You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fundamental<br />

Assessment<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

<strong>ICRA</strong> EQUITY RESEARCH SERVICE<br />

KEWAL KIRAN CLOTHING LIMITED<br />

Q3 FY12 Result Update Industry: Textile & Retail January 24,<br />

2012<br />

Revenue growth moderates due to high base; margins under pressure<br />

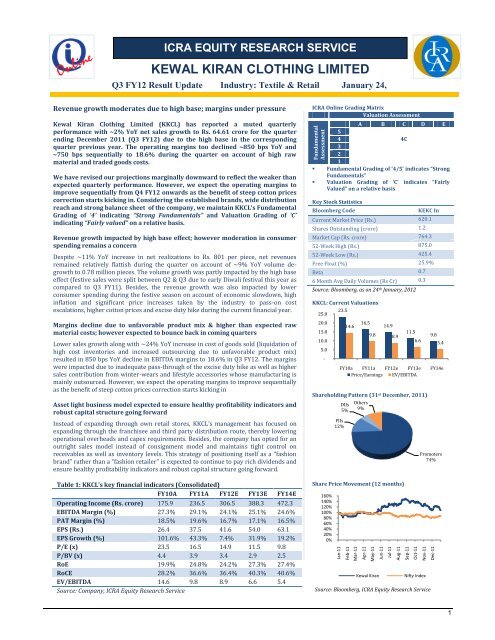

Kewal Kiran Clothing Limited (KKCL) has reported a muted quarterly<br />

performance with ~2% YoY net sales growth to Rs. 64.61 crore for the quarter<br />

ending December 2011 (Q3 FY12) due to the high base in the corresponding<br />

quarter previous year. The operating margins too declined ~850 bps YoY and<br />

~750 bps sequentially to 18.6% during the quarter on account of high raw<br />

material and traded goods costs.<br />

We have revised our projections marginally downward to reflect the weaker than<br />

expected quarterly performance. However, we expect the operating margins to<br />

improve sequentially from Q4 FY12 onwards as the benefit of steep cotton prices<br />

correction starts kicking in. Considering the established brands, wide distribution<br />

reach and strong balance sheet of the company, we maintain KKCL’s Fundamental<br />

Grading of ‘4’ indicating “Strong Fundamentals” and Valuation Grading of ‘C’<br />

indicating “Fairly valued” on a relative basis.<br />

Revenue growth impacted by high base effect; however moderation in consumer<br />

spending remains a concern<br />

Despite ~11% YoY increase in net realizations to Rs. 801 per piece, net revenues<br />

remained relatively flattish during the quarter on account of ~9% YoY volume degrowth<br />

to 0.78 million pieces. The volume growth was partly impacted by the high base<br />

effect (festive sales were split between Q2 & Q3 due to early Diwali festival this year as<br />

compared to Q3 FY11). Besides, the revenue growth was also impacted by lower<br />

consumer spending during the festive season on account of economic slowdown, high<br />

inflation and significant price increases taken by the industry to pass-on cost<br />

escalations, higher cotton prices and excise duty hike during the current financial year.<br />

Margins decline due to unfavorable product mix & higher than expected raw<br />

material costs; however expected to bounce back in coming quarters<br />

Lower sales growth along with ~24% YoY increase in cost of goods sold (liquidation of<br />

high cost inventories and increased outsourcing due to unfavorable product mix)<br />

resulted in 850 bps YoY decline in EBITDA margins to 18.6% in Q3 FY12. The margins<br />

were impacted due to inadequate pass-through of the excise duty hike as well as higher<br />

sales contribution from winter-wears and lifestyle accessories whose manufacturing is<br />

mainly outsourced. However, we expect the operating margins to improve sequentially<br />

as the benefit of steep cotton prices correction starts kicking in<br />

Asset light business model expected to ensure healthy profitability indicators and<br />

robust capital structure going forward<br />

Instead of expanding through own retail stores, KKCL’s management has focused on<br />

expanding through the franchisee and third party distribution route, thereby lowering<br />

operational overheads and capex requirements. Besides, the company has opted for an<br />

outright sales model instead of consignment model and maintains tight control on<br />

receivables as well as inventory levels. This strategy of positioning itself as a “fashion<br />

brand” rather than a “fashion retailer” is expected to continue to pay rich dividends and<br />

ensure healthy profitability indicators and robust capital structure going forward.<br />

