Costs Relating to Regulatory Investigations, Derivative Lawsuits ...

Costs Relating to Regulatory Investigations, Derivative Lawsuits ...

Costs Relating to Regulatory Investigations, Derivative Lawsuits ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

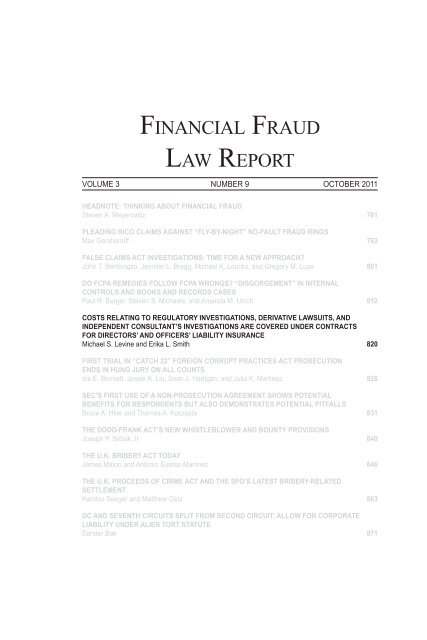

Financial Fraud<br />

Law Report<br />

VOLUME 3 NUMBER 9 OCTOBER 2011<br />

HEADNOTE: THINKING ABOUT FINANCIAL FRAUD<br />

Steven A. Meyerowitz 781<br />

PLEADING RICO CLAIMS AGAINST “FLY-BY-NIGHT” NO-FAULT FRAUD RINGS<br />

Max Gershenoff 783<br />

FALSE CLAIMS ACT INVESTIGATIONS: TIME FOR A NEW APPROACH?<br />

John T. Bentivoglio, Jennifer L. Bragg, Michael K. Loucks, and Gregory M. Luce 801<br />

DO FCPA REMEDIES FOLLOW FCPA WRONGS? “DISGORGEMENT” IN INTERNAL<br />

CONTROLS AND BOOKS AND RECORDS CASES<br />

Paul R. Berger, Steven S. Michaels, and Amanda M. Ulrich 812<br />

COSTS RELATING TO REGULATORY INVESTIGATIONS, DERIVATIVE LAWSUITS, AND<br />

INDEPENDENT CONSULTANT’S INVESTIGATIONS ARE COVERED UNDER CONTRACTS<br />

FOR DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE<br />

Michael S. Levine and Erika L. Smith 820<br />

FIRST TRIAL IN “CATCH 22” FOREIGN CORRUPT PRACTICES ACT PROSECUTION<br />

ENDS IN HUNG JURY ON ALL COUNTS<br />

Iris E. Bennett, Jessie K. Liu, Sean J. Hartigan, and Julia K. Martinez 826<br />

SEC’S FIRST USE OF A NON-PROSECUTION AGREEMENT SHOWS POTENTIAL<br />

BENEFITS FOR RESPONDENTS BUT ALSO DEMONSTRATES POTENTIAL PITFALLS<br />

Bruce A. Hiler and Thomas A. Kuczajda 831<br />

THE DODD-FRANK ACT’S NEW WHISTLEBLOWER AND BOUNTY PROVISIONS<br />

Joseph P. Sirbak, II 840<br />

THE U.K. BRIBERY ACT TODAY<br />

James Ma<strong>to</strong>n and An<strong>to</strong>nio Suarez-Martinez 846<br />

