Standard Chartered Indian Depository Receipts Frequently Asked ...

Standard Chartered Indian Depository Receipts Frequently Asked ...

Standard Chartered Indian Depository Receipts Frequently Asked ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

September 27, 2013<br />

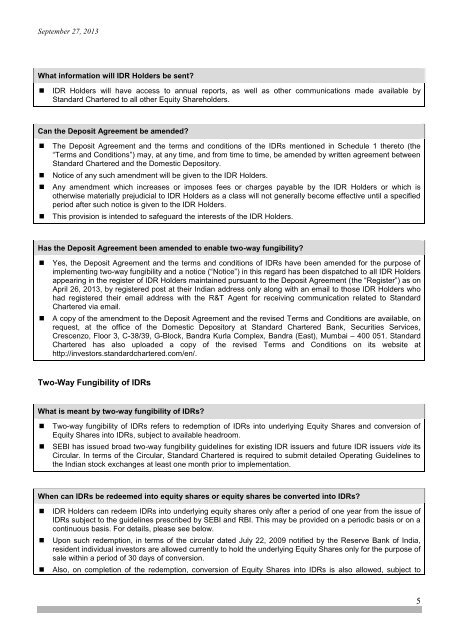

What information will IDR Holders be sent?<br />

• IDR Holders will have access to annual reports, as well as other communications made available by<br />

<strong>Standard</strong> <strong>Chartered</strong> to all other Equity Shareholders.<br />

Can the Deposit Agreement be amended?<br />

• The Deposit Agreement and the terms and conditions of the IDRs mentioned in Schedule 1 thereto (the<br />

“Terms and Conditions”) may, at any time, and from time to time, be amended by written agreement between<br />

<strong>Standard</strong> <strong>Chartered</strong> and the Domestic <strong>Depository</strong>.<br />

• Notice of any such amendment will be given to the IDR Holders.<br />

• Any amendment which increases or imposes fees or charges payable by the IDR Holders or which is<br />

otherwise materially prejudicial to IDR Holders as a class will not generally become effective until a specified<br />

period after such notice is given to the IDR Holders.<br />

• This provision is intended to safeguard the interests of the IDR Holders.<br />

Has the Deposit Agreement been amended to enable two-way fungibility?<br />

• Yes, the Deposit Agreement and the terms and conditions of IDRs have been amended for the purpose of<br />

implementing two-way fungibility and a notice (“Notice”) in this regard has been dispatched to all IDR Holders<br />

appearing in the register of IDR Holders maintained pursuant to the Deposit Agreement (the “Register”) as on<br />

April 26, 2013, by registered post at their <strong>Indian</strong> address only along with an email to those IDR Holders who<br />

had registered their email address with the R&T Agent for receiving communication related to <strong>Standard</strong><br />

<strong>Chartered</strong> via email.<br />

• A copy of the amendment to the Deposit Agreement and the revised Terms and Conditions are available, on<br />

request, at the office of the Domestic <strong>Depository</strong> at <strong>Standard</strong> <strong>Chartered</strong> Bank, Securities Services,<br />

Crescenzo, Floor 3, C-38/39, G-Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. <strong>Standard</strong><br />

<strong>Chartered</strong> has also uploaded a copy of the revised Terms and Conditions on its website at<br />

http://investors.standardchartered.com/en/.<br />

Two-Way Fungibility of IDRs<br />

What is meant by two-way fungibility of IDRs?<br />

• Two-way fungibility of IDRs refers to redemption of IDRs into underlying Equity Shares and conversion of<br />

Equity Shares into IDRs, subject to available headroom.<br />

• SEBI has issued broad two-way fungibility guidelines for existing IDR issuers and future IDR issuers vide its<br />

Circular. In terms of the Circular, <strong>Standard</strong> <strong>Chartered</strong> is required to submit detailed Operating Guidelines to<br />

the <strong>Indian</strong> stock exchanges at least one month prior to implementation.<br />

When can IDRs be redeemed into equity shares or equity shares be converted into IDRs?<br />

• IDR Holders can redeem IDRs into underlying equity shares only after a period of one year from the issue of<br />

IDRs subject to the guidelines prescribed by SEBI and RBI. This may be provided on a periodic basis or on a<br />

continuous basis. For details, please see below.<br />

• Upon such redemption, in terms of the circular dated July 22, 2009 notified by the Reserve Bank of India,<br />

resident individual investors are allowed currently to hold the underlying Equity Shares only for the purpose of<br />

sale within a period of 30 days of conversion.<br />

• Also, on completion of the redemption, conversion of Equity Shares into IDRs is also allowed, subject to<br />

5