Oil Monitor - OilBarrel

Oil Monitor - OilBarrel

Oil Monitor - OilBarrel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Oil</strong> <strong>Monitor</strong><br />

In this edition<br />

Commodities 1<br />

Mediterranean <strong>Oil</strong> & Gas (MOG LN) 4<br />

MEO Australia (MEO AU) 4<br />

San Leon Energy (SLE LN) 4<br />

Global Energy Development (GED LN) 4<br />

Gold <strong>Oil</strong> (GOO LN) 5<br />

Nighthawk Energy (HAWK LN) 5<br />

Ascent Resources (AST LN) 5<br />

Falkland <strong>Oil</strong> & Gas (FOGL LN) 5<br />

Bahamas Petroleum (BPC LN) 6<br />

Jupiter Energy (JPRL LN) 6<br />

Kea Petroleum (KEA LN) 6<br />

Borders & Southern Petroleum (BOR LN) 6<br />

Exploration & Production 8<br />

Exploration 17<br />

Integrated Majors 30<br />

Refiners 32<br />

Disclaimer: Important Information 32<br />

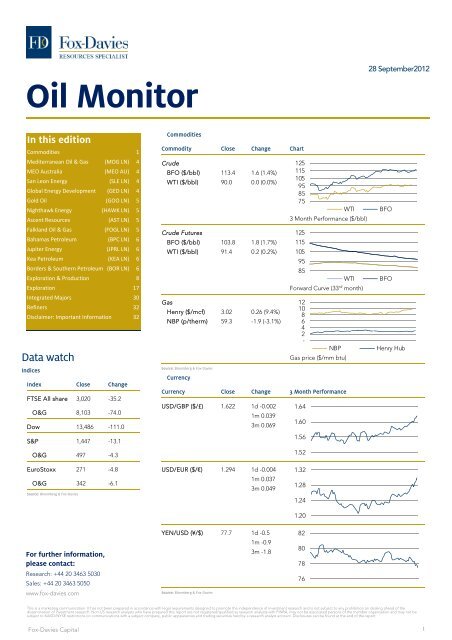

Data watch<br />

Indices<br />

Index Close Change<br />

FTSE All share 3,020 -35.2<br />

O&G 8,103 -74.0<br />

Dow 13,486 -111.0<br />

S&P 1,447 -13.1<br />

O&G 497 -4.3<br />

EuroStoxx 271 -4.8<br />

O&G 342 -6.1<br />

Source: Bloomberg & Fox-Davies<br />

For further information,<br />

please contact:<br />

Research: +44 20 3463 5030<br />

Sales: +44 20 3463 5050<br />

www.fox-davies.com<br />

28 September2012<br />

This is a marketing communication. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the<br />

dissemination of investment research. Non-US research analysts who have prepared this report are not registered/qualified as research analysts with FINRA, may not be associated persons of the member organisation and may not be<br />

subject to NASD/NYSE restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. Disclosures can be found at the end of the report.<br />

