Political Reform Act 2011 - Fair Political Practices Commission

Political Reform Act 2011 - Fair Political Practices Commission

Political Reform Act 2011 - Fair Political Practices Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

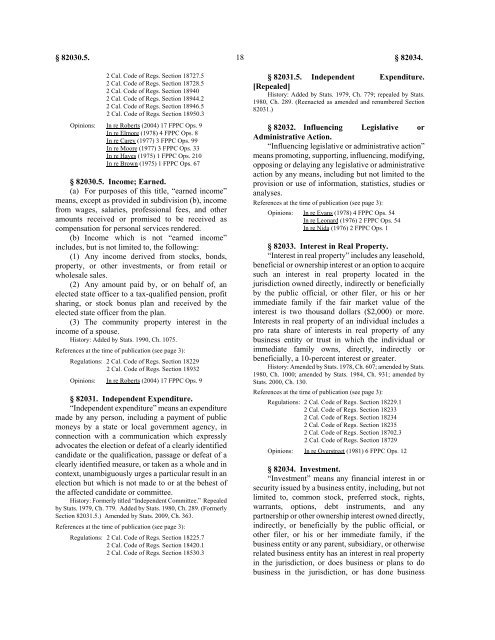

§ 82030.5. 18<br />

§ 82034.<br />

2 Cal. Code of Regs. Section 18727.5<br />

2 Cal. Code of Regs. Section 18728.5<br />

2 Cal. Code of Regs. Section 18940<br />

2 Cal. Code of Regs. Section 18944.2<br />

2 Cal. Code of Regs. Section 18946.5<br />

2 Cal. Code of Regs. Section 18950.3<br />

Opinions: In re Roberts (2004) 17 FPPC Ops. 9<br />

In re Elmore (1978) 4 FPPC Ops. 8<br />

In re Carey (1977) 3 FPPC Ops. 99<br />

In re Moore (1977) 3 FPPC Ops. 33<br />

In re Hayes (1975) 1 FPPC Ops. 210<br />

In re Brown (1975) 1 FPPC Ops. 67<br />

§ 82030.5. Income; Earned.<br />

(a) For purposes of this title, “earned income”<br />

means, except as provided in subdivision (b), income<br />

from wages, salaries, professional fees, and other<br />

amounts received or promised to be received as<br />

compensation for personal services rendered.<br />

(b) Income which is not “earned income”<br />

includes, but is not limited to, the following:<br />

(1) Any income derived from stocks, bonds,<br />

property, or other investments, or from retail or<br />

wholesale sales.<br />

(2) Any amount paid by, or on behalf of, an<br />

elected state officer to a tax-qualified pension, profit<br />

sharing, or stock bonus plan and received by the<br />

elected state officer from the plan.<br />

(3) The community property interest in the<br />

income of a spouse.<br />

History: Added by Stats. 1990, Ch. 1075.<br />

References at the time of publication (see page 3):<br />

Regulations: 2 Cal. Code of Regs. Section 18229<br />

2 Cal. Code of Regs. Section 18932<br />

Opinions: In re Roberts (2004) 17 FPPC Ops. 9<br />

§ 82031. Independent Expenditure.<br />

“Independent expenditure” means an expenditure<br />

made by any person, including a payment of public<br />

moneys by a state or local government agency, in<br />

connection with a communication which expressly<br />

advocates the election or defeat of a clearly identified<br />

candidate or the qualification, passage or defeat of a<br />

clearly identified measure, or taken as a whole and in<br />

context, unambiguously urges a particular result in an<br />

election but which is not made to or at the behest of<br />

the affected candidate or committee.<br />

History: Formerly titled “Independent Committee.” Repealed<br />

by Stats. 1979, Ch. 779. Added by Stats. 1980, Ch. 289. (Formerly<br />

Section 82031.5.) Amended by Stats. 2009, Ch. 363.<br />

References at the time of publication (see page 3):<br />

Regulations: 2 Cal. Code of Regs. Section 18225.7<br />

2 Cal. Code of Regs. Section 18420.1<br />

2 Cal. Code of Regs. Section 18530.3<br />

§ 82031.5. Independent Expenditure.<br />

[Repealed]<br />

History: Added by Stats. 1979, Ch. 779; repealed by Stats.<br />

1980, Ch. 289. (Reenacted as amended and renumbered Section<br />

82031.)<br />

§ 82032. Influencing<br />

Administrative <strong>Act</strong>ion.<br />

Legislative or<br />

“Influencing legislative or administrative action”<br />

means promoting, supporting, influencing, modifying,<br />

opposing or delaying any legislative or administrative<br />

action by any means, including but not limited to the<br />

provision or use of information, statistics, studies or<br />

analyses.<br />

References at the time of publication (see page 3):<br />

Opinions: In re Evans (1978) 4 FPPC Ops. 54<br />

In re Leonard (1976) 2 FPPC Ops. 54<br />

In re Nida (1976) 2 FPPC Ops. 1<br />

§ 82033. Interest in Real Property.<br />

“Interest in real property” includes any leasehold,<br />

beneficial or ownership interest or an option to acquire<br />

such an interest in real property located in the<br />

jurisdiction owned directly, indirectly or beneficially<br />

by the public official, or other filer, or his or her<br />

immediate family if the fair market value of the<br />

interest is two thousand dollars ($2,000) or more.<br />

Interests in real property of an individual includes a<br />

pro rata share of interests in real property of any<br />

business entity or trust in which the individual or<br />

immediate family owns, directly, indirectly or<br />

beneficially, a 10-percent interest or greater.<br />

History: Amended by Stats. 1978, Ch. 607; amended by Stats.<br />

1980, Ch. 1000; amended by Stats. 1984, Ch. 931; amended by<br />

Stats. 2000, Ch. 130.<br />

References at the time of publication (see page 3):<br />

Regulations: 2 Cal. Code of Regs. Section 18229.1<br />

2 Cal. Code of Regs. Section 18233<br />

2 Cal. Code of Regs. Section 18234<br />

2 Cal. Code of Regs. Section 18235<br />

2 Cal. Code of Regs. Section 18702.3<br />

2 Cal. Code of Regs. Section 18729<br />

Opinions: In re Overstreet (1981) 6 FPPC Ops. 12<br />

§ 82034. Investment.<br />

“Investment” means any financial interest in or<br />

security issued by a business entity, including, but not<br />

limited to, common stock, preferred stock, rights,<br />

warrants, options, debt instruments, and any<br />

partnership or other ownership interest owned directly,<br />

indirectly, or beneficially by the public official, or<br />

other filer, or his or her immediate family, if the<br />

business entity or any parent, subsidiary, or otherwise<br />

related business entity has an interest in real property<br />

in the jurisdiction, or does business or plans to do<br />

business in the jurisdiction, or has done business