UNPAIDS FLATHEAD COUNTY LAND INFORMATION SYSTEM 07 ...

UNPAIDS FLATHEAD COUNTY LAND INFORMATION SYSTEM 07 ...

UNPAIDS FLATHEAD COUNTY LAND INFORMATION SYSTEM 07 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

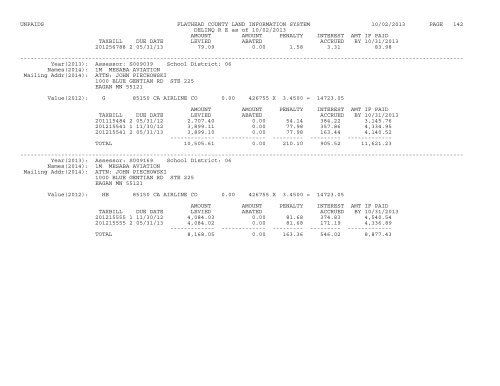

<strong>UNPAIDS</strong> <strong>FLATHEAD</strong> <strong>COUNTY</strong> <strong>LAND</strong> <strong>INFORMATION</strong> <strong>SYSTEM</strong> 10/02/2013 PAGE 142<br />

DELINQ R E as of 10/02/2013<br />

AMOUNT AMOUNT PENALTY INTEREST AMT IF PAID<br />

TAXBILL DUE DATE LEVIED ABATED ACCRUED BY 10/31/2013<br />

201256788 2 05/31/13 79.09 0.00 1.58 3.31 83.98<br />

----------------------------------------------------------------------------------------------------------------------------------<br />

Year(2013): Assessor: S009039 School District: 06<br />

Names(2014): 1M MESABA AVIATION<br />

Mailing Addr(2014): ATTN: JOHN PIECHOWSKI<br />

1000 BLUE GENTIAN RD STE 225<br />

EAGAN MN 55121<br />

Value(2012): G 85150 CA AIRLINE CO 0.00 426755 X 3.4500 = 14723.05<br />

AMOUNT AMOUNT PENALTY INTEREST AMT IF PAID<br />

TAXBILL DUE DATE LEVIED ABATED ACCRUED BY 10/31/2013<br />

201115484 2 05/31/12 2,7<strong>07</strong>.40 0.00 54.14 384.22 3,145.76<br />

201215541 1 11/30/12 3,899.11 0.00 77.98 357.86 4,334.95<br />

201215541 2 05/31/13 3,899.10 0.00 77.98 163.44 4,140.52<br />

------------- ------------- --------- --------- -------------<br />

TOTAL 10,505.61 0.00 210.10 905.52 11,621.23<br />

----------------------------------------------------------------------------------------------------------------------------------<br />

Year(2013): Assessor: S009169 School District: 06<br />

Names(2014): 1M MESABA AVIATION<br />

Mailing Addr(2014): ATTN: JOHN PIECHOWSKI<br />

1000 BLUE GENTIAN RD STE 225<br />

EAGAN MN 55121<br />

Value(2012): HB 85150 CA AIRLINE CO 0.00 426755 X 3.4500 = 14723.05<br />

AMOUNT AMOUNT PENALTY INTEREST AMT IF PAID<br />

TAXBILL DUE DATE LEVIED ABATED ACCRUED BY 10/31/2013<br />

201215555 1 11/30/12 4,084.03 0.00 81.68 374.83 4,540.54<br />

201215555 2 05/31/13 4,084.02 0.00 81.68 171.19 4,336.89<br />

------------- ------------- --------- --------- -------------<br />

TOTAL 8,168.05 0.00 163.36 546.02 8,877.43