Fox-Davies Capital<br />

Commodities<br />

Commodity Close Change Chart<br />

Crude<br />

BFO ($/bbl)<br />

WTI ($/bbl)<br />

Crude Futures<br />

BFO ($/bbl)<br />

WTI ($/bbl)<br />

Gas<br />

Henry ($/mcf)<br />

NBP (p/therm)<br />

Source: Bloomberg & Fox-Davies<br />

Currency<br />

113.4<br />

90.0<br />

103.8<br />

91.4<br />

3.02<br />

59.3<br />

1.6 (1.4%)<br />

0.0 (0.0%)<br />

1.8 (1.7%)<br />

0.2 (0.2%)<br />

0.26 (9.4%)<br />

-1.9 (-3.1%)<br />

125<br />

115<br />

105<br />

95<br />

85<br />

75<br />

3 Month Performance ($/bbl)<br />

125<br />

115<br />

105<br />

95<br />

85<br />

Forward Curve (33 rd month)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

-<br />

Gas price ($/mm btu)<br />

Currency Close Change 3 Month Performance<br />

USD/GBP ($/£) 1.622 1d -0.002<br />

1m 0.039<br />

3m 0.069<br />

USD/EUR ($/€) 1.294 1d -0.004<br />

1m 0.037<br />

3m 0.049<br />

YEN/USD (¥/$) 77.7 1d -0.5<br />

1m -0.9<br />

3m -1.8<br />

Source: Bloomberg & Fox-Davies<br />

1.64<br />

1.60<br />

1.56<br />

1.52<br />

1.32<br />

1.28<br />

1.24<br />

1.20<br />

82<br />

80<br />

78<br />

76<br />

WTI BFO<br />

WTI BFO<br />

NBP Henry Hub<br />

1

<strong>Oil</strong> <strong>Monitor</strong><br />

<strong>Oil</strong> Market<br />

Crude oil<br />

US crude inventories (see below) declined by 2.4mm bbl<br />

to 365.2mm bbl, led by 2.3mm bbl/d decline in imports<br />

which stood at 7.6mm bbl/d.<br />

Crude Inventories (m bbl)<br />

400<br />

375<br />

350<br />

325<br />

300<br />

275<br />

Source: EIA, Bloomberg & Fox-Davies<br />

However crude inventories are still in surplus of 24.2mm<br />

bbl (7%) above last year. Total products supplied over<br />

the last four-week period have averaged 18.4mm bbl/d,<br />

down 3.4% y/y. <strong>Oil</strong> prices rose latter in the week on<br />

positive economic from the U.S. and concerns about<br />

disruption in oil supplies due to rising tensions between<br />

Iran and Western countries including Israel.<br />

<strong>Oil</strong> Price ($/bbl)<br />

Source: Bloomberg & Fox-Davies data<br />

In the U.S., home prices recorded strongest year-to-date<br />

gains since 2005, climbing 5.9% through July signaling<br />

steady recovery in housing market.<br />

<strong>Oil</strong> prices have received further support from Spain as it<br />

pledged to cut its high deficit to ease Europe’s debt<br />

crisis. Spain announced its fifth austerity package under<br />

which it plans to reduce its deficit to 4.5% next year from<br />

8.5% currently.<br />

Fox-Davies Capital<br />

365,180<br />

250<br />

Sep Nov Jan Mar May Jul Sep<br />

150<br />

125<br />

100<br />

75<br />

50<br />

Jul 09 Jan 10 Aug 10 Feb 11 Sep 11 Apr 12 Oct 12 May 13<br />

BFO WTI OPEC<br />

28 September 2012<br />

Brent's premium to U.S. crude further increased to<br />

$20.1/bbl, crossing $20 mark for the first time since<br />

August 16, which continues to raise questions as to<br />

which benchmark is trading at the “incorrect” price.<br />

WTI / BFO Spread ($/bbl)<br />

5<br />

-<br />

(5)<br />

(10)<br />

(15)<br />

(20)<br />

(25)<br />

(30)<br />

(35)<br />

Jul 09 Jan 10 Aug 10 Feb 11 Sep 11 Apr 12 Oct 12 May 13<br />

Source: Bloomberg & Fox-Davies data<br />

We believe that given the wealth of evidence that the<br />

WTI is underpriced, which is suggested by the fact that<br />

nearly every other crude benchmark is trading in line<br />

with Brent.<br />

Exports have trended upwards in the latest data<br />

available (July exports ~2.3mm bbl), but you get the<br />

feeling that they are limited by the demand at the<br />

destination (Canada received 100% of the US’ exports),<br />

rather than the volumes available for export. We believe<br />

that if the spare volumes that were available for export<br />

were actually available, that the Brent / WTI spread<br />

would close significantly.<br />

Distillates, Gasoline & Refinery Charge <strong>Oil</strong><br />

Text Refinery utilization further declined to 87.4% due to<br />

ongoing seasonal maintenance period.<br />

Refinery Charge (m bpd)<br />

17<br />

16<br />

15<br />

14<br />

13<br />

12<br />

Sep Nov Jan Mar May Jul<br />

Source: EIA, Bloomberg & Fox-Davies data<br />

15,053<br />

Refineries are preparing to increase distillate yields for<br />

the upcoming winter season.<br />

2

<strong>Oil</strong> <strong>Monitor</strong><br />

Distillate fuel inventories declined 0.5mm bbl to<br />

127.7mm bbl last week and are 19% lower than last year<br />

levels. Gasoline inventories declined by 0.5mm bbl/d on<br />

lower output and decline in imports.<br />

Distillates Inventories (m bbl)<br />

180<br />

160<br />

140<br />

120<br />

100<br />

Sep Nov Jan Mar May Jul<br />

Source: EIA, Bloomberg & Fox-Davies data<br />

On four week average, gasoline consumption is down by<br />

1.0% y/y to 8.8mm bbl/d. Gasoline and diesel fuel prices<br />

fell for the first time in 12 weeks.<br />

Gasoline Inventories (m bbl)<br />

245<br />

235<br />

225<br />

215<br />

205<br />

195<br />

185<br />

175<br />

Sep Nov Jan Mar May Jul<br />

Source: EIA, Bloomberg & Fox-Davies data<br />

Natural Gas<br />

Text Gas inventories rose by 80bcf to 3.576 tcf (see<br />

following chart) and build was 24bcf lower than last year<br />

and almost in-line with five-year average.<br />

Despite lower injections over past few weeks,<br />

inventories remains 9.0% above last year and 8.6%<br />

above the five-year average and EIA expects inventories<br />

to hit record high levels of 3.950 tcf, by the end of<br />

October, when the traditional injection season ends.<br />

Fox-Davies Capital<br />

127,748<br />

195,828<br />

Gas Inventories (tcf)<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

Sep Nov Jan Mar May Jul<br />

Source: Bloomberg & Fox-Davies<br />

28 September 2012<br />

This year injection season began with 2.477 tcf inventory<br />

compared with 1.581 tcf in 2011. Temperatures during<br />

the storage report week were 0.9 degrees cooler than<br />

the 30-year normal temperature and 2.0 degrees warmer<br />

than the same period last year.<br />

From the Trading Floor<br />

Biggest movers<br />

Biggest Movers<br />

Odin Energy Ltd (AU)<br />

Nighthawk Energy (LN)<br />

Magnolia Petrole (LN)<br />

Pura Vida Energy (AU)<br />

Nexus Energy Ltd (AU)<br />

Target Energy Lt (AU)<br />

Tangiers Petrole (AU)<br />

Orca Energy Ltd (AU)<br />

Sino Gas & Energ (AU)<br />

Interlink Petr (IN)<br />

Tongyang Cement (KS)<br />

Madagascar <strong>Oil</strong> L (LN)<br />

Woburn Energy Pl (LN)<br />

Gulfsands Petrol (LN)<br />

Advance Energy (AU)<br />

Pancontinental (AU)<br />

Elk Petroleum Lt (AU)<br />

Ambassador <strong>Oil</strong> A (AU)<br />

Europa <strong>Oil</strong> & Gas (LN)<br />

Elixir Petroleum (AU)<br />

Source: Bloomberg & Fox-Davies data<br />

-100% -50% 0% 50%<br />

-15.5%<br />

-16.0%<br />

-16.3%<br />

-16.5%<br />

-16.7%<br />

-16.7%<br />

-18.3%<br />

-19.2%<br />

-25.6%<br />

-27.3%<br />

3.6<br />

40.0%<br />

28.7%<br />

28.6%<br />

27.2%<br />

21.7%<br />

20.0%<br />

19.4%<br />

19.0%<br />

16.4%<br />

16.4%<br />

3

<strong>Oil</strong> <strong>Monitor</strong><br />

News Highlights<br />

Mediterranean <strong>Oil</strong> & Gas (MOG LN)<br />

Interim Results – Period of Consolidation<br />

3m Performance The Company farmed out 75% interest<br />

15<br />

in Malta Offshore Area 4 to Genel,<br />

13<br />

allowing the Company to proceed with<br />

planning for the first exploration well;<br />

11<br />

Divested entire working interest in 13<br />

9<br />

non-core exploration and production<br />

gas assets, in onshore Italy.<br />

7<br />

We believe the company is now focus<br />

5<br />

on adding value to Ombrina Mare and<br />

Last Close 13p Guendalina field by accelerating<br />

Change (5-day) 7.2% development activities on this fields.<br />

As at 30 June 2012, MOG held €4.1<br />

million on cash and cash equivalents.<br />

With no leverage on the balance sheet<br />

and revenue flow from Guendalina gas<br />

field, the company is ideally placed to<br />

raise new borrowings to expand its<br />

asset base and fund its exploration<br />

programme.<br />

Source: Bloomberg & Fox-Davies<br />

MEO Australia (MEO AU)<br />

Mud Weighs (Weights) On My Mind…<br />

3m Performance The Company’s announcement this<br />

0.30<br />

week that it will execute a share<br />

placement to existing shareholders and<br />

0.25<br />

that Heron South’s well has required a<br />

heavier mud, highlights not only the<br />

position that the Company is in vis-à-vis<br />

0.20<br />

its exploration potential, but the<br />

0.15<br />

opportunity that is currently presenting<br />

itself.<br />

Last Close A$0.22 The Company, while spending<br />

Change (5-day) 0.0% significantly during this period of high<br />

activity, still has ample resources<br />

(A$55mm), and the money will be<br />

dedicated towards funding future<br />

activities. Given that there is a three<br />

well programme underway, there is<br />

significant<br />

growth.<br />

potential for explosive<br />

That the mud weights have had to be<br />

upped due to an overpressure in South<br />

Heron, confirms the presence of a<br />

significant source rock, and although<br />

there is some 4 days of drilling to go<br />

before reaching the well’s objective, at<br />

least 2 of the 4 elements required for a<br />

successful drilling campaign can be<br />

checked off, namely source and seal.<br />

We are maintaining our BUY<br />

recommendation and A$0.60<br />

Source: Bloomberg & Fox-Davies<br />

Fox-Davies Capital<br />

28 September 2012<br />

San Leon Energy (SLE LN)<br />

Outlook Brightening<br />

3m Performance San Leon’s 1H’12 results outline the<br />

15<br />

progress that the Company has made<br />

in the period, from the drilling activity in<br />

10<br />

Poland, to Albania, which we believe is<br />

the stalking horse in the portfolio.<br />

While the activity in the first half has<br />

5<br />

been significant, the results of that work<br />

has almost exclusively been, or is in the<br />

-<br />

process of being, delivered in the<br />

Last Close 11p second half. While lower drilling activity<br />

Change (5-day) 0.0% is expected for the remainder of the<br />

year, we believe the news flow will<br />

continue, especially with the testing of<br />

the Lelechow-SL1 well.<br />

With Barryroe looking more promising,<br />

the value of SLE’s 4.5% Net Royalty<br />

Interest to the Company is looking<br />

more tangible. With a relatively healthy<br />

cash position (when set against its<br />

programme), further farmouts possible,<br />

and the prospect of early cash flow<br />

from the oil lifted during the testing of<br />

Lelechow-SL1, the outlook for the<br />

Company remains buoyant.<br />

Following today’s announcement, we<br />

are reiterating our 60p target price and<br />

BUY recommendation.<br />

Source: Bloomberg & Fox-Davies<br />

Global Energy Development (GED LN)<br />

Consolidating – 3-Year Plan on Track…<br />

3m Performance 2010 / 2011, management outlined its<br />

90<br />

3-Year plan for raising production and<br />

85<br />

attacking its reserves base. The<br />

80<br />

securing of $12.5mm of new long-term<br />

financing, repaying the outstanding<br />

75<br />

convertible, has alleviated the mediumterm<br />

obstacles to the continued<br />

70<br />

development of the reserves base (as<br />

65<br />

cash resources would have been<br />

Last Close 77p diverted to repaying the outstanding<br />

Change (5-day) 0.7% amounts).<br />

The disposal of the Peruvian assets has<br />

been a boon, as has the reduction in<br />

operating costs arising from the<br />

conversion of an old producer in to a<br />

water well, and both will now allow<br />

management’s time to focus on<br />

consolidating its position in Colombia<br />

and valorising its assets.<br />

We believe that this news should<br />

comfort investors that the management<br />

remains committed to valorising its<br />

assets, and that the 3–Year plan is still<br />

very much in play.<br />

Source: Bloomberg & Fox-Davies<br />

4

<strong>Oil</strong> <strong>Monitor</strong><br />

Gold <strong>Oil</strong> (GOO LN)<br />

It Really is in the GOO<br />

3m Performance As if to prove the adage that “Cash is<br />

3.3<br />

King,” Gold’s 1H results are a salutary<br />

3.2<br />

lesson. With a heavy work programme,<br />

no farm-out partners and next to no<br />

3.1<br />

cash, there has to be a concern that<br />

3.0<br />

come the audited results the auditor<br />

has “Going Concern” issues. In respect<br />

2.9<br />

of its farm-out partners, today’s results<br />

2.8<br />

will form a rod for management’s back,<br />

Last Close - in that it has provided leverage for any<br />

Change (5-day) - potential farminees.<br />

Once the shares come back from<br />

suspension, we can't see them trading<br />

much above novelty value, especially as<br />

existing shareholders will feel obliged<br />

to support the Company with a rights<br />

issue. This doesn’t mean that the assets<br />

are worthless, however. Those with a<br />

long memory will remember a Cairn’s<br />

rights issue, and look what happened<br />

there. There is a long way to go before<br />

Gold could hope to emulate Cairn’s<br />

success, but the point is that just<br />

because the Company needs a rescue<br />

rights issue, it hasn’t impacted the<br />

subsurface, at all.<br />

Source: Bloomberg & Fox-Davies<br />

Nighthawk Energy (HAWK LN)<br />

Sharpening the focus<br />

3m Performance During the year Nighthawk rationalized<br />