<strong>ICRA</strong> Online Grading Matrix<br />

Valuation Assessment<br />

A B C D E<br />

5<br />

4 4C<br />

3<br />

2<br />

1<br />

• Fundamental Grading of ‘4/5’ indicates “Strong<br />

Fundamentals”<br />

• Valuation Grading of ‘C’ indicates “Fairly<br />

Valued” on a relative basis<br />

Key Stock Statistics<br />

Bloomberg Code<br />

KEKC In<br />

Current Market Price (Rs.) 620.1<br />

Shares Outstanding (crore) 1.2<br />

Market Cap (Rs. crore) 764.3<br />

52-Week High (Rs.) 875.0<br />

52-Week Low (Rs.) 425.4<br />

Free Float (%) 25.9%<br />

Beta 0.7<br />

6 Month Avg Daily Volumes (Rs Cr) 0.3<br />

Source: Bloomberg, as on 24 th January, 2012<br />

KKCL: Current Valuations<br />

23.5<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

-<br />

14.6<br />

16.5<br />

14.9<br />

9.8 8.9<br />

11.5<br />

6.6<br />

Shareholding Pattern (31 st December, 2011)<br />

FIIs<br />

12%<br />

9.8<br />

5.4<br />

FY10a FY11a FY12e FY13e FY14e<br />

Price/Earnings EV/EBITDA<br />

DIIs<br />

5%<br />

Others<br />

9%<br />

Promoters<br />

74%<br />

Table 1: KKCL’s key financial indicators (Consolidated)<br />

FY10A FY11A FY12E FY13E FY14E<br />

Operating Income (Rs. crore) 175.9 236.5 306.5 388.3 472.3<br />

EBITDA Margin (%) 27.3% 29.1% 24.1% 25.1% 24.6%<br />

PAT Margin (%) 18.5% 19.6% 16.7% 17.1% 16.5%<br />

EPS (Rs.) 26.4 37.5 41.6 54.0 63.1<br />

EPS Growth (%) 101.6% 43.3% 7.4% 31.9% 19.2%<br />

P/E (x) 23.5 16.5 14.9 11.5 9.8<br />

P/BV (x) 4.4 3.9 3.4 2.9 2.5<br />

RoE 19.9% 24.8% 24.2% 27.3% 27.4%<br />

RoCE 28.2% 36.6% 36.4% 40.3% 40.6%<br />

EV/EBITDA 14.6 9.8 8.9 6.6 5.4<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

Share Price Movement (12 months)<br />

160%<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Kewal Kiran<br />

Nifty Index<br />

Source: Bloomberg, <strong>ICRA</strong> Equity Research Service<br />

1

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

Table 2: KKCL - Q3 FY12 Results<br />

Rs. Crore Q3, FY12 Q2, FY12 QoQ% Q3, FY11 YoY% 9M, FY12 9M, FY11 YoY%<br />

Net Sales 64.2 100.35 -36% 63.02 2% 233.45 180.62 29%<br />

Other Related Income 0.41 0.43 -5% 0.32 28% 1.26 0.91 38%<br />

Operating Income 64.61 100.78 -36% 63.34 2% 234.71 181.53 29%<br />

COGS 29.63 43.49 -32% 23.99 24% 100.57 68.48 47%<br />

Employee Costs 6.78 8.4 -19% 6.31 7% 22.63 19.76 15%<br />

Selling & Distribution 8.29 10.96 -24% 8.67 -4% 28.44 21.13 35%<br />

Other Costs 7.87 11.62 -32% 7.19 9% 27.42 19.59 40%<br />

EBITDA 12.04 26.31 -54% 17.18 -30% 55.65 52.57 6%<br />

Depreciation 1.65 1.5 10% 1.4 18% 4.56 4.1 11%<br />

Interest 0.63 0.82 -23% 0.59 7% 2.0 1.7 21%<br />

Other Income 3.06 2.99 2% 1.6 91% 9.1 5.7 59%<br />

Tax 4.07 8.62 -53% 5.53 -110% 18.47 17.43 6%<br />

PAT (After MI) 8.75 18.36 -52% 11.26 -22% 39.72 35.13 13%<br />

Number of Shares (crore) 1.23 1.23 1.23 1.23 1.23<br />

EPS 7.1 14.9 -52% 9.1 -22% 32 29 13%<br />

CEPS 8.4 16.1 -48% 10.3 -18% 36 32 13%<br />

EBITDA Margin 18.63% 26.11% 27.12% 23.71% 28.96%<br />

PAT Margin 13.54% 18.22% 17.78% 16.92% 19.35%<br />

Source: Company, <strong>ICRA</strong> Equity Research Service<br />

During the quarter, the company opened 26 new stores (10 K-Lounge, 7 Killer EBOs, 7 Integrity EBOs and 2 Lawman<br />

