Fair value reporting for investment properties under US GAAP

Fair value reporting for investment properties under US GAAP

Fair value reporting for investment properties under US GAAP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

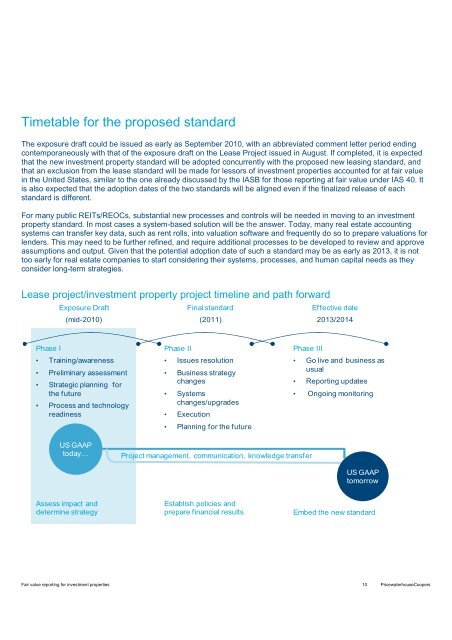

Timetable <strong>for</strong> the proposed standard<br />

The exposure draft could be issued as early as September 2010, with an abbreviated comment letter period ending<br />

contemporaneously with that of the exposure draft on the Lease Project issued in August. If completed, it is expected<br />

that the new <strong>investment</strong> property standard will be adopted concurrently with the proposed new leasing standard, and<br />

that an exclusion from the lease standard will be made <strong>for</strong> lessors of <strong>investment</strong> <strong>properties</strong> accounted <strong>for</strong> at fair <strong>value</strong><br />

in the United States, similar to the one already discussed by the IASB <strong>for</strong> those <strong>reporting</strong> at fair <strong>value</strong> <strong>under</strong> IAS 40. It<br />

is also expected that the adoption dates of the two standards will be aligned even if the finalized release of each<br />

standard is different.<br />

For many public REITs/REOCs, substantial new processes and controls will be needed in moving to an <strong>investment</strong><br />

property standard. In most cases a system-based solution will be the answer. Today, many real estate accounting<br />

systems can transfer key data, such as rent rolls, into valuation software and frequently do so to prepare valuations <strong>for</strong><br />

lenders. This may need to be further refined, and require additional processes to be developed to review and approve<br />

assumptions and output. Given that the potential adoption date of such a standard may be as early as 2013, it is not<br />

too early <strong>for</strong> real estate companies to start considering their systems, processes, and human capital needs as they<br />

consider long-term strategies.<br />

Lease project/<strong>investment</strong> property project timeline and path <strong>for</strong>ward<br />

Phase I<br />

Exposure Draft<br />

(mid-2010)<br />

• Training/awareness<br />

• Preliminary assessment<br />

• Strategic planning <strong>for</strong><br />

the future<br />

• Process and technology<br />

readiness<br />

<strong>US</strong> <strong>GAAP</strong><br />

today…<br />

Assess impact and<br />

determine strategy<br />

Phase II<br />

Final standard<br />

• Issues resolution<br />

• Business strategy<br />

changes<br />

• Systems<br />

changes/upgrades<br />

• Execution<br />

(2011)<br />

• Planning <strong>for</strong> the future<br />

<strong>Fair</strong> <strong>value</strong> <strong>reporting</strong> <strong>for</strong> <strong>investment</strong> <strong>properties</strong> 10 PricewaterhouseCoopers<br />

Phase III<br />

Project management, communication, knowledge transfer<br />

Effective date<br />

2013/2014<br />

• Go live and business as<br />

usual<br />

• Reporting updates<br />

• Ongoing monitoring<br />

<strong>US</strong> <strong>GAAP</strong><br />

tomorrow<br />

Establish policies and<br />

prepare financial results Embed the new standard