Structuring the Revenue Forecasting Process - Government Finance ...

Structuring the Revenue Forecasting Process - Government Finance ...

Structuring the Revenue Forecasting Process - Government Finance ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

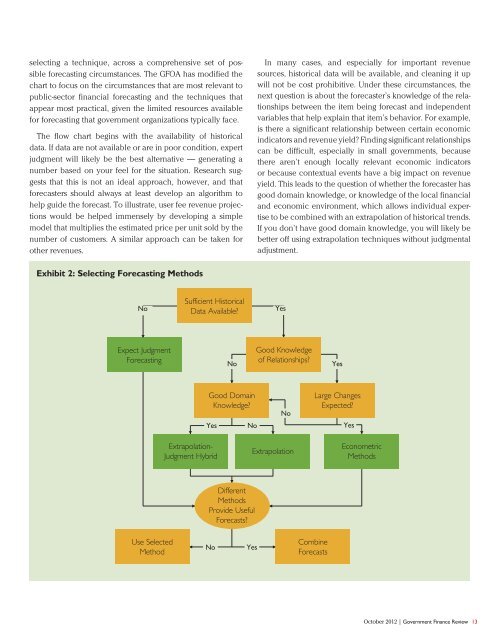

selecting a technique, across a comprehensive set of possible<br />

forecasting circumstances. The GFOA has modified <strong>the</strong><br />

chart to focus on <strong>the</strong> circumstances that are most relevant to<br />

public-sector financial forecasting and <strong>the</strong> techniques that<br />

appear most practical, given <strong>the</strong> limited resources available<br />

for forecasting that government organizations typically face.<br />

The flow chart begins with <strong>the</strong> availability of historical<br />

data. If data are not available or are in poor condition, expert<br />

judgment will likely be <strong>the</strong> best alternative — generating a<br />

number based on your feel for <strong>the</strong> situation. Research suggests<br />

that this is not an ideal approach, however, and that<br />

forecasters should always at least develop an algorithm to<br />

help guide <strong>the</strong> forecast. To illustrate, user fee revenue projections<br />

would be helped immensely by developing a simple<br />

model that multiplies <strong>the</strong> estimated price per unit sold by <strong>the</strong><br />

number of customers. A similar approach can be taken for<br />

o<strong>the</strong>r revenues.<br />

In many cases, and especially for important revenue<br />

sources, historical data will be available, and cleaning it up<br />

will not be cost prohibitive. Under <strong>the</strong>se circumstances, <strong>the</strong><br />

next question is about <strong>the</strong> forecaster’s knowledge of <strong>the</strong> relationships<br />

between <strong>the</strong> item being forecast and independent<br />

variables that help explain that item’s behavior. For example,<br />

is <strong>the</strong>re a significant relationship between certain economic<br />

indicators and revenue yield? Finding significant relationships<br />

can be difficult, especially in small governments, because<br />

<strong>the</strong>re aren’t enough locally relevant economic indicators<br />

or because contextual events have a big impact on revenue<br />

yield. This leads to <strong>the</strong> question of whe<strong>the</strong>r <strong>the</strong> forecaster has<br />

good domain knowledge, or knowledge of <strong>the</strong> local financial<br />

and economic environment, which allows individual expertise<br />

to be combined with an extrapolation of historical trends.<br />

If you don’t have good domain knowledge, you will likely be<br />

better off using extrapolation techniques without judgmental<br />

adjustment.<br />

Exhibit 2: Selecting <strong>Forecasting</strong> Methods<br />

No<br />

Sufficient Historical<br />

Data Available?<br />

Yes<br />

Expect Judgment<br />

<strong>Forecasting</strong><br />

No<br />

Good Knowledge<br />

of Relationships?<br />

Yes<br />

Good Domain<br />

Knowledge?<br />

Yes<br />

No<br />

No<br />

Large Changes<br />

Expected?<br />

Yes<br />

Extrapolation-<br />

Judgment Hybrid<br />

Extrapolation<br />

Econometric<br />

Methods<br />

Different<br />

Methods<br />

Provide Useful<br />

Forecasts?<br />

Use Selected<br />

Method<br />

No<br />

Yes<br />

Combine<br />

Forecasts<br />

October 2012 | <strong>Government</strong> <strong>Finance</strong> Review 13