Pg3 EBOs) through the franchisee route in accordance with its stated distribution strategy. Opening of the new stores<br />

helped compensate the loss of sales from an early Diwali and overall slowdown as each new store opening results in<br />

top line addition of Rs 12 to Rs 16 lakh depending upon the store format. The company closed down 10 stores during<br />

the quarter due to non-viability of these franchises. The company has around 23 new stores in pipeline to be opened<br />

during Q4, FY 12.<br />

KKCL’s sales to national chain stores witnessed a sharp 35% decline on a YoY basis, partly due to the challenging<br />

economic environment. However, the overall impact was negligible as the company has maintained low dependence<br />

on national chain stores due to the lower margins offered by this distribution channel. On the other side, Exports<br />

witnessed a robust 100% growth, albeit on a lower base, as the company increased its exports of “Integriti” and<br />

“Lawman Pg 3” brands. As per the management, exports appeared relatively lucrative due to government incentives<br />

such as duty drawback scheme and absence of excise duties.<br />

In terms of regional distribution, northern region witnessed strong 36% YoY revenue growth on the back of increased<br />

penetration, stronger marketing thrust and launch of winter-wear products range; while the South, West and East<br />

witnessed de-growth of 12%, 15% and 2% respectively. Thus the regional sales distribution now appears more<br />

balanced than earlier years. In terms of product distribution, the revenue contribution from the newly launched<br />

winter-wear products and lifestyle accessories range increased from ~8% in Q3 FY11 to ~21% in Q3 FY12.<br />

2

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

COMPANY PROFILE<br />

Kewal Kiran Clothing Limited (KKCL) is one of the leading manufacturer and retailer of branded apparels and fashionwear<br />

in India. KKCL has over two decades of experience in the domestic readymade garments industry with some<br />

established brands like ‘Killer’, ‘Lawman Pg3’, ‘Integriti’, ‘Easies’ and ‘ADDICTIONS’. KKCL markets its products<br />

through a chain of 240 ‘K-LOUNGE’ showrooms and exclusive brand outlets (EBOs) across the country. Besides,<br />

KKCL’s products are widely marketed at over 3,500 multi-brand outlets (MBOs) and national chain stores like<br />

Shoppers’ Stop and Hypercity.<br />

KKCL is an established player in the denim Jeans category through its flagship Killer brand, besides having a presence<br />

in Trousers, Shirts, T-shirts & Jackets. It has also entered the lifestyle accessories segments like shoes, belts, watches,<br />

bracelets, wallets, caps, bags, sunglasses and deodorants through the ADDICTIONS brand. KKCL’s designing and<br />

manufacturing facilities are mainly located at Dadar and Goregoan (Mumbai), Daman and Vapi in Western India.<br />

Grading Positives:<br />

The key grading positives in our view are: 1) Strongly positioned to benefit from the domestic consumption play due<br />

to Pan-India presence, including its first-mover’s advantage in the Tier-II / Tier-III cities as well as relatively less<br />

penetrated eastern states 2) established brand equity of its flagship product – Killer Jeans 3) Asset light model<br />

reduces overhead costs while maintaining product & service standards 4) Continued focus on profitable growth and<br />

careful store expansion are expected to ensure healthy profitability indicators (like RoCE) for the company going<br />

forward 5) Strong designing expertise, vast experience of the promoters’ in the branded apparel business<br />

Grading Sensitivities:<br />

The key grading sensitivities in our view are: 1) Intense competition in the domestic branded apparels market with<br />

presence of large number of domestic as well as global brands 2) Vulnerability to cotton price fluctuations and<br />

regulatory changes (like excise duty levy) 3) Ability to scale up business while maintaining its financial profile 4) High<br />

dependence on multi-brand outlets (MBOs) and National Chain Stores, which together contribute ~70% of revenues,<br />

can limit bargaining power 5) Increasing contribution from value brands (like Integriti, Lawman Pg3) and low margin<br />

products (like shirts, T-shirts) could moderate margins; cash reserves held by the company yields lower returns. 6)<br />