8<br />

its asset base to focus on the Jolly Ranch<br />

project. It has made decent progress on<br />

6<br />

the Jolly Ranch project (Colorado)<br />

4<br />

following the decision to increase its<br />

stake to 75% and assume operatorship<br />

2<br />

at the beginning of the year. Since then<br />

it has completed the first stage<br />

-<br />

development plan which comprised<br />

Last Close 7p completing work-over programs on 15<br />

Change (5-day) 28.7% wells. Although it did encounter a few<br />

setbacks, the Company has been<br />

successful in increasing production to<br />

60bpd in Aug 2012 from the 30bpd last<br />

year.<br />

Nighthawk has commenced the second<br />

and most important phase of its<br />

development plan (4 well plan) with the<br />

drilling of the first new well (Craig 6-2<br />

well) at Jolly Ranch in nearly three years;<br />

the well has been successful and has<br />

produced over 600 barrels.<br />

Plans to bring the John Craig 6-2 well<br />

onto permanent production will provide<br />

a substantial uplift to production<br />

volumes and will be revenue and cash<br />

flow accretive.<br />

Source: Bloomberg & Fox-Davies<br />

Fox-Davies Capital<br />

28 September 2012<br />

Ascent Resources (AST LN)<br />

All eyes on Petišovci’s project<br />

3m Performance Interim Results: We believe the current<br />

year would all be about commencing<br />

gas production from the Petišovci /<br />

Lovászi tight gas re-development<br />

project in Slovenia.<br />

The Petišovci gas project with<br />

independent P50 gas-in-place estimate<br />

of 504bcf has the potential to bring<br />

step-change in the Company’s<br />

production and revenue line.<br />

The production is now scheduled to<br />

start in 2013 after witnessing certain<br />

operational delays.<br />

The 200 km 2<br />

3<br />

2<br />

1<br />

-<br />

Last Close 2p<br />

Change (5-day) -12.3%<br />

project area straddles the<br />

Hungary/Slovenia border and contains<br />

three depleted shallow conventional oil<br />

and gas fields. Design and engineering<br />

for Phase 1 of the Petišovci project is<br />

complete and procurement and<br />

construction will commence as soon the<br />

necessary consents are finalised.<br />

With no major activities planned on<br />

other blocks, timely progress of the<br />

Petišovci’s project holds key to the<br />

company’s valuation.<br />

Source: Bloomberg & Fox-Davies<br />

Falkland <strong>Oil</strong> & Gas (FOGL LN)<br />

Place Your Bets Please…<br />

3m Performance Scotia has been spudded and as we<br />

100<br />

highlighted following the results of the<br />

90<br />

last well (Loligo or 42/07-01 to give it its<br />

snappier title), we believe that the risk<br />

80<br />

profile has reduced somewhat.<br />

70<br />

What has been unchanged however is<br />

60<br />

the fact that the basin appears to be<br />

gas prone. Still, given the migration<br />

50<br />

pathways, it is all about location,<br />

Last Close 67p location, location, and with Scotia being<br />

Change (5-day) -2.9% further out of the basin, we are hope<br />

that the chances of intersecting a more<br />

liquids prone accumulation is higher, as<br />

liquids are the first to be driven out of<br />

the source rock (assuming the gas is<br />

thermogenic) and theoretically travel<br />

further through the reservoir<br />

sandstones, albeit slower, it’s about<br />

finding that optimum point.<br />

We are reiterating current 100p Target<br />

Price, but maintaining our HOLD<br />

recommendation ahead on the well’s<br />

results.<br />

Source: Bloomberg & Fox-Davies<br />

5

<strong>Oil</strong> <strong>Monitor</strong><br />

Bahamas Petroleum (BPC LN)<br />

Out of its Hands<br />

3m Performance All that the Company can do, it has<br />

10<br />

done, or is in the process of doing. That<br />

8<br />

a referendum will be held by the<br />

Bahamian Government largely leaves its<br />

6<br />

future in the hands of the people of the<br />

4<br />

Bahamas, so it is only right that the<br />

Company now spend its time, effort<br />

2<br />

and funds on supporting a “Yes”<br />

-<br />

campaign.<br />

Last Close 5p If they are successful, then the farm-<br />

Change (5-day) -7.4% outs can proceed with vigour, which will<br />

be necessary, as the wells will be up to<br />

22,500ft deep means that it could be a<br />

300 day well (assuming 25m per day<br />

drill speed) and the cost will be north of<br />

$100mm (Drillship up to 4,000ft<br />

@~$200m/day).<br />

Source: Bloomberg & Fox-Davies<br />

Jupiter Energy (JPRL LN)<br />

Positive Interim update<br />

3m Performance The Company continues to make<br />

40<br />

overall good progress on its Block 31,<br />

Kazakhstan. Trial crude production from<br />

30<br />

J-50 and J-52 wells during 2Q’12<br />

20<br />

averaged 21,500 bbls, which was in-line<br />

with the company’s estimates.<br />

10<br />

It completed testing of the J-51 well<br />

which produced 25,700bbl oil during<br />

-<br />

the 4 months trial period which ended<br />

Last Close 36p on 12th September 2012. Workover on<br />

Change (5-day) 28.7% the exploration well J-53 is expected to<br />

be completed during 4Q’12, which will<br />

be followed by a 3 month production<br />

testing period.<br />

Jupiter plans to file trial production<br />

application for both the J-51 and J-53<br />

wells before year end. Thus we expect<br />

overall production to improve<br />

significantly next year. The Company<br />

raised $A11.6mm (before costs) through<br />

a rights issue during the period, which<br />

is sufficient to fully fund this year’s<br />

exploration<br />

program.<br />

program and workover<br />

The updated reserve report released in<br />

June’12 estimated 2P reserves at<br />

37mm, up 54% compared to the<br />

previous report. With 2 new<br />

exploration wells planned for H2’12,<br />

testing of the J-53 well and a new<br />

reserve report due in early 2013, we are<br />

upbeat about the company’s prospect.<br />

Source: Bloomberg & Fox-Davies<br />

Fox-Davies Capital<br />

28 September 2012<br />

Kea Petroleum (KEA LN)<br />

Declares Puka as Commercial Discovery<br />

3m Performance This week’s news went a long way in de-<br />

15<br />

risking its Puka field and is valuation<br />

positive. Field gross recoverable<br />

10<br />

resource is estimated at 1mm bbl of oil<br />

with a potential upside of up to 3mm<br />

bbl. Additional flow test results from<br />

5<br />

Puka-1 well are better than initial<br />

production test results which led to<br />

-<br />

declaration of commerciality. News that<br />

Last Close 8p Kea now plans to drill Puka 2 well (follow<br />

Change (5-day) -4.3% up well) is another positive.<br />

Source: Bloomberg & Fox-Davies<br />

Borders & Southern Petroleum (BOR LN)<br />

A Question of Commerciality<br />

3m Performance We feel somewhat awkward having a<br />

80<br />

SELL on a Company that has, in all<br />

honesty, done, or is doing nothing<br />

60<br />

wrong. It has formulated a hypothesis,<br />

40<br />

tested successfully and is further<br />

refining its hypothesis. The only issue is<br />

20<br />

geography. Were this find in another<br />

basin, they would be held aloft on<br />

-<br />

shields and carried through the street<br />

Last Close 25p by the Company’s owners. But,<br />

Change (5-day) 5.3% unfortunately, this is a gassy asset in the<br />

South Falklands Basin.<br />

As we have highlighted, there will need<br />

to be a significant amount of gas<br />

produced to lift sufficient liquids to<br />

make this commercial, which raises the<br />

issue of the where that point of<br />

inflection will be. What will be the rate?<br />

What will be the operating costs? These<br />

are the questions that require answers.<br />

We believe for all the successes, this is<br />

the question that will be very difficult to<br />

answer with certainty inside of 5 to 10<br />

years, which puts it beyond most<br />

investors’ time horizons. As a result of<br />

this, we are maintaining our SELL<br />

Recommendation and 18p price target,<br />

as between today and that point in<br />

time, there will be a round of funding<br />

required (current uncommitted cash<br />

~$55mm).<br />

Is it all bleak? No. to our mind, the real<br />

game changer will be the Falklands<br />

Island Government allowing<br />

hydrocarbons to be landed. A land<br />

based LNG and processing facility will<br />

significant de-risk the development and<br />

appraisal risks associated with Darwin,<br />

and could lift not only BOR’s valuations,<br />

but that of FOGL, RKH and all the other<br />

Falklands players that have potentially<br />

gassy assets.<br />

Source: Bloomberg & Fox-Davies<br />

6

<strong>Oil</strong> <strong>Monitor</strong><br />

Stocks under coverage<br />

Company Ticker Recommendation Date<br />

Fox-Davies Capital<br />

Price<br />

28 September 2012<br />

Latest Target Difference<br />

Aminex AEX LN BUY Nov'11 4p 13p 225%<br />

Borders & Southern Petroleum BOR LN SELL Sep'12 25p 18p (28%)<br />

BowLeven BLVN LN Buy Nov'11 77p 250p 225%<br />

Circle <strong>Oil</strong> COP LN BUY Jun'12 21p 95p 352%<br />

Desire Petroleum DES LN UR Mar'11 24p 40p 67%<br />

Enegi <strong>Oil</strong> ENEG LN UR Nov'10 10p 25p 150%<br />

Falkland <strong>Oil</strong> & Gas FOGL LN HOLD Sep'12 67p 100p 49%<br />

Great Eastern Energy GEEC LN BUY Mar'12 263p 440p 67%<br />

Gulf Keystone (London) GKP LN BUY May'12 235p 350p 49%<br />

Gulfsands Petroleum GPX LN HOLD Apr'12 100p 200p 100%<br />

Hardy <strong>Oil</strong> & Gas HDY LN BUY Aug'11 128p 250p 95%<br />

Heritage <strong>Oil</strong> (London) HOIL LN BUY Apr'12 195p 315p 62%<br />

Jubilant Energy JUB LN BUY Mar'12 15p 55p 267%<br />

Matra Petroleum MTA LN BUY Apr'12 2p 4p 95%<br />

Max Petroleum MXP LN SELL Mar'11 4p 10p 150%<br />

Melrose Resources MRS LN BUY Apr'12 129p 175p 36%<br />

MEO Australia (ASX)* MEO AU BUY Feb'12 A$0.22 A$0.60 173%<br />

Premier <strong>Oil</strong> PMO LN BUY Jul'12 363p 485p 34%<br />

Range Resources (London)* RRL LN BUY Aug'12 5p 24p 380%<br />

Red Emperor (London)* RMP LN BUY Aug'12 4p 48p 1,100%<br />

Rockhopper Exploration RKH LN BUY Jul'12 173p 350p 102%<br />

San Leon Energy (London)* SLE LN BUY Jun'12 11p 60p 445%<br />

Sefton Resources SER LN BUY Sep'12 2p 6p 200%<br />

Sterling Energy SEY LN HOLD Apr'12 42p 35p (17%)<br />

Tower Resources TRP LN BUY Jul'12 3p 5p 67%<br />

TXO * TXO LN BUY Apr'12 0.28p 0.90p 221%<br />

Victoria <strong>Oil</strong> & Gas * VOG LN BUY Jul'12 3p 13p 333%<br />

Source: Bloomberg & Fox-Davies<br />

NOTE: Bold indicates Research this week<br />

* - Fox-Davies Client<br />

7

<strong>Oil</strong> <strong>Monitor</strong><br />

Comparables<br />

Exploration & Production<br />

Fox-Davies Capital<br />

28 September 2012<br />

Exchange Reserves Per Barrel of Reserves ($/boe) Per Daily Barrel of Production ($/bopd)<br />

ASE 2P 10.5 27,139<br />

Dublin 2P 0.5 -<br />

EN Paris 1P 9.9 -<br />

Hong Kong 1P 32.0 -<br />

Karachi 1P 1.2 16,572<br />

London 1P 10.2 48,351<br />

2P 7.1 -<br />

London Intl 2P 3.6 45,179<br />

MICEX Main 2P 2.3 31,307<br />

NASDAQ CM 1P 10.0 48,847<br />

NASDAQ GM 1P 20.3 13,812<br />

NASDAQ GS 1P 16.5 52,299<br />

Natl India 1P 24.2 -<br />

2P 36.1 -<br />

New York 1P 12.6 48,391<br />

NYSE MKT LLC 1P 17.3 52,117<br />

Oslo 2P 12.7 40,081<br />

OTC US 1P 5.7 27,309<br />

2P 11.5 -<br />

OTC BB 1P 9.4 33,974<br />

RTS 2P 4.4 36,062<br />

Stockholm 2P 37.1 -<br />

Tokyo 2P 9.0 53,007<br />

Toronto 1P 11.3 43,985<br />

2P 10.5 -<br />

Venture 1P 13.7 37,359<br />

2P 10.8 -<br />

Source: Bloomberg & Fox-Davies Data<br />

Company Name<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Abraxas Petroleum AXAS US $2.33 $215mm $215mm 8.02 60,088<br />

Advantage <strong>Oil</strong> & Gas AAV CN C$3.66 C$616mm $629mm 2.36 21,688<br />

Afren (London) AFR LN 140p £1,520mm $2,465mm 13.32 56,656<br />

Alamo Energy ALME US $0.01 $1mm $1mm 0.32 14,961<br />

Alexander Resources ALX CN C$0.19 C$12mm $12mm 12.63 18,001<br />

Amadeus Energy (ASX) AMU AU A$0.22 A$51mm $49mm 10.97 27,139<br />

American Eagle Energy AMZG US $0.71 $33mm $33mm 20.55 2,228,922<br />

American Standard Energy ASEN US $0.70 $36mm $36mm 10.22 65,078<br />

Amerisur Resources AMER LN 35p £339mm $549mm 71.31 -<br />

Aminex AEX LN 4p £33mm $54mm 0.01 -<br />

Anadarko Petroleum APC US $70.23 $35,092mm $35,092mm 13.45 73,151<br />

8

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Anderson Energy AXL CN C$0.23 C$40mm $40mm 1.26 5,090<br />

Angle Energy NGL CN C$3.81 C$341mm $348mm 4.57 25,645<br />

Antrim Energy (London) AEY LN 52p £96mm $156mm 8.65 94,797<br />

Antrim Energy (Toronto) AEN CN C$0.80 C$147mm $150mm 8.36 91,548<br />

Apache APA US $86.84 $33,973mm $33,973mm 11.06 44,293<br />

Apco <strong>Oil</strong> and Gas APAGF US $16.39 $483mm $483mm 10.66 32,586<br />

Approach Resources AREX US $30.06 $1,159mm $1,159mm 14.77 176,922<br />

ARC Resources ARX CN C$24.10 C$7,388mm $7,538mm 12.72 88,533<br />

Arcan Resources ARN CN C$1.14 C$111mm $114mm 2.76 30,960<br />

Argosy Energy GSY CN C$0.16 C$4mm $4mm 1.15 5,866<br />

Arpetrol RPT CN C$0.02 C$9mm $9mm 1.06 26,329<br />

Arsenal Energy AEI CN C$0.47 C$73mm $75mm 5.98 32,140<br />

Artek Exploration RTK CN C$2.43 C$106mm $108mm 5.56 57,632<br />

Ascent Resources AST LN 2p £16mm $26mm 299.32 -<br />

Athabasca <strong>Oil</strong> ATH CN C$13.05 C$5,214mm $5,320mm 11.51 -<br />

Anton <strong>Oil</strong>field Services ATPAQ US $0.14 $7mm $7mm 0.06 292<br />

Australian Canadian <strong>Oil</strong> Royalties AUCAF US $0.18 $9mm $9mm 239.91 1,210,203<br />

