information! - Girl Scout Council of the Nation's Capital

information! - Girl Scout Council of the Nation's Capital

information! - Girl Scout Council of the Nation's Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

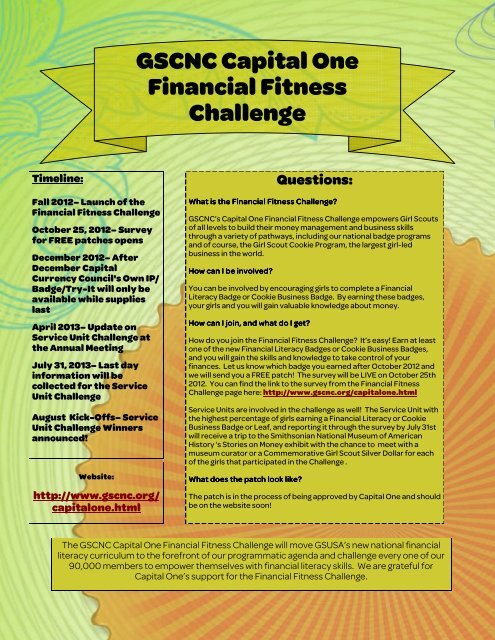

GSCNC <strong>Capital</strong> One<br />

Financial Fitness<br />

Challenge<br />

Timeline:<br />

Fall 2012– Launch <strong>of</strong> <strong>the</strong><br />

Financial Fitness Challenge<br />

October 25, 2012– Survey<br />

for FREE patches opens<br />

December 2012– After<br />

December <strong>Capital</strong><br />

Currency <strong>Council</strong>'s Own IP/<br />

Badge/Try-It will only be<br />

available while supplies<br />

last<br />

April 2013– Update on<br />

Service Unit Challenge at<br />

<strong>the</strong> Annual Meeting<br />

July 31, 2013– Last day<br />

<strong>information</strong> will be<br />

collected for <strong>the</strong> Service<br />

Unit Challenge<br />

August Kick-Offs– Service<br />

Unit Challenge Winners<br />

announced!<br />

Website:<br />

http://www.gscnc.org/<br />

capitalone.html<br />

Questions:<br />

What is <strong>the</strong> Financial Fitness Challenge?<br />

GSCNC’s <strong>Capital</strong> One Financial Fitness Challenge empowers <strong>Girl</strong> <strong>Scout</strong>s<br />

<strong>of</strong> all levels to build <strong>the</strong>ir money management and business skills<br />

through a variety <strong>of</strong> pathways, including our national badge programs<br />

and <strong>of</strong> course, <strong>the</strong> <strong>Girl</strong> <strong>Scout</strong> Cookie Program, <strong>the</strong> largest girl-led<br />

business in <strong>the</strong> world.<br />

How can I be involved?<br />

You can be involved by encouraging girls to complete a Financial<br />

Literacy Badge or Cookie Business Badge. By earning <strong>the</strong>se badges,<br />

your girls and you will gain valuable knowledge about money.<br />

How can I join, and what do I get?<br />

How do you join <strong>the</strong> Financial Fitness Challenge? It’s easy! Earn at least<br />

one <strong>of</strong> <strong>the</strong> new Financial Literacy Badges or Cookie Business Badges,<br />

and you will gain <strong>the</strong> skills and knowledge to take control <strong>of</strong> your<br />

finances. Let us know which badge you earned after October 2012 and<br />

we will send you a FREE patch! The survey will be LIVE on October 25th<br />

2012. You can find <strong>the</strong> link to <strong>the</strong> survey from <strong>the</strong> Financial Fitness<br />

Challenge page here: http://www.gscnc.org/capitalone.html<br />

Service Units are involved in <strong>the</strong> challenge as well! The Service Unit with<br />

<strong>the</strong> highest percentage <strong>of</strong> girls earning a Financial Literacy or Cookie<br />

Business Badge or Leaf, and reporting it through <strong>the</strong> survey by July 31st<br />

will receive a trip to <strong>the</strong> Smithsonian National Museum <strong>of</strong> American<br />