THE U.K. PROCEEDS OF CRIME ACT AND THE SFO’S LATEST BRIBERY-RELATED<br />

SETTLEMENT<br />

Karolos Seeger and Matthew Getz 863<br />

DC AND SEVENTH CIRCUITS SPLIT FROM SECOND CIRCUIT: ALLOW FOR CORPORATE<br />

LIABILITY UNDER ALIEN TORT STATUTE<br />

Sander Bak 871

EDITOR-IN-CHIEF<br />

Steven A. Meyerowitz<br />

President, Meyerowitz Communications Inc.<br />

BOARD OF EDITORS<br />

Frank W. Abagnale<br />

Author, Lecturer, and Consultant<br />

Abagnale and Associates<br />

Stephen L. Ascher<br />

Partner<br />

Jenner & Block LLP<br />

Thomas C. Bogle<br />

Partner<br />

Dechert LLP<br />

David J. Cook<br />

Partner<br />

Cook Collection At<strong>to</strong>rneys<br />

Robert E. Eggmann<br />

Partner<br />

Lathrop & Gage LLP<br />

Jeffrey T. Harfenist<br />

Managing Direc<strong>to</strong>r,<br />

Disputes & <strong>Investigations</strong><br />

Navigant Consulting (PI) LLC<br />

James M. Keneally<br />

Partner<br />

Kelley Drye & Warren LLP<br />

Frank C. Razzano<br />

Partner<br />

Pepper Hamil<strong>to</strong>n LLP<br />

Bethany N. Schols<br />

Member of the Firm<br />

Dykema Gossett PLLC<br />

Bruce E. Yannett<br />

Partner<br />

Debevoise & Plimp<strong>to</strong>n<br />

LLP<br />

The FINANCIAL FRAUD LAW REPORT is published 10 times per year by A.S. Pratt & Sons, 805 Fifteenth<br />

Street, NW., Third Floor, Washing<strong>to</strong>n, DC 20005-2207, Copyright © 2011 THOMPSON MEDIA GROUP LLC.<br />

All rights reserved. No part of this journal may be reproduced in any form — by microfilm, xerography, or<br />

otherwise — or incorporated in<strong>to</strong> any information retrieval system without the written permission of the copyright<br />

owner. For permission <strong>to</strong> pho<strong>to</strong>copy or use material electronically from the Financial Fraud Law Report,<br />

please access www.copyright.com or contact the Copyright Clearance Center, Inc. (CCC), 222 Rosewood Drive,<br />

Danvers, MA 01923, 978-750-8400. CCC is a not-for-profit organization that provides licenses and registration<br />

for a variety of users. For subscription information and cus<strong>to</strong>mer service, call 1-800-572-2797. Direct any<br />

edi<strong>to</strong>rial inquires and send any material for publication <strong>to</strong> Steven A. Meyerowitz, Edi<strong>to</strong>r-in-Chief, Meyerowitz<br />

Communications Inc., PO Box 7080, Miller Place, NY 11764, smeyerow@op<strong>to</strong>nline.net, 631.331.3908 (phone)<br />

/ 631.331.3664 (fax). Material for publication is welcomed — articles, decisions, or other items of interest. This<br />

publication is designed <strong>to</strong> be accurate and authoritative, but neither the publisher nor the authors are rendering<br />

legal, accounting, or other professional services in this publication. If legal or other expert advice is desired, retain<br />

the services of an appropriate professional. The articles and columns reflect only the present considerations and<br />

views of the authors and do not necessarily reflect those of the firms or organizations with which they are affiliated,<br />

any of the former or present clients of the authors or their firms or organizations, or the edi<strong>to</strong>rs or publisher.<br />

POSTMASTER: Send address changes <strong>to</strong> the Financial Fraud Law Report, A.S. Pratt & Sons, 805 Fifteenth<br />

Street, NW., Third Floor, Washing<strong>to</strong>n, DC 20005-2207. ISSN 1936-5586

<strong>Costs</strong> <strong>Relating</strong> <strong>to</strong> Regula<strong>to</strong>ry<br />

<strong>Investigations</strong>, <strong>Derivative</strong> <strong>Lawsuits</strong>, and<br />

Independent Consultant’s <strong>Investigations</strong><br />

Are Covered Under Contracts for<br />

Direc<strong>to</strong>rs’ and Officers’ Liability<br />

Insurance<br />

MICHAEL S. LEVINE AND ERIKA L. SMITH<br />

The authors discuss a United States Court of Appeals for the Second Circuit<br />

decision holding that a policyholder was entitled <strong>to</strong> coverage under<br />

a direc<strong>to</strong>rs’ and officers’ liability insurance contract for costs associated<br />

with financial regula<strong>to</strong>rs’ investigations.<br />

In MBIA Inc. v. Fed. Ins. Co. 1 the U.S. Court of Appeals for the Second<br />

Circuit held that a policyholder was entitled <strong>to</strong> coverage under<br />