Bankers Petroleum BNK CN C$2.95 C$746mm $761mm 2.85 -<br />

Barnwell Industries BRN US $3.14 $26mm $26mm 6.84 12,380<br />

Bashneft OAO BANE RU $64.00 $10,891mm $10,891mm 4.42 36,062<br />

Bayfield Energy Holdings BEH LN 26p £55mm $90mm 4.70 114,904<br />

Beach Energy (ASX) BPT AU A$1.27 A$1,589mm $1,522mm 19.45 -<br />

Bengal Energy BNG CN C$0.78 C$41mm $41mm 212.80 994,154<br />

Berry Petroleum BRY US $40.67 $2,130mm $2,130mm 7.63 58,798<br />

Bill Barrett BBG US $25.26 $1,217mm $1,217mm 5.13 23,864<br />

Birchcliff Energy BIR CN C$6.54 C$925mm $944mm 3.29 50,156<br />

BlackPearl Resources PXX CN C$3.56 C$1,016mm $1,036mm 28.93 135,909<br />

Blue Dolphin Energy BDCO US $6.50 $69mm $69mm 370.85 2,024,497<br />

BNP Resources BNX/A CN C$0.05 C$3mm $3mm 22.85 457,300<br />

Bonanza Creek Energy BCEI US $23.47 $939mm $939mm 21.11 211,218<br />

Bonavista Energy BNP CN C$17.15 C$2,893mm $2,952mm 8.39 41,709<br />

Bonterra Energy BNE CN C$43.82 C$868mm $886mm 21.25 136,263<br />

BPZ Resources BPZ US $2.86 $333mm $333mm 9.59 88,256<br />

BreitBurn Energy Partners BBEP US $19.45 $1,539mm $1,539mm 9.87 77,745<br />

Bridge Energy (London) BRDG LN 126p £80mm $130mm 5.57 64,796<br />

Bridge Energy (Oslo) BRIDGE NO NO₭11.10 NO₭704mm $124mm 5.32 61,860<br />

Burleson Energy BUR AU A$0.04 A$15mm $15mm 4.93 -<br />

C&C Energia CZE CN C$6.40 C$409mm $417mm 22.66 36,251<br />

Cabot <strong>Oil</strong> & Gas COG US $45.02 $9,454mm $9,454mm 17.85 105,386<br />

Cadogan Petroleum CAD LN 19p £43mm $69mm 35.69 -<br />

Cairn India CAIR IN INR331 INR631,789mm $11,976mm 36.15 -<br />

Callon Petroleum Co CPE US $6.05 $239mm $239mm 14.73 46,254<br />

CAMAC Energy CAK US $0.48 $75mm $75mm 28.08 80,977<br />

Canacol Energy CNE CN C$0.45 C$275mm $281mm 28.18 70,366<br />

9

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Canadian Natural Resources CNQ CN C$30.85 C$33,781mm $34,467mm 4.54 56,586<br />

Canadian <strong>Oil</strong> nds COS CN C$21.13 C$10,238mm $10,446mm 6.86 97,767<br />

Candax Energy CAX CN C$0.04 C$43mm $44mm 11.59 79,982<br />

Carnarvon Petroleum CVN AU A$0.10 A$68mm $65mm 5.39 116,439<br />

Carrizo <strong>Oil</strong> & Gas CRZO US $25.34 $1,013mm $1,013mm 6.25 47,197<br />

Caspian Energy CEK CN C$0.10 C$21mm $22mm 6.37 228,619<br />

Celtic Exploration CLT CN C$18.23 C$1,925mm $1,964mm 13.65 117,572<br />

Central Natural Resources CTNR US $25.65 $14mm $14mm 20.15 244,319<br />

Cequence Energy CQE CN C$1.70 C$326mm $333mm 5.41 35,358<br />

Charger Energy CHX CN C$0.42 C$6mm $6mm 0.62 2,317<br />

Chesapeake Energy CHK US $19.10 $12,709mm $12,709mm 3.90 22,367<br />

Chinook Energy CKE CN C$1.51 C$323mm $330mm 10.82 24,139<br />

Cimarex Energy XEC US $58.83 $5,059mm $5,059mm 14.41 49,860<br />

Circle <strong>Oil</strong> COP LN 21p £120mm $194mm 8.41 23,109<br />

Clayton Williams Energy CWEI US $52.73 $641mm $641mm 9.85 42,519<br />

CNOOC (Hong Kong) 883 HK HK$15.90 HK$709,876mm $91,548mm 32.04 106,088<br />

CNOOC (ADR) CEO US $206 $91,860mm $91,860mm 32.14 106,449<br />

Coastal Energy CEO LN 1,155p £1,308mm $2,121mm 23.94 182,008<br />

Comstock Resources CRK US $17.96 $865mm $865mm 3.80 18,915<br />

Concho Resources CXO US $94.43 $9,849mm $9,849mm 25.00 149,212<br />

ConocoPhillips COP US $57.39 $69,703mm $69,703mm 8.14 73,414<br />

Contango <strong>Oil</strong> & Gas MCF US $49.81 $762mm $762mm 17.14 51,391<br />

Continental Resources /OK CLR US $75.60 $13,694mm $13,694mm 26.46 218,393<br />

Corridor Resources CDH CN C$0.65 C$58mm $59mm 3.15 28,938<br />

CREDO Petroleum CRED US $14.50 $146mm $146mm 34.65 172,176<br />

Crescent Point Energy CPG CN C$43.79 C$15,221mm $15,530mm 36.42 209,411<br />

Crew Energy CR CN C$7.31 C$883mm $901mm 6.37 39,203<br />

Crimson Exploration CXPO US $4.33 $199mm $199mm 5.74 25,471<br />

Crocotta Energy CTA CN C$2.73 C$241mm $245mm 8.01 63,085<br />

Cubic Energy QBC US $0.39 $30mm $30mm 2.98 41,960<br />

Cue Energy (ASX) CUE AU A$0.14 A$94mm $90mm 19.58 -<br />

Daleco Resources DLOV US $0.10 $5mm $5mm 52.51 240,619<br />

Daybreak <strong>Oil</strong> & Gas DBRM US $0.05 $2mm $2mm 10.08 65,162<br />

DeeThree Exploration DTX CN C$5.50 C$368mm $376mm 37.91 195,986<br />

Dejour Energy DEJ CN C$0.24 C$35mm $36mm 1.88 77,346<br />

Denbury Resources DNR US $16.54 $6,470mm $6,470mm 13.85 98,175<br />

Det Norske Oljeselskap DETNOR NO NO₭94.60 NO₭12,101mm $2,126mm 35.33 -<br />

Devon Energy DVN US $60.63 $24,525mm $24,525mm 7.93 35,983<br />

Diaz Resources DZR CN C$0.02 C$2mm $2mm 2.35 4,684<br />

Donnybrook Energy DEI CN C$0.12 C$23mm $24mm 6.80 217,560<br />

Dorchester Minerals DMLP US $22.04 $676mm $676mm 44.23 112,091<br />

Dragon <strong>Oil</strong> (London) DGO LN 602p £2,964mm $4,805mm 4.06 66,972<br />

DualEx Energy International DXE CN C$0.20 C$17mm $18mm 736.85 138,464<br />

Dune Energy DUNR US $1.85 $73mm $73mm 5.35 26,749<br />

10

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Eagle Ford <strong>Oil</strong> & Gas ECCE US $0.15 $5mm $5mm 0.08 -<br />

Earthstone Energy ESTE US $14.60 $25mm $25mm 18.60 61,155<br />

Egdon Resources EDR LN 8p £11mm $17mm 7.89 -<br />

EGPI Firecreek EFIR US $0.00 $1mm $1mm 1.32 35,654<br />

Eland <strong>Oil</strong> & Gas ELA LN 110p £148mm $239mm 15.19 -<br />

Emerald <strong>Oil</strong> EOX US $0.84 $138mm $138mm 38.95 511,530<br />

Encana ECA CN C$21.43 C$15,760mm $16,080mm 6.76 26,486<br />

Endeavour International END US $9.50 $443mm $443mm 18.72 125,772<br />

Energen EGN US $52.04 $3,754mm $3,754mm 10.69 65,098<br />

Energy XXI Bermuda EXXI US $35.05 $2,779mm $2,779mm 22.89 61,874<br />

Enerplus ERF CN C$16.31 C$3,222mm $3,288mm 10.20 43,730<br />

EnQuest (London) ENQ LN 116p £930mm $1,508mm 13.09 -<br />

EOG Resources (ADR) EOG US $113 $30,567mm $30,567mm 14.42 69,251<br />

Energy Partners EPL US $20.24 $791mm $791mm 21.06 63,573<br />

EQT EQT US $58.84 $8,802mm $8,802mm 9.38 92,367<br />

Equal Energy EQU CN C$3.41 C$120mm $122mm 3.12 11,755<br />

Maurel et Prom MAU FP €11.68 €1,419mm $1,836mm 9.94 124,068<br />

EV Energy Partner EVEP US $62.99 $2,422mm $2,422mm 12.26 124,409<br />

Evolution Petroleum EPM US $8.25 $238mm $238mm 17.62 412,805<br />

Exall Energy EE CN C$0.84 C$52mm $53mm 11.64 48,705<br />

EXCO Resources XCO US $8.03 $1,740mm $1,740mm 7.49 19,881<br />

Exillon Energy EXI LN 141p £228mm $370mm 1.40 31,934<br />

Fairborne Energy FEL CN C$1.35 C$139mm $141mm 2.12 9,235<br />

Far East Energy FEEC US $0.13 $45mm $45mm 4.67 346,196<br />

FieldPoint Petroleum FPP US $4.50 $36mm $36mm 22.63 139,731<br />

Forest <strong>Oil</strong> FST US $8.41 $994mm $994mm 3.02 17,173<br />

Freehold Royalties FRU CN C$19.81 C$1,300mm $1,327mm 62.01 192,932<br />

FX Energy FXEN US $7.70 $408mm $408mm 43.70 194,062<br />

Gasco Energy GSX US $0.14 $24mm $24mm 3.49 13,063<br />

Gastar Exploration GST US $1.69 $111mm $111mm 6.18 30,694<br />

GeoPark Holdings GPK LN 705p £299mm $485mm 9.48 -<br />

GeoPetro Resources GPR US $0.12 $5mm $5mm 1.64 53,889<br />

Glen Rose Petroleum GLRP US $0.09 $3mm $3mm 4.60 68,678<br />

GED GED LN 77p £28mm $45mm 0.41 40,862<br />

GMX Resources GMXR US $0.83 $63mm $63mm 1.26 5,567<br />

Goodrich Petroleum GDP US $12.44 $453mm $453mm 5.18 23,696<br />

Gran Tierra Energy GTE US $5.13 $1,375mm $1,375mm 47.65 78,841<br />

Gravis <strong>Oil</strong> GRAVE US $0.06 $1mm $1mm 1.67 10,094<br />

Great Eastern Energy GEEC LN 263p £313mm $507mm 2.90 -<br />

Green Dragon Gas GDG LN $3.98 $543mm $543mm 11.36 -<br />

Greenfields Petroleum GNF CN C$4.85 C$75mm $77mm 6.19 68,851<br />

Guide Exploration GO CN C$1.71 C$175mm $178mm 7.39 14,373<br />

Gulf Keystone (London) GKP LN 235p £2,059mm $3,339mm 2.38 445,162<br />

Gulfport Energy GPOR US $31.16 $1,735mm $1,735mm 89.00 270,592<br />

11

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Gulfsands Petroleum GPX LN 100p £123mm $199mm 2.61 23,291<br />

