Managing - Federated Press

Managing - Federated Press

Managing - Federated Press

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Two-Day Event!<br />

rd<br />

3<br />

<strong>Managing</strong><br />

a<br />

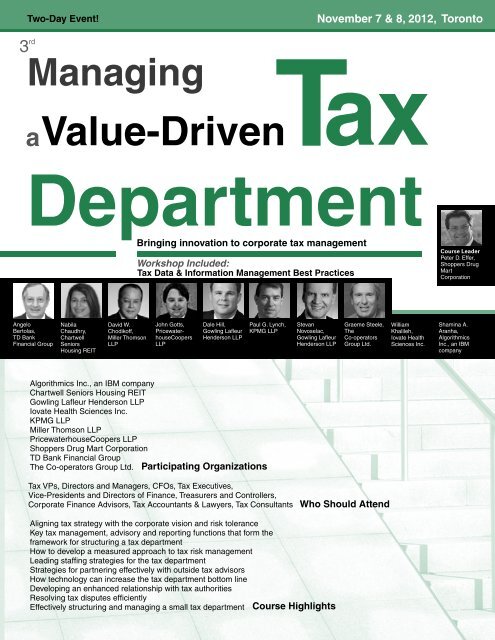

Angelo<br />

Bertolas,<br />

TD Bank<br />

Financial Group<br />

Value-Driven<br />

Nabila<br />

Chaudhry,<br />

Chartwell<br />

Seniors<br />

Housing REIT<br />

David W.<br />

Chodikoff,<br />

Miller Thomson<br />

LLP<br />

John Gotts,<br />

PricewaterhouseCoopers<br />

LLP<br />

Dale Hill,<br />

Gowling Lafleur<br />

Henderson LLP<br />

Paul G. Lynch,<br />

KPMG LLP<br />

Algorithmics Inc., an IBM company<br />

Chartwell Seniors Housing REIT<br />

Gowling Lafleur Henderson LLP<br />

Iovate Health Sciences Inc.<br />

KPMG LLP<br />

Miller Thomson LLP<br />

PricewaterhouseCoopers LLP<br />

Shoppers Drug Mart Corporation<br />

TD Bank Financial Group<br />

The Co-operators Group Ltd. Participating Organizations<br />

T<br />

Department<br />

Bringing innovation to corporate tax management<br />

Workshop Included:<br />

Tax Data & Information Management Best Practices<br />

Stevan<br />

Novoselac,<br />

Gowling Lafleur<br />

Henderson LLP<br />

Tax VPs, Directors and Managers, CFOs, Tax Executives,<br />

Vice-Presidents and Directors of Finance, Treasurers and Controllers,<br />

Corporate Finance Advisors, Tax Accountants & Lawyers, Tax Consultants Who Should Attend<br />

Aligning tax strategy with the corporate vision and risk tolerance<br />

Key tax management, advisory and reporting functions that form the<br />

framework for structuring a tax department<br />

How to develop a measured approach to tax risk management<br />

Leading staffing strategies for the tax department<br />

Strategies for partnering effectively with outside tax advisors<br />

How technology can increase the tax department bottom line<br />

Developing an enhanced relationship with tax authorities<br />

Resolving tax disputes efficiently<br />

Effectively structuring and managing a small tax department Course Highlights<br />

