36.16<br />

0.04, MF60-0622 2011-12 28.84 2.68 31.52<br />

TOTALS 88.37 22.92 111.29<br />

37. HAWATMEH ELIAS & *2008-09 190.06 108.48 298.54<br />

HAWATMEH FRANCESCA M 2009-10 207.87 85.92 293.79<br />

R117945 09-11-05-CA-02600-00 2010-11 217.51 55.11 272.62<br />

403. SUNDOWNE ADDN. TO DEPOE BAY, 2011-12 222.63 20.77 243.40<br />

BLOCK 8, LOT 3, DOC200321679 TOTALS 838.07 270.28 1,108.35<br />

38. HAWATMEH ELIAS & *2008-09 222.96 127.70 350.66<br />

HAWATMEH FRANCESCA M 2009-10 232.78 96.21 328.99<br />

R120390 09-11-05-CA-02700-00 2010-11 243.65 61.72 305.37<br />

403. SUNDOWNE ADDN. TO DEPOE BAY, 2011-12 249.31 23.27 272.58<br />

BLOCK 8, LOT 4, DOC200321679 TOTALS 948.70 308.90 1,257.60<br />

39. PERRY DENNIS J & *2008-09 106.20 60.88 167.08<br />

PERRY ANEL 2009-10 109.17 45.12 154.29<br />

R358919 09-11-08-AB-04800-00 2010-11 114.25 28.94 143.19<br />

403. BAY ADDN. TO DEPOE BAY, 2011-12 116.83 10.92 127.75<br />

BLOCK 1, LOT 12, DOC200714567 TOTALS 446.45 145.86 592.31<br />

40. PERRY DENNIS J & *2008-09 627.75 359.92 987.67<br />

PERRY ANEL 2009-10 645.50 266.80 912.30<br />

R361296 09-11-08-AB-04900-00 2010-11 675.60 171.14 846.74<br />

403. BAY ADDN. TO DEPOE BAY, 2011-12 691.49 64.54 756.03<br />

BLOCK 1, LOT 13, DOC200714567 TOTALS 2,640.34 862.40 3,502.74<br />

41. GRAHAM BRYANT T *2008-09 196.19 112.48 308.67<br />

R16059 09-11-08-DB-01700-00 403. 2009-10 201.69 83.36 285.05<br />

INDIAN CREEK SUBDIVISION, BLOCK 1, 2010-11 211.01 53.44 264.45<br />

LOT 3, DOC200808509 2011-12 215.90 20.16 236.06<br />

TOTALS 824.79 269.44 1,094.23<br />

42. NASHVILLE LUMBER CO *2008-09 4.84 2.77 7.61<br />

R523403 10-09-04-00-00699-00 2009-10 5.48 2.27 7.75<br />

290. TWNSHP 10, RNG 09, ACRES 2010-11 5.51 1.39 6.90<br />

0.72, M-7707 2011-12 5.50 0.50 6.00<br />

TOTALS 21.33 6.93 28.26<br />

43. SMITH ROBERT BLAKE *2008-09 3,298.41 1,891.10 5,189.51<br />

R311994 10-11-32-DD-04500-00 2009-10 3,354.17 1,386.38 4,740.55<br />

104. SEA LAKE TERRACE, LOT 24, 2010-11 3,459.53 876.41 4,335.94<br />

MF262-1051 & MF377-2402 2011-12 3,550.53 331.39 3,881.92<br />

TOTALS 13,662.64 4,485.28 18,147.92<br />

44. HUNT FRANK C & *2008-09 532.39 305.24 837.63<br />

HUNT NINA 2009-10 543.43 224.62 768.05<br />

R299062 11-10-00-00-01001-00 2010-11 560.73 142.06 702.79<br />

260. TWNSHP 11, RNG 10, ACRES 2011-12 576.74 53.84 630.58<br />

9.00, POTENTIAL ADDITIONAL TAX TOTALS 2,213.29 725.76 2,939.05<br />

LIABILITY DUE TO DISQUALIFIED<br />

EXCLUSIVE FARM USE $2076.30<br />

45. HYDEN STACY S & *2008-09 61.24 35.11 96.35<br />

HYDEN DONNA J 2009-10 62.76 25.94 88.70<br />

R509404 11-10-05-00-01501-00 2010-11 64.79 16.40 81.19<br />

280. TWNSHP 11, RNG 10, ACRES 2011-12 66.65 6.23 72.88<br />