Halcon Resources HK US $7.28 $1,574mm $1,574mm 73.60 376,533<br />

Hardy <strong>Oil</strong> & Gas HDY LN 128p £93mm $151mm 72.09 -<br />

Harvest Natural Resources HNR US $9.11 $342mm $342mm 7.85 47,817<br />

Hawk Exploration HWK/A CN C$0.38 C$13mm $13mm 9.93 31,158<br />

Hawkley <strong>Oil</strong> and Gas HOG AU A$0.19 A$55mm $52mm 6.53 248,654<br />

Hemisphere Energy HME CN C$0.68 C$34mm $35mm 43.83 183,576<br />

Heritage <strong>Oil</strong> (London) HOIL LN 195p £503mm $816mm 1.90 992,772<br />

Houston American Energy HUSA US $0.96 $36mm $36mm 308.30 1,013,950<br />

Hyperion Exploration HYX CN C$0.62 C$34mm $34mm 6.08 33,819<br />

Inpex (ADR) IPXHY US $15.12 $22,110mm $22,110mm 0.02 146<br />

Inpex (Tokyo) 1605 JP ¥465,500 ¥1,701,775mm $21,913mm 9.01 53,007<br />

Insignia Energy ISN CN C$0.70 C$41mm $42mm 1.39 -<br />

Inter<strong>Oil</strong> E&P IOX NO NO₭7.94 NO₭379mm $67mm 9.18 10,530<br />

Isramco ISRL US $120 $327mm $327mm 8.97 147,942<br />

Ithaca Energy IAE CN C$1.86 C$482mm $492mm 9.05 110,619<br />

Ivanhoe Energy IE CN C$0.54 C$186mm $190mm 115.97 196,054<br />

JKX <strong>Oil</strong> & Gas (London) JKX LN 77p £132mm $214mm 2.20 22,529<br />

Kodiak <strong>Oil</strong> & Gas KOG US $9.43 $2,487mm $2,487mm 62.10 632,049<br />

Kosmos Energy KOS US $11.42 $4,445mm $4,445mm 86.81 255,482<br />

La Cortez Energy LCTZ US $0.14 $7mm $7mm 75.52 67,533<br />

Laredo Petroleum Holdings LPI US $21.83 $2,799mm $2,799mm 17.34 114,579<br />

Legacy <strong>Oil</strong> & Gas LEG CN C$6.95 C$996mm $1,016mm 11.46 82,199<br />

Legacy Reserves LGCY US $29.01 $1,393mm $1,393mm 21.61 104,929<br />

LGX <strong>Oil</strong> & Gas OIL CN C$0.91 C$28mm $28mm 15.53 52,327<br />

Linn Energy LINE US $41.19 $8,220mm $8,220mm 14.28 131,014<br />

Lone Pine Resources LPR US $1.60 $136mm $136mm 1.97 8,387<br />

Longview <strong>Oil</strong> LNV CN C$7.12 C$333mm $340mm 8.96 52,868<br />

LRR Energy LRE US $18.83 $296mm $296mm 8.78 44,392<br />

Lucas Energy LEI US $2.29 $57mm $57mm 8.16 384,035<br />

Lundin (Stockholm) LUPE SS SE₭162 SE₭51,374mm $7,879mm 37.15 -<br />

Magnum Energy /Canada MEN CN C$0.13 C$7mm $8mm 12.53 36,507<br />

Magnum Hunter Resources MHR US $4.48 $754mm $754mm 16.36 133,019<br />

Manitok Energy MEI CN C$1.95 C$120mm $123mm 13.43 172,406<br />

Marathon <strong>Oil</strong> MRO US $30.02 $21,177mm $21,177mm 11.62 52,493<br />

Marquee Energy MQL CN C$0.99 C$52mm $53mm 4.75 31,177<br />

Matador Resources Co MTDR US $10.37 $576mm $576mm 17.12 77,988<br />

Max Petroleum MXP LN 4p £41mm $66mm 6.18 -<br />

McMoRan Exploration Co MMR US $11.87 $1,921mm $1,921mm 43.77 59,709<br />

Mediterranean <strong>Oil</strong> & Gas MOG LN 13p £56mm $90mm 2.09 -<br />

MEG Energy MEG CN C$37.15 C$7,223mm $7,369mm 3.58 276,906<br />

Melrose Resources (London) MRS LN 129p £148mm $240mm 2.43 6,082<br />

Memorial Production Partners MEMP US $18.99 $322mm $322mm 5.71 44,573<br />

Metgasco MEL AU A$0.20 A$78mm $75mm 1.15 -<br />

12

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Mexco Energy MXC US $6.60 $13mm $13mm 6.26 55,545<br />

Mid-Con Energy Partners MCEP US $21.89 $401mm $401mm 39.84 335,576<br />

Miller Energy Resources MILL US $5.26 $221mm $221mm 23.69 194,416<br />

Montana Exploration MTZ CN C$0.37 C$8mm $8mm 18.95 54,696<br />

Newfield Exploration Co NFX US $31.56 $4,260mm $4,260mm 6.35 29,989<br />

Nexen NXY CN C$24.83 C$13,160mm $13,427mm 14.85 70,670<br />

Nido Petroleum (ASX) NDO AU A$0.04 A$50mm $48mm 3.32 -<br />

Niko Resources NKO CN C$12.49 C$645mm $658mm 10.22 17,780<br />

Noble Energy NBL US $93.11 $16,558mm $16,558mm 13.23 72,118<br />

Norse Energy (Oslo) NEC NO NO₭2.15 NO₭234mm $41mm 3.89 47,853<br />

Norse Energy (ADR) NSEEY US $0.37 $40mm $40mm 3.81 46,865<br />

Northern <strong>Oil</strong> and Gas NOG US $16.92 $1,076mm $1,076mm 22.87 203,360<br />

Northern Petroleum NOP LN 66p £63mm $102mm 1.34 62,713<br />

Norwegian Energy AS NOR NO NO₭5.10 NO₭1,244mm $219mm 9.67 -<br />

NovaTek OAO NVTK RM RUB354 RUB1,074,549mm $34,651mm 2.38 34,982<br />

Novus Energy NVS CN C$0.87 C$165mm $169mm 11.48 84,558<br />

Oakridge Energy OAKR US $1.55 $6mm $6mm 8.88 138,067<br />

Oasis Petroleum OAS US $29.10 $2,716mm $2,716mm 34.30 252,775<br />

<strong>Oil</strong> India OINL IN INR493 INR296,059mm $5,612mm 24.20 -<br />

<strong>Oil</strong> Search (London) OSH AU A$7.42 A$9,879mm $9,462mm 16.45 -<br />

<strong>Oil</strong> Search (ADR) OISHY US $78.09 $10,397mm $10,397mm 18.08 -<br />

<strong>Oil</strong>ex (ASX) OEX AU A$0.06 A$21mm $20mm 0.24 -<br />

<strong>Oil</strong>ex (London) OEX LN 4p £14mm $23mm 0.27 -<br />

Oracle Energy OEC CN C$0.12 C$4mm $4mm 45.82 -<br />

Pace <strong>Oil</strong> & Gas PCE CN C$2.90 C$136mm $139mm 1.95 9,630<br />

Pacific Rubiales Energy PRE CN C$23.35 C$6,891mm $7,031mm 14.23 67,083<br />

Pakistan Petroleum (Karachi) PPL PA PKR176 PKR288,527mm $3,043mm 1.18 16,572<br />

Palliser <strong>Oil</strong> & Gas PXL CN C$0.67 C$36mm $37mm 20.94 26,796<br />

Pan Orient Energy POE CN C$2.86 C$162mm $166mm 8.71 65,137<br />

Panhandle <strong>Oil</strong> and Gas PHX US $31.24 $257mm $257mm 13.79 60,372<br />

Paramount Resources POU CN C$29.72 C$2,543mm $2,595mm 47.14 143,199<br />

Pioneer Drilling Co PDCE US $31.57 $955mm $955mm 6.15 47,351<br />

Pengrowth Energy PGF CN C$6.68 C$3,364mm $3,433mm 10.18 45,578<br />

Penn Virginia PVA US $6.45 $296mm $296mm 1.94 13,439<br />

Penn West Petroleum PWT CN C$14.23 C$6,786mm $6,924mm 9.50 41,844<br />

Perpetual Energy PMT CN C$1.23 C$181mm $185mm 2.20 7,552<br />

PetroBakken Energy PBN CN C$13.95 C$2,620mm $2,673mm 13.14 65,572<br />

Petrodorado Energy PDQ CN C$0.19 C$89mm $91mm 171.53 -<br />

Petroneft (Dublin) PTR ID €0.10 €41mm $53mm 0.55 102,545<br />

Petroneft (London) PTR LN 8p £32mm $52mm 0.53 99,625<br />

Petroquest Energy PQ US $6.74 $432mm $432mm 9.34 30,116<br />

Petsec Energy (ASX) PSA AU A$0.15 A$35mm $34mm 12.56 -<br />

Petsec Energy (ADR) PSJEY US $0.76 $36mm $36mm 13.29 -<br />

Pinecrest Energy PRY CN C$1.70 C$364mm $372mm 4.56 40,014<br />

13

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Pioneer Natural Resources PXD US $105 $12,877mm $12,877mm 11.88 94,303<br />

Pioneer Southwest Energy Partners PSE US $26.17 $935mm $935mm 18.28 133,581<br />

Plains Exploration & Production PXP US $37.36 $4,819mm $4,819mm 11.50 47,037<br />

PostRock Energy PSTR US $1.56 $19mm $19mm 0.89 2,152<br />

Premier <strong>Oil</strong> (London) PMO LN 363p £1,918mm $3,111mm 10.58 76,202<br />

Premier <strong>Oil</strong> (ADR) PMOIY US $6.02 $3,185mm $3,185mm 10.83 78,022<br />

