Customs Information Paper (11) 78 (PDF 32K) - HM Revenue ...

Customs Information Paper (11) 78 (PDF 32K) - HM Revenue ...

Customs Information Paper (11) 78 (PDF 32K) - HM Revenue ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

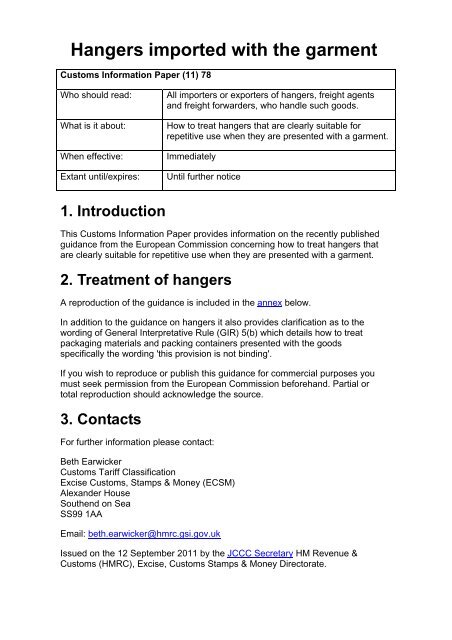

Hangers imported with the garment<br />

<strong>Customs</strong> <strong>Information</strong> <strong>Paper</strong> (<strong>11</strong>) <strong>78</strong><br />

Who should read:<br />

What is it about:<br />

When effective:<br />

Extant until/expires:<br />

All importers or exporters of hangers, freight agents<br />

and freight forwarders, who handle such goods.<br />

How to treat hangers that are clearly suitable for<br />

repetitive use when they are presented with a garment.<br />

Immediately<br />

Until further notice<br />

1. Introduction<br />

This <strong>Customs</strong> <strong>Information</strong> <strong>Paper</strong> provides information on the recently published<br />

guidance from the European Commission concerning how to treat hangers that<br />

are clearly suitable for repetitive use when they are presented with a garment.<br />

2. Treatment of hangers<br />

A reproduction of the guidance is included in the annex below.<br />

In addition to the guidance on hangers it also provides clarification as to the<br />

wording of General Interpretative Rule (GIR) 5(b) which details how to treat<br />

packaging materials and packing containers presented with the goods<br />

specifically the wording 'this provision is not binding'.<br />

If you wish to reproduce or publish this guidance for commercial purposes you<br />

must seek permission from the European Commission beforehand. Partial or<br />

total reproduction should acknowledge the source.<br />

3. Contacts<br />

For further information please contact:<br />

Beth Earwicker<br />

<strong>Customs</strong> Tariff Classification<br />

Excise <strong>Customs</strong>, Stamps & Money (ECSM)<br />

Alexander House<br />

Southend on Sea<br />

SS99 1AA<br />

Email: beth.earwicker@hmrc.gsi.gov.uk<br />

Issued on the 12 September 20<strong>11</strong> by the JCCC Secretary <strong>HM</strong> <strong>Revenue</strong> &<br />

<strong>Customs</strong> (<strong>HM</strong>RC), Excise, <strong>Customs</strong> Stamps & Money Directorate.

If you have a question about the content of this paper please use the details<br />

provided in the Contacts section. For general <strong>HM</strong>RC queries speak to the Excise<br />

& <strong>Customs</strong> Helpline on Tel 0845 010 9000.<br />

To find out what you can expect from <strong>HM</strong>RC and what they expect from you go<br />

to Your Charter.