Merchandise obsolescence risks due to rapidly evolving fashion trends and changing customer preferences<br />

Table 3: Company Factsheet<br />

Name of the Company<br />

Kewal Kiran Clothing Limited (KKCL)<br />

Year of Incorporation 1980<br />

Nature of Businesses<br />

Branded apparels manufacturing and retailing<br />

Products<br />

Jeans, Trousers, Shirts, T-shirts, Jackets and Lifestyle accessories<br />

Brands<br />

‘Killer’, ‘Lawman Pg3’, ‘Integriti’, ‘Easies’ and ‘ADDICTIONS’<br />

Company Stores<br />

130 K-Lounges, 54 Killer EBOs, 37 Integriti EBOs, 9 LawmanPg3-EBOs, 3 Addiction-EBO, 7 Factory Outlet<br />

Distribution Network<br />

Over 3,500 Multi-brand outlets (MBOs) and National Chain stores (like Shoppers stop and Hypercity)<br />

Exports<br />

Middle East, Sri Lanka, Nepal and other countries<br />

Vendors<br />

Fabric manufacturers like Arvind Mills, Raymond, KG Denim, etc<br />

Manufacturing Capacity<br />

3.5 Million pieces per annum (could be stretched further depending on product mix)<br />

Manufacturing Locations Washing, cutting, stitching and garmenting facilities at Dadar and Goregaon (Mumbai), Daman and Vapi<br />

Key Joint Ventures<br />

33% stake in White Knitwear Private Ltd in Surat SEZ<br />

Bankers<br />

Standard Chartered Bank<br />

Auditors<br />

M/s. Jain & Trivedi, M/s. N.A. Shah Associates<br />

IPO Details<br />

Rs. 80.6 crore raised in 2006, Issue of 31 lac shares at Rs. 260 per share, shares are listed on BSE and NSE<br />

Registered & Corporate Office Kewal Kiran Estate, Behind Tirupati Udyog, 460/7, I.B. Patel Road, Goregaon (East), Mumbai - 400 063<br />

