the business link niagara niagara's business newspaper

the business link niagara niagara's business newspaper

the business link niagara niagara's business newspaper

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

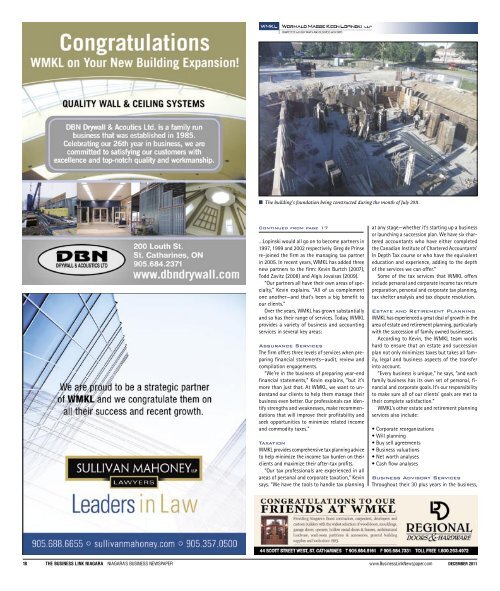

The building’s foundation being constructed during <strong>the</strong> month of July 2011.<br />

Continued from page 17<br />

…Lopinski would all go on to become partners in<br />

1997, 1999 and 2002 respectively. Greg de Prinse<br />

re-joined <strong>the</strong> firm as <strong>the</strong> managing tax partner<br />

in 2005. In recent years, WMKL has added three<br />

new partners to <strong>the</strong> firm: Kevin Burtch (2007),<br />

Todd Zavitz (2008) and Algis Jovaisas (2009).<br />

“Our partners all have <strong>the</strong>ir own areas of specialty,”<br />

Kevin explains. “All of us complement<br />

one ano<strong>the</strong>r—and that’s been a big benefit to<br />

our clients.”<br />

Over <strong>the</strong> years, WMKL has grown substantially<br />

and so has <strong>the</strong>ir range of services. Today, WMKL<br />

provides a variety of <strong>business</strong> and accounting<br />

services in several key areas:<br />

Assurance Services<br />

The firm offers three levels of services when preparing<br />

financial statements—audit, review and<br />

compilation engagements.<br />

“We’re in <strong>the</strong> <strong>business</strong> of preparing year-end<br />

financial statements,” Kevin explains, “but it’s<br />

more than just that. At WMKL, we want to understand<br />

our clients to help <strong>the</strong>m manage <strong>the</strong>ir<br />

<strong>business</strong> even better. Our professionals can identify<br />

strengths and weaknesses, make recommendations<br />

that will improve <strong>the</strong>ir profitability and<br />

seek opportunities to minimize related income<br />

and commodity taxes.”<br />

Taxation<br />

WMKL provides comprehensive tax planning advice<br />

to help minimize <strong>the</strong> income tax burden on <strong>the</strong>ir<br />

clients and maximize <strong>the</strong>ir after-tax profits.<br />

“Our tax professionals are experienced in all<br />

areas of personal and corporate taxation,” Kevin<br />

says. “We have <strong>the</strong> tools to handle tax planning<br />

at any stage—whe<strong>the</strong>r it’s starting up a <strong>business</strong><br />

or launching a succession plan. We have six chartered<br />

accountants who have ei<strong>the</strong>r completed<br />

<strong>the</strong> Canadian Institute of Chartered Accountants’<br />

In Depth Tax course or who have <strong>the</strong> equivalent<br />

education and experience, adding to <strong>the</strong> depth<br />

of <strong>the</strong> services we can offer.”<br />

Some of <strong>the</strong> tax services that WMKL offers<br />

include personal and corporate income tax return<br />

preparation, personal and corporate tax planning,<br />

tax shelter analysis and tax dispute resolution.<br />

Estate and Retirement Planning<br />

WMKL has experienced a great deal of growth in <strong>the</strong><br />

area of estate and retirement planning, particularly<br />

with <strong>the</strong> succession of family owned <strong>business</strong>es.<br />

According to Kevin, <strong>the</strong> WMKL team works<br />

hard to ensure that an estate and succession<br />

plan not only minimizes taxes but takes all family,<br />

legal and <strong>business</strong> aspects of <strong>the</strong> transfer<br />

into account.<br />

“Every <strong>business</strong> is unique,” he says, “and each<br />

family <strong>business</strong> has its own set of personal, financial<br />

and corporate goals. It’s our responsibility<br />

to make sure all of our clients’ goals are met to<br />

<strong>the</strong>ir complete satisfaction.”<br />

WMKL’s o<strong>the</strong>r estate and retirement planning<br />

services also include:<br />

• Corporate reorganizations<br />

• Will planning<br />

• Buy sell agreements<br />

• Business valuations<br />

• Net worth analyses<br />

• Cash flow analyses<br />

Business Advisory Services<br />

Throughout <strong>the</strong>ir 30 plus years in <strong>the</strong> <strong>business</strong>,<br />

18 THE BUSINESS LINK NIAGARA NIAGARA’S BUSINESS NEWSPAPER www.BusinessLinkNewspaper.com DECEMBER 2011