direc<strong>to</strong>rs’ and officers’ liability insurance contracts for costs associated<br />

with financial regula<strong>to</strong>rs’ investigations, including costs associated<br />

with the investigation of a derivative shareholder litigation and the cost<br />

of an independent consultant’s investigation pursuant <strong>to</strong> a settlement with<br />

government regula<strong>to</strong>rs.<br />

Michael S. Levine, counsel with Hun<strong>to</strong>n & Williams LLP, represents and advises<br />

policyholders and other commercial clients in complex insurance coverage and<br />

business disputes. Erika L. Smith is an associate at the firm.<br />

820<br />

Published by A.S. Pratt in the Oc<strong>to</strong>ber 2011 issue of the Financial Fraud Law Report<br />

Copyright © 2011 THOMPSON MEDIA GROUP LLC. 1-800-572-2797.

CONTRACTS FOR DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE<br />

BACKGROUND<br />

MBIA, Inc. (“MBIA” or the “Policyholder”), a Connecticut bond insurer,<br />

purchased direc<strong>to</strong>rs’ and officers’ insurance policies from Federal<br />

Insurance Co. (“Federal”) and ACE American Insurance Co. (“Ace”) (collectively<br />

the “Insurers”). The policies provided coverage for, among other<br />

things, “Securities Claims” and “Securities Defense <strong>Costs</strong>.” Securities<br />

Claims were defined <strong>to</strong> be “a formal or informal administrative or regula<strong>to</strong>ry<br />

proceeding or inquiry commenced by the filing of a notice of charges,<br />

formal or informal investigative order or similar document.” Securities<br />

Defense <strong>Costs</strong> were defined as “costs incurred in defending or investigating<br />

Securities Claims.”<br />

On March 9, 2001, the Securities and Exchange Commission (“SEC”)<br />

issued a formal order of investigation of MBIA. In 2004, as part of the<br />

investigation, the SEC issued several subpoenas <strong>to</strong> MBIA, seeking documents<br />

concerning its compliance with securities laws, financial recordkeeping<br />

and financial reporting. The New York at<strong>to</strong>rney general (“NYAG”)<br />

followed suit and issued a subpoena <strong>to</strong> MBIA in connection with a separate,<br />

but similar, investigation. Following the initial phases of the SEC and<br />

NYAG investigations, MBIA was targeted for three specific transactions:<br />

the AHERF transaction, the Capital Asset transaction, and the US Airways<br />

transaction.<br />

In May 2005, MBIA informed its Insurers that it was the subject of a<br />

regula<strong>to</strong>ry investigation by providing the SEC and NYAG subpoenas <strong>to</strong><br />

the Insurers. The Insurers did not view the subpoenas as sufficient <strong>to</strong> trigger<br />

coverage; however, they accepted the subpoenas as notice of a potential<br />

claim under the policies. In the summer of 2005, when the SEC and the<br />

NYAG considered issuing additional subpoenas, MBIA negotiated voluntary<br />

compliance in lieu of the subpoenas <strong>to</strong> avoid further adverse publicity.<br />

The SEC and the NYAG accepted voluntary compliance concerning the<br />

Capital Asset and US Airways transactions.<br />

In August 2005, federal and state regula<strong>to</strong>rs advised MBIA that they<br />

intended <strong>to</strong> take action against MBIA for securities law violations. MBIA<br />

sought consent from its Insurers <strong>to</strong> settle with the regula<strong>to</strong>rs. The Insurers<br />

contended the settlement was not covered by the policy, but, nevertheless,<br />

821

FINANCIAL FRAUD LAW REPORT<br />

agreed <strong>to</strong> waive lack of written consent <strong>to</strong> settlement as a defense <strong>to</strong> coverage.<br />

Accordingly, MBIA signed a preliminary offer of settlement with<br />

the SEC and the NYAG, which included, among other terms, that MBIA<br />

agreed <strong>to</strong> hire an independent consultant <strong>to</strong> review the Capital Asset and<br />

