Standard Chartered Indian Depository Receipts Frequently Asked ...

Standard Chartered Indian Depository Receipts Frequently Asked ...

Standard Chartered Indian Depository Receipts Frequently Asked ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

September 27, 2013<br />

connection with the deposit of IDRs, cancellation or redemption of IDRs, release of Equity Shares or any<br />

subsequent sale thereof. IDR holders are advised to consult their own counsel and advisors as to the tax<br />

consequences of redemption of IDRs into underlying equity shares under <strong>Indian</strong> and other applicable laws,<br />

before making an application for redemption.<br />

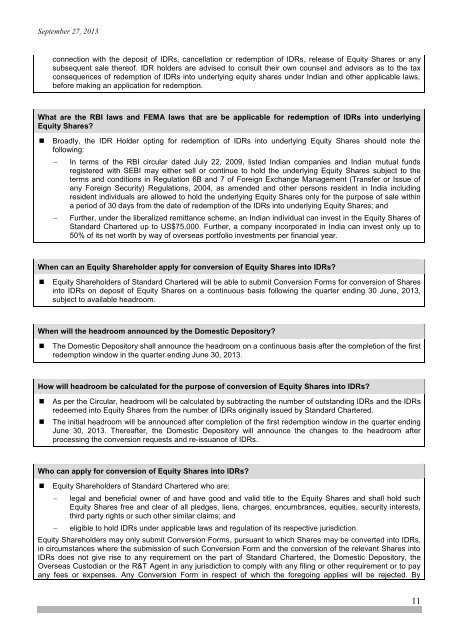

What are the RBI laws and FEMA laws that are be applicable for redemption of IDRs into underlying<br />

Equity Shares?<br />

• Broadly, the IDR Holder opting for redemption of IDRs into underlying Equity Shares should note the<br />

following:<br />

<br />

<br />

In terms of the RBI circular dated July 22, 2009, listed <strong>Indian</strong> companies and <strong>Indian</strong> mutual funds<br />

registered with SEBI may either sell or continue to hold the underlying Equity Shares subject to the<br />

terms and conditions in Regulation 6B and 7 of Foreign Exchange Management (Transfer or Issue of<br />

any Foreign Security) Regulations, 2004, as amended and other persons resident in India including<br />

resident individuals are allowed to hold the underlying Equity Shares only for the purpose of sale within<br />

a period of 30 days from the date of redemption of the IDRs into underlying Equity Shares; and<br />

Further, under the liberalized remittance scheme, an <strong>Indian</strong> individual can invest in the Equity Shares of<br />

<strong>Standard</strong> <strong>Chartered</strong> up to US$75,000. Further, a company incorporated in India can invest only up to<br />

50% of its net worth by way of overseas portfolio investments per financial year.<br />

When can an Equity Shareholder apply for conversion of Equity Shares into IDRs?<br />

• Equity Shareholders of <strong>Standard</strong> <strong>Chartered</strong> will be able to submit Conversion Forms for conversion of Shares<br />

into IDRs on deposit of Equity Shares on a continuous basis following the quarter ending 30 June, 2013,<br />

subject to available headroom.<br />

When will the headroom announced by the Domestic <strong>Depository</strong>?<br />

• The Domestic <strong>Depository</strong> shall announce the headroom on a continuous basis after the completion of the first<br />

redemption window in the quarter ending June 30, 2013.<br />

How will headroom be calculated for the purpose of conversion of Equity Shares into IDRs?<br />

• As per the Circular, headroom will be calculated by subtracting the number of outstanding IDRs and the IDRs<br />

redeemed into Equity Shares from the number of IDRs originally issued by <strong>Standard</strong> <strong>Chartered</strong>.<br />

• The initial headroom will be announced after completion of the first redemption window in the quarter ending<br />

June 30, 2013. Thereafter, the Domestic <strong>Depository</strong> will announce the changes to the headroom after<br />

processing the conversion requests and re-issuance of IDRs.<br />

Who can apply for conversion of Equity Shares into IDRs?<br />

• Equity Shareholders of <strong>Standard</strong> <strong>Chartered</strong> who are:<br />

<br />

<br />

legal and beneficial owner of and have good and valid title to the Equity Shares and shall hold such<br />

Equity Shares free and clear of all pledges, liens, charges, encumbrances, equities, security interests,<br />

third party rights or such other similar claims; and<br />

eligible to hold IDRs under applicable laws and regulation of its respective jurisdiction.<br />

Equity Shareholders may only submit Conversion Forms, pursuant to which Shares may be converted into IDRs,<br />

in circumstances where the submission of such Conversion Form and the conversion of the relevant Shares into<br />

IDRs does not give rise to any requirement on the part of <strong>Standard</strong> <strong>Chartered</strong>, the Domestic <strong>Depository</strong>, the<br />

Overseas Custodian or the R&T Agent in any jurisdiction to comply with any filing or other requirement or to pay<br />

any fees or expenses. Any Conversion Form in respect of which the foregoing applies will be rejected. By<br />

11