Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

Launch Announcement for Callable Bull/Bear Contracts ... - HKExnews

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This announcement appears <strong>for</strong> in<strong>for</strong>mation purposes only and does not constitute an invitation or offer to acquire,<br />

purchase or subscribe <strong>for</strong> the CBBCs described below.<br />

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited (the stock exchange)<br />

take no responsibility <strong>for</strong> the contents of this announcement, make no representation as to its accuracy or<br />

completeness and expressly disclaim any liability whatsoever <strong>for</strong> any loss howsoever arising from or in reliance<br />

upon the whole or any part of the contents of this announcement.<br />

This is a derivative product or a structured product which involves derivatives. Do not invest in it unless you fully<br />

understand and are willing to assume the risks associated with it. You are warned that the price of the CBBCs<br />

may fall in value as rapidly as it may rise and you may sustain a total loss of your investment. You should fully<br />

understand their potential risks and rewards and independently determine that they are appropriate <strong>for</strong> you. You<br />

should consult with advisers if necessary.<br />

<strong>Bull</strong>/<strong>Bear</strong> CBBCs<br />

issued by<br />

The Hongkong and Shanghai Banking Corporation Limited<br />

(incorporated in Hong Kong with limited liability under the Companies Ordinance of Hong Kong)<br />

Non-collateralised Structured Products<br />

<strong>Announcement</strong><br />

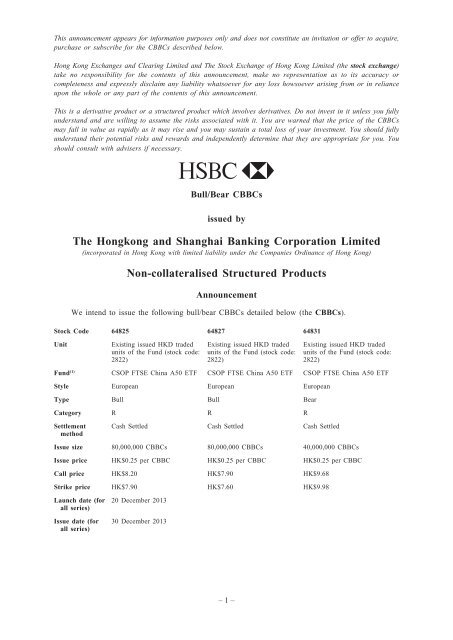

We intend to issue the following bull/bear CBBCs detailed below (the CBBCs).<br />

Stock Code 64825 64827 64831<br />

Unit<br />

Existing issued HKD traded<br />

units of the Fund (stock code:<br />

2822)<br />

Existing issued HKD traded<br />

units of the Fund (stock code:<br />

2822)<br />

Existing issued HKD traded<br />

units of the Fund (stock code:<br />

2822)<br />

Fund (1) CSOP FTSE China A50 ETF CSOP FTSE China A50 ETF CSOP FTSE China A50 ETF<br />

