“HSBC 5 Swipes Promotion” (“Promot - HSBC Sri Lanka

“HSBC 5 Swipes Promotion” (“Promot - HSBC Sri Lanka

“HSBC 5 Swipes Promotion” (“Promot - HSBC Sri Lanka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

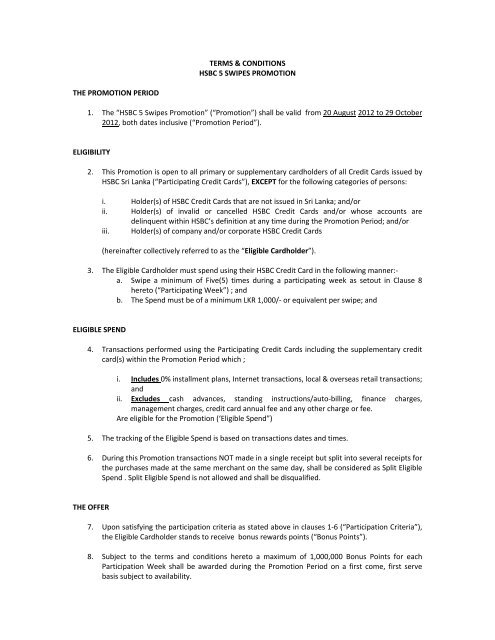

TERMS & CONDITIONS<br />

<strong>HSBC</strong> 5 SWIPES PROMOTION<br />

THE PROMOTION PERIOD<br />

1. The <strong>“<strong>HSBC</strong></strong> 5 <strong>Swipes</strong> <strong>Promotion”</strong> (“<strong>Promotion”</strong>) shall be valid from 20 August 2012 to 29 October<br />

2012, both dates inclusive (<strong>“Promot</strong>ion Period”).<br />

ELIGIBILITY<br />

2. This Promotion is open to all primary or supplementary cardholders of all Credit Cards issued by<br />

<strong>HSBC</strong> <strong>Sri</strong> <strong>Lanka</strong> (“Participating Credit Cards”), EXCEPT for the following categories of persons:<br />

i. Holder(s) of <strong>HSBC</strong> Credit Cards that are not issued in <strong>Sri</strong> <strong>Lanka</strong>; and/or<br />

ii. Holder(s) of invalid or cancelled <strong>HSBC</strong> Credit Cards and/or whose accounts are<br />

delinquent within <strong>HSBC</strong>’s definition at any time during the Promotion Period; and/or<br />

iii. Holder(s) of company and/or corporate <strong>HSBC</strong> Credit Cards<br />

(hereinafter collectively referred to as the “Eligible Cardholder”).<br />

3. The Eligible Cardholder must spend using their <strong>HSBC</strong> Credit Card in the following manner:‐<br />

a. Swipe a minimum of Five(5) times during a participating week as setout in Clause 8<br />

hereto (“Participating Week”) ; and<br />

b. The Spend must be of a minimum LKR 1,000/‐ or equivalent per swipe; and<br />

ELIGIBLE SPEND<br />

4. Transactions performed using the Participating Credit Cards including the supplementary credit<br />

card(s) within the Promotion Period which ;<br />

i. Includes 0% installment plans, Internet transactions, local & overseas retail transactions;<br />

and<br />

ii. Excludes cash advances, standing instructions/auto‐billing, finance charges,<br />

management charges, credit card annual fee and any other charge or fee.<br />

Are eligible for the Promotion (‘Eligible Spend”)<br />

5. The tracking of the Eligible Spend is based on transactions dates and times.<br />

6. During this Promotion transactions NOT made in a single receipt but split into several receipts for<br />

the purchases made at the same merchant on the same day, shall be considered as Split Eligible<br />

Spend . Split Eligible Spend is not allowed and shall be disqualified.<br />

THE OFFER<br />

7. Upon satisfying the participation criteria as stated above in clauses 1‐6 (“Participation Criteria”),<br />

the Eligible Cardholder stands to receive bonus rewards points (“Bonus Points”).<br />

8. Subject to the terms and conditions hereto a maximum of 1,000,000 Bonus Points for each<br />

Participation Week shall be awarded during the Promotion Period on a first come, first serve<br />

basis subject to availability.

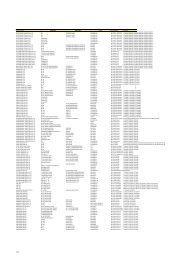

Table 1: Participating Weeks & Cash Back Allocation<br />

Participating Weeks * Weekly Rewards points<br />

allocation<br />

Week 1 20 August 2012 – 26 August 2012 1,000,000 (1,000 per customer)<br />

Week 2 27 August 2012 – 02 September 2012 1,000,000 (1,000 per customer)<br />

Week 3 03 September 2012 – 09 September 2012 1,000,000 (1,000 per customer)<br />

Week 4 10 September 2012 – 16 September 2012 1,000,000 (1,000 per customer)<br />

Week 5 17 September 2012 – 23 September 2012 1,000,000 (1,000 per customer)<br />

Week 6 24 September 2012 – 30 September 2012 1,000,000 (1,000 per customer)<br />

Week 7 01 October 2012 – 07 October 2012 1,000,000 (1,000 per customer)<br />

Week 8 08 October 2012 – 14 October 2012 1,000,000 (1,000 per customer)<br />

Week 9 15 October 2012 – 21 October 2012 1,000,000 (1,000 per customer)<br />

Week 10 22 October 2012 – 28 October 2012 1,000,000 (1,000 per customer)<br />

TOTAL POINTS ALLOCATION 10,000,000<br />

9. Subject to Clause 10 hereto once the Eligible Cardholder satisfies the Participation Criteria (in<br />

clause 3 above) in any Participating Week, the Eligible Cardholder shall stand to receive 1000<br />

