“Motorcycles: European Market Briefs 2013-2014”. - Export.gov

“Motorcycles: European Market Briefs 2013-2014”. - Export.gov

“Motorcycles: European Market Briefs 2013-2014”. - Export.gov

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

29 U.S. Commercial Service Resource Guide for the <strong>European</strong> Motorcycle Industry<br />

scooters offer affordable transportation. Low purchase costs and gasoline consumption of<br />

about 2 liters per 100 kilometers guarantee cheap mobility in times of record gasoline<br />

prices and increasingly congested cities with extremely limited and restricted parking<br />

space.<br />

<strong>Market</strong> Share of Motorcycles (≥80cm³) according to <strong>Market</strong> Segment, 2012<br />

<strong>Market</strong> Segment<br />

<strong>Market</strong> Share<br />

%<br />

Change 2011 - 2012 %<br />

Sport 35.26 +2.68<br />

Enduro 27.16 +11.07<br />

Chopper 12.84 +8.06<br />

Classic 10.68 -2.43<br />

Supersport 8.15 -10.93<br />

Touring bike/ luxury<br />

tourer<br />

4.54 -19.15<br />

Others 1.37 +4.36<br />

KEY SUPPLIERS AND MODELS<br />

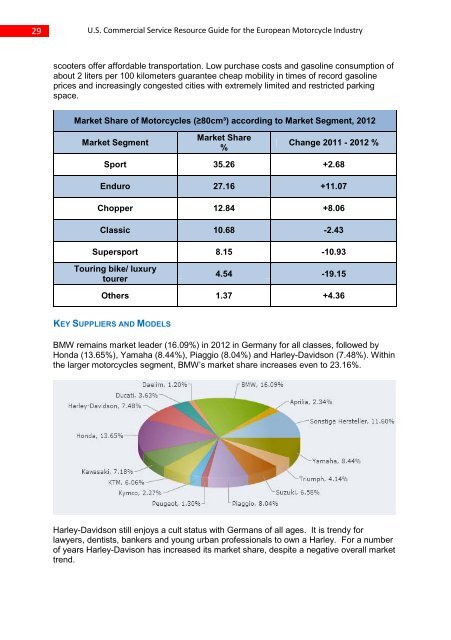

BMW remains market leader (16.09%) in 2012 in Germany for all classes, followed by<br />

Honda (13.65%), Yamaha (8.44%), Piaggio (8.04%) and Harley-Davidson (7.48%). Within<br />

the larger motorcycles segment, BMW’s market share increases even to 23.16%.<br />

Harley-Davidson still enjoys a cult status with Germans of all ages. It is trendy for<br />

lawyers, dentists, bankers and young urban professionals to own a Harley. For a number<br />

of years Harley-Davison has increased its market share, despite a negative overall market<br />

trend.