US Airways transactions, both of which were at issue in the investigation<br />

and alleged violations.<br />

As a result of the investigations, MBIA’s shareholders brought two derivative<br />

suits alleging financial wrongdoing by MBIA. In accordance with<br />

Connecticut law, MBIA was required <strong>to</strong> set up a committee of independent<br />

direc<strong>to</strong>rs (the “Demand Investigation Committee” or “DIC”) and a special<br />

litigation committee (the “SLC”) <strong>to</strong> determine whether maintaining the<br />

suits was in the best interests of MBIA. The SLC ultimately determined<br />

that the lawsuits should be dismissed, but not before MBIA had incurred<br />

substantial costs.<br />

MBIA agreed <strong>to</strong> pay $50 million in civil penalties for the AHERF<br />

transaction, and MBIA was exonerated of any wrongdoing for the Capital<br />

Asset and US Airways transactions. The Insurers, however, agreed <strong>to</strong><br />

cover only $6.4 million in costs, refusing <strong>to</strong> cover costs associated with the<br />

NYAG investigation, the Capital Asset investigation or the US Airways<br />

investigations.<br />

As a result, MBIA filed a lawsuit in the Southern District of New York<br />

<strong>to</strong> compel the Insurers <strong>to</strong> cover the costs of all three investigations. After<br />

review, the district court granted summary judgment in favor of MBIA<br />

regarding coverage for costs associated with all three investigations, as<br />

well as the costs incurred by the SLC. The district court awarded summary<br />

judgment <strong>to</strong> the Insurers with respect <strong>to</strong> coverage for costs associated with<br />

the independent consultant’s investigation. Both parties appealed.<br />

The Insurers argued that the district court erred in two ways. First, the<br />

Insurers argued that the NYAG investigation, the Capital Asset investigation<br />

and the US Airways investigations were not “Securities Claims,” as<br />

defined by the policies. In support, the Insurers contended that the NYAG<br />

subpoena did not constitute a formal order, and the caption on the SEC order<br />

served <strong>to</strong> limit the scope of the investigation <strong>to</strong> a certain class of transactions,<br />

not <strong>to</strong> include the Capital Asset or US Airways investigations. The<br />

Insurers also argued that the Capital Asset and US Airways investigations<br />

822

CONTRACTS FOR DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE<br />

were not Securities Claims because MBIA voluntarily complied with the<br />

SEC’s document requests rather than producing them through the subpoena<br />

process and because the SEC official making the requests was not<br />

named on the initial SEC order.<br />

Second, the Insurers argued that the district court erred because costs<br />

incurred by the SLC either were not covered, since the SLC was not an<br />

“Insured Person,” or they were subject <strong>to</strong> a $200,000 policy sublimit.<br />

MBIA argued that the district court erred in denying coverage for the<br />

costs of the independent consultant.<br />

HOLDING<br />

Upon review, the Second Circuit affirmed the district court’s ruling for<br />

MBIA concerning the costs associated with the three investigations and<br />

the costs incurred by the SLC. But, the Second Circuit reversed the district<br />

court concerning the independent consultant’s costs and held that MBIA is<br />

also entitled <strong>to</strong> coverage for those costs.<br />

According <strong>to</strong> the Second Circuit, the NYAG’s subpoena came within<br />

the definition of a “Securities Claim” because the subpoena was “at least a<br />

similar document” <strong>to</strong> a “formal or informal investigative order” that commenced<br />

a regula<strong>to</strong>ry proceeding. Thus, because the subpoena amounted <strong>to</strong><br />

a Securities Claim, the investiga<strong>to</strong>ry costs associated with that subpoena<br />

were “Securities Losses” as defined in the policy.<br />

The court also held that the SEC’s investigations of the Capital Asset<br />

and US Airways transactions were covered “Securities Losses.” The court<br />

looked <strong>to</strong> the nature and scope of the SEC’s formal order, and not <strong>to</strong> the<br />

caption or persons named on the subpoena, as the Insurers had argued, <strong>to</strong><br />

define the scope of the investigation. The court stated that the investigation<br />

need not be pursued by only individuals named on the formal order. The<br />

court also refused <strong>to</strong> attach significance <strong>to</strong> MBIA’s voluntarily compliance<br />

with the regula<strong>to</strong>rs’ document requests, explaining that a company may<br />

take steps <strong>to</strong> mitigate public relations damage and exposure without jeopardizing<br />

coverage that otherwise would be reasonably expected <strong>to</strong> apply.<br />

