Georgian Court University Magazine

Georgian Court University Magazine

Georgian Court University Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

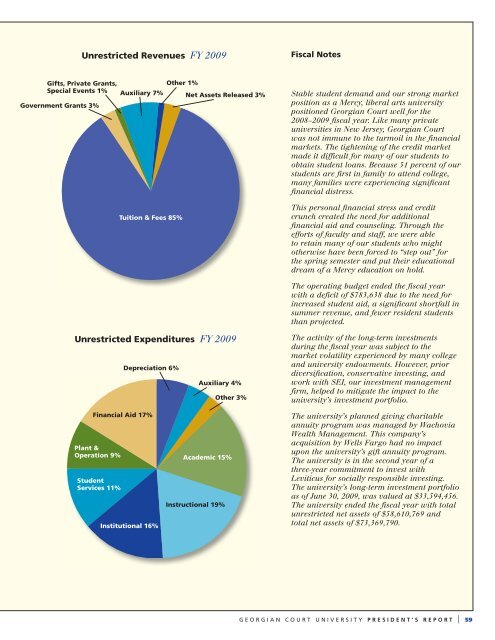

Unrestricted Revenues FY 2009<br />

Fiscal Notes<br />

Gifts, Private Grants,<br />

Special Events 1%<br />

Government Grants 3%<br />

Auxiliary 7%<br />

Other 1%<br />

Net Assets Released 3%<br />

Stable student demand and our strong market<br />

position as a Mercy, liberal arts university<br />

positioned <strong>Georgian</strong> <strong>Court</strong> well for the<br />

2008–2009 fiscal year. Like many private<br />

universities in New Jersey, <strong>Georgian</strong> <strong>Court</strong><br />

was not immune to the turmoil in the financial<br />

markets. The tightening of the credit market<br />

made it difficult for many of our students to<br />

obtain student loans. Because 51 percent of our<br />

students are first in family to attend college,<br />

many families were experiencing significant<br />

financial distress.<br />

Tuition & Fees 85%<br />

Tuition & Fees 85%<br />

This personal financial stress and credit<br />

crunch created the need for additional<br />

financial aid and counseling. Through the<br />

efforts of faculty and staff, we were able<br />

to retain many of our students who might<br />

otherwise have been forced to “step out” for<br />

the spring semester and put their educational<br />

dream of a Mercy education on hold.<br />

The operating budget ended the fiscal year<br />

with a deficit of $783,638 due to the need for<br />

increased student aid, a significant shortfall in<br />

summer revenue, and fewer resident students<br />

than projected.<br />

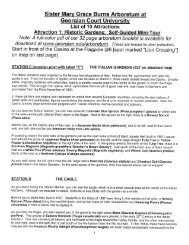

Unrestricted Expenditures FY 2009<br />

Depreciation 6%<br />

Auxiliary 4%<br />

Other 3%<br />

The activity of the long-term investments<br />

during the fiscal year was subject to the<br />

market volatility experienced by many college<br />

and university endowments. However, prior<br />

diversification, conservative investing, and<br />

work with SEI, our investment management<br />

firm, helped to mitigate the impact to the<br />

university’s investment portfolio.<br />

Financial Aid 17%<br />

Plant &<br />

Operation 9%<br />

Student<br />

Services 11%<br />

Institutional 16%<br />

Academic 15%<br />

Instructional 19%<br />

The university’s planned giving charitable<br />

annuity program was managed by Wachovia<br />

Wealth Management. This company’s<br />

acquisition by Wells Fargo had no impact<br />

upon the university’s gift annuity program.<br />

The university is in the second year of a<br />

three-year commitment to invest with<br />

Leviticus for socially responsible investing.<br />

The university’s long-term investment portfolio<br />

as of June 30, 2009, was valued at $33,594,456.<br />

The university ended the fiscal year with total<br />

unrestricted net assets of $58,610,769 and<br />

total net assets of $73,369,790.<br />

GEORGIAN COURT UNIVERSITY PRESIDENT’S REPORT | 59