November 7 & 8, 2012, Toronto<br />

ax<br />

Graeme Steele,<br />

The<br />

Co-operators<br />

Group Ltd.<br />

William<br />

Khalileh,<br />

Iovate Health<br />

Sciences Inc.<br />

Course Leader<br />

Peter D. Effer,<br />

Shoppers Drug<br />

Mart<br />

Corporation<br />

Shamina A.<br />

Aranha,<br />

Algorithmics<br />

Inc., an IBM<br />

company

FACULTY<br />

COURSE LEADER<br />

PETER D. EFFER<br />

Peter D. Effer is Vice President, Taxation,<br />

with Shoppers Drug Mart Inc.<br />

CO-LECTURERS<br />

SHAMINA A. ARANHA<br />

Shamina A. Aranha is Director Tax and Treasury<br />

at Algorithmics Inc.<br />

ANGELO BERTOLAS<br />

Angelo Bertolas is Vice President Canadian<br />

Tax at TD Bank Group based in Toronto<br />

were he is responsible for Canadian Tax<br />

Compliance, Global Tax Governance and<br />

Tax Authority Relations.<br />

NABILA CHAUDHRY<br />

Nabila Chaudhry is the Director, Taxation<br />

with Chartwell Seniors Housing REIT.<br />

COURSE PROGRAM<br />

THE ROLE OF THE CFO<br />

Since typical CFOs in today’s corporate environment get mired with<br />

much more than the traditional accounting and financial responsibilities,<br />

to what extent should they really get involved with the tax<br />

department? And what should the CFO really expect from the tax<br />

group? This discussion will address those questions and other issues.<br />

• Aligning tax strategy with the corporate vision and risk tolerance<br />

• Getting the tax department involved on various projects from the<br />

get-go<br />

• Supporting the tax function and tax lead projects<br />

• Discussing the type of communication between the tax function<br />

and CFO<br />

SUPPLEMENTARY COURSE MATERIAL<br />

DAVID W. CHODIKOFF<br />

David W. Chodikoff is a tax partner with the<br />

national law firm of Miller Thomson LLP. He<br />

spent nearly 16 years as a Department of Justice<br />

tax counsel and specializes in tax litigation<br />

and international dispute resolution.<br />

JOHN GOTTS<br />

John Gotts, Tax Partner with PricewaterhouseCoopers<br />

LLP, is the Canadian Leader<br />

of PwC’s Tax Management and Accounting<br />

Services practice. He works with clients to optimize<br />

the operational effectiveness of their tax<br />

department by maximizing the effectiveness of<br />

their people, processes and technology.<br />

DALE HILL<br />

Dale Hill is a partner in Gowlings’ Ottawa<br />

office and is the national leader of the Gowlings<br />

Transfer Pricing and Competent Authority<br />

team.<br />

STRUCTURING THE TAX DEPARTMENT<br />

WILLIAM KHALILEH<br />

William Khalileh is the Associate Director, Tax,<br />

with the Iovate Health Sciences Inc.<br />

PAUL G. LYNCH<br />

Paul Lynch is a tax partner with KPMG LLP<br />

and the national leader of the firm’s Tax Dispute<br />

Resolution & Controversy practice. His<br />

focus is on helping taxpayers prevent, negotiate,<br />

manage and resolve disputes with the tax<br />

authorities.<br />

STEVAN NOVOSELAC<br />

Stevan Novoselac is a Partner with Gowling<br />

Lafleur Henderson LLP, joining in 2006 to<br />

become head of the Tax Dispute Resolution<br />

practice as part of the Tax National Practice<br />

Group.<br />

GRAEME STEELE<br />

Graeme Steele is Vice President, Taxation at<br />

the Co-Operators Group Ltd.<br />

In effectively structuring the tax department, the goal should be to<br />

increase efficiency and cost-effectiveness while continuing to deliver<br />

value to the organization. This discussion details the key tax management,<br />

tax advisory and tax reporting functions that form the framework<br />

for structuring a tax department.<br />

• Creating operational efficiencies with clearly defined goals and<br />

objectives<br />

• Developing integrated processes to enable effective day-to-day<br />

operations<br />

• Effective corporate oversight<br />

• The role of technology<br />

• When to consider outsourcing or offshoring<br />

<strong>Federated</strong> <strong>Press</strong> is now providing delegates with access to an innovative new database containing at least 25 interactive multimedia presentations by<br />

leading experts and approximately 20 hours of lectures on the topics covered by this course, including all slides and speakers’ papers. See the list of<br />

presentations on page 4.<br />

Delegates will also receive a trial subscription to the Tax Channel, a much broader resource representing hundreds of hours of interactive multimedia<br />

lectures on leading edge Tax topics as delivered at our many recent Tax conferences and courses.