Windmill<br />

0.6 MW Capacity at Survey No.1119/P, Village Kuchhadi, Taluka Porbunder, District Porbunder, Gujarat<br />

Source: Company, <strong>ICRA</strong> Online Research<br />

3

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

KKCL’s Key Milestones:<br />

1980:<br />

M/s Keval Kiran<br />

& Co<br />

incorporated<br />

1989:<br />

Launch of<br />

‘KILLER’<br />

1998:<br />

Launch of<br />

‘LAWMAN’<br />

& ‘EASIES’<br />

2002:<br />

Launch of<br />

‘INTEGRITI’<br />

2004:<br />

Launch of<br />

the first ‘K-<br />

LOUNGE’<br />

2006:<br />

IPO of 31<br />

Lac Shares<br />

2007:<br />

KILLER<br />

WOMEN<br />

Wear<br />

Launched<br />

2011:<br />

Launch of<br />

'Addictions'<br />

KKCL’s Corporate Structure:<br />

Kewal Kiran Clothing Limited (KKCL)<br />

Branded apparel<br />

manufacturer and retailer<br />

Killer<br />

Lawman Pg3<br />

easies<br />

Integriti<br />

Addictions<br />

Launch: 1989<br />

Launch: 1998<br />

Launch: 1998<br />

Launch: 2002<br />

Launch: 2011<br />

Segment: Premium<br />

Segment: Mid-premium<br />

Segment: Mid-premium<br />

Segment: Value<br />

Segment: Lifestyle<br />

Products: Denim Jeans,<br />

Designer wear<br />

Products: Clubwear<br />

Jeans, Shirts, Jackets,<br />

trousers, etc<br />

Products: Formal &<br />

Semi-formal menswear<br />

Products: Casuals,<br />

formals and Jeans<br />

Products: Footwear,<br />

Gym Wear, Swim Wear,<br />

eyewear, etc<br />

Revenue Contribution:<br />

51%<br />

Revenue Contribution:<br />

21%<br />

Revenue Contribution:<br />

2%<br />

Revenue Contribution:<br />

25%<br />

Revenue Contribution:<br />

1%<br />

Competition: Levis, Lee,<br />

Spyker, Pepe, Wrangler<br />

Latest Innovations &<br />

Launches: Winter wear –<br />

Jackets and Sweaters<br />

Competition: Mufti,<br />

Newport, Flying<br />

Machine, etc<br />

Latest Innovations &<br />

Launches: Vertebrae and<br />

Chica range<br />

Competition: Peter<br />

England, Dockers, S.<br />

Kumars, etc<br />

Latest Innovations &<br />

Launches: Winter wear<br />

Competition: Mufti,<br />

Adams, Ruff & Tuff, etc<br />

Latest Innovations &<br />

Launches: Integriti Galz<br />

Competition: Titan,<br />

Fastrack, etc<br />

Latest Innovations &<br />

Launches: Deodorants<br />

and personal care<br />

products<br />

Source: Company, <strong>ICRA</strong> Online Research<br />

Governance structure:<br />

KKCL is managed by an eight member Board, which includes four independent directors and four members from the<br />

Jain family. While the family is closely involved in running KKCL’s business, the company has a professional<br />

management structure across the company. The promoter group holds 74% equity stake in the company and the rest<br />

is widely held by institutional and retail investors. The disclosures in KKCL’s Annual Report are adequate and have<br />

been broadly in line with that followed by the industry.<br />

4

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

VALUATION GRADING<br />

In assessing a company's valuation, various parameters are looked at including the company's earnings and growth<br />

prospects; its ability to generate free cash flows and its capacity to generate returns from the capital invested. The<br />

valuation is also benchmarked against an appropriate peer set or index. The opinion on a company's relative valuation<br />

is expressed using the following five-point scale as follows:<br />

Table 4: <strong>ICRA</strong> Equity Research Service—Valuation Grades<br />

Valuation Grade<br />

Grade Implication<br />

A<br />

Significantly Undervalued<br />

B<br />

Moderately Undervalued<br />

C<br />

Fairly Valued<br />

D<br />

Moderately Overvalued<br />

E<br />

Significantly Overvalued<br />

While assessing a company's relative valuation,<br />

the historical price volatility exhibited by the<br />

stock, besides its liquidity, is also taken into<br />

account. The extent of overvaluation or<br />

undervaluation is adjusted for the relative<br />

volatility displayed by the stock.<br />

Source: <strong>ICRA</strong> Online Research<br />

KKCL’s current valuation multiple (~11.5x times FY13 earnings) is at a discount to valuations of broader market<br />

indices like Nifty Index and CNX 500 index. KKCL continues to be reasonably valued domestic consumption plays with<br />

strong established brand, wide distribution reach and strong balance sheet. Overall, we expect the company to report<br />

a healthy 26% CAGR revenue growth and 19% CAGR EPS growth over the FY11a-FY14e period, aided by rapid<br />

expansions in Tier – II and Tier – III cities. Hence, we assign a valuation grade of “C” to KKCL on a grading scale of ‘A’<br />

to ‘E’, which indicates that the company is “Fairly Valued” on a relative basis.<br />

