Investor Presentation

Investor Presentation

Investor Presentation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

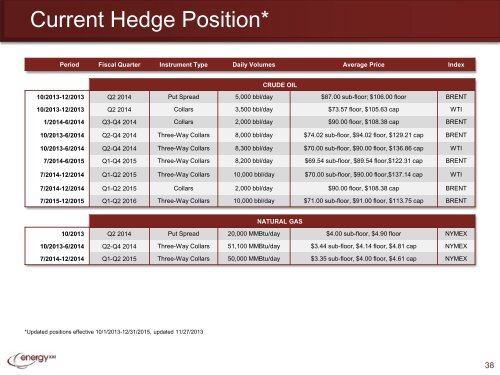

Current Hedge Position*<br />

Period Fiscal Quarter Instrument Type Daily Volumes Average Price Index<br />

CRUDE OIL<br />

10/2013-12/2013 Q2 2014 Put Spread 5,000 bbl/day $87.00 sub-floor; $106.00 floor BRENT<br />

10/2013-12/2013 Q2 2014 Collars 3,500 bbl/day $73.57 floor, $105.63 cap WTI<br />

1/2014-6/2014 Q3-Q4 2014 Collars 2,000 bbl/day $90.00 floor, $108.38 cap BRENT<br />

10/2013-6/2014 Q2-Q4 2014 Three-Way Collars 8,000 bbl/day $74.02 sub-floor, $94.02 floor, $129.21 cap BRENT<br />

10/2013-6/2014 Q2-Q4 2014 Three-Way Collars 8,300 bbl/day $70.00 sub-floor, $90.00 floor, $136.86 cap WTI<br />

7/2014-6/2015 Q1-Q4 2015 Three-Way Collars 8,200 bbl/day $69.54 sub-floor, $89.54 floor,$122.31 cap BRENT<br />

7/2014-12/2014 Q1-Q2 2015 Three-Way Collars 10,000 bbl/day $70.00 sub-floor, $90.00 floor,$137.14 cap WTI<br />

7/2014-12/2014 Q1-Q2 2015 Collars 2,000 bbl/day $90.00 floor, $108.38 cap BRENT<br />

7/2015-12/2015 Q1-Q2 2016 Three-Way Collars 10,000 bbl/day $71.00 sub-floor, $91.00 floor, $113.75 cap BRENT<br />

NATURAL GAS<br />

10/2013 Q2 2014 Put Spread 20,000 MMBtu/day $4.00 sub-floor, $4.90 floor NYMEX<br />

10/2013-6/2014 Q2-Q4 2014 Three-Way Collars 51,100 MMBtu/day $3.44 sub-floor, $4.14 floor, $4.81 cap NYMEX<br />

7/2014-12/2014 Q1-Q2 2015 Three-Way Collars 50,000 MMBtu/day $3.35 sub-floor, $4.00 floor, $4.61 cap NYMEX<br />

*Updated positions effective 10/1/2013-12/31/2015, updated 11/27/2013<br />

38