Retirement Questionnaire - Hilliard Lyons

Retirement Questionnaire - Hilliard Lyons

Retirement Questionnaire - Hilliard Lyons

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

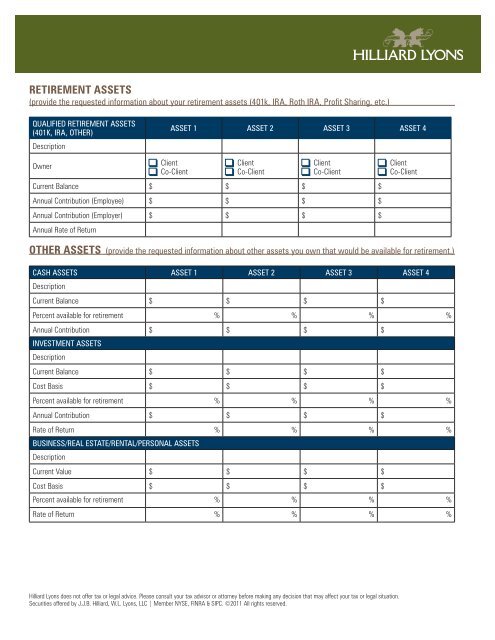

RETIREMENT ASSETS<br />

(provide the requested information about your retirement assets (401k, IRA, Roth IRA, Profit Sharing, etc.)<br />

QUALIFIED RETIREMENT ASSETS<br />

(401K, IRA, OTHER)<br />

Description<br />

Owner<br />

ASSET 1 ASSET 2 ASSET 3 ASSET 4<br />

Client<br />

Co-Client<br />

Client<br />

Co-Client<br />

Client<br />

Co-Client<br />

Current Balance $ $ $ $<br />

Annual Contribution (Employee) $ $ $ $<br />

Annual Contribution (Employer)<br />

Annual Rate of Return<br />

$ $ $ $<br />

Client<br />

Co-Client<br />

OTHER ASSETS (provide the requested information about other assets you own that would be available for retirement.)<br />

CASH ASSETS<br />

Description<br />

ASSET 1 ASSET 2 ASSET 3 ASSET 4<br />

Current Balance $ $ $ $<br />

Percent available for retirement % % % %<br />

Annual Contribution<br />

INVESTMENT ASSETS<br />

Description<br />

$ $ $ $<br />

Current Balance $ $ $ $<br />

Cost Basis $ $ $ $<br />

Percent available for retirement % % % %<br />

Annual Contribution $ $ $ $<br />

Rate of Return<br />

BUSINESS/REAL ESTATE/RENTAL/PERSONAL ASSETS<br />

Description<br />

% % % %<br />

Current Value $ $ $ $<br />

Cost Basis $ $ $ $<br />

Percent available for retirement % % % %<br />

Rate of Return % % % %<br />

<strong>Hilliard</strong> <strong>Lyons</strong> does not offer tax or legal advice. Please consult your tax advisor or attorney before making any decision that may affect your tax or legal situation.<br />

Securities offered by J.J.B. <strong>Hilliard</strong>, W.L. <strong>Lyons</strong>, LLC | Member NYSE, FINRA & SIPC. ©2011 All rights reserved.