Table 5: KKCL’S Relative Valuations:<br />

<strong>ICRA</strong> Estimates<br />

KEWAL KIRAN<br />

CLOTHING<br />

NIFTY<br />

INDEX<br />

CNX 500<br />

INDEX<br />

CNX MIDCAP<br />

INDEX<br />

FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E<br />

Price/Earnings 14.90 11.48 14.74 12.70 13.91 11.68 12.28 10.21<br />

EV/EBITDA 8.94 6.62 9.91 8.73 9.82 8.32 10.22 8.17<br />

Price /Sales 2.49 1.97 1.59 1.45 1.27 1.14 0.77 0.70<br />

Price /Book Value 3.38 2.91 2.36 2.08 2.04 1.80 1.37 1.24<br />

Price/Cash Flow 13.23 10.32 10.34 8.98 9.86 8.25 9.56 7.34<br />

<strong>ICRA</strong> Estimates<br />

KEWAL KIRAN<br />

CLOTHING<br />

PANTALOON<br />

RETAIL<br />

SHOPPERS<br />

STOP<br />

TRENT<br />

ARVIND<br />

FY12 FY13 FY12 FY13 FY12 FY13 FY12 FY13 FY12 FY13<br />

Price/Earnings 14.90 11.48 19.33 14.32 39.99 25.78 n.m. 37.42 7.48 5.78<br />

EV/EBITDA 8.94 6.62 10.59 9.05 18.47 13.19 154.73 15.58 6.34 5.58<br />

Price /Sales 2.49 1.97 0.29 0.25 0.80 0.65 0.94 0.67 0.48 0.42<br />

Price /Book Value 3.38 2.91 1.16 1.08 4.19 3.72 2.11 2.37 1.07 0.91<br />

Price/Cash Flow 13.23 10.32 8.53 6.84 21.83 15.72 61.41 21.00 4.45 3.59<br />

Source: Bloomberg, <strong>ICRA</strong> Equity Research Service * Bloomberg Consensus Estimates as on 24 th January, 2012<br />