Bonus Points subject to availability for that Participating Week and which is on a first come, first<br />

serve basis .<br />

10. The maximum Bonus Points awarded shall be 3,000 per Eligible Cardholder throughout the<br />

Promotion Period.<br />

11. The Bonus Points earned by a Primary and / or Supplementary Credit Cardholder shall be added<br />

to the primary Cardholders Credit Card Account within four (4) to six (6) weeks from the end of<br />

the Promotion Period.<br />

12. The Eligible Cardholder will receive notification of the Bonus Points, if any, through their monthly<br />

Credit Card statement that follows after the date of the addition of the Bonus Points.<br />

13. Any request from any Eligible Cardholders or any other person to add the Bonus Points to the<br />

Eligible Cardholders other or any third party’s <strong>HSBC</strong> Credit Card account shall not be honored.<br />

GENERAL TERMS AND CONDITIONS<br />

14. <strong>HSBC</strong> reserves the right to substitute the Bonus Points with any other prize or item of similar<br />

value at any time with 3 days prior notice by placing a banner on the <strong>HSBC</strong> <strong>Sri</strong> <strong>Lanka</strong> web page.<br />

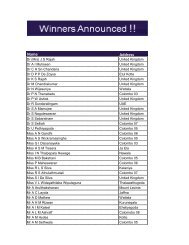

15. <strong>HSBC</strong> reserves the right to publish or display the name, picture and city of residence of the<br />

Eligible Cardholders who have been selected to receive the Bonus Points for this Promotion for<br />

advertising and publicity purposes. By participating in this Promotion, the selected Eligible<br />

Cardholders hereby consent to and agree that <strong>HSBC</strong> shall be at liberty to publish their names,<br />

pictures and city of residence without compensation for advertising and publicity purposes.<br />

16. <strong>HSBC</strong> reserves the right at its absolute discretion to vary, delete or add to any of these Terms &<br />

Conditions with 3 days prior notice by placing a banner on the <strong>HSBC</strong> <strong>Sri</strong> <strong>Lanka</strong> web page.<br />

17. These Terms and Conditions, may be amended from time to time pursuant to Clause 17, shall<br />

prevail over any provisions or representations contained in any other promotional materials<br />

advertising this Promotion

18. <strong>HSBC</strong> may use any of the following modes to communicate notices in relation to this Promotion<br />

to the Eligible Cardholder:<br />

i) individual notice to the Eligible Cardholder (whether by written notice or via electronic<br />

means) sent to the Eligible Cardholder’s latest address/email address as maintained in<br />

the <strong>HSBC</strong>’s records;<br />

ii) press advertisements;<br />

iii) notice in the Eligible Cardholder’s credit card statement(s);<br />

iv) display at its business premises; or<br />

v) notice on <strong>HSBC</strong>’s internet website(s);<br />

19. These Terms and Conditions are in addition to the respective Credit Card Terms and Conditions<br />

of <strong>HSBC</strong> <strong>Sri</strong> <strong>Lanka</strong> and the Rewards Terms and Conditions which are available on<br />

“http://www.hsbc.lk/1/2/personal/credit‐card/quick‐consumer‐guide/credit‐card‐terms‐andcondtions<br />

“ and “http://www.hsbc.lk/1/2/personal/credit‐card/rewards/rewards‐terms‐andconditions<br />

“ respectively.<br />

20. In the event of inconsistency between these Terms and Conditions and the General Terms and<br />

Conditions, these Terms and Conditions shall prevail in so far as they apply to this Promotion.<br />

21. <strong>HSBC</strong> shall not be liable for any default due to any act of God, war, riot, strike, terrorism,<br />

epidemic, lockout, industrial action, fire, flood, drought, storm or any event beyond the<br />

reasonable control of <strong>HSBC</strong>.<br />

22. <strong>HSBC</strong> reserves the right to cancel, terminate or suspend this Promotion with 3 days prior notice.<br />

For the avoidance of doubt, cancellation, termination or suspension by <strong>HSBC</strong> of this Promotion<br />

shall not entitle the Eligible Cardholder/potential winners/winners to any claim or compensation<br />

against <strong>HSBC</strong> for any and all losses or damages suffered or incurred by the Eligible<br />

Cardholder/potential winners/winners as a direct or indirect result of the act of cancellation,<br />

termination or suspension.<br />

23. In no event will <strong>HSBC</strong> be liable for any losses or damages (including without limitation, loss of<br />

income, profits or goodwill, direct or indirect, incidental, consequential, exemplary, punitive or<br />

special damages of any part including third parties) howsoever arising whether in contract, tort,<br />

negligence or otherwise, in connection with this Promotion, even if <strong>HSBC</strong> has been advised of the<br />

possibility of such damages in advance, and all such damages are expressly excluded.<br />

24. <strong>HSBC</strong>’s decision on all matters relating to this Promotion including but not limited to the<br />

eligibility to participate, the selection of the recipient of the Bonus Points for this Promotion, and<br />

in case of any dispute, shall be final and binding on all Eligible Cardholders who participate in this<br />

Promotion and no correspondence will be entertained.<br />

25. By participating in this Promotion, the Eligible Cardholder agrees to be bound by these Terms<br />

and Conditions and the decisions of <strong>HSBC</strong><br />

26. Nothing herein amounts to a commitment or representation by <strong>HSBC</strong> to conduct similar<br />

promotions in future<br />

27. These terms and conditions shall be governed by and construed in accordance with the laws of<br />

<strong>Sri</strong> <strong>Lanka</strong>.