TAXUD/575040/20<strong>11</strong> EN<br />

Annex<br />

EUROPEAN COMMISSION<br />

DIRECTORATE-GENERAL<br />

TAXATION AND CUSTOMS UNION<br />

<strong>Customs</strong> Policy, Legislation, Tariff<br />

HS Convention, combined nomenclature, tariff classification<br />

Bruxelles, le 12 mai 20<strong>11</strong><br />

Brussels, 12 May 20<strong>11</strong><br />

Brüssel, 12. Mai 20<strong>11</strong><br />

LIMITÉ<br />

LIMITED<br />

NUR FÜR DEN DIENSTGEBRAUCH<br />

COMITÉ DU CODE DES DOUANES<br />

SECTION NOMENCLATURE TARIFAIRE ET STATISTIQUE<br />

(«SECTEUR TEXTILE»)<br />

CUSTOMS CODE COMMITTEE<br />

TARIFF AND STATISTICAL NOMENCLATURE SECTION<br />

(“TEXTILES SECTOR”)<br />

AUSSCHUSS FÜR DEN ZOLLKODEX<br />

FACHBEREICH ZOLLTARIFLICHE UND STATISTISCHE NOMENKLATUR<br />

(„TEXTILSEKTOR“)<br />

Objet:<br />

Subject:<br />

Betrifft:<br />

Classement de cintres<br />

Classification of clothes hangers<br />

Einreihung von Kleiderbügeln<br />

À la suite de la discussion tenue au cours de la 43 e réunion du comité, les délégations<br />

trouveront ci-joint une analyse sur l’application de la règle générale 5 b) pour<br />

l’interprétation de la nomenclature combinée dans le contexte du point en objet. Ce<br />

document sera soumis pour discussion lors d’une prochaine réunion du comité.<br />

Further to the discussion during the 43 rd meeting of the Committee, delegates will find<br />

herewith an analysis on the application of General Rule for the interpretation of the<br />

Combined Nomenclature (GIR) 5(b) in the context of the above-mentioned subject.<br />

This document will be discussed during a forthcoming meeting of the Committee.<br />

Im Anschluss an die Erörterungen auf der 43. Sitzung des Ausschusses erhalten die<br />

Delegierten hiermit eine Analyse der Anwendung der Allgemeinen Vorschrift für die<br />

Auslegung der Kombinierten Nomenklatur (AV) 5 b) im Zusammenhang mit der oben<br />

genannten Ware. Das Dokument wird auf einer der nächsten Ausschusssitzungen<br />

erörtert.

EN<br />

1. Background<br />

The interpretation of the wording of GIR 5 (b) and the tariff classification of clothes<br />

hangers that are imported with garments hanging on them, was examined by the <strong>Customs</strong><br />

Code Committee, Tariff and Statistical Nomenclature Section (Textile Sector) at its 35 th<br />

and 43 rd meeting, following a submission by the administration of a Member State.<br />

According to GIR 5 (b), "subject to the provisions of rule 5(a), packing materials and<br />

packing containers (1) presented with the goods therein shall be classified with the goods<br />

if they are of a kind normally used for packing such goods. However, this provision is<br />

not binding when such packing materials or packing containers are clearly suitable for<br />

repetitive use." Footnote (1) to this GIR states that "The term 'packing materials' and<br />

'packing containers' mean any external or internal containers, holders, wrappings or<br />

supports other than transport devices (e.g. transport containers), tarpaulins, tackle or<br />

ancillary transport equipment. The term 'packing containers' does not cover the<br />

containers referred to in general rule 5 (a). "<br />

The issue debated concerns the fact whether clothes hangers should be classified<br />

separately or together with the garments. Also, in this context, the main question is<br />

whether clothes hangers could be considered as 'packing materials' within the meaning<br />

of GIR 5(b). If this question is to be answered in the affirmative, two additional<br />

questions arise, namely:<br />

– when the clothes hangers 'are clearly suitable for repetitive use', what is the precise<br />

meaning of the terms 'this provision is not binding' in the last sentence of GIR 5(b);<br />

– how to determine whether clothes hangers are 'clearly suitable for repetitive use'?<br />

2. Analysis<br />

This analysis only concerns the interpretation, as a matter of Union law, of the Combined<br />

Nomenclature and is not therefore aimed at clarifying purely technical issues which<br />

might arise in this context.<br />

2.1 With this in mind, the Commission services are of the opinion that, with regard to<br />

the main question, clothes hangers can be considered as holders or supports within<br />

the meaning of GIR 5(b), as they are not only meant to display the garments; they<br />

also serve to protect the garments during transport or storage and they are designed<br />

to facilitate the hanging of clothes in order to prevent wrinkles.<br />

Consequently, such hangers are in principle to be classified together with the<br />

garments with which they are imported, as packing materials pursuant to GIR 5(b).<br />

