Annual Report 2006

Annual Report 2006

Annual Report 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

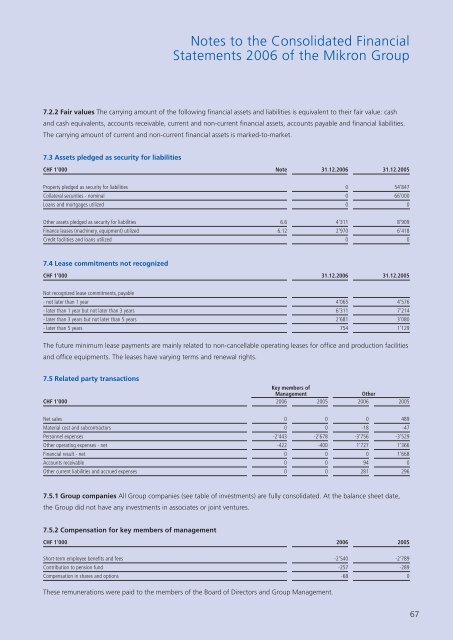

Notes to the Consolidated Financial<br />

Statements <strong>2006</strong> of the Mikron Group<br />

7.2.2 Fair values The carrying amount of the following financial assets and liabilities is equivalent to their fair value: cash<br />

and cash equivalents, accounts receivable, current and non-current financial assets, accounts payable and financial liabilities.<br />

The carrying amount of current and non-current financial assets is marked-to-market.<br />

7.3 Assets pledged as security for liabilities<br />

CHF 1‘000 Note 31.12.<strong>2006</strong> 31.12.2005<br />

Property pledged as security for liabilities 0 54‘847<br />

Collateral securities - nominal 0 66‘000<br />

Loans and mortgages utilized 0 0<br />

Other assets pledged as security for liabilities 6.6 4‘311 8‘909<br />

Finance leases (machinery, equipment) utilized 6.12 2‘970 6‘418<br />

Credit facilities and loans utilized 0 0<br />

7.4 Lease commitments not recognized<br />

CHF 1‘000 31.12.<strong>2006</strong> 31.12.2005<br />

Not recognized lease commitments, payable<br />

- not later than 1 year 4‘065 4‘576<br />

- later than 1 year but not later than 3 years 6‘311 7‘214<br />

- later than 3 years but not later than 5 years 2‘681 3‘080<br />

- later than 5 years 754 1‘129<br />

The future minimum lease payments are mainly related to non-cancellable operating leases for office and production facilities<br />

and office equipments. The leases have varying terms and renewal rights.<br />

7.5 Related party transactions<br />

Key members of<br />

Management Other<br />

CHF 1‘000 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Net sales 0 0 0 489<br />

Material cost and subcontractors 0 0 -18 -47<br />

Personnel expenses -2‘443 -2‘678 -3‘756 -3‘529<br />

Other operating expenses - net -422 -400 1‘727 1‘366<br />

Financial result - net 0 0 0 1‘668<br />

Accounts receivable 0 0 94 0<br />

Other current liabilities and accrued expenses 0 0 281 296<br />

7.5.1 Group companies All Group companies (see table of investments) are fully consolidated. At the balance sheet date,<br />

the Group did not have any investments in associates or joint ventures.<br />

7.5.2 Compensation for key members of management<br />

CHF 1‘000 <strong>2006</strong> 2005<br />

Short-term employee benefits and fees -2‘540 -2‘789<br />

Contribution to pension fund -257 -289<br />

Compensation in shares and options -68 0<br />

These remunerations were paid to the members of the Board of Directors and Group Management.<br />

67