COURSE PROGRAM<br />

TAX RISK MANAGEMENT<br />

The changing regulatory landscape and shifting business environments<br />

mean that tax departments face a greater risk of being noncompliant<br />

with tax laws and regulations, and are more apt to enter<br />

into disputes with tax authorities. This session will explore how to develop<br />

a measured and methodical approach to tax risk management.<br />

• <strong>Managing</strong> increasingly complex tax laws and regulations<br />

• Dealing with resource shortages and technology constraints<br />

• Improving processes and controls to achieve greater compliance<br />

• Designing, testing and implementing effective internal controls<br />

• How to avoid and resolve potential disputes with tax authorities<br />

STAFFING STRATEGIES OF A COST EFFECTIVE TAX<br />

OPERATION<br />

Strategic staffing for the tax department can allow organizations to<br />

more closely monitor their staff size and costs in order to produce<br />

greater efficiencies. This session will look at leading staffing strategies<br />

for the tax department to ensure the hiring and retaining of<br />

quality people.<br />

• Using flexible staffing to react to increased or unexpected work<br />

loads<br />

• Latest tools for addressing tax staffing<br />

• Key staffing and training considerations<br />

• Motivating and developing staff<br />

• Methods of identifying and attracting experienced and talented tax<br />

professionals<br />

PARTNERING WITH OUTSIDE TAX ADVISORS<br />

The benefits of selective outsourcing, or co-sourcing of the tax<br />

compliance activities include a higher ROI in the tax function, freedom<br />

from day-to-day compliance concerns, more time for planning,<br />

exposure to the latest technology and a more accurate and timely<br />

compliance delivery. This discussion will address strategies for partnering<br />

effectively with outside tax advisors.<br />

• Outsourcing vs. co-sourcing vs. advising<br />

• How to effectively partner with your advisors<br />

• How to select advisors and getting value for your fees<br />

• Comparing in-house functions vs. outside partners’ role<br />

• Differences between law firms and accounting firms<br />

USING TECHNOLOGY TO INCREASE YOUR BOTTOM LINE<br />

The role of technology has been growing more important in the tax<br />

function and, as such, tax executives should be strategically involved<br />

with major business IT initiatives. This session will examine the role<br />

of tax executives during planning for IT initiatives and how technology<br />

can increase the tax department bottom line.<br />

• Achieving saving through improved use of technology<br />

• IT transformation and the role of the tax executive<br />

• Ensuring that IT systems capture all tax data requirements<br />

• Guarding against lack of appropriate data<br />

• Building the tax technology business case<br />

TAX MANAGEMENT & PLANNING: TAX PROCESS<br />

IMPROVEMENT<br />

Transforming the tax group from a staff/compliance function to a full<br />

member of the senior executive team, requires the senior tax executive<br />

to effectively communicate with the tax group and gain their full<br />

support for making a change. Articulating the objective with senior<br />

management is the next step. Find out how to go about rebuilding<br />

and expanding the tax function to meet new market demands.<br />

• Structuring and implementing the tax function<br />

• Hiring, retaining and motivating tax professionals<br />

• Marketing the tax function<br />

• Setting departmental objectives<br />

DEVELOPING AN EFFICIENT AND TRANSPARENT<br />

RELATIONSHIP WITH TAX AUTHORITIES AT TD BANK<br />

Tax transparency in dealing with tax authorities is an issue that will continue<br />

to grow in importance. This session will explore how to develop<br />

and maintain an enhanced relationship with tax authorities in order to<br />

minimize future difficulties.<br />

• Identifying and meeting tax compliance requirements of tax<br />

authorities<br />

• Identifying, managing and mitigating compliance risk<br />

• How transparency with the tax authorities helps in dispute resolution<br />

• Practical advice from the TD Bank on how to maintain transparency<br />

RESOLVING TAX DISPUTES EFFICIENTLY<br />

Knowing how to approach the tax authorities’ different bureaucratic<br />

levels helps resolve tax disputes efficiently and cost effectively. How<br />

should your tax department prepare for an audit? What is the auditor<br />

trying to achieve? This discussion will examine how to effectively deal<br />

with tax disputes at every stage of the process.<br />

• How is an audit protocol negotiated?<br />

• Once an assessment is raised, how is an appeals officer<br />

approached?<br />

• Approaching the government lawyer once the assessment is<br />

confirmed<br />

• Best negotiation strategies for various government officials<br />

EFFECTIVELY STRUCTURING AND MANAGING A SMALL<br />

TAX DEPARTMENT<br />

Tax executives from smaller tax departments are being asked to deliver<br />

greater value on limited resources. When faced with the reality of<br />

budget constraints and a shortage of skilled talent, success becomes<br />

dependent on the ability to structure tax departments and organize<br />

resources to deliver value. This session will examine methods for successfully<br />