2.2 However, according to the last sentence of GIR 5(b), this provision is not binding<br />

in case such hangers are clearly suitable for repetitive use. In previous discussions,<br />

several Member States had expressed the view that the term 'not binding' should<br />

be interpreted as meaning that importers are allowed to pick and choose whether

they want to have the coat hangers, which are suitable for repetitive use, classified<br />

separately or together with the garments.<br />

The Commission services do not share this view, since the phrase at issue does not<br />

contain any reference to a choice and does not indicate whether it would be the<br />

importer or the customs administration who would be allowed to choose.<br />

Moreover, such interpretation would not serve the interests of legal certainty and<br />

ease of verification by customs, and would not ensure uniform application of the<br />

Combined Nomenclature.<br />

In this context, the Commission services are of the opinion that the text 'non<br />

binding' means 'not applicable'. Consequently, the first sentence of GIR 5(b)<br />

according to which clothes hangers would be classified as packing materials<br />

together with the garments, does not apply if it is established that they are clearly<br />

suitable for repetitive use. Thus, such hangers are to be classified separately,<br />

pursuant to the other general interpretation rules and notes to the Combined<br />

Nomenclature.<br />

2.3 With regard to the suitability of the clothes hangers for repetitive use, the<br />

Commission services consider that it should be assessed on the basis of their<br />

objective characteristics. A product is suitable for repetitive use when it is<br />

apparent from the way it is made and from the materials used that it is designed to<br />

have a long usable life. The intended use of the hangers by the operators or by the<br />

final consumers is in principle of no relevance when assessing their suitability for<br />

repetitive use.<br />

As the Court of Justice of the European Union recently held in paragraph 47 of the<br />

judgment of 16 December 2010, in case C-339/09 Skoma Lux 1 , " it should be<br />

noted that, whilst, the intended use of a product may constitute an objective<br />

criterion for classification if it is inherent to the product, and that inherent<br />

character must be capable of being assessed on the basis of the product's objective<br />

characteristics and properties (see Case C-l83/06 RUMA [2007] ECR 1-1559,<br />

paragraph 36, and Roeckl Sporthandschuhe, paragraph 28), the intended use of<br />

the product is a relevant criterion only where the classification cannot be made on<br />

the sole basis of the objective characteristics and properties of the product (see, to<br />

that effect, Case 38/76 Industriemetall WMA [1976] ECK 2027, paragraph 7) ".<br />

Finally, in this context, the Commission services are of the view that the<br />

explanatory note to the Combined Nomenclature (CNEN) to GIR 5(b) is not<br />

applicable to clothes hangers. The explanatory note states that packing containers<br />

normally used for marketing beverages, jam, mustard, spices etc. are to be<br />

classified with the goods they contain even if clearly suitable for repetitive use. As<br />

1<br />

http://curia.europa.eu/jurisp/cgi-<br />

bin/form.pl?lang=en&alljur=alljur&jurcdj=jurcdj&jurtpi=jurtpi&jurtfp=jurtfp&numaff=C-<br />

339/09&nomusuel=&docnodecision=docnodecision&allcommjo=allcommjo&affint=affint&affclose=affclo<br />

se&alldocrec=alldocrec&docdecision=docdecision&docor=docor&docav=docav&docsom=docsom&docinf<br />

=docinf&alldocnorec=alldocnorec&docnoor=docnoor&docppoag=docppoag&radtypeord=on&newform=ne<br />

wform&docj=docj&docop=docop&docnoj=docnoj&typeord=ALL&domaine=&mots=&resmax=100&Sub<br />

mit=Rechercher

the explanatory note refers to packing containers, its scope cannot be enlarged to<br />

include holders or supports, such as clothes hangers.<br />

3. Conclusion<br />

In light of the above, the Commission services conclude that tariff classification of<br />

clothes hangers is to be done following an assessment of their objective characteristics<br />

and properties. While single use hangers are to be considered as packing materials within<br />

the meaning of GIR 5(b) and consequently, classified together with the garments,<br />

hangers which are clearly suitable for repetitive use must be classified pursuant to GIR 1<br />

and 6 and if necessary pursuant to the relevant notes of the Combined Nomenclature and<br />

to the other general rules.