Annual report 2010 - Hapimag

Annual report 2010 - Hapimag

Annual report 2010 - Hapimag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

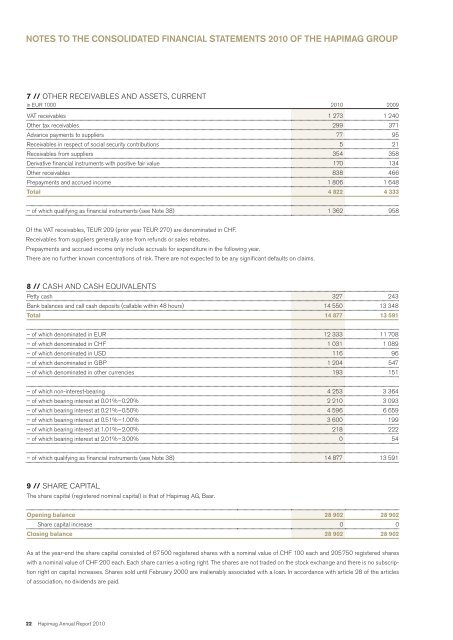

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS <strong>2010</strong> OF THE HAPIMAG GrouP<br />

7 // otheR ReceivaBles anD assets, cuRRent<br />

in euR 1000 <strong>2010</strong> 2009<br />

VAT receivables 1 273 1 240<br />

Other tax receivables 299 371<br />

Advance payments to suppliers 77 95<br />

Receivables in respect of social security contributions 5 21<br />

Receivables from suppliers 354 358<br />

Derivative financial instruments with positive fair value 170 134<br />

Other receivables 838 466<br />

Prepayments and accrued income 1 806 1 648<br />

Total 4 822 4 333<br />

– of which qualifying as financial instruments (see Note 38) 1 362 958<br />

Of the vat receivables, teuR 209 (prior year teuR 270) are denominated in chf.<br />

Receivables from suppliers generally arise from refunds or sales rebates.<br />

Prepayments and accrued income only include accruals for expenditure in the following year.<br />

There are no further known concentrations of risk. There are not expected to be any significant defaults on claims.<br />

8 // cash and cash equivalents<br />

Petty cash 327 243<br />

Bank balances and call cash deposits (callable within 48 hours) 14 550 13 348<br />

Total 14 877 13 591<br />

– of which denominated in euR 12 333 11 708<br />

– of which denominated in chf 1 031 1 089<br />

– of which denominated in usD 116 96<br />

– of which denominated in GBP 1 204 547<br />

– of which denominated in other currencies 193 151<br />

– of which non-interest-bearing 4 253 3 364<br />

– of which bearing interest at 0.01%–0.20% 2 210 3 093<br />

– of which bearing interest at 0.21%–0.50% 4 596 6 659<br />

– of which bearing interest at 0.51%–1.00% 3 600 199<br />

– of which bearing interest at 1.01%–2.00% 218 222<br />

– of which bearing interest at 2.01%–3.00% 0 54<br />

– of which qualifying as financial instruments (see Note 38) 14 877 13 591<br />

9 // shaRE capital<br />

The share capital (registered nominal capital) is that of <strong>Hapimag</strong> ag, Baar.<br />

Opening balance 28 902 28 902<br />

share capital increase 0 0<br />

Closing balance 28 902 28 902<br />

As at the year-end the share capital consisted of 67500 registered shares with a nominal value of chf 100 each and 205750 registered shares<br />

with a nominal value of chf 200 each. Each share carries a voting right. The shares are not traded on the stock exchange and there is no subscription<br />

right on capital increases. Shares sold until February 2000 are inalienably associated with a loan. In accordance with article 28 of the articles<br />

of association, no dividends are paid.<br />

22 <strong>Hapimag</strong> <strong>Annual</strong> Report <strong>2010</strong>