Investor Presentation

Investor Presentation

Investor Presentation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

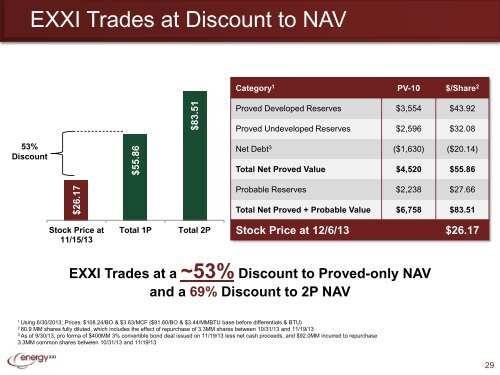

EXXI Trades at Discount to NAV<br />

Category 1 PV-10 $/Share 2<br />

$83.51<br />

Proved Developed Reserves $3,554 $43.92<br />

Proved Undeveloped Reserves $2,596 $32.08<br />

53%<br />

Discount<br />

$55.86<br />

Net Debt 3 ($1,630) ($20.14)<br />

Total Net Proved Value $4,520 $55.86<br />

$26.17<br />

Probable Reserves $2,238 $27.66<br />

Total Net Proved + Probable Value $6,758 $83.51<br />

Stock Price at<br />

11/15/13<br />

Total 1P<br />

Total 2P<br />

Stock Price at 12/6/13 $26.17<br />

EXXI Trades at a ~53% Discount to Proved-only NAV<br />

and a 69% Discount to 2P NAV<br />

1<br />

Using 6/30/2013; Prices: $108.24/BO & $3.63/MCF ($91.60/BO & $3.44/MMBTU base before differentials & BTU)<br />

2<br />

80.9 MM shares fully diluted, which includes the effect of repurchase of 3.3MM shares between 10/31/13 and 11/19/13<br />

3<br />

As of 9/30/13, pro forma of $400MM 3% convertible bond deal issued on 11/19/13 less net cash proceeds, and $92.0MM incurred to repurchase<br />

3.3MM common shares between 10/31/13 and 11/19/13<br />

29