structuring and managing small tax departments.<br />

• Essential skills required for tax management in smaller departments<br />

• Achieving more with limited resources: structure and staffing issues<br />

• Creating value through streamlining and reducing costs<br />

• How to use technology to leverage limited resources<br />

• Evaluating your resource needs<br />

WORKSHOP<br />

TAX DATA & INFORMATION MANAGEMENT BEST<br />

PRACTICES<br />

To achieve greater efficiency, tax departments need to focus on reducing<br />

the time spent collecting and manipulating data for tax accounting<br />

and reporting purposes. As well, they must ensure that data management<br />

practices support compliance with respect to tax compliance.<br />

This workshop will examine best practices for tax data management.<br />

• Avoiding running afoul with tax authorities over inadequate records<br />

• Designing and implementing tax-specific ERP applications<br />

• Implementing effective tax record storage and recovery processes<br />

• Meeting tax authority record storage requirements

MULTIMEDIA<br />

Your registration includes an interactive multimedia database comprising the following presentations from recent <strong>Federated</strong> <strong>Press</strong> courses and conferences.<br />

They are presented in their entirety with complete audio or video and accompanying slides. You may also purchase the multimedia proceedings of the<br />

course which will be available on CD-ROM 60 days after the course.<br />

Raising the Visibility & Effectiveness of the<br />

Tax Department/ Tax Management &<br />

Planning/ Best Practices of Highly Effective<br />

Tax Departments<br />

John Giakoumakis<br />

Barrick Gold Corporation<br />

Transfer Pricing & Real Profits<br />

David Hogan<br />

Fuji Photo<br />

Reengineering the Tax Department<br />

John Giakoumakis<br />

Barrick Gold Corporation<br />

Partnering with Outside Tax Advisors<br />

Paula Moore<br />

Cott Corporation<br />

Creating a Value-Driven Tax Function<br />

Brad Rowse<br />

Bank of Nova Scotia<br />

Raising the Visibility & Effectiveness of<br />

the Tax Department / Tax Management and<br />

Planning<br />

John Giakoumakis<br />

Barrick Gold Corporation<br />

Best Practices of Highly Effective Tax<br />

Departments / Creating a Value Driven Tax<br />

Function<br />

John Giakoumakis<br />

Barrick Gold Corporation<br />

Partnering With Outside Tax Advisors<br />

Peter Effer<br />

Shoppers Drug Mart Corporation<br />

Dealing With CRA<br />

Ralph T. Neville<br />

BDO Dunwoody LLP<br />

Transfer Pricing From a CFO’s Perspective<br />

Martin Przysuski<br />

BDO Dunwoody LLP<br />

Tax Effective Supply Chain Management<br />

Kenneth R. Turko<br />

CCL Industries Inc.<br />

Reengineering the Tax Department<br />

Kenneth R. Turko<br />

CCL Industries Inc.<br />

Corporate Tax Fundamentals<br />

Salvador M. Borraccia<br />

Baker & McKenzie LLP<br />

Reportable Transactions and Aggressive Tax<br />

Planning<br />

John Sorensen<br />

Gowlings<br />

Tax Executive’s Perspective: A Panel<br />

Discussion<br />

Pierre Bocti<br />

Hewlett-Packard (Canada) Co.<br />

<strong>Managing</strong> Risks in a Tax Audits<br />

David C. Nathanson, Q.C.<br />

Davis LLP<br />

<strong>Managing</strong> Tax Audits: Key Issues<br />

John Giakoumakis<br />

Barrick Gold Corporation<br />

Registration: To reserve your place, call <strong>Federated</strong> <strong>Press</strong> toll-free at 1-800-363-0722.<br />

In Toronto, call (416) 665-6868 or fax to (416) 665-7733. Then mail your payment along with the<br />

registration form. Places are limited. Your reservation will be confirmed before the course.<br />