PrimeEnergy PNRG US $27.03 $71mm $71mm 3.89 17,208<br />

Primera Energy Resources PTT CN C$0.17 C$10mm $10mm 4.36 26,355<br />

Progress Energy Resources PRQ CN C$21.89 C$5,150mm $5,254mm 15.56 116,192<br />

Pyramid <strong>Oil</strong> Co PDO US $4.30 $20mm $20mm 36.40 129,939<br />

QEP Resources QEP US $31.66 $5,628mm $5,628mm 9.00 42,952<br />

QR Energy QRE US $19.45 $728mm $728mm 9.47 53,231<br />

Questerre Energy QEC CN C$0.71 C$164mm $167mm 64.37 259,195<br />

Quicksilver Resources KWK US $4.28 $740mm $740mm 1.53 10,354<br />

Range Resources (US) RRC US $70.08 $11,387mm $11,387mm 13.00 118,695<br />

Range Resources (ASX)* RRS AU A$0.08 A$159mm $152mm 7.00 179,081<br />

Range Resources (London)* RRL LN 5p £105mm $170mm 7.82 200,083<br />

Range Resources (ADR)* RGRYY US $3.00 $159mm $159mm 7.30 186,960<br />

Recovery Energy RECV US $4.39 $79mm $79mm 124.37 283,180<br />

Red Fork Energy (ASX) RFE AU A$0.73 A$281mm $269mm 15.10 -<br />

Red Fork Energy (ADR) RDFEY US $7.26 #VALUE! #VALUE! - -<br />

Renegade Petroleum RPL CN C$2.70 C$242mm $247mm 28.92 99,387<br />

Resaca Exploitation RSOX LN 14p £3mm $4mm 0.35 8,102<br />

Reserve Petroleum RSRV US $295 $47mm $47mm 57.65 116,643<br />

Resolute Energy REN US $9.13 $565mm $565mm 9.59 89,031<br />

Rex Energy REXX US $13.33 $703mm $703mm 11.11 105,039<br />

RMP Energy RMP CN C$2.09 C$215mm $219mm 9.40 60,773<br />

Roc <strong>Oil</strong> (ASX) ROC AU A$0.37 A$249mm $239mm 15.82 -<br />

Rock Energy RE CN C$0.97 C$38mm $39mm 1.75 12,823<br />

Rockhopper Exploration RKH LN 173p £491mm $796mm 1.77 -<br />

Rosetta Resources ROSE US $47.62 $2,518mm $2,518mm 15.30 203,996<br />

ROXI Petroleum RXP LN 3p £19mm $31mm 12.36 -<br />

Royale Energy ROYL US $4.32 $48mm $48mm 59.73 86,600<br />

RusPetro RPO LN 109p £363mm $589mm 0.38 127,976<br />

Salamander Energy (London) SMDR LN 206p £529mm $858mm 11.38 47,591<br />

Sanchez Energy SN US $20.05 $672mm $672mm 99.75 1,399,067<br />

SandRidge Energy SD US $6.99 $3,433mm $3,433mm 7.12 52,295<br />

Santos (ASX) STO AU A$11.36 A$10,855mm $10,398mm 8.05 -<br />

Santos (ADR) SSLTY US $11.71 $11,190mm $11,190mm 8.66 -<br />

Saratoga Resources SARA US $5.44 $168mm $168mm 8.59 63,550<br />

Sea Dragon Energy SDX CN C$0.07 C$24mm $25mm 3.43 22,557<br />

Second Wave Petroleum SCS CN C$0.94 C$79mm $81mm 10.15 47,031<br />

Serica Energy (London) SQZ LN 29p £51mm $82mm 9.90 -<br />

Shoreline Energy SEQ CN C$3.70 C$21mm $21mm 3.96 36,173<br />

14

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Skope Energy SKL CN C$0.15 C$1mm $1mm 0.08 195<br />

SM Energy SM US $52.80 $3,440mm $3,440mm 15.97 43,070<br />

Soco International SIA LN 331p £1,098mm $1,780mm 13.66 145,953<br />

Sonde Resources SOQ CN C$0.70 C$44mm $44mm 4.51 15,513<br />

Southern Pacific Resource STP CN C$1.43 C$488mm $498mm 2.75 117,096<br />

Southwestern Energy SWN US $34.94 $12,198mm $12,198mm 11.83 50,886<br />

Spindletop <strong>Oil</strong> & Gas SPND US $2.09 $16mm $16mm 36.94 119,666<br />

Sprint Energy SPS AU A$0.02 A$15mm $15mm 1.22 -<br />

Sterling Energy SEY LN 42p £92mm $150mm 374.81 273,613<br />

Sterling Resources SLG CN C$1.40 C$312mm $318mm 9.63 4,486,415<br />

Stone Energy SGY US $25.41 $1,259mm $1,259mm 12.75 34,429<br />

Storm Resources SRX CN C$1.50 C$93mm $95mm 10.90 164,168<br />

Sun River Energy SNRV US $0.11 $4mm $4mm 124.13 120,494<br />

Sure Energy SHR CN C$0.62 C$38mm $38mm 6.58 31,836<br />

Surge Energy SGY CN C$7.75 C$551mm $562mm 17.11 90,690<br />

Swift Energy SFY US $20.83 $893mm $893mm 5.42 30,212<br />

Talisman Energy TLM CN C$13.47 C$13,900mm $14,182mm 11.07 38,537<br />

Tap <strong>Oil</strong> (ASX) TAP AU A$0.73 A$175mm $168mm 20.68 -<br />

Tatneft (Moscow) TATN RM RUB202 RUB439,006mm $14,157mm 2.15 27,632<br />

Tatneft (ADR) OAOFY US $40.00 $14,528mm $14,528mm 2.20 28,356<br />

Tengasco TGC US $0.72 $43mm $43mm 16.77 81,963<br />

Terra Energy TT CN C$0.11 C$11mm $11mm 0.32 2,166<br />

Tethys Petroleum TPL CN C$0.71 C$204mm $208mm 14.32 42,620<br />

Texas Vanguard <strong>Oil</strong> TVOC US $10.90 $15mm $15mm 18.97 56,829<br />

Texon Petroleum TXN AU A$0.38 A$92mm $88mm 13.68 -<br />

Torquay <strong>Oil</strong> TOC/A CN C$0.13 C$6mm $6mm 5.31 17,797<br />

TransAtlantic Petroleum TNP CN C$1.03 C$379mm $387mm 18.83 82,774<br />

TransGlobe Energy TGL CN C$10.39 C$762mm $778mm 13.01 64,272<br />

Traverse Energy TVL CN C$0.64 C$28mm $29mm 110.67 225,779<br />

Triangle Petroleum TPLM US $7.19 $319mm $319mm 214.84 1,222,797<br />

Tribute Resources TRB CN C$0.05 C$3mm $4mm 93.19 -<br />

Trilogy Energy TET CN C$25.17 C$2,284mm $2,331mm 25.45 80,341<br />

Tullow <strong>Oil</strong> (London) TLW LN 1,373p £12,455mm $20,197mm 67.25 260,937<br />

Tullow <strong>Oil</strong> (ADR) TUWOY US $11.10 $20,139mm $20,139mm 67.06 -<br />

Tuscany Energy TUS CN C$0.08 C$10mm $10mm 5.84 39,461<br />

Twin Butte Energy TBE CN C$2.82 C$612mm $625mm 20.03 80,456<br />

Twoco Petroleums TWO CN C$0.08 C$6mm $6mm 1.23 13,496<br />

Ultra Petroleum UPL US $21.93 $3,354mm $3,354mm 3.86 28,565<br />

Urals Energy UEN LN 5p £13mm $20mm 26.82 -<br />

US Energy Wyoming USEG US $2.14 $59mm $59mm 18.27 47,749<br />

Vaalco Energy EGY US $8.63 $499mm $499mm 83.02 95,268<br />

Vanguard Natural Resources VNR US $28.94 $1,670mm $1,670mm 20.70 122,417<br />

Venoco VQ US $11.87 $730mm $730mm 7.42 40,179<br />

Vermilion Energy VET CN C$46.18 C$4,547mm $4,639mm 31.70 129,426<br />

15

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Local Currency Local Market $<br />

Market Cap<br />

28 September 2012<br />

Per Barrel of Per Daily Barrel of<br />

Reserves ($/boe) Production ($/bopd)<br />

Vero Energy VRO CN C$2.53 C$124mm $126mm 3.53 13,231<br />

Victoria <strong>Oil</strong> & Gas * VOG LN 3p £69mm $112mm 2.08 258,439<br />

W&T Offshore WTI US $19.24 $1,431mm $1,431mm 12.00 30,021<br />

Waldron Energy WDN CN C$0.48 C$19mm $20mm 1.67 6,985<br />

Warren Resources WRES US $3.06 $220mm $220mm 9.71 44,833<br />

Westfire Energy WFE CN C$4.08 C$275mm $281mm 9.54 47,537<br />

Whitecap Resources WCP CN C$7.48 C$951mm $970mm 13.10 166,284<br />

Whiting Petroleum WLL US $47.08 $5,538mm $5,538mm 15.93 80,854<br />

Winstar Resources WIX CN C$3.00 C$107mm $110mm 9.20 65,125<br />

Woodside Petroleum (ASX) WPL AU A$33.14 A$27,304mm $26,154mm 17.75 -<br />

Woodside Petroleum (ADR) WOPEY US $34.50 $28,425mm $28,425mm 19.29 -<br />

WPX Energy WPX US $16.73 $3,330mm $3,330mm 3.60 13,304<br />

Xcite Energy (London) XEL LN 110p £319mm $518mm 4.46 -<br />

Xcite Energy (Toronto) XEL CN C$1.75 C$508mm $518mm 4.47 -<br />

Yoho Resources YO CN C$1.74 C$80mm $81mm 5.67 32,877<br />

ZaZa Energy ZAZA US $2.99 $304mm $304mm 52.70 355,808<br />

Zhaikmunai ZKM LI $10.16 $1,898mm $1,898mm 3.64 45,179<br />

Source: Bloomberg & Fox-Davies Data<br />

16

<strong>Oil</strong> <strong>Monitor</strong><br />

Exploration<br />

Fox-Davies Capital<br />

28 September 2012<br />

Exchange Per Barrel of Resource ($/boe)<br />

ASE 0.08<br />

Canada Ntnl 0.01<br />

London 0.07<br />

Venture 0.06<br />

Source: Bloomberg & Fox-Davies Data<br />

Company Name<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

Per Barrel of Resources<br />

($/boe)<br />

3D <strong>Oil</strong> TDO AU A$0.07 A$15mm $14mm -<br />

3Legs Resources 3LEG LN 42p £35mm $57mm -<br />

Abenteuer Resources ABU CN C$0.07 C$1mm $1mm -<br />

Acer Energy ACN AU A$0.21 A$95mm $91mm -<br />

Adira Energy ADENF US $0.14 $25mm $25mm -<br />

Advance Energy AVD AU A$0.01 A$5mm $4mm -<br />

ADX Energy ADX AU A$0.02 A$9mm $8mm -<br />

Africa <strong>Oil</strong> AOI CN C$9.65 C$2,135mm $2,178mm -<br />

Alberta <strong>Oil</strong>sands AOS CN C$0.10 C$15mm $15mm -<br />

Alcorn Gold Resources APM PM PHP0.02 PHP2,295mm $55mm -<br />

Alkane Energy ALK LN 20p £20mm $33mm -<br />

Alon Natural Gas Exploration ALGS IT ILs3,635 ILs50,740mm $12,976mm -<br />

Altex Industries ALTX US $0.10 $1mm $1mm -<br />

Altima Resources ARH CN C$0.05 C$12mm $12mm -<br />

Ambassador <strong>Oil</strong> and Gas AQO AU A$0.10 A$14mm $13mm -<br />

American Energy Group AEGG US $0.16 $6mm $6mm -<br />

Americas Petrogas BOE CN C$1.56 C$330mm $336mm -<br />

Anglo Canadian <strong>Oil</strong> ACG CN C$0.03 C$6mm $6mm -<br />

Antares Energy AZZ AU A$0.49 A$125mm $119mm -<br />

Anterra Energy AE/A CN C$0.05 C$12mm $13mm -<br />

Archer Petroleum ARK CN C$0.10 C$mm $mm -<br />

Argos Resources ARG LN 24p £52mm $85mm 0.09<br />

Atlantic Petroleum ATLA IR DKK190 DKK499mm $87mm -<br />

Aurelian <strong>Oil</strong> & Gas AUL LN 9p £43mm $69mm -<br />

Aurora <strong>Oil</strong> & Gas (ASX) AUT AU A$3.60 A$1,612mm $1,544mm -<br />

AusTex <strong>Oil</strong> (ASX) AOK AU A$0.14 A$44mm $43mm -<br />

AusTex <strong>Oil</strong> (ADR) ATXDY US $7.19 $47mm $47mm -<br />

Austin Exploration (ASX) AKK AU A$0.03 A$42mm $40mm -<br />

Australian <strong>Oil</strong> & Gas AOGC US $0.03 $1mm $1mm -<br />

Australian <strong>Oil</strong> AOC AU A$0.05 A$4mm $4mm -<br />

Avner <strong>Oil</strong> Exploration AVNRL IT ILs224 ILs747,002mm $191,039mm -<br />