5

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

ANNEXURES<br />

Kewal Kiran Clothing Limited – P&L Estimates (Consolidated)<br />

Rs. Crore FY10a FY11a FY12e FY13e FY14e<br />

Net sales 175.3 235.3 305.0 386.4 470.0<br />

Other related income 0.6 1.2 1.5 1.9 2.3<br />

Operating Income (OI) 175.9 236.5 306.5 388.3 472.3<br />

Growth Rate (%) 21.0% 34.4% 29.6% 26.7% 21.6%<br />

EBITDA 48.1 68.9 74.0 97.6 116.3<br />

Depreciation 5.8 5.9 6.5 7.5 9.0<br />

EBIT 42.2 63.0 67.5 90.1 107.3<br />

Interest expenses 2.3 2.1 2.5 2.2 2.2<br />

Other income/expense 8.9 8.3 11.8 11.9 11.4<br />

PBT (before extraordinary) 48.7 69.3 76.8 99.8 116.6<br />

Extraordinary Gain/Loss 0.0 0.0 0.0 0.0 0.0<br />

PAT 32.5 46.2 51.3 66.6 77.8<br />

No of shares 12,325,037 12,325,037 12,325,037 12,325,037 12,325,037<br />

DPS 85.5 40.8 16.0 20.8 24.3<br />

EPS 26.4 37.5 41.6 54.0 63.1<br />

CEPS 31.1 42.3 46.9 60.1 70.4<br />

Kewal Kiran Clothing Limited – Balance Sheet Estimates (Consolidated)<br />

Rs. Crore FY10a FY11a FY12e FY13e FY14e<br />

Net worth 175.2 197.8 226.0 262.6 305.4<br />

Minority interest 0.0 - - - 0.0<br />

Total Debt 15.8 5.6 11.0 11.0 11.0<br />

Non-Operating Non Current Liability 0.0 0.0 0.0 0.0 0.0<br />

Deferred Tax Liability (1.7) (1.6) (1.6) (1.6) (1.6)<br />

Trade Creditors 16.0 18.2 22.8 28.5 35.0<br />

Other Current Liabilities and Prov. 13.8 30.3 43.8 56.2 67.0<br />

Total liabilities 219.2 250.2 302.0 356.7 416.7<br />

Net Fixed Assets 40.0 40.6 43.1 49.6 59.6<br />

Capital Work in Progress 2.7 2.1 2.1 2.1 2.1<br />

Total Net Fixed Assets 42.7 42.7 45.3 51.8 61.8<br />

Total Long-Term Investments 32.9 26.8 26.8 26.8 26.8<br />

Cash and Bank Balances 80.2 95.3 114.1 129.6 143.7<br />

Receivables (incl. bills discounted) 24.1 29.8 43.6 60.7 80.5<br />

Inventories 21.8 36.8 48.0 57.1 66.4<br />

Loans & Advances 1.4 2.0 2.6 3.3 4.0<br />

Other Current Assets 16.0 16.7 21.6 27.4 33.3<br />

Total Current Assets 143.5 180.7 229.9 278.1 328.0<br />

Total Assets 219.2 250.2 302.0 356.7 416.7<br />

6

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

Kewal Kiran Clothing Limited – Cash Flow Estimates (Consolidated)<br />

Rs. Crore FY10a FY11a FY12e FY13e FY14e<br />

OPBDIT 48.1 68.9 74.0 97.6 116.3<br />

Less: Taxes 16.4 23.0 25.5 33.2 38.8<br />

Changes in Net Working Capital 2.8 (0.6) (9.3) (9.6) (12.3)<br />

Net Interest Charges (2.3) (2.1) (2.5) (2.2) (2.2)<br />

Cash flow from operating activities 32.1 43.2 36.6 52.6 63.1<br />

Investments (2.1) 6.1 0.0 0.0 0.0<br />

Capital expenditures (3.0) (5.7) (9.0) (14.0) (19.0)<br />

Cash flow from investing activities (5.1) 0.3 (9.0) (14.0) (19.0)<br />

Equity Raised / (Buyback) 0.0 0.0 0.0 0.0 0.0<br />

Loans Raised / (Repaid) (7.8) (10.2) 5.4 0.0 0.0<br />

Others (Including Extra-ordinaries) 0.0 (0.1) 0.0 0.0 0.0<br />

Dividend (4.3) (15.4) (14.3) (23.1) (30.0)<br />

Cash Flow from Financing activities (12.1) (25.8) (8.9) (23.1) (30.0)<br />

Cumulative cash flow 14.9 17.7 18.7 15.5 14.1<br />

Opening Cash Balance 65.3 80.2 95.3 114.1 129.6<br />

Closing Cash Balance 80.2 97.9 114.1 129.6 143.7<br />

Kewal Kiran Clothing Limited – Key Financial Ratios (Consolidated)<br />

FY10a FY11a FY12e FY13e FY14e<br />

Growth indicators<br />

Sales Growth 21.2% 34.2% 29.6% 26.7% 21.6%<br />

EBITDA Growth 101.6% 43.3% 7.4% 31.9% 19.2%<br />

EPS Growth 128.1% 42.2% 11.0% 29.8% 16.8%<br />

Cash EPS Growth 98.8% 35.8% 10.9% 28.3% 17.1%<br />

Profitability indicators<br />

EBITDA Margin 27.3% 29.1% 24.1% 25.1% 24.6%<br />

EBIT Margin 24.0% 26.7% 22.0% 23.2% 22.7%<br />

PAT Margin 18.5% 19.6% 16.7% 17.1% 16.5%<br />

RoE 19.9% 24.8% 24.2% 27.3% 27.4%<br />

ROCE 28.2% 36.6% 36.4% 40.3% 40.6%<br />

Liquidity ratios<br />

Debtor (days) 50 46 50 55 60<br />

Inventory (days) 90 112 105 100 95<br />

Net working capital/Revenues 24.0% 21.6% 23.6% 24.1% 24.9%<br />

Capitalization Ratios<br />

Total Debt/(Equity + MI) 0.1 0.0 0.0 0.0 0.0<br />

Interest coverage 20.6 33.4 29.8 44.3 52.9<br />

Total Debt/EBITDA 0.3 0.1 0.1 0.1 0.1<br />

Valuation Ratios<br />

Price/Sales 4.3 3.2 2.5 2.0 1.6<br />

Price/Earnings 23.5 16.5 14.9 11.5 9.8<br />

Price/Book Value 4.4 3.9 3.4 2.9 2.5<br />

EV/EBITDA 14.6 9.8 8.9 6.6 5.4<br />

Price/Cash Flows 19.9 14.7 13.2 10.3 8.8<br />

7

<strong>ICRA</strong> Equity Research Service<br />