0.26, MF439-0561 TOTALS 255.44 83.68 339.12<br />

46. HYDEN STACY S & DONNA JEAN *2008-09 131.77 75.57 207.34<br />

M483934 11-10-05-00-01606-00 2009-10 130.14 53.80 183.94<br />

280. MFD STRUCT SERIAL # 2010-11 139.23 35.28 174.51<br />

14702PDRIIJS4352, X # 95094 ON 2011-12 143.30 13.37 156.67<br />

REAL ACCT 11-10-05-00-01606-00, TOTALS 544.44 178.02 722.46<br />

REAL MS<br />

47. HYDEN STACY S & *2008-09 923.14 529.27 1,452.41<br />

HYDEN DONNA J 2009-10 918.69 379.72 1,298.41<br />

R501499 11-10-05-00-01606-00 2010-11 946.58 239.80 1,186.38<br />

280. TWNSHP 11, RNG 10, ACRES 2011-12 972.79 90.80 1,063.59<br />

5.00, MS X# 95094, MF439-0565 TOTALS 3,761.20 1,239.59 5,000.79<br />

48. GRAY ELDON & *2008-09 15.03 8.61 23.64<br />

GRAY NYNA 2009-10 14.99 6.21 21.20<br />

R278933 11-10-07-AD-00501-00 2010-11 15.06 3.81 18.87<br />

203. TWNSHP 11, RNG 10, ACRES 2011-12 15.03 1.41 16.44<br />

0.13, DOC200509350 TOTALS 60.11 20.04 80.15<br />

49. FREDERIC BARBARA A *2008-09 103.27 59.21 162.48<br />

R434500 11-10-08-D0-00900-00 2009-10 106.11 43.85 149.96<br />

203. TWNSHP 11, RNG 10, ACRES 2010-11 109.67 27.79 137.46<br />

0.43, MF293-0657 2011-12 112.69 10.52 123.21<br />

TOTALS 431.74 141.37 573.11<br />

50. HUNT FRANK C & *2008-09 1,269.33 727.36 1,996.69<br />

HUNT NINA 2009-10 362.04 149.64 511.68<br />

R292068 11-10-11-00-00400-00 2010-11 371.73 94.18 465.91<br />

260. TWNSHP 11, RNG 10, ACRES 2011-12 380.79 35.54 416.33<br />

7.68, SENIOR CITIZEN TOTALS 2,383.89 1,006.72 3,390.61<br />

DEFERRAL-CANCELLED, NOT YET PAID,<br />

POTENTIAL ADDITIONAL TAX LIABILITY<br />

DUE TO DISQUALIFIED EXCLUSIVE FARM<br />

USE $688.32, DEED BK 189 PG 386<br />

51. KASPER MICHAEL E JR & *2008-09 1,795.87 1,029.64 2,825.51<br />

KASPER JEANETTE A 2009-10 1,813.96 749.76 2,563.72<br />

R258822 11-10-16-00-01703-00 2010-11 1,871.07 474.00 2,345.07<br />

280. TWNSHP 11, RNG 10, ACRES 2011-12 1,924.75 179.64 2,104.39<br />

2.53, MF340-1454 TOTALS 7,405.65 2,433.04 9,838.69<br />

52. MAYFIELD KENNETH R *2007-08 297.39 212.14 509.53<br />

R56466 11-10-17-BC-04000-00 203. *2008-09 460.39 263.96 724.35<br />

GRAHAM'S 4TH ADDN TO TOLEDO, BLOCK 2009-10 473.11 195.56 668.67<br />

6, LOT 10 & 11, PTNS OF, 2010-11 489.28 123.95 613.23<br />

MF186-2026 2011-12 503.03 46.96 549.99<br />

TOTALS 2,223.20 842.57 3,065.77<br />

53. NEWPORT LODGE NO 85 AF & AM *2008-09 1,100.95 605.72 1,706.67<br />

% MAYES STEVE & 2009-10 1,964.97 812.19 2,777.16<br />

MAYES SHERRIE, CONT 2010-11 2,032.37 514.87 2,547.24<br />

R63530 11-10-17-BC-04400-00 203. 2011-12 2,089.38 195.02 2,284.40<br />

GRAHAM'S 4TH ADDN TO TOLEDO, BLOCK TOTALS 7,187.67 2,127.80 9,315.47<br />

54. PORT OF TOLEDO *2008-09 289.26 160.05 449.31<br />

