Accounting is Broken - Investment Analysts Journal

Accounting is Broken - Investment Analysts Journal

Accounting is Broken - Investment Analysts Journal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Stern Stewart & Co.<br />

Transparency <strong>is</strong> not just<br />

about d<strong>is</strong>closing more<br />

data or even principally<br />

about that. It <strong>is</strong> chiefly<br />

about giving investors a<br />

clear window into how<br />

managers make or<br />

should make dec<strong>is</strong>ions<br />

that are in their best<br />

interests.<br />

The first step in the<br />

separation process <strong>is</strong> to<br />

measure profit before<br />

subtracting any financing<br />

charges. The result<br />

<strong>is</strong> known as net operating<br />

profit after taxes, or<br />

NOPAT for short.<br />

Unlike book net<br />

income, NOPAT <strong>is</strong> not<br />

affected by transitory<br />

shifts in capital structure<br />

or interest rates.<br />

The second step <strong>is</strong> to<br />

subtract all financing<br />

costs as re p resented by<br />

the strategic, weighted<br />

average cost of capital.<br />

The result <strong>is</strong> a popular<br />

method to measure economic<br />

profit that <strong>is</strong><br />

called EVA, or economic<br />

value added.<br />

WACC <strong>is</strong> the blended<br />

cost of all capital. It <strong>is</strong><br />

computed by weighting<br />

the after-tax cost of<br />

each capital component<br />

by its representation in<br />

an ideal capital structure<br />

mix.<br />

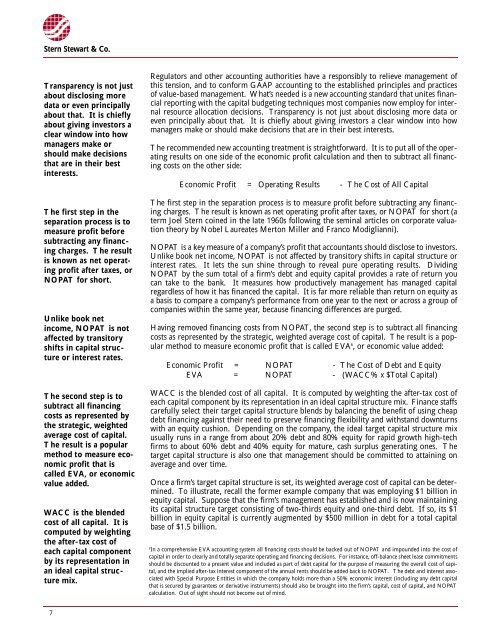

Regulators and other accounting authorities have a responsibly to relieve management of<br />

th<strong>is</strong> tension, and to conform GAAP accounting to the establ<strong>is</strong>hed principles and practices<br />

of value-based management. What’s needed <strong>is</strong> a new accounting standard that unites financial<br />

re p o rting with the capital budgeting techniques most companies now employ for internal<br />

re s o u rce allocation dec<strong>is</strong>ions. Tr a n s p a rency <strong>is</strong> not just about d<strong>is</strong>closing more data or<br />

even principally about that. It <strong>is</strong> chiefly about giving investors a clear window into how<br />

managers make or should make dec<strong>is</strong>ions that are in their best intere s t s .<br />

The recommended new accounting treatment <strong>is</strong> straightforw a rd. It <strong>is</strong> to put all of the operating<br />

results on one side of the economic profit calculation and then to subtract all financing<br />

costs on the other side:<br />

Economic Profit = Operating Results - The Cost of All Capital<br />

The first step in the separation process <strong>is</strong> to measure profit before subtracting any financing<br />

charges. The result <strong>is</strong> known as net operating profit after taxes, or NOPAT for short (a<br />

t e rm Joel Stern coined in the late 1960s following the seminal articles on corporate valuation<br />

theory by Nobel Laureates Merton Miller and Franco Modiglianni).<br />

N O PAT <strong>is</strong> a key measure of a company’s profit that accountants should d<strong>is</strong>close to investors.<br />

Unlike book net income, NOPAT <strong>is</strong> not affected by transitory shifts in capital stru c t u re or<br />

i n t e rest rates. It lets the sun shine through to reveal pure operating results. Dividing<br />

N O PAT by the sum total of a firm ’s debt and equity capital provides a rate of re t u rn you<br />

can take to the bank. It measures how productively management has managed capital<br />

re g a rdless of how it has financed the capital. It <strong>is</strong> far more reliable than re t u rn on equity as<br />

a bas<strong>is</strong> to compare a company’s perf o rmance from one year to the next or across a group of<br />

companies within the same year, because financing diff e rences are purg e d .<br />

Having removed financing costs from NOPAT, the second step <strong>is</strong> to subtract all financing<br />

costs as re p resented by the strategic, weighted average cost of capital. The result <strong>is</strong> a popular<br />

method to measure economic profit that <strong>is</strong> called EVA 6 , or economic value added:<br />

Economic Profit = NOPAT - The Cost of Debt and Equity<br />

E VA = NOPAT - (WACC% x $Total Capital)<br />

WACC <strong>is</strong> the blended cost of all capital. It <strong>is</strong> computed by weighting the after-tax cost of<br />

each capital component by its re p resentation in an ideal capital stru c t u re mix. Finance staff s<br />

c a refully select their target capital stru c t u re blends by balancing the benefit of using cheap<br />

debt financing against their need to pre s e rve financing flexibility and withstand downturn s<br />

with an equity cushion. Depending on the company, the ideal target capital stru c t u re mix<br />

usually runs in a range from about 20% debt and 80% equity for rapid growth high-tech<br />

f i rms to about 60% debt and 40% equity for mature, cash surplus generating ones. The<br />

t a rget capital stru c t u re <strong>is</strong> also one that management should be committed to attaining on<br />

average and over time.<br />

Once a firm ’s target capital stru c t u re <strong>is</strong> set, its weighted average cost of capital can be determined.<br />

To illustrate, recall the former example company that was employing $1 billion in<br />

equity capital. Suppose that the firm ’s management has establ<strong>is</strong>hed and <strong>is</strong> now maintaining<br />

its capital stru c t u re target cons<strong>is</strong>ting of two-thirds equity and one-third debt. If so, its $1<br />

billion in equity capital <strong>is</strong> currently augmented by $500 million in debt for a total capital<br />

base of $1.5 billion.<br />

6<br />

In a comprehensive EVA accounting system all financing costs should be backed out of NOPAT and impounded into the cost of<br />

capital in order to clearly and totally separate operating and financing dec<strong>is</strong>ions. For instance, off-balance sheet lease commitments<br />

should be d<strong>is</strong>counted to a present value and included as part of debt capital for the purpose of measuring the overall cost of capital,<br />

and the implied after-tax interest component of the annual rents should be added back to NOPAT. The debt and interest associated<br />

with Special Purpose Entities in which the company holds more than a 50% economic interest (including any debt capital<br />

that <strong>is</strong> secured by guarantees or derivative instruments) should also be brought into the firm ’s capital, cost of capital, and NOPAT<br />

calculation. Out of sight should not become out of mind.<br />

7