Style European European European<br />

Type <strong>Bull</strong> <strong>Bull</strong> <strong>Bear</strong><br />

Category R R R<br />

Settlement<br />

method<br />

Cash Settled Cash Settled Cash Settled<br />

Issue size 80,000,000 CBBCs 80,000,000 CBBCs 40,000,000 CBBCs<br />

Issue price HK$0.25 per CBBC HK$0.25 per CBBC HK$0.25 per CBBC<br />

Call price HK$8.20 HK$7.90 HK$9.68<br />

Strike price HK$7.90 HK$7.60 HK$9.98<br />

<strong>Launch</strong> date (<strong>for</strong><br />

all series)<br />

Issue date (<strong>for</strong><br />

all series)<br />

20 December 2013<br />

30 December 2013<br />

– 1 –

Stock Code 64825 64827 64831<br />

Observation<br />

commencement<br />

date (<strong>for</strong> all<br />

series)<br />

31 December 2013<br />

Expiry date 20 October 2014 24 November 2014 1 December 2014<br />

Valuation date<br />

The trading day (2) immediately<br />

preceding the expiry date<br />

The trading day (2) immediately<br />

preceding the expiry date<br />

Board lot 2,000 CBBCs 2,000 CBBCs 2,000 CBBCs<br />

Entitlement One unit One unit One unit<br />

Number of<br />

CBBCs per<br />

Entitlement<br />

Ten CBBCs Ten CBBCs Ten CBBCs<br />

Funding cost per HK$0.115 HK$0.086 HK$0.168<br />

launch date (3)<br />

CBBC as of<br />

Effective 3.68x 3.68x 3.68x<br />

gearing (4)<br />

Gearing (4) 3.68x 3.68x 3.68x<br />

Premium (4) 12.92% 9.66% 18.78%<br />

Liquidity<br />

provider<br />

HSBC Securities Brokers<br />

(Asia) Limited<br />

(Broker ID: 9609)<br />

Levels 17 and 18,<br />

HSBC Main Building,<br />

1 Queen’s Road Central,<br />

Hong Kong<br />

Tel: (852) 2822 1849<br />

HSBC Securities Brokers<br />

(Asia) Limited<br />

(Broker ID: 9611)<br />

Levels 17 and 18,<br />

HSBC Main Building,<br />

1 Queen’s Road Central,<br />

Hong Kong<br />

Tel: (852) 2822 1849<br />

The trading day (2) immediately<br />

preceding the expiry date<br />

HSBC Securities Brokers<br />

(Asia) Limited<br />

(Broker ID: 9615)<br />

Levels 17 and 18,<br />

HSBC Main Building,<br />

1 Queen’s Road Central,<br />

Hong Kong<br />

Tel: (852) 2822 1849<br />

(1)<br />

The name of the Fund is included here <strong>for</strong> identification purposes only. “FTSE ® ” is a trade mark of the London Stock Exchange<br />

Group companies (“LSEG”) and is used by FTSE International Limited (“FTSE”) under licence . The CBBCs are not sponsored,<br />

endorsed, sold, or promoted by FTSE, LSEG or CSOP Asset Management Limited (“CSOP”). FTSE, LSEG and CSOP make<br />

no representations or warranties with respect to this document or to the owners of the CBBCs or any member of the public<br />

regarding the advisability of investing in the CBBCs. FTSE, LSEG and CSOP have no obligation or liability in connection with<br />

the operation, marketing, trading or sale of the CBBCs.<br />

(2)<br />

“trading day” means a day on which the stock exchange is scheduled to be open <strong>for</strong> trading <strong>for</strong> its regular trading sessions.<br />

(3)<br />

The funding cost is calculated in accordance with the following <strong>for</strong>mula:<br />

Funding Cost =<br />

Strike price x funding rate x n/365<br />

Number of CBBCs per entitlement<br />

Where:<br />

(i)<br />

(ii)<br />

“n” is the number of days remaining to expiration; initially, “n” is the number of days from (and including) the launch<br />

date to (and including) the trading day immediately preceding the expiry date; and<br />

the funding rate will fluctuate throughout the term of the CBBCs as further described in the relevant supplemental listing<br />

document in respect of the CBBCs. As of the launch date, the funding rate (a) in respect of stock code 64825 was 18.12%<br />

p.a.; (b) in respect of stock code 64827 was 12.64% p.a.; (c) in respect of stock code 64831 was 18.31% p.a..<br />

(4)<br />

The gearing, effective gearing and premium may not be comparable to similar in<strong>for</strong>mation provided by other issuers of structured<br />

products as each issuer may use different pricing models.<br />

– 2 –

The CBBCs are in global registered <strong>for</strong>m and exercisable only in the relevant trading board lots<br />

specified above.<br />

What is a mandatory call event? What happens if a mandatory call event occurs?<br />

For a series of bull CBBCs:<br />

A mandatory call event occurs if the spot price is at or below the call price at any time during<br />

a trading day in the observation period.<br />

For a series of bear CBBCs:<br />

A mandatory call event occurs if the spot price is at or above the call price at any time during<br />

a trading day in the observation period.<br />

Spot price means:<br />

(1) in respect of a continuous trading session of the stock exchange, the price per unit concluded<br />

by means of automatic order matching on the stock exchange as reported in the official<br />

real-time dissemination mechanism <strong>for</strong> the stock exchange during such continuous trading<br />

session in accordance with the Rules of the Exchange (the trading rules), excluding direct<br />

business (as defined in the trading rules); and<br />

(2) in respect of a pre-opening session or a closing auction session (if applicable) of the stock<br />

exchange (as the case may be), the final indicative equilibrium price (as defined in the<br />

trading rules) of the unit (if any) calculated at the end of the pre-order matching period of<br />

such pre-opening session or closing auction session (if applicable) (as the case may be) in<br />

accordance with the trading rules, excluding direct business (as defined in the trading rules),<br />

subject to such modification and amendment prescribed by the stock exchange from time to time.<br />