% MAYES STEVE 2009-10 390.36 161.35 551.71<br />

R523017 11-10-18-A0-00800-00 2010-11 391.75 99.24 490.99<br />

203. TWNSHP 11, RNG 10, TRACT BAY TOTALS 1,071.37 420.64 1,492.01<br />

#1, LEASE ONLY, M-6362<br />

55. OSTLING CHRISTINA LYNN & *2008-09 1,399.17 796.59 2,195.76<br />

KERR HENRIETTA 2009-10 1,565.07 646.88 2,211.95<br />

R99290 11-11-05-DC-10500-00 104. 2010-11 1,614.22 408.94 2,023.16<br />

PHELPS ADDN.-NEWPORT, BLOCK 2, LOT 2011-12 1,656.61 154.61 1,811.22<br />

6 & 7, PTN OF, DOC200904908 TOTALS 6,235.07 2,007.02 8,242.09<br />

56. EAGLES BAY DEVELOPMENT LLC *2008-09 2,750.69 1,577.06 4,327.75<br />

R23854 11-11-08-AC-11100-00 107. 2009-10 2,797.06 1,156.12 3,953.18<br />

NEWPORT, BLOCK 7, LOT 2, 2010-11 2,884.97 730.87 3,615.84<br />

DOC200800577 2011-12 2,960.88 276.36 3,237.24<br />

TOTALS 11,393.60 3,740.41 15,134.01<br />

57. PARKER MIKE THOMAS *2008-09 1,022.04 585.96 1,608.00<br />

R52302 11-11-08-BB-09500-00 107. 2009-10 1,039.24 429.55 1,468.79<br />

STEWARTS BLOCKS (ORIG 5), LOT 4, 2010-11 1,071.81 271.52 1,343.33<br />

MF191-0654 2011-12 1,099.99 102.68 1,202.67<br />

TOTALS 4,233.08 1,389.71 5,622.79<br />

58. CHU DOUGLAS S *2008-09 1,258.22 721.39 1,979.61<br />

R248338 11-11-08-CB-01102-00 2009-10 1,279.34 528.79 1,808.13<br />

104. BAYLEY AND CASE'S THIRD 2010-11 1,197.95 303.48 1,501.43<br />

ADDN., BLOCK 86, LOT 12 E 1/2 OF, 2011-12 1,314.83 122.72 1,437.55<br />

DOC200304421 TOTALS 5,050.34 1,676.38 6,726.72

59. CHU DOUGLAS S *2008-09 610.47 350.01 960.48<br />

R253105 11-11-08-CB-01104-00 2009-10 620.77 256.59 877.36<br />

104. BAYLEY AND CASE'S THIRD 2010-11 640.24 162.20 802.44<br />

ADDN., BLOCK 86, LOT 11, 2011-12 656.99 61.32 718.31<br />

DOC:200304421 TOTALS 2,528.47 830.12 3,358.59<br />

60. MACNAB TIMOTHY P & *2008-09 84.12 48.24 132.36<br />

CATHERINE F 2009-10 86.42 35.73 122.15<br />

R152705 11-11-31-AA-06800-00 2010-11 88.78 22.48 111.26<br />

190. PACIFIC SHORES, BLOCK 5, LOT 2011-12 92.34 8.62 100.96<br />

10, MF334-2301 TOTALS 351.66 115.07 466.73<br />

61. ELLIOTT TERRY R & *2008-09 9.05 4.83 13.88<br />

ELLIOTT PATRICIA 2009-10 1,653.70 683.52 2,337.22<br />

R41457 13-10-28-DA-01600-00 331. 2010-11 1,707.72 432.62 2,140.34<br />

TWNSHP 13, RNG 10, ACRES 1.16, 2011-12 1,758.49 164.14 1,922.63<br />

MF336-2317 TOTALS 5,128.96 1,285.11 6,414.07<br />

62. TRIPP JAMES M JR 2010-11 136.73 34.64 171.37<br />

R473863 13-11-09-00-01000-00 2011-12 140.46 13.10 153.56<br />

300. TWNSHP 13, RNG 11, ACRES TOTALS 277.19 47.74 324.93<br />

1.28, MF200-1558<br />

63. TRIPP JAMES M JR *2008-09 298.06 158.96 457.02<br />

R56256 13-11-09-00-01000-00 332. 2009-10 1,495.78 618.26 2,114.04<br />

TWNSHP 13, RNG 11, ACRES 5.00, 2010-11 1,542.92 390.88 1,933.80<br />

