Annual Report (in PDF) - Hongkong Land

Annual Report (in PDF) - Hongkong Land

Annual Report (in PDF) - Hongkong Land

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial Review<br />

Dividend<br />

The Board is recommend<strong>in</strong>g a f<strong>in</strong>al dividend of US¢9.00 per share<br />

(2006: US¢7.00 per share) giv<strong>in</strong>g a total dividend payable for the year<br />

of US¢13.00 per share (2006: US¢10.00 per share), represent<strong>in</strong>g an<br />

<strong>in</strong>crease of 30%. The dividends are payable <strong>in</strong> cash.<br />

Cash Flow<br />

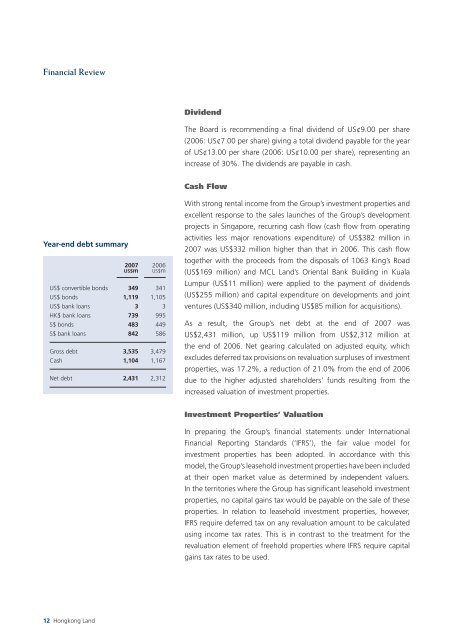

Year-end debt summary<br />

2007 2006<br />

us$m us$m<br />

us$ convertible bonds 349 341<br />

us$ bonds 1,119 1,105<br />

us$ bank loans 3 3<br />

hk$ bank loans 739 995<br />

S$ bonds 483 449<br />

S$ bank loans 842 586<br />

Gross debt 3,535 3,479<br />

Cash 1,104 1,167<br />

Net debt 2,431 2,312<br />

With strong rental <strong>in</strong>come from the Group’s <strong>in</strong>vestment properties and<br />

excellent response to the sales launches of the Group’s development<br />

projects <strong>in</strong> S<strong>in</strong>gapore, recurr<strong>in</strong>g cash flow (cash flow from operat<strong>in</strong>g<br />

activities less major renovations expenditure) of US$382 million <strong>in</strong><br />

2007 was US$332 million higher than that <strong>in</strong> 2006. This cash flow<br />

together with the proceeds from the disposals of 1063 K<strong>in</strong>g’s Road<br />

(US$169 million) and MCL <strong>Land</strong>’s Oriental Bank Build<strong>in</strong>g <strong>in</strong> Kuala<br />

Lumpur (US$11 million) were applied to the payment of dividends<br />

(US$255 million) and capital expenditure on developments and jo<strong>in</strong>t<br />

ventures (US$340 million, <strong>in</strong>clud<strong>in</strong>g US$85 million for acquisitions).<br />

As a result, the Group’s net debt at the end of 2007 was<br />

US$2,431 million, up US$119 million from US$2,312 million at<br />

the end of 2006. Net gear<strong>in</strong>g calculated on adjusted equity, which<br />

excludes deferred tax provisions on revaluation surpluses of <strong>in</strong>vestment<br />

properties, was 17.2%, a reduction of 21.0% from the end of 2006<br />

due to the higher adjusted shareholders’ funds result<strong>in</strong>g from the<br />

<strong>in</strong>creased valuation of <strong>in</strong>vestment properties.<br />

Investment Properties’ Valuation<br />

In prepar<strong>in</strong>g the Group’s f<strong>in</strong>ancial statements under International<br />

F<strong>in</strong>ancial <strong>Report</strong><strong>in</strong>g Standards (‘IFRS’), the fair value model for<br />

<strong>in</strong>vestment properties has been adopted. In accordance with this<br />

model, the Group’s leasehold <strong>in</strong>vestment properties have been <strong>in</strong>cluded<br />

at their open market value as determ<strong>in</strong>ed by <strong>in</strong>dependent valuers.<br />

In the territories where the Group has significant leasehold <strong>in</strong>vestment<br />

properties, no capital ga<strong>in</strong>s tax would be payable on the sale of these<br />

properties. In relation to leasehold <strong>in</strong>vestment properties, however,<br />

IFRS require deferred tax on any revaluation amount to be calculated<br />

us<strong>in</strong>g <strong>in</strong>come tax rates. This is <strong>in</strong> contrast to the treatment for the<br />

revaluation element of freehold properties where IFRS require capital<br />

ga<strong>in</strong>s tax rates to be used.<br />

12 <strong>Hongkong</strong> <strong>Land</strong>