Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Maximum trade price means the highest spot price during the MCE valuation period (being the<br />

period commencing from and including the moment upon which the mandatory call event occurs and up<br />

to the end of the following trading session on the stock exchange, subject to any potential extension).<br />

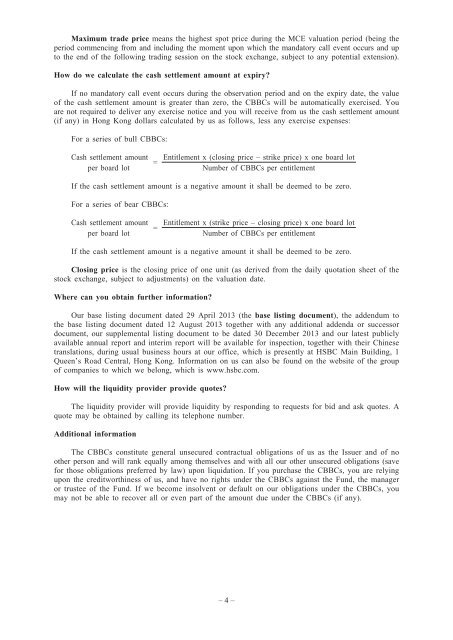

How do we calculate the cash settlement amount at expiry?<br />

If no mandatory call event occurs during the observation period and on the expiry date, the value<br />

of the cash settlement amount is greater than zero, the CBBCs will be automatically exercised. You<br />

are not required to deliver any exercise notice and you will receive from us the cash settlement amount<br />

(if any) in Hong Kong dollars calculated by us as follows, less any exercise expenses:<br />

For a series of bull CBBCs:<br />

Cash settlement amount<br />

per board lot<br />

=<br />

Entitlement x (closing price – strike price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the cash settlement amount is a negative amount it shall be deemed to be zero.<br />

For a series of bear CBBCs:<br />

Cash settlement amount<br />

per board lot<br />

=<br />

Entitlement x (strike price – closing price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the cash settlement amount is a negative amount it shall be deemed to be zero.<br />

Closing price is the closing price of one unit (as derived from the daily quotation sheet of the<br />

stock exchange, subject to adjustments) on the valuation date.<br />

Where can you obtain further in<strong>for</strong>mation?<br />

Our base listing document dated 29 April 2013 (the base listing document), the addendum to<br />

the base listing document dated 12 August 2013 together with any additional addenda or successor<br />

document, our supplemental listing document to be dated 30 December 2013 and our latest publicly<br />

available annual report and interim report will be available <strong>for</strong> inspection, together with their Chinese<br />

translations, during usual business hours at our office, which is presently at HSBC Main Building, 1<br />

Queen’s Road Central, Hong Kong. In<strong>for</strong>mation on us can also be found on the website of the group<br />

of companies to which we belong, which is www.hsbc.com.<br />

How will the liquidity provider provide quotes?<br />

The liquidity provider will provide liquidity by responding to requests <strong>for</strong> bid and ask quotes. A<br />

quote may be obtained by calling its telephone number.<br />

Additional in<strong>for</strong>mation<br />

The CBBCs constitute general unsecured contractual obligations of us as the Issuer and of no<br />

other person and will rank equally among themselves and with all our other unsecured obligations (save<br />

<strong>for</strong> those obligations preferred by law) upon liquidation. If you purchase the CBBCs, you are relying<br />

upon the creditworthiness of us, and have no rights under the CBBCs against the Fund, the manager<br />

or trustee of the Fund. If we become insolvent or default on our obligations under the CBBCs, you<br />

may not be able to recover all or even part of the amount due under the CBBCs (if any).<br />

– 4 –