Accounting is Broken - Investment Analysts Journal

Accounting is Broken - Investment Analysts Journal

Accounting is Broken - Investment Analysts Journal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Stern Stewart & Co.<br />

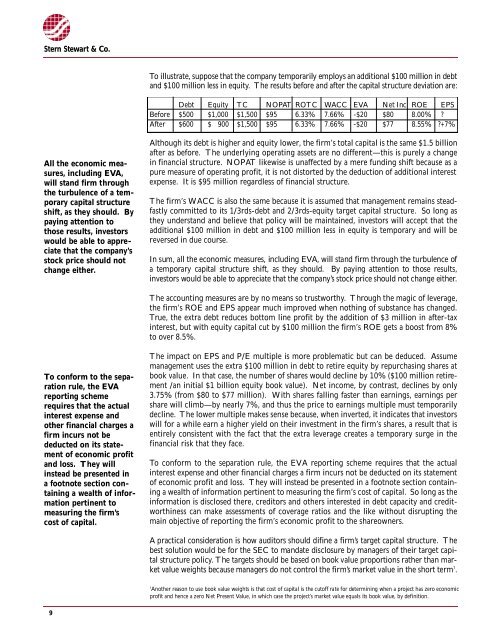

To illustrate, suppose that the company temporarily employs an additional $100 million in debt<br />

and $100 million less in equity. The results before and after the capital stru c t u re deviation are :<br />

D e b t E q u i t y T C N O PAT R O T C WA C C E VA Net Inc R O E E P S<br />

B e f o re $ 5 0 0 $ 1 , 0 0 0 $ 1 , 5 0 0 $ 9 5 6 . 3 3 % 7 . 6 6 % - $ 2 0 $ 8 0 8 . 0 0 % ?<br />

A f t e r $ 6 0 0 $ 900 $ 1 , 5 0 0 $ 9 5 6 . 3 3 % 7 . 6 6 % - $ 2 0 $ 7 7 8.55% ?+7%<br />

All the economic meas<br />

u res, including EVA ,<br />

will stand firm thro u g h<br />

the turbulence of a temp<br />

o r a ry capital stru c t u re<br />

shift, as they should. By<br />

paying attention to<br />

those results, investors<br />

would be able to appreciate<br />

that the company’s<br />

stock price should not<br />

change either.<br />

Although its debt <strong>is</strong> higher and equity lower, the firm’s total capital <strong>is</strong> the same $1.5 billion<br />

after as before. The underlying operating assets are no different—th<strong>is</strong> <strong>is</strong> purely a change<br />

in financial structure. NOPAT likew<strong>is</strong>e <strong>is</strong> unaffected by a mere funding shift because as a<br />

pure measure of operating profit, it <strong>is</strong> not d<strong>is</strong>torted by the deduction of additional interest<br />

expense. It <strong>is</strong> $95 million regardless of financial structure.<br />

The firm’s WACC <strong>is</strong> also the same because it <strong>is</strong> assumed that management remains steadfastly<br />

committed to its 1/3rds-debt and 2/3rds-equity target capital structure. So long as<br />

they understand and believe that policy will be maintained, investors will accept that the<br />

additional $100 million in debt and $100 million less in equity <strong>is</strong> temporary and will be<br />

reversed in due course.<br />

In sum, all the economic measures, including EVA, will stand firm through the turbulence of<br />

a temporary capital stru c t u re shift, as they should. By paying attention to those re s u l t s ,<br />

investors would be able to appreciate that the company’s stock price should not change either.<br />

The accounting measures are by no means so tru s t w o rt h y. Through the magic of leverage,<br />

the firm’s ROE and EPS appear much improved when nothing of substance has changed.<br />

True, the extra debt reduces bottom line profit by the addition of $3 million in after-tax<br />

interest, but with equity capital cut by $100 million the firm’s ROE gets a boost from 8%<br />

to over 8.5%.<br />

To conform to the separation<br />

rule, the EVA<br />

re p o rting scheme<br />

re q u i res that the actual<br />

i n t e rest expense and<br />

other financial charges a<br />

f i rm incurs not be<br />

deducted on its statement<br />

of economic pro f i t<br />

and loss. They will<br />

instead be presented in<br />

a footnote section containing<br />

a wealth of information<br />

pertinent to<br />

measuring the firm ’s<br />

cost of capital.<br />

The impact on EPS and P/E multiple <strong>is</strong> more problematic but can be deduced. Assume<br />

management uses the extra $100 million in debt to retire equity by repurchasing shares at<br />

book value. In that case, the number of shares would decline by 10% ($100 million retirement<br />

/an initial $1 billion equity book value). Net income, by contrast, declines by only<br />

3.75% (from $80 to $77 million). With shares falling faster than earnings, earnings per<br />

share will climb—by nearly 7%, and thus the price to earnings multiple must temporarily<br />

decline. The lower multiple makes sense because, when inverted, it indicates that investors<br />

will for a while earn a higher yield on their investment in the firm’s shares, a result that <strong>is</strong><br />

entirely cons<strong>is</strong>tent with the fact that the extra leverage creates a temporary surge in the<br />

financial r<strong>is</strong>k that they face.<br />

To conform to the separation rule, the EVA reporting scheme requires that the actual<br />

interest expense and other financial charges a firm incurs not be deducted on its statement<br />

of economic profit and loss. They will instead be presented in a footnote section containing<br />

a wealth of information pertinent to measuring the firm’s cost of capital. So long as the<br />

information <strong>is</strong> d<strong>is</strong>closed there, creditors and others interested in debt capacity and creditworthiness<br />

can make assessments of coverage ratios and the like without d<strong>is</strong>rupting the<br />

main objective of reporting the firm’s economic profit to the shareowners.<br />

A practical consideration <strong>is</strong> how auditors should difine a firm ’s target capital stru c t u re. The<br />

best solution would be for the SEC to mandate d<strong>is</strong>closure by managers of their target capital<br />

stru c t u re policy. The targets should be based on book value pro p o rtions rather than market<br />

value weights because managers do not control the firm ’s market value in the short term 7 .<br />

7<br />

Another reason to use book value weights <strong>is</strong> that cost of capital <strong>is</strong> the cutoff rate for determining when a project has zero economic<br />

p rofit and hence a zero Net Present Value, in which case the pro j e c t ’s market value equals its book value, by definition.<br />

9