Read a PDF Sample of Initial Public Offerings - Harriman House

Read a PDF Sample of Initial Public Offerings - Harriman House

Read a PDF Sample of Initial Public Offerings - Harriman House

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

An Introduction to IPOs | Chapter 1<br />

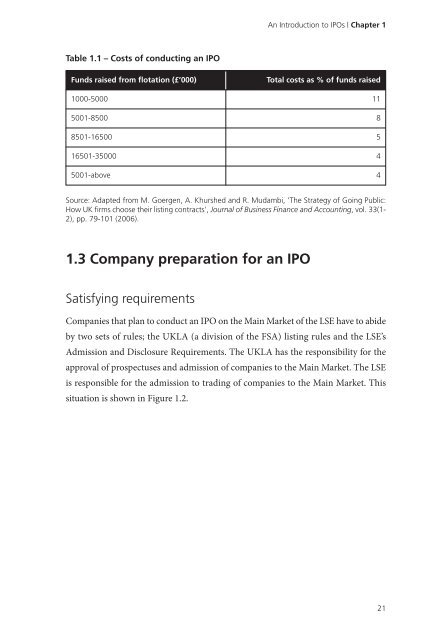

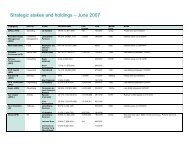

Table 1.1 – Costs <strong>of</strong> conducting an IPO<br />

Funds raised from flotation (£’000)<br />

Total costs as % <strong>of</strong> funds raised<br />

1000-5000 11<br />

5001-8500 8<br />

8501-16500 5<br />

16501-35000 4<br />

5001-above 4<br />

Source: Adapted from M. Goergen, A. Khurshed and R. Mudambi, ‘The Strategy <strong>of</strong> Going <strong>Public</strong>:<br />

How UK firms choose their listing contracts’, Journal <strong>of</strong> Business Finance and Accounting, vol. 33(1-<br />

2), pp. 79-101 (2006).<br />

1.3 Company preparation for an IPO<br />

Satisfying requirements<br />

Companies that plan to conduct an IPO on the Main Market <strong>of</strong> the LSE have to abide<br />

by two sets <strong>of</strong> rules; the UKLA (a division <strong>of</strong> the FSA) listing rules and the LSE’s<br />

Admission and Disclosure Requirements. The UKLA has the responsibility for the<br />

approval <strong>of</strong> prospectuses and admission <strong>of</strong> companies to the Main Market. The LSE<br />

is responsible for the admission to trading <strong>of</strong> companies to the Main Market. This<br />

situation is shown in Figure 1.2.<br />

21