USAA Beneficiary Form

USAA Beneficiary Form

USAA Beneficiary Form

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

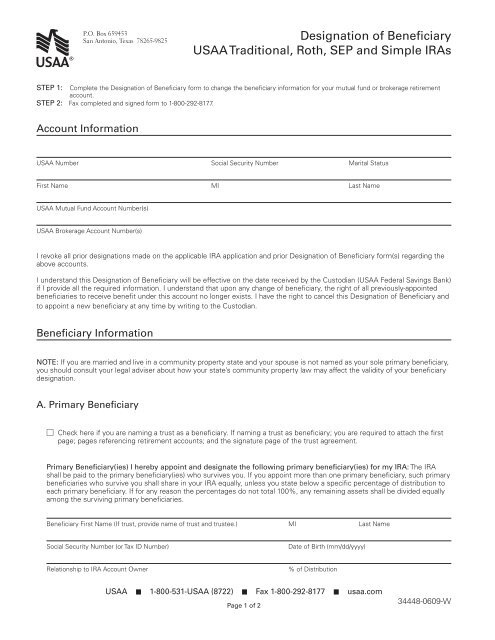

P.O. Box 659453<br />

San Antonio, Texas 78265-9825<br />

Designation of Benefi ciary<br />

<strong>USAA</strong> Traditional, Roth, SEP and Simple IRAs<br />

STEP 1: Complete the Designation of Benefi ciary form to change the benefi ciary information for your mutual fund or brokerage retirement<br />

account.<br />

STEP 2: Fax completed and signed form to 1-800-292-8177.<br />

Account Information<br />

<strong>USAA</strong> Number Social Security Number Marital Status<br />

First Name MI Last Name<br />

<strong>USAA</strong> Mutual Fund Account Number(s)<br />

<strong>USAA</strong> Brokerage Account Number(s)<br />

I revoke all prior designations made on the applicable IRA application and prior Designation of Benefi ciary form(s) regarding the<br />

above accounts.<br />

I understand this Designation of Benefi ciary will be effective on the date received by the Custodian (<strong>USAA</strong> Federal Savings Bank)<br />

if I provide all the required information. I understand that upon any change of benefi ciary, the right of all previously-appointed<br />

benefi ciaries to receive benefi t under this account no longer exists. I have the right to cancel this Designation of Benefi ciary and<br />

to appoint a new benefi ciary at any time by writing to the Custodian.<br />

Benefi ciary Information<br />

NOTE: If you are married and live in a community property state and your spouse is not named as your sole primary benefi ciary,<br />

you should consult your legal adviser about how your state’s community property law may affect the validity of your benefi ciary<br />

designation.<br />

A. Primary Benefi ciary<br />

Check here if you are naming a trust as a benefi ciary. If naming a trust as benefi ciary; you are required to attach the fi rst<br />

page; pages referencing retirement accounts; and the signature page of the trust agreement.<br />

Primary Benefi ciary(ies) I hereby appoint and designate the following primary benefi ciary(ies) for my IRA: The IRA<br />

shall be paid to the primary benefi ciary(ies) who survives you. If you appoint more than one primary benefi ciary, such primary<br />

benefi ciaries who survive you shall share in your IRA equally, unless you state below a specifi c percentage of distribution to<br />

each primary benefi ciary. If for any reason the percentages do not total 100%, any remaining assets shall be divided equally<br />

among the surviving primary benefi ciaries.<br />

Benefi ciary First Name (If trust, provide name of trust and trustee.) MI Last Name<br />

Social Security Number (or Tax ID Number) Date of Birth (mm/dd/yyyy)<br />

Relationship to IRA Account Owner % of Distribution<br />

<strong>USAA</strong> 1-800-531-<strong>USAA</strong> (8722) Fax 1-800-292-8177 usaa.com<br />

Page 1 of 2<br />

34448-0609-W

Address City State Zip Code<br />

First Name MI Last Name<br />

Social Security Number (or Tax ID Number) Date of Birth (mm/dd/yyyy)<br />

Relationship to IRA Account Owner % of Distribution<br />

Address City State Zip Code<br />

Attach an additional sheet of paper if more space is needed.<br />

B. Secondary Benefi ciary<br />

Check here if you are naming a trust as a benefi ciary. If naming a trust as benefi ciary; you are required to attach the fi rst<br />

page; pages referencing retirement accounts; and the signature page of the trust agreement<br />

Secondary (Contingent) Benefi ciary(ies) I hereby appoint and designate the following secondary benefi ciary(ies) for<br />

my IRA: The IRA shall be paid to the secondary benefi ciary(ies) who survive you only if you survive the primary benefi ciary<br />

(or all of the primary benefi ciaries, if you designate multiple primary benefi ciaries). In that event, surviving secondary<br />

benefi ciary(ies) shall share in the IRA assets equally, unless you state below a specifi c percentage of distribution to each<br />

secondary benefi ciary. If for any reason the percentages do not total 100%, any remaining assets shall be divided equally<br />

among the surviving secondary benefi ciaries.<br />

Benefi ciary First Name (If trust, provide name of trust and trustee.) MI Last Name<br />

Social Security Number (or Tax ID Number) Date of Birth (mm/dd/yyyy)<br />

Relationship to IRA Account Owner % of Distribution<br />

Address City State Zip Code<br />

First Name MI Last Name<br />

Social Security Number (or Tax ID Number) Date of Birth (mm/dd/yyyy)<br />

Relationship to IRA Account Owner % of Distribution<br />

Address City State Zip Code<br />

Attach an additional sheet of paper if more space is needed.<br />

Signature<br />

x<br />

Signature of Account Holder Date (mm/dd/yyyy)<br />

Page 2 of 2