AWE AWE AU A$1.31 A$684mm $655mm -<br />

Azabache Energy AZA CN C$0.30 C$37mm $38mm -<br />

Azabache Energy AZGS US $0.16 $2mm $2mm -<br />

Bahamas Petroleum (London) BPC LN 5p £57mm $92mm 0.01<br />

Bakken Resources BKKN US $0.29 $16mm $16mm -<br />

17

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Baraka Energy and Resources BKP AU A$0.01 A$27mm $26mm -<br />

Bass Strait <strong>Oil</strong> BAS AU A$0.02 A$8mm $8mm -<br />

Bayou City Exploration BYCX US $0.64 $1mm $1mm -<br />

Bayshore Petroleum BSH CN C$0.33 C$5mm $5mm -<br />

Baytex Energy BTE CN C$47.12 C$5,667mm $5,782mm -<br />

Bellatrix Exploration BXE CN C$3.96 C$426mm $434mm -<br />

Benakat Petroleum Energy BIPI IJ IDR184 IDR6,448,050mm $672mm -<br />

Big Sky Petroleum BSP CN C$0.14 C$8mm $9mm -<br />

Blackhawk Resource /Canada BLR CN C$0.13 C$3mm $3mm -<br />

Blacksands Petroleum BSPE US $1.15 $19mm $19mm -<br />

Blue Energy BUL AU A$0.05 A$51mm $49mm -<br />

Bluebird Energy BBE LN 0.45p £2mm $4mm -<br />

BNK Petroleum BKX CN C$0.71 C$102mm $105mm -<br />

Bontan BNTNF US $0.05 $2mm $2mm -<br />

Border Petroleum BOR CN C$0.14 C$31mm $32mm -<br />

Borders & Southern Petroleum BOR LN 25p £121mm $196mm -<br />

Boss Resources BOE AU A$0.06 A$23mm $22mm -<br />

Bounty <strong>Oil</strong> & Gas NL BUY AU A$0.02 A$15mm $14mm -<br />

BowLeven BLVN LN 77p £227mm $368mm -<br />

Brenham <strong>Oil</strong> & Gas BRHM US $0.07 $8mm $8mm -<br />

Brinx Resources BNXR US $0.07 $2mm $2mm -<br />

Brixton Energy BRX CN C$0.03 C$1mm $1mm -<br />

Brookwater Ventures BW CN C$0.03 C$3mm $3mm -<br />

Brownstone Energy BWN CN C$0.22 C$28mm $28mm -<br />

BRS Resources BRS CN C$0.10 C$5mm $5mm -<br />

Buccaneer Energy BCC AU A$0.06 A$82mm $78mm -<br />

Bucking Horse Energy BUC CN C$1.48 C$33mm $34mm -<br />

Buru Energy BRU AU A$2.92 A$733mm $702mm -<br />

Butte Energy BEN CN C$0.21 C$9mm $9mm -<br />

Cairn Energy CNE LN 276p £1,660mm $2,692mm -<br />

Cairn Energy (ADR) CRNCY US $8.94 $2,693mm $2,693mm -<br />

Calvalley Petroleums CVI/A CN C$2.17 C$205mm $209mm -<br />

Canada Energy Partners CE CN C$0.16 C$13mm $14mm -<br />

Canadian Imperial Venture CQV CN C$0.02 C$8mm $8mm -<br />

Canadian Overseas Petroleum XOP CN C$0.22 C$61mm $62mm -<br />

Canadian Phoenix Resources CXP CN C$1.20 C$69mm $70mm -<br />

Canadian Quantum Energy CQM CN C$0.14 C$4mm $4mm -<br />

Canadian Spirit Resources SPI CN C$0.36 C$33mm $33mm -<br />

Cobalt International Energy CIG AU A$0.06 A$14mm $13mm -<br />

Caza <strong>Oil</strong> & Gas (London) CAZA LN 7p £12mm $19mm -<br />

Caza <strong>Oil</strong> & Gas (Toronto) CAZ CN C$0.10 C$16mm $17mm -<br />

CBM Asia Development TCF CN C$0.17 C$29mm $29mm -<br />

Central Petroleum (ASX) CTP AU A$0.14 A$187mm $179mm -<br />

CGX Energy OYL CN C$0.24 C$99mm $101mm -<br />

18

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Challenger Energy CEL AU A$0.08 A$26mm $25mm -<br />

Chariot <strong>Oil</strong> & Gas CHAR LN 31p £63mm $102mm 0.01<br />

Circle Star Energy CRCL US $0.36 $11mm $11mm -<br />

Clontarf Energy CLON LN 2p £4mm $6mm -<br />

Cobalt International Energy CIE US $22.16 $9,099mm $9,099mm -<br />

Cobra Venture CBV CN C$0.24 C$4mm $4mm -<br />

Columbus Energy CEL CN C$0.03 C$2mm $2mm -<br />

Comet Ridge COI AU A$0.11 A$44mm $42mm -<br />

Commodity Quest AB COMQ SS SE₭0.08 SE₭14mm $2mm -<br />

Constellation Energy Partners CEP US $1.29 $31mm $31mm -<br />

Contact Exploration CEX CN C$0.17 C$32mm $33mm -<br />

Continental Energy CPPXF US $0.05 $5mm $5mm -<br />

Cooper Energy COE AU A$0.51 A$168mm $161mm -<br />

Cross Border Resources XBOR US $1.20 $19mm $19mm -<br />

Crown Point Ventures CWV CN C$0.40 C$41mm $42mm -<br />

CUB Energy KUB CN C$0.40 C$84mm $86mm -<br />

Cygam Energy CYG CN C$0.36 C$37mm $38mm -<br />

Cypress Hills Resource CHY CN C$0.15 C$2mm $2mm -<br />

Deep Well <strong>Oil</strong> & Gas DWOG US $0.08 $11mm $11mm -<br />

Delek Drilling - DEDRL IT ILs1,270 ILs694,648mm $177,650mm -<br />

Delek Energy Systems DLEN IT ILs158,800 ILs808,160mm $206,680mm -<br />

Delphi Energy DEE CN C$1.27 C$167mm $170mm -<br />

Delta <strong>Oil</strong> & Gas DLTA US $0.10 $1mm $1mm -<br />

Derek <strong>Oil</strong> & Gas DRK CN C$0.03 C$3mm $3mm -<br />

Desire Petroleum DES LN 24p £80mm $130mm -<br />

Desmarais Energy DES CN C$0.04 C$2mm $2mm -<br />

Devin Energy DVC/H CN C$0.48 C$4mm $4mm -<br />

DNO (Oslo) DNO NO NO₭11.03 NO₭11,287mm $1,983mm -<br />

Double Eagle Petroleum Co DBLE US $5.55 $62mm $62mm -<br />

Doxa Energy DXA CN C$0.15 C$5mm $5mm -<br />

Dragon <strong>Oil</strong> (Dublin) DGO ID €7.54 €3,715mm $4,805mm -<br />

Drillsearch Energy DLS AU A$1.55 A$599mm $574mm -<br />

Duma Energy DUMA US $1.95 $26mm $26mm -<br />

Dundee Energy DEN CN C$0.40 C$66mm $67mm -<br />

Eaglewood Energy EWD CN C$0.48 C$42mm $42mm -<br />

Earth Heat Resources EHR AU A$0.01 A$7mm $6mm -<br />

East West Petroleum EW CN C$0.39 C$32mm $33mm -<br />

Eastern American Natural Gas NGT US $21.16 $125mm $125mm -<br />

Eco Atlantic <strong>Oil</strong> & Gas EOG CN C$0.35 C$21mm $22mm -<br />

Ecosse Energy * ECS CN C$0.43 C$20mm $20mm 0.01<br />

Edge Resources EDE CN C$0.31 C$33mm $34mm -<br />

El Condor Minerals LCO CN C$0.06 C$6mm $6mm -<br />

Elixir Petroleum EXR AU A$0.02 A$7mm $6mm -<br />

Elk Petroleum ELK AU A$0.25 A$36mm $35mm -<br />

19

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Emerald Bay Energy EBY CN C$0.06 C$6mm $6mm -<br />