Location: Novotel Toronto Centre Hotel, 45 The Esplanade, Toronto, ON, M5E 1W2<br />

Conditions: Registration covers attendance for one person, the supplementary course material<br />

as described in this document, lunch on both days, morning coffee on both days and<br />

refreshments during all breaks. The proceedings of the course will be captured on audio or<br />

video. Multimedia proceedings with all slides and handouts can be purchased separately on a<br />

CD-ROM which will also include the course material.<br />

Time: This course is a two-day event. Registration begins at 8:00 a.m. The morning sessions<br />

start promptly at 9:00. The second day ends at 4:00 p.m.<br />

TO REGISTER FOR MANAGING A VALUE-DRIVEN TAX DEPARTMENT<br />

Name<br />

Title Department<br />

Approving Manager Name<br />

Approving Manager Title<br />

Organization<br />

Address<br />

City Province Postal Code<br />

Telephone Fax e-mail<br />

Please bill my credit card: AMEX VISA Mastercard<br />

# Expiration date:<br />

Signature :<br />

Payment enclosed: Please invoice. PO Number:<br />

WHEN CALLING, PLEASE MENTION PRIORITY CODE:<br />

MVDT1211/E<br />

MAIL COMPLETED FORM WITH PAYMENT TO:<br />

<strong>Federated</strong> <strong>Press</strong> P.O. Box 4005, Station “A”<br />

Toronto, Ontario M5W 2Z8<br />

Preparing for a Tax Audit: The Role of Counsel<br />

Clifford L. Rand<br />

Stikeman Elliott LLP<br />

<strong>Managing</strong> a Tax Audit: The Tax Director’s Role<br />

Pierre Bocti<br />

Hewlett-Packard (Canada) Co.<br />

Workshop: Tax Litigation -- Best Practices<br />

Before the Court<br />

David W. Chodikoff<br />

Miller Thomson LLP<br />

<strong>Managing</strong> Risks: A Practical Perspective<br />

Linda Spencer<br />

Symcor Inc.<br />

Solving Non-Compliance Through Voluntary<br />

Disclosure<br />

Stevan Novoselac<br />

Gowlings<br />

Assessments, Objections & the Appeals<br />

Process<br />

Michele Anderson<br />

Couzin Taylor LLP / Ernst & Young LLP<br />

Dealing with Foreign-Based Information<br />

Requests<br />

Salvador M. Borraccia<br />

Baker & McKenzie LLP<br />

<strong>Managing</strong> Transfer Pricing Audits<br />

Andrew Kingissepp<br />

Osler, Hoskin & Harcourt LLP<br />

Cancellation: Please note that non-attendance at the course does not entitle the registrant<br />

to a refund. In the event that a registrant becomes unable to attend following the deadline for<br />

cancellation, a substitute attendee may be delegated. Please notify <strong>Federated</strong> <strong>Press</strong> of any<br />

changes as soon as possible. <strong>Federated</strong> <strong>Press</strong> assumes no liability for changes in program content<br />

or speakers. A full refund of the attendance fee will be provided upon cancellation in writing<br />

received prior to October 24, 2012. No refunds will be issued after this date<br />

Discounts: <strong>Federated</strong> <strong>Press</strong> has special team discounts. Groups of 3 or more from the same<br />

organization receive 15%. For larger groups please call.<br />

Payment must be received prior to October 31, 2012<br />

Phone: 1-800-363-0722 Toronto: (416) 665-6868 Fax: (416) 665-7733<br />

/<br />

REGISTRATION COSTS<br />

NUMBER OF PARTICIPANTS:<br />

COURSE: $1975<br />

COURSE + PROCEEDINGS CD-ROM:<br />

$1975 + $175 = $ 2150<br />

PROCEEDINGS CD-ROM: $599<br />

NOTE: Please add 13% HST to all prices.<br />

Proceedings CD-ROM will be available 60 days<br />

after the course takes place<br />

Enclose your cheque payable to<br />

<strong>Federated</strong> <strong>Press</strong> in the amount of:<br />

GST Reg. # R101755163<br />

PBN#101755163PG0001<br />

For additional delegates please duplicate this form<br />

and follow the normal registration process