Kewal Kiran Clothing Limited<br />

<strong>ICRA</strong> Limited<br />

CORPORATE OFFICE<br />

Building No. 8, 2nd Floor,<br />

Tower A, DLF Cyber City, Phase II,<br />

Gurgaon 122002<br />

Ph: +91-124-4545300, 4545800<br />

Fax; +91-124-4545350<br />

REGISTERED OFFICE<br />

1105, Kailash Building, 11 th Floor,<br />

26, Kasturba Gandhi Marg,<br />

New Delhi – 110 001<br />

Tel: +91-11-23357940-50<br />

Fax: +91-11-23357014<br />

MUMBAI<br />

Mr. L. Shivakumar<br />

Mobile: 9821086490<br />

3rd Floor, Electric Mansion,<br />

Appasaheb Marathe Marg, Prabhadevi,<br />

Mumbai - 400 025<br />

Ph : +91-22-30470000,<br />

24331046/53/62/74/86/87<br />

Fax : +91-22-2433 1390<br />

E-mail: shivakumar@icraindia.com<br />

GURGAON<br />

Mr. Vivek Mathur<br />

Mobile: 9871221122<br />

Building No. 8, 2nd Floor,<br />

Tower A, DLF Cyber City, Phase II,<br />

Gurgaon 122002<br />

Ph: +91-124-4545300, 4545800<br />

Fax; +91-124-4545350<br />

E-mail: vivek@icraindia.com<br />

CHENNAI<br />

Mr. Jayanta Chatterjee<br />

Mobile: 9845022459<br />

Mr. D. Vinod<br />

Mobile: 9940648006<br />

5th Floor, Karumuttu Centre,<br />

498 Anna Salai, Nandanam,<br />

Chennai-600035.<br />

Tel: +91-44-45964300,<br />

24340043/9659/8080<br />

Fax:91-44-24343663<br />

E-mail: jayantac@icraindia.com<br />

d.vinod@icraindia.com<br />

KOLKATA<br />

A-10 & 11, 3rd Floor, FMC Fortuna,<br />

234/ 3A, A.J.C. Bose Road,<br />

Kolkata-700020.<br />

Tel: +91-33-22876617/ 8839,<br />

22800008, 22831411<br />

Fax: +91-33-2287 0728<br />

AHMEDABAD<br />

Mr. Animesh Bhabhalia<br />

Mobile: 9824029432<br />

907 & 908 Sakar -II, Ellisbridge,<br />

Ahmedabad- 380006<br />

Tel: +91-79-26585049/2008/5494,<br />

Fax:+91-79- 2648 4924<br />

E-mail: animesh@icraindia.com<br />

HYDERABAD<br />

Mr. M.S.K. Aditya<br />

Mobile: 9963253777<br />

301, CONCOURSE, 3rd Floor,<br />

No. 7-1-58, Ameerpet,<br />

Hyderabad 500 016.<br />

Tel: +91-40-23735061, 23737251<br />

Fax: +91-40- 2373 5152<br />

E-mail: adityamsk@icraindia.com<br />

PUNE<br />

Mr. L. Shivakumar<br />

Mobile: 9821086490<br />

5A, 5th Floor, Symphony,<br />

S. No. 210, CTS 3202,<br />

Range Hills Road, Shivajinagar,<br />

Pune-411 020<br />

Tel : +91- 20- 25561194,<br />

25560195/196,<br />

Fax : +91- 20- 2553 9231<br />

E-mail: shivakumar@icraindia.com<br />

BANGALORE<br />

Mr. Jayanta Chatterjee<br />

Mobile: 9845022459<br />

'The Millenia', Tower B,<br />

Unit No. 1004, 10th Floor,<br />

Level 2, 12-14, 1 & 2, Murphy Road,<br />

Bangalore - 560 008<br />

Tel: +91-80-43326400,<br />

Fax: +91-80-43326409<br />

E-mail: jayantac@icraindia.com<br />

www.icra.in<br />

<strong>ICRA</strong> ONLINE LIMITED<br />

Corporate Office<br />

107, 1st Floor, Raheja Arcade<br />

Plot No. 61, Sector-XI, CBD Belapur, Navi Mumbai<br />

Maharashtra-400614.<br />

Ph : +91-22-67816163 (Direct); 67816100<br />

Fax : +91-22-27563057<br />

Investor Desk: equity.research@icraonline.com<br />

www. icraonline.com<br />

Disclaimer: Although reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’ without any<br />

warranty of any kind, and <strong>ICRA</strong> in particular, makes no representation or warranty, express or implied, as to the accuracy, timeliness or completeness of<br />

any such information. All information contained herein must be construed solely as statements of opinion, and <strong>ICRA</strong> shall not be liable for any losses<br />

incurred by users from any use of this publication or its contents. <strong>ICRA</strong> grades are not a recommendation to buy, sell or hold any securities of the graded<br />

entity.<br />

This Report is solely for the personal information of the authorized recipient in India only. The information contained in this report shall in no way either<br />

directly or indirectly be reproduced, redistributed, communicated in any form whatsoever to any other person both within India or outside India. Nor is<br />

it permissible for the information to be disseminated or copied in whole or in part, for any purpose whatsoever.<br />

Disclosure: The <strong>ICRA</strong> Equity Research Service is a mandate-based, paid service. In this case, <strong>ICRA</strong> or <strong>ICRA</strong> Online has received both the mandate and the<br />

research fee from the entity reported on.<br />

8