Emerald <strong>Oil</strong> & Gas NL EMR AU A$0.01 A$12mm $12mm -<br />

Empire Energy International EEGC US $0.01 $2mm $2mm -<br />

Empire Energy Group (ASX) EEG AU A$0.15 A$45mm $43mm -<br />

Empire Energy Group (ADR) EEGNY US $4.89 $73mm $73mm -<br />

Empire <strong>Oil</strong> & Gas EGO AU A$0.01 A$62mm $60mm -<br />

Empire Petroleum EMPR US $0.02 $2mm $2mm -<br />

Empyrean Energy EME LN 9p £19mm $30mm -<br />

Enegi <strong>Oil</strong> ENEG LN 10p £13mm $21mm -<br />

Energi Mega Persada (Indonesia) ENRG IJ IDR90.00 IDR3,652,570mm $381mm -<br />

EnerJex Resources ENRJ US $0.64 $45mm $45mm -<br />

Enhanced <strong>Oil</strong> Resources EOR CN C$0.16 C$26mm $26mm -<br />

Entek Energy ETE AU A$0.09 A$47mm $45mm -<br />

Enterprise Energy Resources EER CN C$0.13 C$6mm $6mm -<br />

Epsilon Energy /Canada EPS CN C$1.97 C$98mm $100mm -<br />

ERHC Energy ERHE US $0.14 $101mm $101mm -<br />

Europa <strong>Oil</strong> & Gas Holdings EOG LN 7p £10mm $16mm -<br />

European Gas EPG AU A$0.38 A$29mm $28mm -<br />

Exoma Energy EXE AU A$0.09 A$37mm $35mm -<br />

FairWest Energy FEC CN C$0.04 C$11mm $11mm -<br />

Falcon <strong>Oil</strong> & Gas FO CN C$0.20 C$139mm $142mm -<br />

Falkland <strong>Oil</strong> & Gas FOGL LN 67p £214mm $348mm 0.07<br />

FAR (ASX) FAR AU A$0.04 A$87mm $84mm -<br />

Faroe Petroleum FPM LN 151p £321mm $521mm -<br />

FEC Resources FECOF US $0.01 $6mm $6mm -<br />

Force Energy FORC US $0.02 $1mm $1mm -<br />

Forent Energy FEN CN C$0.06 C$8mm $8mm -<br />

Forum Energy FEP LN 76p £27mm $44mm -<br />

Frontera Resources FRR LN 0.49p £10mm $16mm -<br />

Gale Force Petroleum GFP CN C$0.24 C$15mm $15mm -<br />

Gallic Energy GLC CN C$0.07 C$11mm $11mm -<br />

Gambit Energy GMEI US $0.25 $7mm $7mm -<br />

Gas2Grid GGX AU A$0.08 A$47mm $45mm -<br />

Gasol GAS LN 19p £6mm $10mm -<br />

Gastem GMR CN C$0.07 C$6mm $6mm -<br />

Genel Energy GENL LN 772p £1,650mm $2,676mm -<br />

GeoGlobal Resources GGR US $0.12 $17mm $17mm -<br />

GeoMet GMET US $0.16 $6mm $6mm -<br />

Georox Resources GXR CN C$0.10 C$3mm $3mm -<br />

Givot Olam <strong>Oil</strong> Exploration GIVOL IT ILs3.30 ILs34,878mm $8,920mm -<br />

Global <strong>Oil</strong> & Gas AG 3GOK GR €1.05 €5mm $7mm -<br />

Global Petroleum (ASX) GBP AU A$0.14 A$28mm $27mm -<br />

Global Petroleum (London) GBP LN 9p £17mm $28mm -<br />

Globe Exploration GLEX IT ILs22.80 ILs248mm $64mm -<br />

20

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Golden Gate Petroleum (ASX) GGP AU A$0.01 A$19mm $18mm -<br />

Gran Tierra Exchangeco GTX CN C$5.00 C$38mm $39mm -<br />

Grand Gulf Energy GGE AU A$0.00 A$11mm $11mm -<br />

Greencastle Resources VGN CN C$0.10 C$5mm $5mm -<br />

Greenpower Energy GPP AU A$0.06 A$4mm $4mm -<br />

Greenvale Mining (ASX) GRV AU A$0.05 A$3mm $3mm -<br />

Groundstar Resources GSA CN C$0.02 C$1mm $1mm -<br />

GSV GSVI US $0.02 $mm $mm -<br />

Guardian Exploration GX CN C$0.02 C$1mm $2mm -<br />

Gujarat Natural Resources GERL IN INR85.00 INR3,294mm $62mm -<br />

Gulf Coast <strong>Oil</strong> & Gas GCOG US $0.00 $mm $mm -<br />

Gulf Keystone (ADR) GFKSY US $78.67 $3,446mm $3,446mm -<br />

Gulf Shores Resources GUL CN C$0.02 C$1mm $2mm -<br />

Gulf United Energy GLFE US $0.06 $33mm $33mm -<br />

Hibiscus Petroleum Bhd HIBI MK MYR1.76 MYR772mm $252mm -<br />

Hindustan <strong>Oil</strong> Exploration HOE IN INR118 INR15,398mm $292mm -<br />

HKN HKN US $1.90 $33mm $33mm -<br />

Holloman Energy HENC US $0.31 $34mm $34mm -<br />

Horizon <strong>Oil</strong> HZN AU A$0.30 A$339mm $325mm -<br />

Horn Petroleum HRN CN C$0.33 C$32mm $33mm -<br />

HRT Participacoes em Petroleo HRTP3 BZ BrR4.56 BrR1,343mm $662mm -<br />

Huntington Exploration HEI CN C$0.04 C$3mm $3mm -<br />

Hyperdynamics HDY US $0.70 $118mm $118mm -<br />

Icon Energy /Australia ICN AU A$0.22 A$103mm $99mm -<br />

Idaho Natural Resources IDN/H CN C$0.30 C$1mm $1mm -<br />

IGAS Energy IGAS LN 78p £126mm $204mm -<br />

Incremental <strong>Oil</strong> & Gas IOG AU A$0.24 A$37mm $36mm -<br />

Index <strong>Oil</strong> & Gas IXOG US $0.00 $mm $mm -<br />

Indigo-Energy IDGG US $0.00 $1mm $1mm -<br />

Indus Gas INDI LN 990p £1,811mm $2,936mm -<br />

Infinity Energy Resources IFNY US $1.68 $35mm $35mm -<br />

INOC Dead Sea HLDSL IT ILs1,552 ILs48,955mm $12,520mm -<br />

Interlink Petroleum ITP IN INR20.95 INR522mm $10mm -<br />

International Frontier Resources IFR CN C$0.09 C$5mm $5mm -<br />

Interra Resources ITRR SP SGD0.42 SGD184mm $150mm -<br />

Iofina IOF LN 67p £85mm $138mm -<br />

Iona Energy INA CN C$0.45 C$145mm $148mm -<br />

Ironhorse <strong>Oil</strong> & Gas IOG CN C$0.14 C$4mm $4mm -<br />

Israel Land Development Energy IE IT ILs18.80 ILs17,517mm $4,480mm -<br />

Israel Opportunity Energy ISOPL IT ILs18.00 ILs13,434mm $3,436mm -<br />

Isramco Negev 2 ISRAL IT ILs48.40 ILs626,863mm $160,315mm -<br />

Jacka Resources JKA AU A$0.15 A$37mm $36mm -<br />

Jadela <strong>Oil</strong> JOC CN C$0.25 C$7mm $7mm -<br />

Japan Petroleum Exploration 1662 JP ¥3,130 ¥178,894mm $2,304mm -<br />

21

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Jayhawk Energy JYHW US $0.02 $1mm $1mm -<br />

Jubilant Energy JUB LN 15p £61mm $99mm -<br />

Junex JNX CN C$0.76 C$51mm $52mm -<br />

Jupiter Energy JPR AU A$0.53 A$81mm $77mm -<br />

Jura Energy JEC CN C$0.30 C$21mm $21mm -<br />

Kairiki Energy KIK AU A$0.00 A$5mm $5mm -<br />

Kallisto Energy KEC CN C$0.09 C$5mm $5mm -<br />

Kanto Natural Gas Development 1661 JP ¥427 ¥26,045mm $335mm -<br />

Karoon Gas (ASX) KAR AU A$5.40 A$1,196mm $1,145mm -<br />

KazMunaiGas E&P JSC RDGZ KZ KZT16,275 KZT1,093,557mm $7,297mm -<br />

KEA Petroleum KEA LN 8p £43mm $69mm -<br />

Key Petroleum KEY AU A$0.03 A$14mm $13mm -<br />

KFG Resources KFG CN C$0.04 C$2mm $2mm -<br />

Kina Petroleum KPL AU A$0.37 A$72mm $69mm -<br />

Kingsland Energy KLE CN C$0.65 C$41mm $42mm -<br />

Kulczyk <strong>Oil</strong> Ventures KOV PW PLN1.30 PLN626mm $197mm -<br />

Kunlun Energy (Hong Kong) 135 HK HK$13.58 HK$109,083mm $14,068mm -<br />

L&M Energy LME NZ NZ$0.06 NZ$41mm $50mm -<br />

Lakes <strong>Oil</strong> LKO AU A$0.00 A$21mm $20mm -<br />

Lansdowne <strong>Oil</strong> & Gas LOGP LN 57p £80mm $129mm -<br />

Lapidoth-Heletz LPHLL IT ILs10.00 ILs14,024mm $3,586mm -<br />

Lariat Energy LE CN C$0.08 C$1mm $1mm -<br />

Leed Resources LDP LN 0.28p £7mm $12mm -<br />

Leni Gas & <strong>Oil</strong> LGO LN 0.40p £5mm $8mm -<br />

Lexaria LXRP US $0.08 $1mm $1mm -<br />

Linc Energy (ASX) LNC AU A$0.63 A$318mm $304mm -<br />

Linc Energy (ADR) LNCGY US $6.70 $338mm $338mm -<br />

Lion Energy LIO AU A$0.04 A$5mm $4mm -<br />

LNG Energy LNG CN C$0.06 C$20mm $21mm -<br />

Longford Energy LFD/H CN C$0.13 C$23mm $23mm -<br />

Longreach <strong>Oil</strong> & Gas LOI CN C$0.95 C$22mm $23mm 0.06<br />

Longreach <strong>Oil</strong> LGO AU A$0.00 A$1mm $1mm -<br />

Loon Energy LNE CN C$0.10 C$2mm $2mm -<br />

Lynden Energy LVL CN C$0.67 C$74mm $75mm -<br />

Madagascar <strong>Oil</strong> MOIL LN 26p £67mm $109mm -<br />

Madalena Ventures MVN CN C$0.25 C$77mm $79mm -<br />

Magellan Petroleum MPET US $1.04 $56mm $56mm -<br />

Magnolia Petroleum MAGP LN 4p £26mm $42mm -<br />

Mako Hydrocarbons (ASX) MKE AU A$0.09 A$15mm $14mm -<br />

Mammoth Energy Group MMTE US $0.00 $1mm $1mm -<br />

Manas Petroleum MNAP US $0.11 $19mm $19mm -<br />

Marauder Resources East Coast MES CN C$0.06 C$4mm $4mm -<br />

Mari Gas MARI PA PKR97.51 PKR8,959mm $94mm -<br />

Marksmen Energy MAH CN C$0.10 C$3mm $3mm -<br />

22

<strong>Oil</strong> <strong>Monitor</strong><br />

Company Name<br />

Fox-Davies Capital<br />

Bloomberg<br />

Ticker<br />

Previous Closing<br />

Price<br />

Market Cap<br />

Local Currency Local Market $<br />

28 September 2012<br />

Per Barrel of Resources<br />

($/boe)<br />

Mart Resources MMT CN C$1.44 C$512mm $523mm -<br />

MASS Petroleum MASP US $0.30 $9mm $9mm -<br />

Matachewan Consolidated Mines MCM/A CN C$0.25 C$3mm $3mm -<br />

Matra Petroleum MTA LN 2p £30mm $49mm -<br />

Maurel & Prom Nigeria MPNG FP €2.06 €238mm $307mm -<br />

Maverick Drilling & Exploration MAD AU A$1.20 A$541mm $518mm -<br />

Maverick Minerals MVRM US $0.26 $3mm $3mm -<br />

Maxim Resources MXM CN C$0.04 C$1mm $1mm -<br />

Mcchip Resources MCS CN C$1.77 C$10mm $10mm -<br />

Medco Energi (Indonesia) MEDC IJ IDR1,710 IDR5,698,491mm $594mm -<br />

MEO Australia (ASX)* MEO AU A$0.22 A$119mm $114mm 0.05<br />