MF200-1558 2011-12 1,500.34 140.03 1,640.37<br />

TOTALS 4,837.10 1,308.13 6,145.23<br />

64. HOCH THOMAS W *2008-09 69.28 39.73 109.01<br />

R507642 13-11-16-00-00202-00 2009-10 69.80 28.84 98.64<br />

300. TWNSHP 13, RNG 11, ACRES 2010-11 71.72 18.15 89.87<br />

0.54, POTENTIAL ADDITIONAL TAX 2011-12 73.55 6.87 80.42<br />

LIABILITY DUE TO DISQUALIFIED TOTALS 284.35 93.59 377.94<br />

EXCLUSIVE FARM USE $63.20,<br />

MF294-2380<br />

65. HOCH THOMAS W *2008-09 824.57 472.77 1,297.34<br />

R90867 13-11-16-00-00202-00 332. 2009-10 832.93 344.28 1,177.21<br />

TWNSHP 13, RNG 11, ACRES 5.00, 2010-11 858.31 217.44 1,075.75<br />

POTENTIAL ADDITIONAL TAX LIABILITY 2011-12 882.13 82.33 964.46<br />

DUE TO DISQUALIFIED EXCLUSIVE FARM TOTALS 3,397.94 1,116.82 4,514.76<br />

USE $3728.28, MF294-2380<br />

66. POWDER CREEK CONSTRUCTION INC *2008-09 65.22 34.98 100.20<br />

R372542 13-11-19-CA-00203-00 2009-10 184.81 76.40 261.21<br />

301. PACIFIC MOBILE ESTATES 2010-11 189.87 48.11 237.98<br />

CONDO, LOT RESERVED TO OWNERS, 2011-12 194.32 18.13 212.45<br />

DOC200518244 TOTALS 634.22 177.62 811.84<br />

67. OPELSKI CHRISTINE WEST *2008-09 2,995.39 1,717.36 4,712.75<br />

R159971 13-11-20-BC-03200-00 2009-10 3,074.06 1,270.60 4,344.66<br />

301. WALDPORT HEIGHTS - FIRST 2010-11 3,159.42 800.39 3,959.81<br />

ADDN., LOT 3, DOC200801985 2011-12 3,234.28 301.87 3,536.15<br />

TOTALS 12,463.15 4,090.22 16,553.37<br />

68. MAZINGO LINDA J *2008-09 701.33 402.11 1,103.44<br />

R339747 13-11-20-DD-03000-00 2009-10 719.47 297.37 1,016.84<br />

331. TWNSHP 13, RNG 11, ACRES 2010-11 742.86 188.20 931.06<br />

0.27, UNTITLED MANUFACTURED 2011-12 764.90 71.40 836.30<br />

STRUCTURE, DOC200807041 TOTALS 2,928.56 959.08 3,887.64<br />

69. INGLIMA NATHAN P & *2008-09 857.62 491.69 1,349.31<br />

INGLIMA DANNELLA J 2009-10 838.24 346.47 1,184.71<br />

R478806 13-11-27-B0-01800-00 2010-11 760.93 192.76 953.69<br />

331. TWNSHP 13, RNG 11, ACRES 2011-12 671.17 62.64 733.81<br />

1.00, DOC200609826 TOTALS 3,127.96 1,093.56 4,221.52<br />

70. APAU RICHARD K & *2008-09 223.90 120.65 344.55<br />

APAU LISA MARIE 2009-10 593.65 245.38 839.03<br />

R507253 13-11-30-BB-10500-00 2010-11 610.02 154.52 764.54<br />

301. FOREST HILLS, LOT 35, ACRES 2011-12 624.40 58.29 682.69<br />

0.35, DOC200704362 TOTALS 2,051.97 578.84 2,630.81<br />

71. APAU RICHARD K & *2008-09 161.06 85.89 246.95<br />

APAU LISA MARIE 2009-10 529.44 218.83 748.27<br />

R507254 13-11-30-BB-10600-00 2010-11 544.05 137.84 681.89<br />

301. FOREST HILLS, LOT 36, ACRES 2011-12 457.93 42.75 500.68<br />

0.27, DOC200704362 TOTALS 1,692.48 485.31 2,177.79<br />

72. BUNDY CAREY *2008-09 30.22 17.33 47.55<br />