A trading day means a day on which the stock exchange is scheduled to be open <strong>for</strong> trading <strong>for</strong><br />

its regular trading sessions.<br />

The observation period means the period from the observation commencement date to the trading<br />

day immediately preceding the expiry date (both dates inclusive).<br />

Upon the occurrence of a mandatory call event, the CBBCs will terminate automatically and<br />

you will receive from us the residual value being an amount calculated by us in accordance with the<br />

following <strong>for</strong>mula, less any exercise expenses:<br />

For a series of bull CBBCs:<br />

Residual value per board lot =<br />

Entitlement x (minimum trade price – strike price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the residual value is a negative amount it shall be deemed to be zero.<br />

Minimum trade price means the lowest spot price during the MCE valuation period (being the<br />

period commencing from and including the moment upon which the mandatory call event occurs and up<br />

to the end of the following trading session on the stock exchange, subject to any potential extension).<br />

For a series of bear CBBCs:<br />

Residual value per board lot =<br />

Entitlement x (strike price – maximum trade price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the residual value is a negative amount it shall be deemed to be zero.<br />

– 3 –

Maximum trade price means the highest spot price during the MCE valuation period (being the<br />

period commencing from and including the moment upon which the mandatory call event occurs and up<br />

to the end of the following trading session on the stock exchange, subject to any potential extension).<br />

How do we calculate the cash settlement amount at expiry?<br />

If no mandatory call event occurs during the observation period and on the expiry date, the value<br />

of the cash settlement amount is greater than zero, the CBBCs will be automatically exercised. You<br />

are not required to deliver any exercise notice and you will receive from us the cash settlement amount<br />

(if any) in Hong Kong dollars calculated by us as follows, less any exercise expenses:<br />

For a series of bull CBBCs:<br />

Cash settlement amount<br />

per board lot<br />

=<br />

Entitlement x (closing price – strike price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the cash settlement amount is a negative amount it shall be deemed to be zero.<br />

For a series of bear CBBCs:<br />

Cash settlement amount<br />

per board lot<br />

=<br />

Entitlement x (strike price – closing price) x one board lot<br />

Number of CBBCs per entitlement<br />

If the cash settlement amount is a negative amount it shall be deemed to be zero.<br />

Closing price is the closing price of one unit (as derived from the daily quotation sheet of the<br />

stock exchange, subject to adjustments) on the valuation date.<br />

Where can you obtain further in<strong>for</strong>mation?<br />

Our base listing document dated 29 April 2013 (the base listing document), the addendum to<br />

the base listing document dated 12 August 2013 together with any additional addenda or successor<br />

document, our supplemental listing document to be dated 30 December 2013 and our latest publicly<br />

available annual report and interim report will be available <strong>for</strong> inspection, together with their Chinese<br />

translations, during usual business hours at our office, which is presently at HSBC Main Building, 1<br />

Queen’s Road Central, Hong Kong. In<strong>for</strong>mation on us can also be found on the website of the group<br />

of companies to which we belong, which is www.hsbc.com.<br />

How will the liquidity provider provide quotes?<br />

The liquidity provider will provide liquidity by responding to requests <strong>for</strong> bid and ask quotes. A<br />

quote may be obtained by calling its telephone number.<br />

Additional in<strong>for</strong>mation<br />

The CBBCs constitute general unsecured contractual obligations of us as the Issuer and of no<br />

other person and will rank equally among themselves and with all our other unsecured obligations (save<br />

<strong>for</strong> those obligations preferred by law) upon liquidation. If you purchase the CBBCs, you are relying<br />

upon the creditworthiness of us, and have no rights under the CBBCs against the Fund, the manager<br />

or trustee of the Fund. If we become insolvent or default on our obligations under the CBBCs, you<br />

may not be able to recover all or even part of the amount due under the CBBCs (if any).<br />

– 4 –

An application will be made to the stock exchange <strong>for</strong> the listing of, and permission to deal in,<br />

the CBBCs on the stock exchange. The date of commencement of dealings in the CBBCs is expected<br />

to be 31 December 2013.<br />

Other than being a licensed bank in Hong Kong regulated by the Hong Kong Monetary Authority,<br />

a registered institution under the Securities and Futures Ordinance (Cap. 571) of Hong Kong and a<br />

licensed bank under the Banking Ordinance (Cap. 155) of Hong Kong, we are not regulated by any<br />

of the bodies referred to in rule 15A.13(2) or (3) of the Rules Governing the Listing of Securities on<br />

the Stock Exchange.<br />

Our long-term debt ratings are AA- by Standard and Poor’s Ratings Services, a division of The<br />

McGraw-Hill Companies, Inc. and Aa2 by Moody’s Investors Service, Inc., New York.<br />

The Hongkong and Shanghai Banking Corporation Limited<br />

20 December 2013<br />

– 5 –