Next, the Second Circuit held that MBIA could recover the costs associated<br />

with the SLC, thereby rejecting the Insurers’ argument that the<br />

823

FINANCIAL FRAUD LAW REPORT<br />

SLC was not an “Insured Person” under the policy. The court reasoned<br />

that the SLC’s independence was an “independence of judgment,” rather<br />

than a new source of authority. The court also held that the Insurers failed<br />

<strong>to</strong> prove that the SLC costs fell within the $200,000 policy sublimit for<br />

shareholder demand investigations. The court reasoned that the $200,000<br />

sublimit would apply only <strong>to</strong> pre-litigation demand costs and not <strong>to</strong> litigation-related<br />

costs of the SLC.<br />

Finally, the Second Circuit determined whether the costs associated with<br />

the independent consultant were covered under the policies. The district<br />

court had found that MBIA could not recover the independent consultant<br />

costs because MBIA breached the policies’ “right <strong>to</strong> associate” provision.<br />

But, the Second Circuit disagreed, finding that MBIA fulfilled its obligations<br />

under the right <strong>to</strong> associate clause when it provided notice <strong>to</strong> the Insurers of<br />

the claims involved in the settlement discussions. The court explained that<br />

“where the insured gives the insurers an invitation <strong>to</strong> associate with adequate<br />

information about the claim under consideration for settlement, the insured<br />

has done what is required under this clause.” This is the case even if, as in<br />

MBIA, the policyholder simply informs the insurers of the proposed settlement,<br />

but fails <strong>to</strong> inform the insurers of any additional components, such as<br />

an independent consultant. Any other result, according <strong>to</strong> the court, would<br />

require the policyholder <strong>to</strong> revisit the claim with the nonparticipating insurer<br />

each time negotiations about the same claim “take a new twist.” The court<br />

noted that independent consultants are not a “rare component of regula<strong>to</strong>ry<br />

settlements” and should not be an unforeseeable component of the settlement<br />

discussions. Thus, where the Insurers were notified of the proposed<br />

settlement but failed <strong>to</strong> take part in settlement negotiations, the Policyholder<br />

was entitled <strong>to</strong> recover the costs of the independent consultant’s investigation,<br />

particularly where the Insurers failed <strong>to</strong> object after they learned of the<br />

independent consultant component.<br />

IMPLICATIONS<br />

The MBIA decision is of particular significance <strong>to</strong> policyholders in<br />

<strong>to</strong>day’s economy, where lawmakers, governmental audi<strong>to</strong>rs and regula<strong>to</strong>rs<br />

are becoming increasingly suspicious of corporate dealings and transac-<br />

824

CONTRACTS FOR DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE<br />

tions, thereby requiring policyholders <strong>to</strong> incur substantial investigation<br />

and compliance costs. As illustrated in MBIA, the costs of such regula<strong>to</strong>ry<br />

suspicion and investigation should be covered under contracts for Direc<strong>to</strong>rs<br />

& Officers liability insurance.<br />

The decision is also significant because it broadly interprets the definition<br />

of “Securities Claims” and “Securities Defense <strong>Costs</strong>,” thereby suggesting<br />

that other fees and costs associated with a covered Direc<strong>to</strong>rs &<br />

Officers liability claim likewise should be covered under contracts for Direc<strong>to</strong>rs<br />

& Officers liability insurance.<br />

Finally, the MBIA decision underscores the importance of keeping an<br />

insurer informed, even when the insurer denies coverage, defends under a<br />

reservation of rights or chooses <strong>to</strong> opt out of settlement negotiations. Although<br />

the policyholder ultimately prevailed on the independent consultant<br />

issue, the court stressed the importance of providing adequate notice<br />

<strong>to</strong> the insurer regarding the claim under consideration for settlement.<br />

NOTE<br />

1<br />

No. 10-0355-cv, 2011 U.S. App. Lexis 13402 (2d Cir. July 1, 2011).<br />

825