Fee structure for allocation of GS1 Company Prefix ... - GS1 India

Fee structure for allocation of GS1 Company Prefix ... - GS1 India

Fee structure for allocation of GS1 Company Prefix ... - GS1 India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

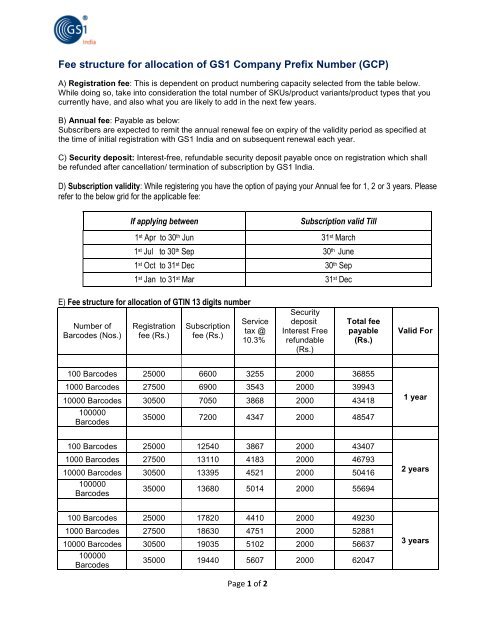

<strong>Fee</strong> <strong>structure</strong> <strong>for</strong> <strong>allocation</strong> <strong>of</strong> <strong>GS1</strong> <strong>Company</strong> <strong>Prefix</strong> Number (GCP)<br />

A) Registration fee: This is dependent on product numbering capacity selected from the table below.<br />

While doing so, take into consideration the total number <strong>of</strong> SKUs/product variants/product types that you<br />

currently have, and also what you are likely to add in the next few years.<br />

B) Annual fee: Payable as below:<br />

Subscribers are expected to remit the annual renewal fee on expiry <strong>of</strong> the validity period as specified at<br />

the time <strong>of</strong> initial registration with <strong>GS1</strong> <strong>India</strong> and on subsequent renewal each year.<br />

C) Security deposit: Interest-free, refundable security deposit payable once on registration which shall<br />

be refunded after cancellation/ termination <strong>of</strong> subscription by <strong>GS1</strong> <strong>India</strong>.<br />

D) Subscription validity: While registering you have the option <strong>of</strong> paying your Annual fee <strong>for</strong> 1, 2 or 3 years. Please<br />

refer to the below grid <strong>for</strong> the applicable fee:<br />

If applying between<br />

Subscription valid Till<br />

1 st Apr to 30 th Jun 31 st March<br />

1 st Jul to 30 th Sep 30 th June<br />

1 st Oct to 31 st Dec 30 th Sep<br />

1 st Jan to 31 st Mar 31 st Dec<br />

E) <strong>Fee</strong> <strong>structure</strong> <strong>for</strong> <strong>allocation</strong> <strong>of</strong> GTIN 13 digits number<br />

Number <strong>of</strong><br />

Barcodes (Nos.)<br />

Registration<br />

fee (Rs.)<br />

Subscription<br />

fee (Rs.)<br />

Service<br />

tax @<br />

10.3%<br />

Security<br />

deposit<br />

Interest Free<br />

refundable<br />

(Rs.)<br />

Total fee<br />

payable<br />

(Rs.)<br />

Valid For<br />

100 Barcodes 25000 6600 3255 2000 36855<br />

1000 Barcodes 27500 6900 3543 2000 39943<br />

10000 Barcodes 30500 7050 3868 2000 43418<br />

100000<br />

Barcodes<br />

35000 7200 4347 2000 48547<br />

1 year<br />

100 Barcodes 25000 12540 3867 2000 43407<br />

1000 Barcodes 27500 13110 4183 2000 46793<br />

10000 Barcodes 30500 13395 4521 2000 50416<br />

100000<br />

Barcodes<br />

35000 13680 5014 2000 55694<br />

2 years<br />

100 Barcodes 25000 17820 4410 2000 49230<br />

1000 Barcodes 27500 18630 4751 2000 52881<br />

10000 Barcodes 30500 19035 5102 2000 56637<br />

100000<br />

Barcodes<br />

35000 19440 5607 2000 62047<br />

3 years<br />

Page 1 <strong>of</strong> 2

Other fees applicable are as below:-<br />

1. Password resetting : Rs 276.00 inclusive <strong>of</strong> service tax<br />

2. Duplicate copy <strong>of</strong> documents : Rs 276.00 inclusive <strong>of</strong> service tax<br />

Cheque return charges : Rs 276.00 inclusive <strong>of</strong> service tax<br />

In event <strong>of</strong> dishonour <strong>of</strong> cheque at the time <strong>of</strong> realization due to any reason, the payment shall be made only by<br />

NEFT or DD / PO in favor <strong>of</strong> <strong>GS1</strong> <strong>India</strong> alongwith Rs 250.00 as cheque return charges.<br />

3. Change <strong>of</strong> capacity <strong>of</strong> <strong>GS1</strong> <strong>Company</strong> <strong>Prefix</strong>( GCP) number :<br />

Proper care should be taken while applying <strong>for</strong> GCP number. Any request <strong>for</strong> change in <strong>GS1</strong> <strong>Company</strong> prefix number<br />

on account <strong>of</strong> change in product range type or SKU shall be entertained within 30 days from the date <strong>of</strong> its <strong>allocation</strong><br />

subject to the submission <strong>of</strong> the followings:-<br />

A: Documents<br />

a. Declaration on the letterhead <strong>of</strong> the company seeking change in GCP number stating that it has not used the prefix<br />

allocated on any <strong>of</strong> the product since <strong>allocation</strong>.<br />

b. Original copy <strong>of</strong> the GCP allotment letter titled “Licence <strong>for</strong> use <strong>of</strong> <strong>GS1</strong> <strong>Company</strong> <strong>Prefix</strong> number". it shall be the<br />

responsibility <strong>of</strong> the company to ensure that no photocopies <strong>of</strong> the original letters are taken and kept in the record.<br />

B: <strong>Fee</strong>s<br />

a. Differential fee amount between the fee paid at the time <strong>of</strong> initial allotment and fee applicable on desired new<br />

product range / type / SKUs.<br />

b. Processing fee <strong>of</strong> Rs 1103.00 inclusive <strong>of</strong> service tax towards seeking change <strong>of</strong> capacity <strong>of</strong> <strong>GS1</strong> company prefix<br />

number.<br />

Page 2 <strong>of</strong> 2