History ‘s Stories on Money exhibit with <strong>the</strong> chance to meet with a<br />

museum curator or a Commemorative <strong>Girl</strong> <strong>Scout</strong> Silver Dollar for each<br />

<strong>of</strong> <strong>the</strong> girls that participated in <strong>the</strong> Challenge .<br />

What does <strong>the</strong> patch look like?<br />

The patch is in <strong>the</strong> process <strong>of</strong> being approved by <strong>Capital</strong> One and should<br />

be on <strong>the</strong> website soon!<br />

The GSCNC <strong>Capital</strong> One Financial Fitness Challenge will move GSUSA’s new national financial<br />

literacy curriculum to <strong>the</strong> forefront <strong>of</strong> our programmatic agenda and challenge every one <strong>of</strong> our<br />

90,000 members to empower <strong>the</strong>mselves with financial literacy skills. We are grateful for<br />

<strong>Capital</strong> One’s support for <strong>the</strong> Financial Fitness Challenge.

MONEY MATTERS QUIZ<br />

1. What is a Budget?<br />

A. A budget is a plan for saving and spending money<br />

B. A budget is a way to get <strong>the</strong> things you want, but don't need<br />

C. A budget is a way to spend your parents’ money<br />

2. How can girls learn <strong>the</strong> difference between wants and needs?<br />

A. By writing down <strong>the</strong> things <strong>the</strong>y use on a day to day basis<br />

B. Buy <strong>the</strong> things you think look cool from <strong>the</strong> mall<br />

C. Put all <strong>of</strong> your purchases on a credit card, even if you exceed your limit<br />

3. How can girls learn about Money Management in <strong>Girl</strong> <strong>Scout</strong>s?<br />

A. All <strong>of</strong> <strong>the</strong> choices below<br />

B. By participating in <strong>the</strong> <strong>Girl</strong> <strong>Scout</strong> Cookie Program<br />

C. By earning <strong>the</strong> Financial Literacy or Cookie Business badges or leaves<br />

4. What <strong>Girl</strong> <strong>Scout</strong> levels have Financial Literacy and Cookie Business<br />

recognitions?<br />

A. Daisy-Ambassador<br />

B. Brownie-Ambassador<br />

C. Cadette-Ambassador—only teens should be learning about money management.<br />

5. When thinking about credit what does APR stand for?<br />

A. Annual Percentage Rate<br />

B. After Purchase Regret<br />

C. All Payments Rejoice<br />

6. The internet is fast becoming one <strong>of</strong> <strong>the</strong> best places to comparison shop.<br />

What’s <strong>the</strong> best way to comparison shop online?<br />

A. Search online for <strong>the</strong> item and find three different prices on three different sites<br />

B. Buy from <strong>the</strong> first website that you find<br />

C. Ignore <strong>the</strong> reviews left from customers<br />

7. What does a credit score <strong>of</strong> over 700 mean?<br />

A. It is recognized as very good credit<br />

B. It is recognized as a bad score for credit<br />

Are you<br />

Financially<br />

Fit?<br />

Mostly A's-<br />

Olympian<br />

You are Olympian in <strong>the</strong><br />

world <strong>of</strong> Financial<br />

Fitness! Use your<br />

knowledge to work on <strong>the</strong><br />

Financial Literacy and<br />

Cookie Business Badges<br />

with your girls.<br />

Mostly B's-<br />

Fit<br />

You are Fit with your<br />

Finances. Your knowledge<br />

as well as <strong>information</strong> from<br />

<strong>the</strong> Financial Literacy and<br />

Cookie Business Badges will<br />

help your girls learn about<br />

<strong>the</strong>ir finances.<br />

Mostly C's-<br />

Couch Potato<br />

You are currently at <strong>the</strong><br />

Couch Potato level, but<br />

don't fret! Learn about all<br />

<strong>of</strong> <strong>the</strong>se topics with your<br />

girls by working on <strong>the</strong> new<br />

Financial Literacy or Cookie<br />

Business.<br />

C. What is a credit score?