R524047 13-12-36-AB-00198-00 2009-10 28.39 11.73 40.12<br />

341. TWNSHP 13, RNG 12, ACRES 2010-11 28.51 7.23 35.74<br />

0.05, POTENTIAL ADDITIONAL TAX 2011-12 28.57 2.67 31.24<br />

LIABILITY, DOC200508933 TOTALS 115.69 38.96 154.65<br />

73. RAGSDALE CHARLES R *2008-09 306.60 167.70 474.30<br />

R521169 13-12-36-AC-03401-00 2009-10 623.65 257.77 881.42<br />

380. TWNSHP 13, RNG 12, ACRES 2010-11 643.93 163.12 807.05<br />

0.31, DOC200518146 LESS 2011-12 663.06 61.89 724.95<br />

DOC200520297 TOTALS 2,237.24 650.48 2,887.72<br />

74. WINGS AIRLINE SERVICES INC *2008-09 275.18 157.78 432.96<br />

R480666 13-12-36-CD-03600-00 2009-10 282.27 116.67 398.94<br />

380. WAKEETUM GREEN NO. 1, BLOCK 2010-11 291.38 73.81 365.19<br />

1, LOT 4, MF196-1113 2011-12 299.97 27.99 327.96<br />

TOTALS 1,148.80 376.25 1,525.05<br />

75. WINGS AIRLINE SERVICES INC *2008-09 306.42 175.68 482.10<br />

R10266 13-12-36-CD-03700-00 380. 2009-10 314.34 129.94 444.28<br />

WAKEETUM GREEN NO. 1, BLOCK 1, LOT 2010-11 324.48 82.21 406.69<br />

5, DOC200804633 2011-12 334.09 31.18 365.27<br />

TOTALS 1,279.33 419.01 1,698.34<br />

76. WHITE CROSS CORP & *2008-09 20.59 10.99 31.58<br />

MANNING JIM L & 2009-10 2,470.83 1,021.28 3,492.11<br />

MANNING ROSALEE 2010-11 2,231.46 565.31 2,796.77<br />

R72254 13-12-36-DB-02800-00 380. 2011-12 2,016.67 188.23 2,204.90<br />

TWNSHP 13, RNG 12, ACRES 0.55, TOTALS 6,739.55 1,785.81 8,525.36<br />

DOC200705074<br />

77. SUNDERMAN PEARL A TRUSTEE *2008-09 581.01 319.18 900.19<br />

R520535 14-12-26-BC-06900-00 2009-10 1,048.39 433.34 1,481.73<br />

327. BLACK STONE, LOT 17, ACRES 2010-11 1,083.11 274.39 1,357.50<br />

0.28, DOC201004180 2011-12 1,107.87 103.40 1,211.27<br />

TOTALS 3,820.38 1,130.31 4,950.69<br />

PLEASE NOTE<br />

Amounts do not include interest from 09/17/12 to the date of payment.<br />

Contact the <strong>tax</strong> office for the correct interest figures.<br />

All payments must be in the form of certified funds; cash,<br />

money order, cashier’s check, or online credit cards only.<br />

Personal checks will be returned as if not received.<br />

Please make remittance to:<br />

<strong>LINCOLN</strong> <strong>COUNTY</strong> TAX COLLECTOR<br />

225 WEST OLIVE STREET, ROOM 205<br />

NEWPORT, OREGON 97365<br />

PAY ONLINE: www.co.lincoln.or.us<br />

For information, phone (541) 265-4139<br />

Business hours are from 8:30 a.m. to 5:00 p.m.<br />

A publication fee of 5% of all <strong>tax</strong>es and interest will be<br />

added to the total <strong>tax</strong> and interest due. All <strong>tax</strong>es due for the<br />

years prior to 2008-09, plus additional fees, must be received<br />

by the <strong>tax</strong> office for exclusion from judgment.